We have put together this information to help with your communications. You may wish to use some or all of it in your own materials.

Please note:

The RSMR Passive Plus portfolios are a range of five portfolios of funds offering access to the long term growth potential of the main asset classes available to investors: equities, bonds, alternatives* and cash. The portfolios, which are constructed and managed by RSMR Portfolio Services, use funds managed by leading fund management businesses from around the world.

As their name implies, the RSMR Passive Plus portfolios comprise mainly passive funds, alongside targeted exposure to active funds**. Only RSMR-rated funds are used, apart from any cash or money market exposure. The portfolios are only available when recommended by a financial adviser.

* ”Alternatives” are investments that are categorised outside the equities, bonds and cash asset classes. There are many types of alternatives that can be accessed through funds, for example property, commodities, infrastructure and absolute returns

**Active investing involves a fund manager selecting specific investments, whereas passive investments typically track an existing group of investments, such as a stock market index. Although passive funds often feature lower charges, active funds can offer additional benefits in respect of managing risk and potential returns.

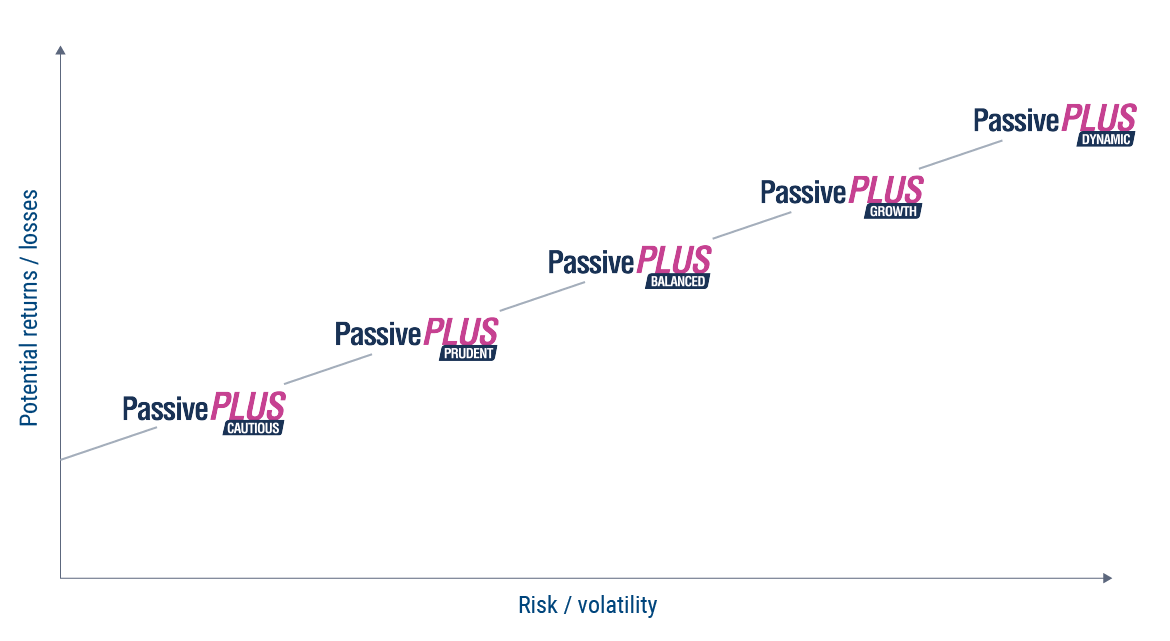

Each of the RSMR Passive Plus portfolios aims to provide a particular level of investment performance relative to the level of investment risk taken. In general, the higher the performance potential, the higher the potential risk, as indicated in the chart.

The names of the portfolios, from the lowest risk/return option to the highest, are:

RSMR Portfolio Services was launched in 2018 to be specifically responsible for managing discretionary investment portfolios on behalf of financial advisers and their clients, including the RSMR Managed Portfolio Service. It is regulated by the Financial Conduct Authority (FCA) for this purpose.

RSMR Portfolio Services is wholly owned by RSMR, which has been helping UK financial advisers with their clients’ investments since 2004. RSMR’s accomplished investment team has over 250 years of collective experience. Their market-leading fund ratings and portfolios are underpinned by rigorous research, experience and analysis. RSMR’s team constantly monitors and assesses the fund market, to ensure the level of quality and performance is maintained, meeting with around 600 fund managers each year. They consider ESG (Environmental, Social and Governance considerations) as a risk factor that they take into account in all their research and ratings.

For more information about RSMR and the RSMR Passive Plus portfolios speak to your financial adviser.

March 2024

This is intended for investment professionals and should not be relied upon by private investors or any other persons. Past performance is not a guide to future performance. The value of investments and any income from them can fall as well as rise, is not guaranteed and your clients may get back less than they invest. RSMR MPS is provided by RSMR Portfolio Services Limited. RSMR Portfolio Services Limited is a limited company registered in England and Wales under Company number 07137872. Registered office at Number 20, Ryefield Business Park, Belton Road, Silsden BD20 0EE, RSMR Portfolio Services Limited is authorised and regulated by the Financial Conduct Authority under number 788854. RSMR is a registered Trademark.