27 Jun 2025

Since the founding of Walter Scott in 1983, we have applied a rigorous fundamental approach to investing in the world’s great businesses. We believe that companies generate wealth, not stock markets. Exceptional wealth generators are few and far between. So, we seek to identify and invest in the small group of companies that can generate wealth for our clients. These are market-leading firms that have clear competitive advantages, superior margins, low debt, strong cash generation, robust returns on investment, and predictable and superior growth prospects. Over the long term our approach has delivered excellent returns for our investors.

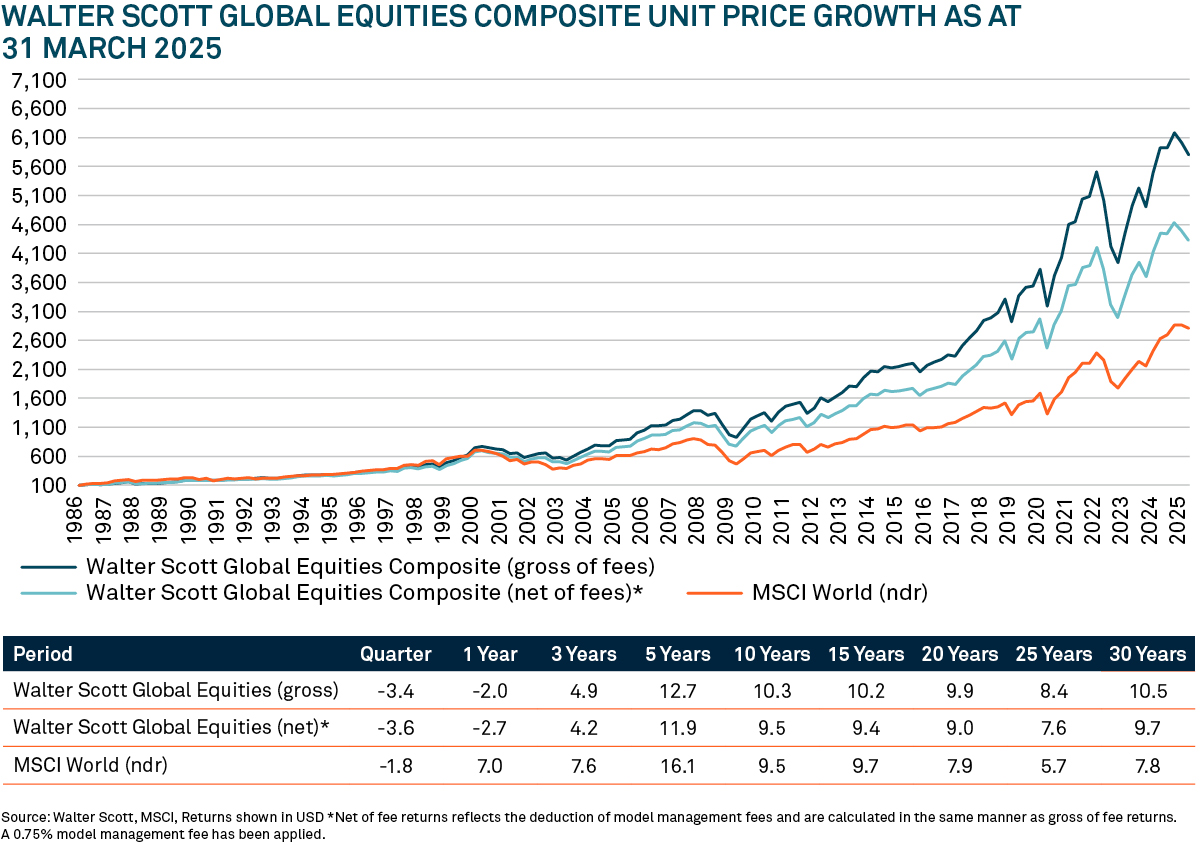

First chart: MSCI World is used as a comparative index for this strategy for illustrative purposes. The strategy does not aim to replicate the composition or performance of the comparative index

