03 Mar 2023

Vincent Juvyns, Global Market Strategist

"The demand for green bonds should remain elevated, amid increased investor appetite for sustainable securities that offer transparency over the use of proceeds, and ongoing regulator and central bank encouragement."

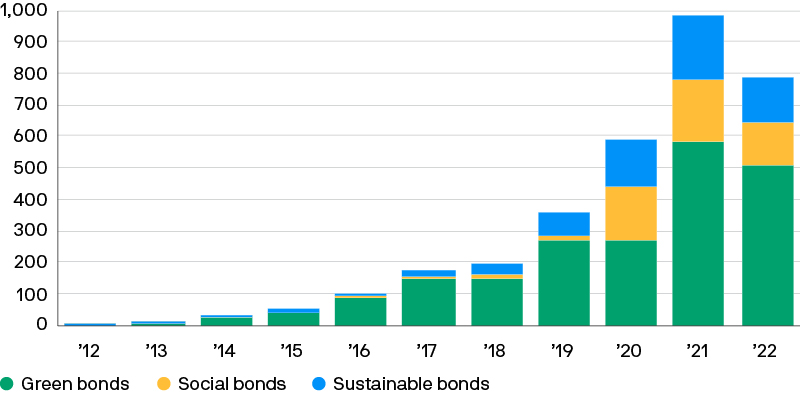

Since the issuance of the first green bond by the European Investment Bank in 2007, the green bonds market has grown substantially (Exhibit 1), with green bond issuance now exceeding $500bn per year.

Exhibit 1: Global sustainable, social and green bond issuance

USD billions

Source: Refinitiv Eikon, J.P. Morgan Asset Management. Green bonds are those where 100% of the net bond proceeds are allocated to green projects. Social bonds are those where the bond proceeds have a focus on delivering positive social outcomes. Sustainable bonds are those where the bond proceeds are directed to a mix of both green and social projects or if the bond coupon/ characteristics can vary based on achieving predefined sustainability targets. Past performance is not a reliable indicator of current and future results. Guide to the Markets - Europe. Data as of 31 December 2022.

This growth should accelerate further in the coming years, as the proceeds from green bonds are used to finance the energy transition. Forecasts for the amount of global investment needed to reach Net Zero stand at several trillion dollars per year by 2030.1

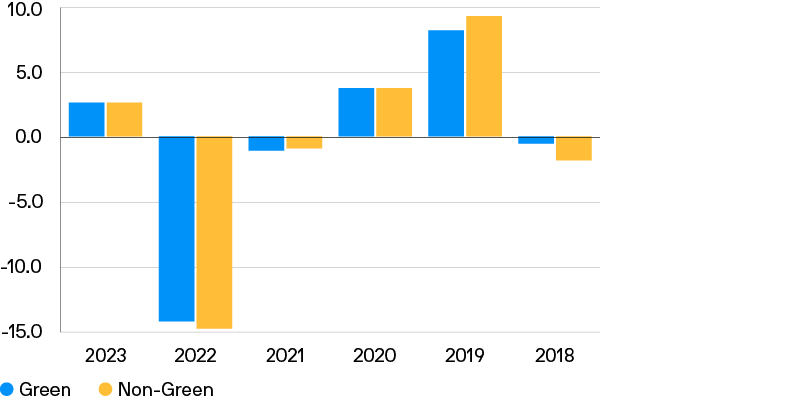

A substantial part of these climate-related investments could be financed through the issuance of green bonds, as these generally offer slightly lower financing costs, or a “greenium” (Exhibit 2), compared to traditional bonds, thanks to the strong demand for this type of instrument.

However, while this greenium is a financial advantage for issuers of green bonds, the benefits for investors is less clear. Why, one may wonder, would investors accept a lower yield on their investment for reasons beyond a regulatory requirement or non-financial incentive? The answer, we believe, lies in the strong fundamental, quantitative and technical factors that underpin demand for green bonds.

Exhibit 2: Spread between green and traditional corporate bonds

Basis points

Source: Barclays Research, J.P. Morgan Asset Management. Data shown is for a Barclays Research custom universe of green and non-green investment-grade credits, matched by issuer, currency, seniority and maturity. The universe consists of 160 pairs, 99 EUR denominated and 61 USD denominated. Spread difference is measured using the option- adjusted spread. Past performance is not a reliable indicator of current and future results. Guide to the Markets - Europe. Data as of 31 December 2022.

