09 Feb 2022

In the second of this inflation mini-series we take a closer look at what is going on in the developed world’s labour markets. The supply chain problems discussed in part 1 may linger for some months but whether this turns into a lasting inflation problem depends on the jobs market. If workers are able to bargain for higher wages in the face of rising living costs then this has the potential to feed a wage-price spiral and medium-term inflationary pressure.

Such bargaining power was notably absent in the last cycle. For several years after the financial crisis, as unemployment declined, wage growth remained lackluster. It appeared that the inverse relationship between unemployment and wage growth was broken. It took a long-time and near record low levels of unemployment before wages started to pick up.

What’s so remarkable about the recent recovery in the labour market from the deep pandemic induced recession is the sheer speed at which we have returned to the point where workers again have bargaining power. From its peak of 10%, US unemployment took 8 years to fall to current levels after the financial crisis. From its pandemic peak of nearly 15%, US unemployment has recovered to 3.9% in less than 2 years.

The unemployment rate can be an imperfect measure of the tightness of the labour market but there are multiple signs that demand for labour is currently high relative to the available supply of workers. For a start, the gap between the number of Americans who think that jobs are plentiful and those who think they are hard to get is very close to the highest level on record. And they are taking advantage of the plentiful job opportunities and the fact that job switchers tend to get bigger pay increases than those who stay with their current employer. The number of people quitting their job is at record highs.

Businesses are also reporting a very tight labour market. The National Federation of Independent Business survey shows that the number of small businesses struggling to hire the workers they need is very high by historic standards and the number who have raised pay in the last 6 months and are planning future pay rises are both at record highs. Layoffs are also near record lows as companies cling on to workers in the knowledge of how hard it is to replace them.

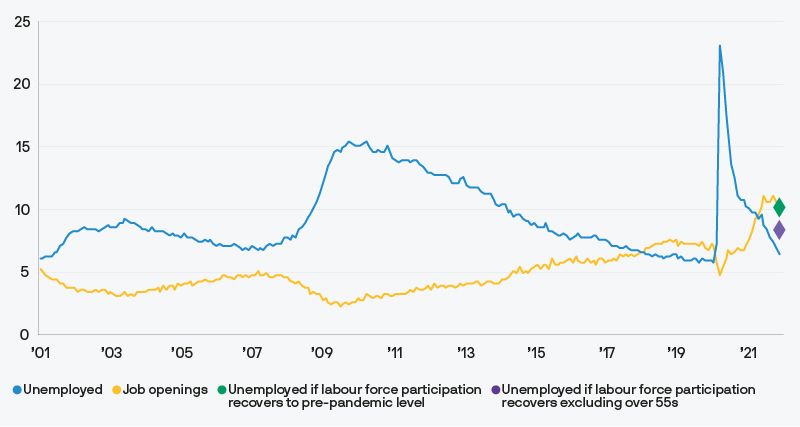

A simple way of looking at the tightness of the labour market is to compare the number of people who are unemployed to the number of job adverts/openings. For most of the last 20 years, there were more unemployed people than there were job openings. Today, despite the fact that unemployment is still slightly higher than pre-pandemic, the number of job openings has boomed and is far in excess of the number of unemployed workers (Exhibit 1).

Exhibit 1: US unemployed and job openings

Millions of people

But to be counted in the unemployment numbers you have to be looking for work and the percentage of Americans who are working or looking for work (the participation rate) has declined since the start of the pandemic. So will a rise in the participation rate, when/if more people start looking for work, lead to a less tight labour market?

Since the start of the pandemic, the growth in the number of Americans not in the labour force (those who are not currently working and not looking for work) is primarily due to those over 55 years old. It is probably fair to assume that eventually most of the under 55s who were working pre-pandemic will return to work. However, there are good reasons to believe that many over 55s will have retired permanently.

Many would have naturally retired anyway over the last two years. But we suspect some others will have been able to retire earlier than they otherwise would have because of the enormous gains in the US stock market since the start of 2020. The S&P 500 ended 2021 47% higher than at the start of 2020. That will have boosted the value of pensions and other investments. House prices have also risen by 28% benefitting anyone who wants to withdraw equity from their house or downsize to help fund their retirement. Of the over 55s who have left the labour force, 95% say they don’t want a job.

The key point is that even if the participation rate does rise, the number of available workers is likely to remain low relative to the number of job vacancies.

Could Omicron reduce demand for workers? Our base case is that any economic disruption from Omicron is likely to be relatively short-lived given how quickly it spreads and the fact that the proportion of cases who are hospitalised seems to be lower compared with previous waves. The forthcoming anti-viral pills which reduce hospitalisation among the infected should also help limit the length of any significant economic disruption.

