21 Jun 2022

"Across E, S and G factors, there are areas where China is making great strides, and there are other areas where investors would like to see much more progress."

With the Chinese economy maturing and personal incomes rising rapidly, China is fast becoming the world’s biggest consumer market. Within the next two decades, almost all forecasters expect China to be the biggest economy in the world, by nominal GDP. At the same time, J.P. Morgan Asset Management’s Long-Term Capital Market Assumptions rank China close to the top of the table for expected stock market returns over the coming 10 to 15 years.

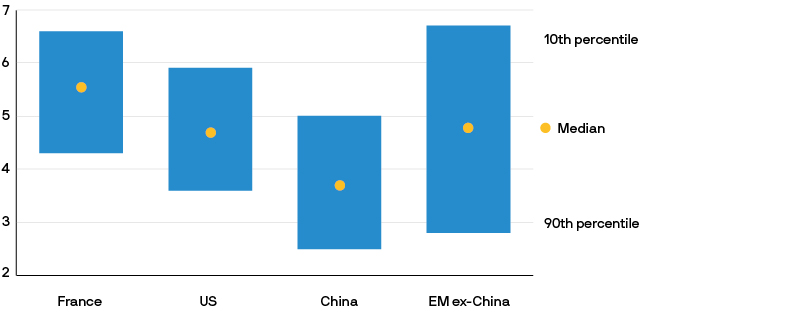

While China’s growth potential is undeniable, we are increasingly asked whether investing in China can be reconciled with investing sustainably. In this piece we tackle this complex conundrum by looking at the environmental, social and governance (ESG) considerations raised by investing in China. Median ESG scores are lower for Chinese companies relative to developed markets based on MSCI data, but the range within each region is typically larger than the range across different regions.

We find that the arguments are not always black and white. The lens may change, for example, when thinking about investing in individual companies domiciled in China, versus investing in the state directly via Chinese government bonds. Nevertheless, each reader of this report will likely have a different view on the relative arguments of ESG investing in China.

Exhibit 1: Weighted average ESG scores

MSCI ESG score

Source: MSCI, J.P. Morgan Asset Management. The score represents the weighted average of the scores received by MSCI on all the key issues contributing to the final rating of the company. Data as of 11 May 2022.

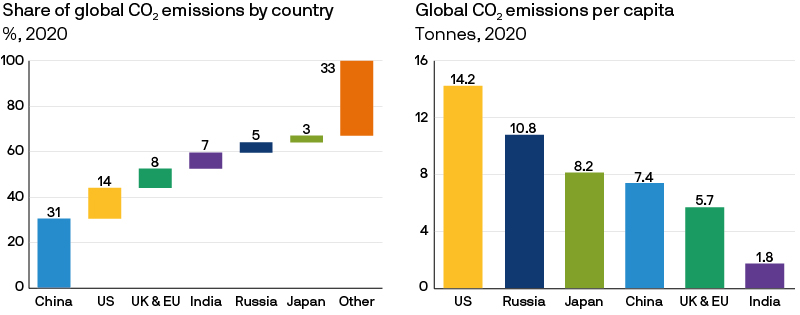

On many metrics China does not stack up well on environmental matters. China’s greenhouse gas emissions exceeded those of the developed market economies combined for the first time in 20191. Last year the administration pledged to end financing of overseas coal-fired power plants, but Chinese banks financed nearly 70% of the world’s coal power projects from 2016-2020 under its Belt and Road initiative, according to the Council on Foreign Relations. While Beijing has committed to carbon neutrality by 2060, China’s emissions are set to continue rising to the end of this decade.

However, some of China’s environmental issues merely reflect the fact that China has a very large population and its economy is still at a relatively early stage of development, with a much greater dependency on manufacturing compared to developed markets. For example, China is the biggest emitter of greenhouse gases in absolute terms, but in per capita terms, Chinese emissions are only just over half that of the US. Production that has been outsourced from developed markets to China is another factor. Researchers from the University of Chicago have estimated that roughly 15% of Chinese emissions are attributable to goods that are exported and consumed abroad. We are also seeing China accelerate its environmental ambitions in an international context. Beijing’s efforts on a Common Ground Taxonomy, which targets greater international alignment on green taxonomies, under the International Platform for Sustainable Finance platform is one example.

Exhibit 2: CO2 emissions across regions

Source: (Both charts) Gapminder, Global Carbon Project, Our World in Data, United Nations, J.P. Morgan Asset Management. CO2 emissions are from the burning of fossil fuels for energy and cement production. Emission impact from land use change (such as deforestation) is not included. Data as of 31 March 2022.

China’s environmental policy is also driving the rapid increase in renewable energy infrastructure. China has ambitions to take 25% of its energy use from renewables by 2030, which although below the European Union’s 40% target, may be more straightforward to reach. China is by far the biggest manufacturer of renewables equipment, commanding 50% of global wind turbine production, 66% of solar panel production and 90% of the battery storage market2.

