02 Jan 2026

Portfolio Manager Luke Newman discusses why he believes absolute return strategies are set to play a pivotal role in 2026, offering diversification and resilience to offset uncertainty and evolving market dynamics.

As we look ahead to 2026, the investment environment remains highly complex, shaped by persistent macroeconomic and geopolitical uncertainties. Sovereign debt concerns, tariff risks, and AI-driven market dynamics continue to dominate headlines. The role and impact of fiscal and monetary policy remains crucial, particularly from the US Federal Reserve, given pressure from the US government to cut rates at a faster pace. These elements contribute to an environment of elevated volatility and dispersion, providing fertile ground for active management and stock picking.

More broadly, we see the role of absolute return strategies evolving, not just as a lower-risk equity proxy, but used more for their diversification benefits. Investors are increasingly seeking these strategies to navigate the complex landscape, in pursuit of consistent real returns, regardless of market direction. This shift highlights the growing importance of diversification and risk mitigation in portfolios, particularly relevant when during periods of positive correlation between equities and fixed income.

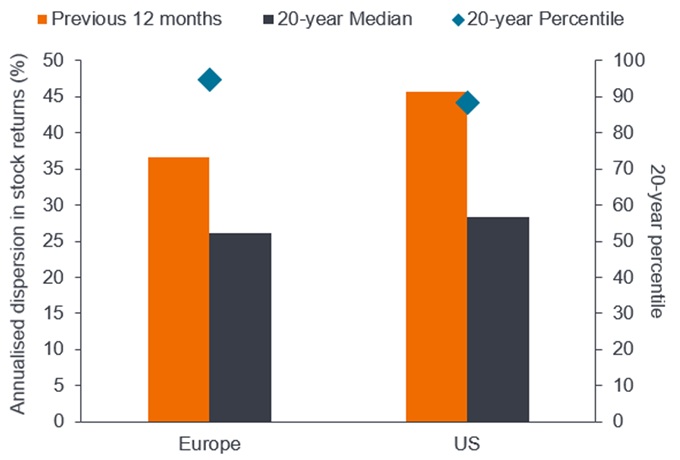

In 2026, compelling opportunities are likely to arise from the increased stock dispersion and heightened volatility in global markets. Higher stock dispersion allows for more nuanced stock selection based on fundamentals, rather than broad sector trends. This kind of environment is highly favourable for equity long/short strategies, as they can exploit both long and short positions driven by fundamental analysis. The focus on company-specific factors, such as management quality, margin structure, and valuation, will be crucial, allowing skilled stock pickers to differentiate performance.

In the US, the evolving economic landscape, characterised by potential interest rate cuts and a cooling labour market, presents opportunities in sectors beyond the dominant technology firms.

In Europe, the prospects in the defence and financial sectors seem promising, given increased government spending and deregulation initiatives. The UK market, with its broad international revenue exposure, offers diversified optionality across sectors. The impact of a weakening dollar has reduced the value of foreign earnings for UK corporations when converted back to sterling. A stronger dollar could prove supportive for UK equities, specifically among businesses with significant US dollar revenue exposure, potentially reversing a headwind observed throughout much of the year.

Possibly the most underappreciated risk for 2026 is the potential for geopolitical tensions to escalate unexpectedly, creating significant disruptions across global markets. 2025 provided a taster of what that could look like, with short-sharp shocks around US tariff threats and concerns related to the big ‘MAG7’ US tech stocks that are dominating markets. Investors held their breath in November 2025 in anticipation of Nvidia’s quarterly results, so if the momentum for the AI super-cycle shows even a hairline crack, we would expect markets to react.

This risk is exacerbated by the interconnectedness of global economies, where a regional conflict or policy change could ripple through markets worldwide. Unexpected tariffs or sanctions could disrupt trade flows, impacting earnings for multinational corporations and leading to market volatility. This a particular concern for highly concentrated markets, like the US, where overall market performance is dominated by a small number of mega-cap tech stocks. As such, we see maintaining a highly liquid, dynamic and diversified portfolio in more volatile periods as crucial to managing risk effectively.

Gone are the days of rising tides lifting all boats, where just being active in the right market was sufficient to see the value of your portfolio rise. Stock dispersion remains elevated relative to history, emphasising the importance of stock selection as a primary driver of returns. Investors are paying much closer attention to results than they have at any point since the Global Financial Crisis, emphasising the importance of good stock selection.

Source: Morgan Stanley Alpha, FactSet, as at 26 August 2025, RHS 30 June 2025. Past performance does not predict future returns.

In a landscape characterised by heightened volatility and stock dispersion, the ability to capitalise on both long and short opportunities becomes increasingly valuable. Absolute return strategies offer the potential for consistent real returns regardless of market direction, providing diversification benefits and risk mitigation, especially when equities and fixed income exhibit unhelpful correlations.

As we look ahead to 2026, we believe that investors should focus on strategies that prioritise fundamental analysis, with the flexibility to adapt to changing market conditions. With fundamentals driving share prices more than broad market trends, the skill of stock pickers in identifying undervalued opportunities and managing risks is paramount. Engaging with experienced managers who can leverage these dynamics could be crucial for achieving differentiated performance and enhancing portfolio resilience.