24 Jun 2025

For over a decade, the U.S. economy has outperformed the rest of the world. There are two factors that determine long-term growth in gross domestic product: productivity and the labor market. Last week, we compared the productivity growth of the U.S. economy to that of other major developed economies, and found that U.S. productivity has been growing twice as fast as the rest of the world.

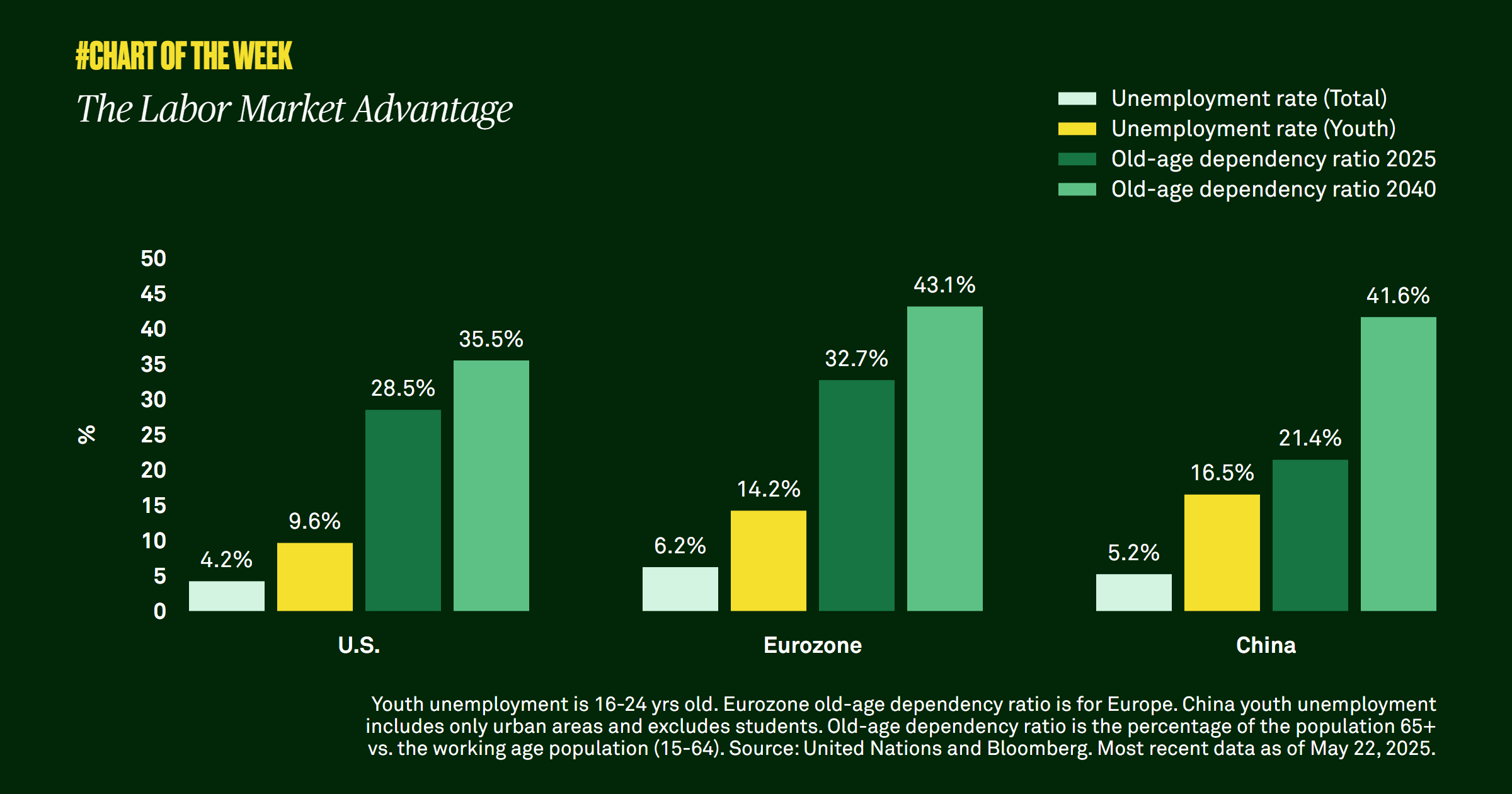

This week we examine the other input to the economic growth equation: the labor market. Again, metrics of labor market health continue to favor the U.S. Compared to the Eurozone and China, total unemployment is 1-2% and 4.5-7% lower for youth unemployment. Moreover, in the next 10-15 years, the populations of Europe and China are on track to age faster than in the U.S. By 2040, old-age dependency ratios, a measure of the population above 65 years old compared to the working age population, are set to rise roughly 10% in the Eurozone, 20% in China and only 7% in the U.S. In 2040, the ratio is expected to be 42-43% in China and the Eurozone vs. 35% in the U.S. The key message here is that current unemployment rates and projected changes in demographics continue to shine brightest on the U.S.

So, is U.S. exceptionalism still alive? We believe so. The U.S. has been a leader in driving the evolution of artificial intelligence (AI) technology. In our view, investing in the U.S. is, among other things, investing in the potential of AI, which has been propelling higher earnings for large cap technology companies as well as productivity gains and profit margin expansion for companies across all sectors.