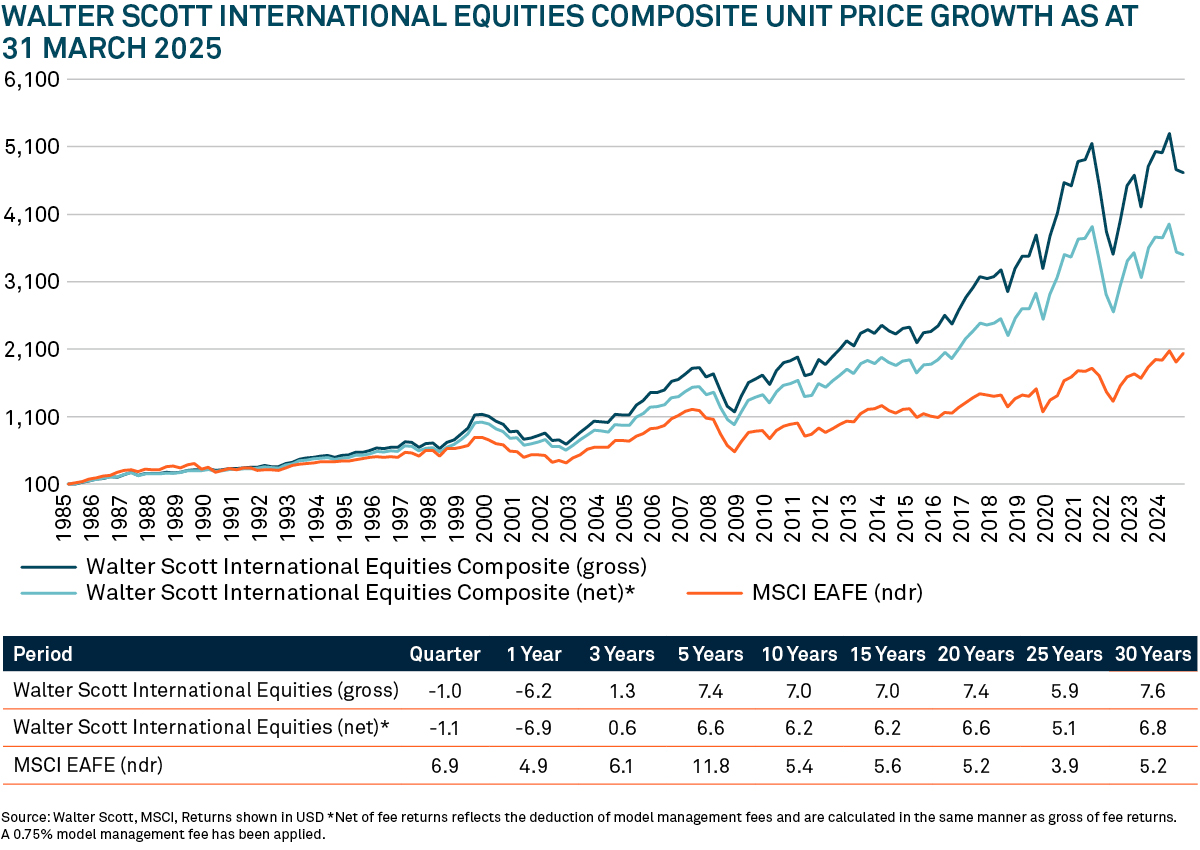

Second chart: MSCI EAFE is used as a comparative index for this strategy for illustrative purposes. The strategy does not aim to replicate the composition or performance of the comparative index

Walter Scott claims compliance with the Global Investment Performance Standards (GIPS). A GIPS compliant presentation is available upon request via your BNY Mellon Investment Management EMEA contact.

However, the last five years have represented a deeply frustrating period for Walter Scott and our clients.

The normalisation of interest rates around much of the world in 2022, while healthy in many respects, was nevertheless a short term but significant headwind for equity investors, and particularly growth investors. As higher interest rates and inflation began to affect consumers and corporates, we felt that Walter Scott’s focus on high-quality businesses should have put us at a significant advantage. However, instead of broadly gravitating toward quality, investors found solace in artificial intelligence (AI), with half of the returns in the MSCI World (in USD terms) over the ensuing three years being driven by just seven stocks – the so-called ‘Magnificent 7’2 .

While frustrating, one thing we can say with confidence is that these periods of market concentration rarely last – a concept we explored in a previous piece.

While Walter Scott’s limited exposure to the Magnificent 7 (Microsoft and Alphabet are long-standing holdings) represented a significant performance headwind, it was not the only one.

Relative performance was also negatively impacted by several of the areas which Walter Scott has long gravitated going through periods of particular challenge:

Healthcare

The Covid pandemic was highly disruptive to the sector: entire production lines had to be re-tooled overnight to produce vaccines, hospitals repurposed; elective surgeries cancelled; inventories ramped up for fear of an inability to resupply. The upshot was that an industry which is traditionally not cyclical, suddenly found itself in a cycle.