1. Fundamentals: Green bonds are more defensive than traditional bonds and have similar duration-adjusted returns

When comparing the Bloomberg Global Aggregate Index and the Bloomberg MSCI Global Green Bond Index, we observe that although the green bond index has a higher credit quality, it has underperformed and has been more volatile than its non-green counterpart since its inception.

However, this discrepancy is mainly due to its higher duration (7.2 vs. 6.8) which weighed on the relative performance of the green bond index as yields rose in 2022. When we look at the security level, by comparing bond pairs (green and non-green) that have similar features2, it appears that green bonds have similar duration-adjusted returns (Exhibit 3) but with a lower spread volatility (Exhibit 4) and better downside protection.

Exhibit 3: Duration adjusted returns

%

Exhibit 4: Non-Green less Green Spread Difference

Basis points

Sources: Bloomberg, J.P.Morgan Asset Management. Data as at January 2023.

2. Quantitative: The greenium is not as negative as investors may think

The greenium is a well-known feature of green bonds but its size is generally limited. The Federal Reserve3 has recently estimated that “on average, dollar- and euro-denominated green corporate bonds have a primary market credit spread that is 8 basis points lower compared to conventional”.

In addition, following the yield increase in 2022, the greenium’s share of total yield has decreased substantially, from almost 10%4 of the green bond yield at the start of 2022 to around 2% today.

Finally, because the greenium is a function of the supply and demand imbalances for green bonds, it is not stable over time and across regions, thereby offering alpha opportunities for active investors (Exhibit 2).

3. Technicals: The green bonds market allows investors to benefit from strong flows into sustainable investment solutions

Demand for green bonds should remain elevated, amid increased investor appetite for sustainable securities that offer transparency over the use of proceeds. Environmental, social and governance (ESG) funds, such as those categorised as Article 9 under the European Union’s Sustainable Finance Disclosure Regulation (SFDR), have been gaining traction since the SFDR was introduced. Article 9 funds, which have an explicit sustainable objective and only allocate to sustainable investments, are not obliged to invest in green bonds instead of traditional bonds. However, green bonds can be more attractive for Article 9 funds because they provide greater transparency over the use of proceeds.

On top of investor demand, central banks could also potentially contribute to an increase in demand for green bonds. Some central banks see climate change as part of their mandate, with the European Central Bank (ECB) going so far as to announce that its “corporate bond holdings will be tilted towards issuers with better climate performance”5. The ECB has also recognised the important role that green bonds will play in funding the climate transition and could therefore give preferential treatment to green bonds in its primary market bidding behaviour, subject to certain conditions.6

Conclusion

We believe green bonds will continue to benefit from strong fundamental, quantitative and technical factors.

The greenium is generally seen as a “financial cost” for investors. However, it has historically been relatively limited, while its share of total yield has decreased substantially recently. In addition, the greenium is not stable over time and across regions, and so offers alpha opportunities for active investors.

Moreover, green bonds have historically been proven to be more defensive than traditional bonds, as evidenced by lower duration-adjusted volatility, and have similar duration-adjusted returns.

The demand for green bonds should remain elevated, amid increased investor appetite for sustainable securities that offer transparency over the use of proceeds, and ongoing regulator and central bank encouragement.

However, to fully harness the potential of green bonds, active management is essential. Given the absence of a global definition of what a green bond is, the ability to analyse the use of the proceeds is key to avoid greenwashing and regulatory risks.

1 International Energy Agency (IEA) World Energy Investment 2022 report. 2030e is based on the IEA’s net zero by 2050 scenario.

2 Issuer, capital structure, currency, rating and maturity.

3 https://www.federalreserve.gov/econres/ifdp/files/ifdp1346.pdf

4 Based on a theoretical Greenium of 8 basis points as % of Yield to worst of the Bloomberg MSCI Global Green Bond Index.

5 https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220704~4f48a72462.en.html

6 https://www.ecb.europa.eu/mopo/implement/app/html/ecb.cspp_climate_change-faq.en.html

The Market Insights programme provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the programme explores the implications of current economic data and changing market conditions. For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programmes are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programmes, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2023 JPMorgan Chase & Co. All rights reserved.