26 Jun 2025

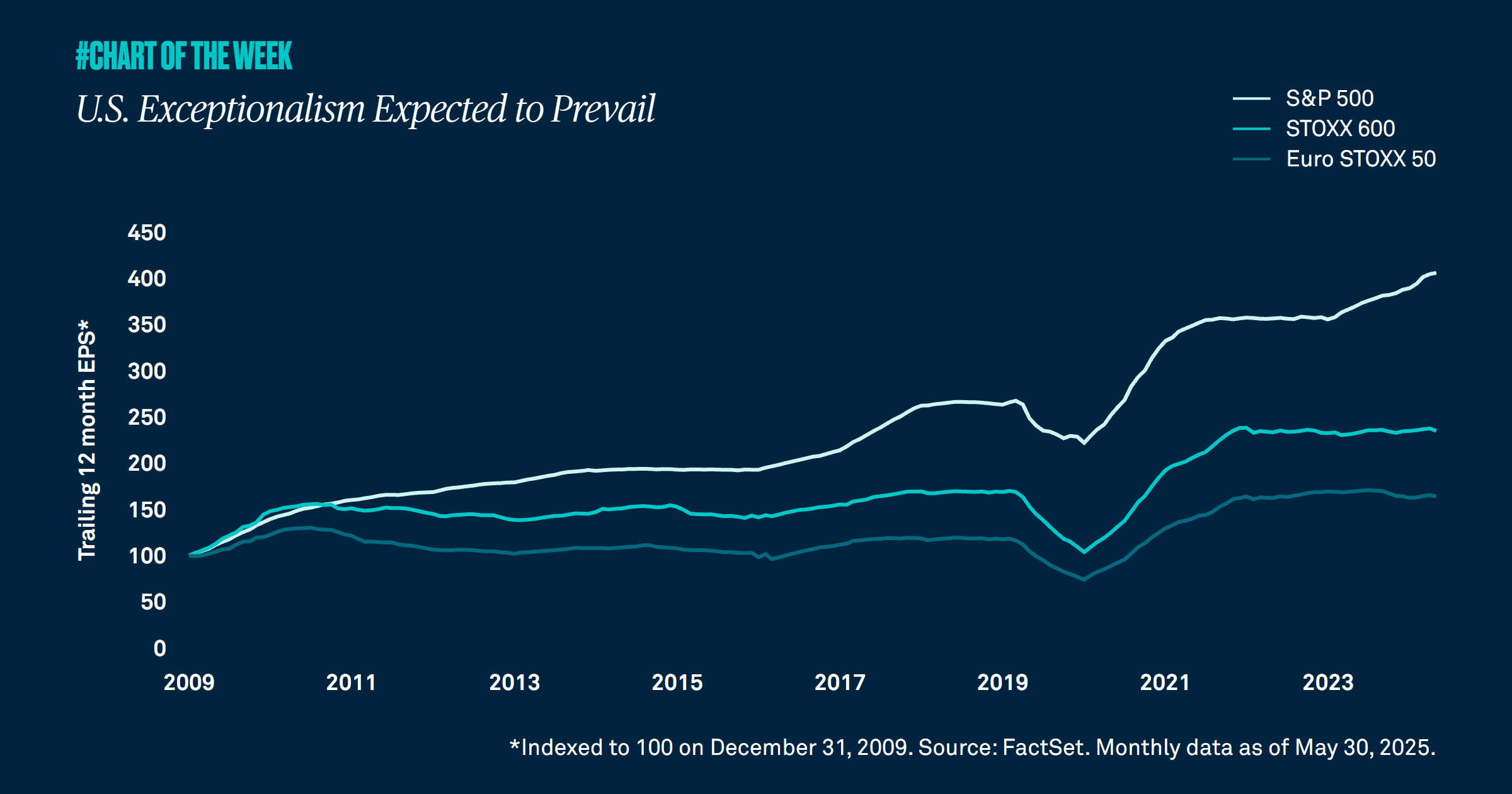

A popular topic of conversation among investors has been the idea that after a healthy run, U.S. exceptionalism may be out of steam. Over the period of January 1 to May 31, international equity markets have outperformed the U.S. for the first time since 2017. Still, we believe the S&P 500 will continue its strategic outperformance. Why? One key reason is superior earnings growth.

Earnings can help predict relative returns across different regions when one examines their long-term performance trends. Since 2010, S&P 500 earnings grew at an annualized rate of 9.6%, outpacing the STOXX Europe 600 by 1.7 times and three times for the more concentrated EURO STOXX 50. Additionally, this year S&P 500 earnings are expected to grow 8.8% compared to 2% for the STOXX Europe 600 and 3.6% for the EURO STOXX 50.

As we discussed in previous weeks, greater productivity and labor market characteristics in the U.S. are priming the domestic economy for faster growth than its peers abroad. Economic growth feeds stock market returns and earnings growth, which is anticipated to rank highest in the U.S. For these reasons, we expect U.S. exceptionalism to resume and strategic outperformance to persist. As a result, we continue to favor U.S. equities over the rest of the world.