21 Jan 2026

We have seen a softening in market momentum led by US equities and based around two factors. Firstly, there are reduced expectations for an interest rate cut in the aftermath of the October’s Federal Reserve (Fed) meeting.

Post the event, Fed Chair Jerome Powell stated that a December cut was not a ‘foregone conclusion’ and per Fed Fund Futures the probability of a December cut fell from 100% in late October to under 40% by mid-November.

Secondly, the recent round of mega cap tech earnings reports has shown that while businesses are generating huge revenues, the scale of their artificial intelligence (AI) investments is causing some concern. The market appears to be becoming more discerning on the size of capital expenditure, with more scepticism emerging over the likely returns on investments. Equally, the shift from cashflow-funded investment to a mix including additional borrowing appears to have impacted sentiment.

While the overall move lower is relatively minor in the broader scheme of things, the pause and subsequent reversal serve as a reminder that markets do not go up in a straight line. As with every other market theme, winners and losers will emerge. While AI may well be transformative over time, not every company investing billions will reap the rewards for which they strive.

Overall, we remain constructive on the basis that economic fundamentals are benign, earnings growth expectations are solid and even if we do see a Fed ‘pause’ in December, the direction of travel for US interest rates is still lower.

Equities

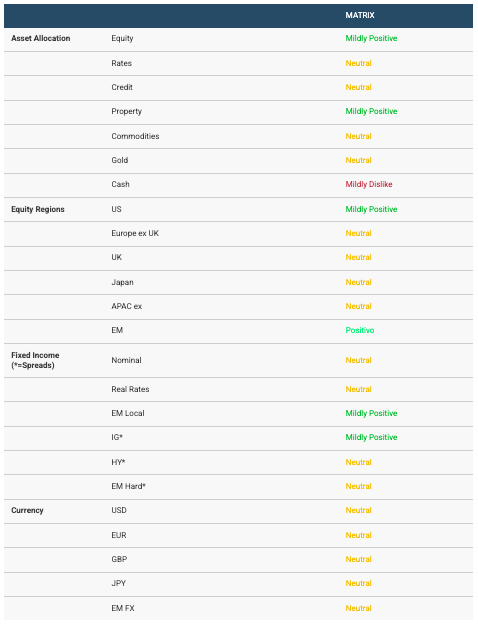

We remain mildly positive on equities. The recent earnings season was positive, with a broadening of growth in US equities, strong growth in Japan and an improvement in emerging markets. We remain mindful that, even with the recent slowing in momentum and mild pullback in markets, valuations are still towards the ‘rich’ end of the spectrum. Given our positive economic outlook, likely lower interest rates and expectations for positive earnings growth, we still see the strongest opportunities in equities.

Fixed income

We maintain a neutral stance on bonds. We continue to see some volatility in government bonds – moves triggered by heightened concerns over debt levels and fiscal deficits. The monetary policy backdrop remains supportive as interest rates gradually come down, though we note that at some point rates in Japan will go the other way. Valuations are not compelling across investment grade and high yield segments, which alongside emerging market bonds offer spreads at the very bottom of historical ranges.

European equities

We remain neutral on European equities but are cognisant that the direction of travel appears more positive as we look towards next year. The asset class performed strongly in the first half of 2025 with excitement around potential fiscal stimulus. Optimism was led by developments in Germany as reforms to the ‘debt brake’ looked set to unleash significant spending on defence and infrastructure. However, by mid-year market patience had worn thin and the outperformance of stocks was eroded. All the same, we believe that patient investors may well be rewarded in 2026 as stimulus begins to have an impact. Any improvement in German growth would also likely have a positive ‘halo effect’ on wider Europe, and earnings expectations are moving higher as a result.

Source: Columbia Threadneedle Investments, as at 11 November 2025.

Important information

For use by professional clients and/or equivalent investor types in your jurisdiction (not to be used with or passed on to retail clients). For marketing purposes.

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investmen t advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In the UK: Issued by Threadneedle Asset Management Limited, No. 573204 and/or Columbia Threadneedle Management Limited, No. 517895, both registered in England and Wales and authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A., registered with the Registre de Commerce et des Sociétés (Luxembourg), No. B 110242 and/or Columbia Threadneedle Netherlands B.V., regulated by the Dutch Authority for the Financial Markets (AFM), registered No. 08068841.

In Switzerland: Issued by Threadneedle Portfolio Services AG, Registered address: Claridenstrasse 41, 8002 Zurich, Switzerland.

In the Middle East: This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA).

For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution.

For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.

This document may be made available to you by an affiliated company which is part of the Columbia Threadneedle Investments group of companies: Columbia Threadneedle Management Limited in the UK; Columbia Threadneedle Netherlands B.V., regulated by the Dutch Authority for the Financial Markets (AFM), registered No. 08068841. Columbia Threadneedle Investments (Columbia Threadneedle) is the global brand name of the Columbia and Threadneedle group of companies.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. © 2025 Columbia Threadneedle. All rights reserved.