Unlike management teams in traditionally cyclical industries, those in healthcare were not used to this. Consequently, post-Covid, healthcare companies have faced numerous, somewhat unpredictable, headwinds and an increasingly unforgiving investor base. Any failure to accurately guide the market has been brutally punished. More recently, we’ve seen pharmaceutical companies being the subject of US scrutiny over drug pricing, albeit how they might actually be affected remains uncertain.

None of this however, alters the fact that healthcare is a sector which benefits from numerous structural tailwinds and the further we get from the pandemic, the more confident we can be that these will reassert themselves, as cyclical factors ebb.

As we potentially move into a period of economic weakness it also seems inevitable that investors will once again be drawn to a sector that – while it may have just experienced its own pandemic-induced cycle – is not sensitive to broader economic cycles.

Industrials

The term ‘Industrials’ sometimes tends to be associated with highly cyclical, metal-bashing industries, and these are not the kind of companies that typically appeal to Walter Scott. However, over the last few years, the Industrials sector has become something of a dumping ground for businesses that MSCI struggles to slot into other sectors (e.g. credit databases business Experian), or which it needs to reallocate to avoid its technology sector becoming an overly large part of the index (payroll processors ADP and Paychex).

It is also home to some quintessentially Walter Scott type businesses. This includes industrial distributor Fastenal. Over the last 25 years it's compounded its earnings at 11.3% per annum, and delivered an annualised return to shareholders, including the reinvestment of dividends, of 15.4%. 3Fastenal and businesses like it: Ferguson (another distributor), Old Dominion (less than truckload trucking), Copart (salvage car auctions) have one thing in common; deep and growing, but often highly fragmented markets that are ripe for consolidation.

Unlike healthcare these companies are not immune to economic cycles and consequently were weak last year, as investors put their faith in the virtual world of AI while worrying about a slow-down in the real world. This was a very real and very significant headwind to short-term performance, but as long-term investors, it represented an opportunity for us – we were able to establish a position in Ferguson at a time when it was out of investor favour.

China

Over the last five years, Walter Scott has moved from having a mixture of direct and indirect exposure to China, to purely indirect. This is largely due to the evolving political situation in the country. In particular, the government’s increasing willingness to assert its authority over or punish private companies that don’t align with its objectives, sometimes seemingly without warning.

While not precluding investment (the country is home to a number of truly excellent, innovative businesses), for now it’s been enough to make the indirect approach more appealing. However, given both the domestic slow down and increasing friction with the US, more recently, any exposure, whether via AIA Group (a pan-Asian life insurance company), or the big global consumer names, has represented a headwind for performance. This has manifested itself across both the Financial and Consumer sectors within the portfolio. Some of this is due to overwhelmingly negative sentiment towards China. For instance, until recently, investors largely ignored the improving operating performance of AIA. However, as long as companies deliver, ultimately the market can only ignore good fundamentals for so long.

Walter Scott has long believed – based on over a century of market returns – that if we can deliver portfolio real returns of 7-10% over the long term, this should lead to a healthy degree of outperformance of the broader market which over that longer term period, has on average delivered just over 5% in real terms.4

Over the last 10 years to the end of March 31st, the portfolio’s holdings have delivered an average annual growth in EPS of 12.7% - which is very much in line with this objective. 5If we continue to deliver on this not only should this be supportive of strong absolute returns for investors, but we’re also confident that it will result in attractive relative returns. This confidence is underpinned by continuing news flow from portfolio companies.

Intuitive Surgical– global leader in robotic surgery

Robotic-assisted surgery pioneer Intuitive Surgical enjoyed a buoyant start to 2025, with first-quarter revenues rising 19% compared to the same period last year. More procedures using the company’s da Vinci surgical system and more system placements with customers helped to drive revenue growth. For 2025, management raised guidance for full-year procedure growth, an encouraging sign given the current macroeconomic uncertainty.

Regarding tariffs, Intuitive is taking a conservative approach, expecting gross margins to shrink slightly this year. The company has plans in place to mitigate the impact, including optimising costs by rebalancing production. However, most of the company’s Mexican manufacturing will incur zero tariffs under the rules of the US-Mexico-Canada trade agreement. The long-term outlook remains highly encouraging. As the population of the developed world ages, the demand for healthcare, and surgical procedures specifically, is set to increase. Robotic minimally invasive surgery is set to grow at a faster pace than the overall market because of its superior safety, efficacy, and cost profiles.