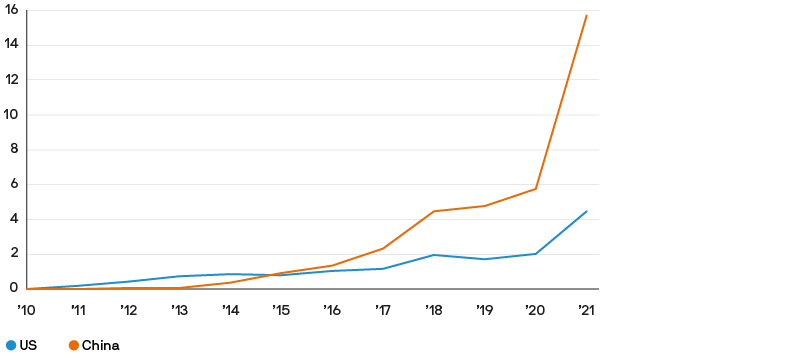

The electrical infrastructure that can make use of renewable sources of energy is also advancing rapidly. China’s electric vehicle penetration passed 15% in 2021 and is comfortably on track to exceed the 20% target for 2025 according to the International Energy Agency (IEA). By contrast, electric vehicle penetration in the US is less than 5%.

Emissions trading is another area where China is making progress from a low base, having launched a national emission trading scheme (ETS) in 2021. While the launch came more than 15 years after the European Union started their equivalent market, China’s carbon market is now the largest in the world. After a flurry of activity post the launch, data quality issues have subsequently delayed the market’s expansion into other industries outside of electricity.

Exhibit 3: Electric vehicle sales market share

% of total sales

Source: International Energy Agency, China Passenger Car Association, J.P. Morgan Asset Management. Data as of 11 May 2022.

Social concerns in China often relate to the treatment of workers as well as broader public health issues relating to living standards, particularly with regards to pollution in cities. China’s record on human rights and treatment of ethnic minorities is also regularly highlighted as a cause for concern.

While worker rights sit well below the strict standards rigidly enforced in Europe, for example, the Chinese authorities have been making strides on this front. In 2021, the Chinese Supreme Court ruled that the 9-9-6 working practice (9am to 9pm, six days a week), which had been commonplace in industries such as technology, was illegal. In April 2022, China approved the ratification of 20 International Labour Organization conventions on forced labour.

With regards to broader social standards, again the conclusion is that progress is being made, albeit from a very low base with substantial further progress required. One example is China’s air pollution, where greater efforts to regulate and move key polluting activities away from densely populated areas have improved air quality in cities, such as Beijing and Shanghai, by roughly 50%3. Lower China air pollution levels have resulted in an increase in life expectancy of two years since 2013, although we note that the national average levels of pollution still sit six times higher than the World Health Organization guidelines.

There has been significant progress on poverty alleviation, where the Chinese government has had considerable success dispersing the fruits of the country’s economic development through to its population. Over the past 40 years, the number of people in China with incomes below $1.90 per day – the International Poverty Line as defined by the World Bank – has fallen by 800 million.

In the recent decade, higher income cohorts have seen incomes rise more quickly, but President Xi has made “common prosperity” a key policy agenda to reduce income and wealth inequality. The common prosperity drive has also led to new initiatives that aim to better protect individuals across the economic spectrum, such as pressure on businesses to provide insurance for employees.

When it comes to governance, state governance and corporate governance should not be viewed as interchangeable for China investment. State level considerations may often be more relevant for fixed income investors than equity investors given the size of the government bond market. The lack of democracy is a worry for many investors, with trepidation as to the ambitions of authoritarian regimes increasing further following Russia’s invasion of Ukraine. Yet at the same time, the inclusion of Chinese government bonds in flagship indexes such as the FTSE World Government Bond Index (WGBI) that started in 2021 is helping to provide overseas investors with more comfort that China is determined to attract more foreign capital, and therefore willing to becoming increasingly aligned to international standards.

At a corporate level, governance scores on average are significantly lower than for developed market peers, but closer to those of other emerging market countries. The weight of state-owned enterprises (SOEs) in major indices is one area of concern: while China now has more companies on the Fortune Global 500 list than any other country, nearly 75% of these are SOEs.

Nevertheless, we do find that corporate governance standards are on an upward trend, particularly in “new economy” sectors, such as technology, and more commonly in companies listing on the A-share market. The quality and availability of corporate reporting is also improving, with the proportion of companies in the CSI 300 index producing ESG reports nearly doubling over the past decade, for example.

One thing is certain: ESG considerations for Chinese assets will remain a complex and emotive topic for the foreseeable future, as they encompass a spectrum of varying beliefs and opinions. Across E, S and G factors, there are areas where China is making great strides, and there are other areas where investors would like to see much more progress. It is also clear that the decision to invest in Chinese state assets is very different to investing in companies in China. Looking ahead, we expect the relative weights that our clients assign to each issue will likely determine the role of Chinese assets within a sustainable portfolio.

1 Rhodium Group, https://rhg.com/research/chinas-emissions-surpass-developed-countries/

2 Wood Mackenzie, https://www.woodmac.com/press-releases/chinas-renewables-boom-year-poses-major-challenges-to-western-markets/

3 University of Chicago Air Quality Life Index, https://aqli.epic.uchicago.edu/wp-content/uploads/2022/02/China-Report_FEB2022-2.pdf