Now that businesses know how quickly demand can bounce back and the difficulty they are having hiring at the moment, we believe that if they believe any economic disruption is likely to be short-lived then they will be much less willing to let go of workers than they were at the start of the pandemic. So we expect that any reduction in labour market tightness due to Omicron is likely to only prove temporary.

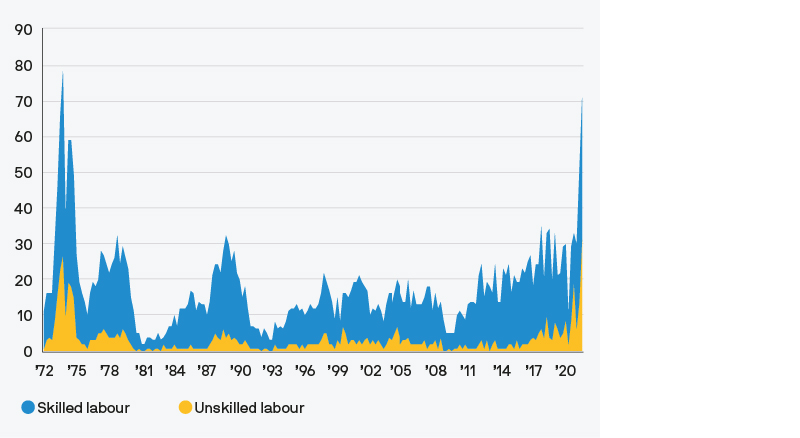

It’s not just in the US that the labour market looks tight. In the UK, the furlough scheme has done a spectacular job of preserving employment. At one point in 2020 about a third of UK private sector workers were on furlough, yet with the furlough scheme now ended, unemployment is only very slightly higher than it was pre-pandemic. Various business surveys (Exhibits 2 and 3) also indicate a tight labour market. Immigration controls post-Brexit could also limit the ability of businesses to fill roles with European workers.

Exhibit 2: Bank of England Agents’ survey - Recruitment difficulties

Survey score

Exhibit 3: UK CBI survey - Factors limiting production

% of respondents

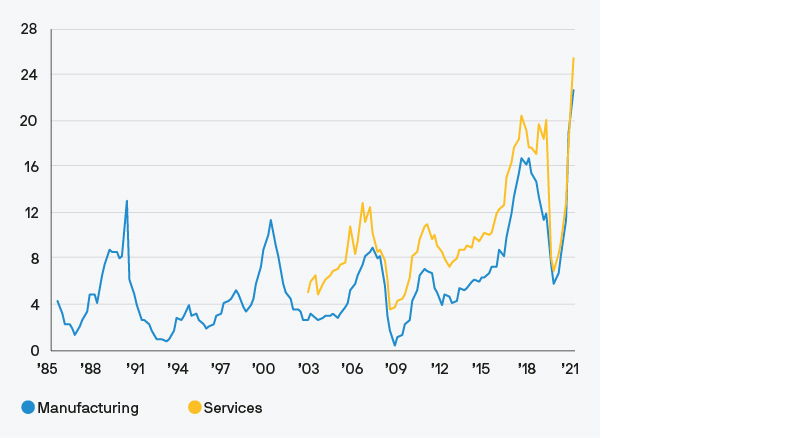

In Europe, there tends to be more inertia in wages because pay deals tend to be struck on a multi-year basis. We also have less granular and timely data to monitor the situation relative to the US and UK. However, the risks are clear: businesses are reporting difficulty hiring the workers they need (Exhibit 4).

And politicians, under pressure given rising living costs, appear to be supportive of higher wage growth. Indeed last November the European Parliament issued a draft directive on a minimum wage which aims to lay down minimum requirements to ensure an income that allows for a decent standard of living for workers and their families. This can either be via a statutory minimum wage or by allowing workers to negotiate their wages with their employers via collective bargaining. The new German government has already put forward a proposal for a 22% increase in the German minimum wage which would directly affect the salaries of roughly one fifth of the German workforce.

Exhibit 4: Eurozone business surveys - Labour limiting production

% of respondents

Conclusion

In summary, labour markets look remarkably tight only two years after the start of the pandemic, particularly in the US and UK. Tight labour markets could lead to higher and more sustained wage gains than were seen in the last cycle. Unless they are accompanied by better productivity gains, higher wage inflation will lead to core inflation staying above target on a more sustained basis than investors and central banks currently expect. In part 3 next week, we will consider the best options across the asset spectrum for investors to protect their capital.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2022 JPMorgan Chase & Co. All rights reserved.