AIA Group – pan-Asian life insurer

A resilient set of first-quarter results highlighted that Hong Kong based AIA remains in excellent health. The important VONB (value-of-new-business) metric hit US$1.5bn, up 13% compared with the same quarter last year. AIA Hong Kong, the group’s largest business area, enjoyed a strong quarter, while China, Malaysia, Singapore and Thailand all performed well. This growth adds to a sturdy recurring earnings base, and management expect that the company will reach its target of delivering a 9 to 11% compound annual growth rate in operating profit per share between 2023 and 2026.

Looking at the longer term, favourable economic and social factors underpin growth for AIA across its Asia-Pacific markets. The company is benefiting from ongoing urbanisation trends as well as rising wealth and disposable incomes. The middle classes and active workforce are growing rapidly. The inability of state-funded retirement income and medical and welfare services to meet demand in much of the region combines with these factors to provide enormous structural growth opportunities for the business.

Compass – a leading contract caterer

Compass enjoyed a rock solid first half of 2025, and is now in its fourth consecutive year of delivering net new business within its over 4-5% target range. Client retention exceeded 96%, like-for-like margins continue to tick up, and operating profit rose over 10% over the period.

Management is augmenting growth through accretive M&A. Compass closed US$1bn of acquisitions in the year to date at the end of the first quarter of 2025, with Dupont Restauration in France and 4Service in Norway accounting for the bulk of that expenditure. It also continued with its portfolio rationalisation project, exiting the Chile and Kazakhstan markets. Over the past 12 months, the company has opted to focus on core markets, while departing non-core countries, such as Argentina, China and the UAE.

Cognizant Technology Solutions – multinational IT consulting and outsourcing company

The pivot from stabilising the business to growth is continuing to gather momentum at Cognizant, as evidenced by the company’s first-quarter results. Revenues rose 8% on a constant currency basis and operating margins edged higher, exceeding the upper end of management expectations. The health sciences and financial service-related areas led the way on a segment basis, while North America was strong from a geographic perspective. Bookings were down slightly, but the 12-month book-to-bill ratio, an indication of good demand, remained a solid 1.3x.

Navigating a course through the rapidly evolving technology landscape is prompting leading companies to increasingly seek support from trusted technology partners. Cognizant offers its customers a ‘best of both worlds’ proposition: the significant labour cost benefits of offshore delivery combined with the reassurance of working with a US-domiciled partner. By continuously investing to develop leading-edge digital capabilities and industry-specific expertise, the company remains at the forefront of technological developments.

Understandably, this is one of the most common questions we currently receive.

Traditionally, the focus on resilience that is hardwired into our process has meant that Walter Scott portfolios have held up well in times of equity market stress. We believe that in so far as turbulent markets can go hand-in-hand with a weakening of the global economy/recession, this will continue to be the case. As such, it is very tempting to point to global trade concerns as a catalyst for a turnaround in relative performance. High-quality companies, with growth driven through competitive differentiation rather than cyclical support, will come to the fore when growth is harder to come by.

There’s never any room for complacency. We’re currently checking through portfolio holdings to see how companies are responding to the current challenges. Many are no strangers to disruptive macro events – the GFC, European Debt Crisis, and latterly, the Covid pandemic. But these quality businesses – with market-leading products or services, pricing power, good margins and robust balance sheets coupled with an ability to adapt and innovate – look well-placed to weather potential tempests and prosper over the long term.

However – and this is important – given the nature of the headwinds that have been impacting the portfolio over the last two to four years, it is just as likely that the turnaround in performance does not come in the form a single dramatic quarter or couple of quarters. Rather, we expect a narrative of outperformance to gradually unfold over time. Fundamentals drive returns. We are convinced that over the long term the companies we hold will deliver excellent and durable earnings growth given their many strengths. We believe that this is likely to be reflected in superior portfolio returns for our investors.

Past performance is not a guide to future performance.

The value of investments can fall. Investors may not get back the amount invested.

1 Investment Managers are appointed by BNY Mellon Investment Management EMEA Limited (BNYMIM EMEA), BNY Mellon Fund Management (Luxembourg) S.A. (BNY MFML) or affiliated fund operating companies to undertake portfolio management activities in relation to contracts for products and services entered into by clients with BNYMIM EMEA, BNY MFML or the BNY Mellon funds.

2 MSCI World Index, Business Insider, as at May 2025

3 Fastenal 25-year OP CAGR, Bloomberg, as at end of December 2024

4 Walter Scott, Dimson-Marsh-Staunton Global Returns Data, as at 31 December 2024

5 BNY LTGE Earnings Growth, Walter Scott, FactSet, as at 31 March 2025