The Passive Plus range comprises 5 managed investment portfolios for UK advisory businesses to recommend to clients. By adjusting the weightings of equities, fixed interest, alternatives, and cash within each portfolio, we offer a choice of managed portfolio investments to suit a wide range of risk appetites. The RSMR Passive Plus range is adapted from a range launched in February 2018 by RSMR which was managed by RSMR on an advisory basis for an external client.

Each investment portfolio is designed and managed by the highly experienced RSMR Managed Portfolio Service Investment Team. Each portfolio aims to deliver a particular level of investment performance relative to the level of risk and the choice of risk/return options allows advice businesses to make recommendations to satisfy their clients' attitude to risk.

The RSMR investment team analyses the entire Investment Association (IA) universe, and they conduct around 600 fund manager meetings each year. Regular meetings with fund managers across the globe ensure that the funds we rate not only meet our exacting standards but also have the processes in place to deliver the expected performance in their specific sectors and regions. Only a limited number of funds receive an RSMR rating, and these are carefully monitored and reviewed on an ongoing basis.

The initial fund analysis takes each IA sector and looks at a range of appropriate performance and risk measures. Funds that display attractive performance and risk characteristics may then be taken forward for further analysis. Both quantitative and qualitative measures are used to ensure that a fund’s performance has been produced by a robust investment and risk management process and by a strong fund manager or team. These factors combine to give us some indication of how a fund may perform in the future.

We look at statistical risk measures to further understand funds and how they operate. We consider funds in relation to their benchmark and sector and in relation to their objectives, as well as in absolute terms. This allows us to gauge how much risk a fund may take, which is an important consideration when building combinations of funds for our managed investment portfolios.

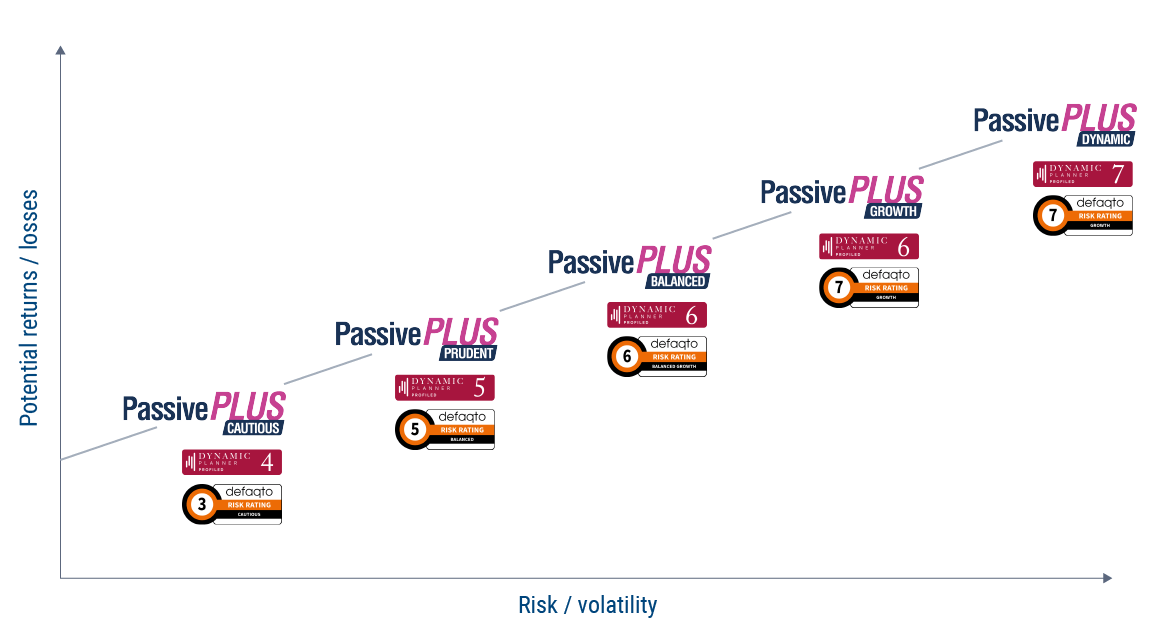

We provide clients with a choice of 5 managed investment portfolios: Passive Plus Cautious (the lowest risk), Passive Plus Prudent, Passive Plus Balanced, Passive Plus Growth and Passive Plus Dynamic (the highest risk).

We provide clients with a choice of 5 managed investment portfolios: Passive Plus Cautious (the lowest risk), Passive Plus Prudent, Passive Plus Balanced, Passive Plus Growth and Passive Plus Dynamic (the highest risk).

The RSMR Managed Portfolio Service (MPS) supports advice businesses by simplifying the advice and suitability challenge, while at the same time seeking to deliver improved investor outcomes.

Comprising 8 risk-profiled portfolios (including our income option)

Comprising 4 risk-profiled portfolios

This is intended for investment professionals and should not be relied upon by private investors or any other persons. Past performance is not a guide to future performance. The value of investments and any income from them can fall as well as rise, is not guaranteed and your clients may get back less than they invest. RSMR MPS is provided by RSMR Portfolio Services Limited. RSMR Portfolio Services Limited is a limited company registered in England and Wales under Company number 07137872. Registered office at Number 20, Ryefield Business Park, Belton Road, Silsden BD20 0EE, RSMR Portfolio Services Limited is authorised and regulated by the Financial Conduct Authority under number 788854. RSMR is a registered Trademark.