05 May 2022

With inflation reaching multi-decade highs, Portfolio Managers Jason England and Dan Siluk believe that the path for central banks has become perilously narrow, thus increasing the chances of a policy error catching investors by surprise.

Key takeaways:

For fixed income investors, 2022 was supposed to follow a predictable script, although one not without challenges. Continued economic reopening should have allowed global central banks to remove extraordinary policy measures, including stepping away from zero-percent interest rate policy (ZIRP). While higher rates can present a headwind for bond valuations, the uneven nature of economic reopening meant that nimble portfolios could increase allocations to regions less pressed to raise rates in the near term.

This outlook has changed in recent weeks. An already worrisome pace of inflation has only increased, as seen by the U.S. headline and core Consumer Price Indices rising 7.9% and 6.4%, respectively, in February. Exacerbating inflation has been the rise in commodities prices related to the conflict in Ukraine. With many Russian exports being shunned, prices of several industrial inputs have skyrocketed. Year to date though March 18, Brent crude futures have returned 39% and those of nickel roughly 78%. Such dislocations across the commodities complex have compounded what was already a supply shock reverberating through the global economy. Much of the past year’s acceleration in inflation has been owed to shortages of semiconductor chips, labor and other key economic ingredients.

These developments amplify our concerns about the potential for monetary policy error. Policymakers must perform a perilous balancing act. Should they overtighten, the global economy could slip into recession. If they fall behind the curve and higher inflation expectations become embedded, bond valuations could come under pressure as higher discounts are commanded to compensate for the diminished value of future cash flows.

Given the presence of these risks, we believe that fixed income investors should consider prioritizing capital preservation and minimizing volatility over the next several months rather than seek potentially risky ways to maximize income in what has again become an uncertain economic and market backdrop.

We’ve long stated that all regions of the global economy rode the same elevator down at the onset of the pandemic. Since then, we have expected individual countries to take different escalators on the way up, with the speed and steepness of the trip dictated by their degree of economic reopening and accompanying levels of inflation. Varying cadences of economic recovery would prove favorable for bonds as some countries remaining accommodative longer than others could provide refuge from the risks posed by rising policy rates.

The last few months, however, have seen a rush toward a single escalator – one faster and steeper than nearly anyone had expected. Rather than lowering the level of accommodation, the path of monetary policy can now be characterized as one of tightening. Driving this is months of accelerating inflation, with February’s data the latest proof point. Market-based expectations provide little solace as the five- and 10-year inflation averages implied in the U.S. TIPS market are 3.60% and 2.95%, respectively – both well above the Federal Reserve’s (Fed) heretofore red line of 2.0%. The outlook for sticky prices is similar in most other developed (and many emerging) markets.

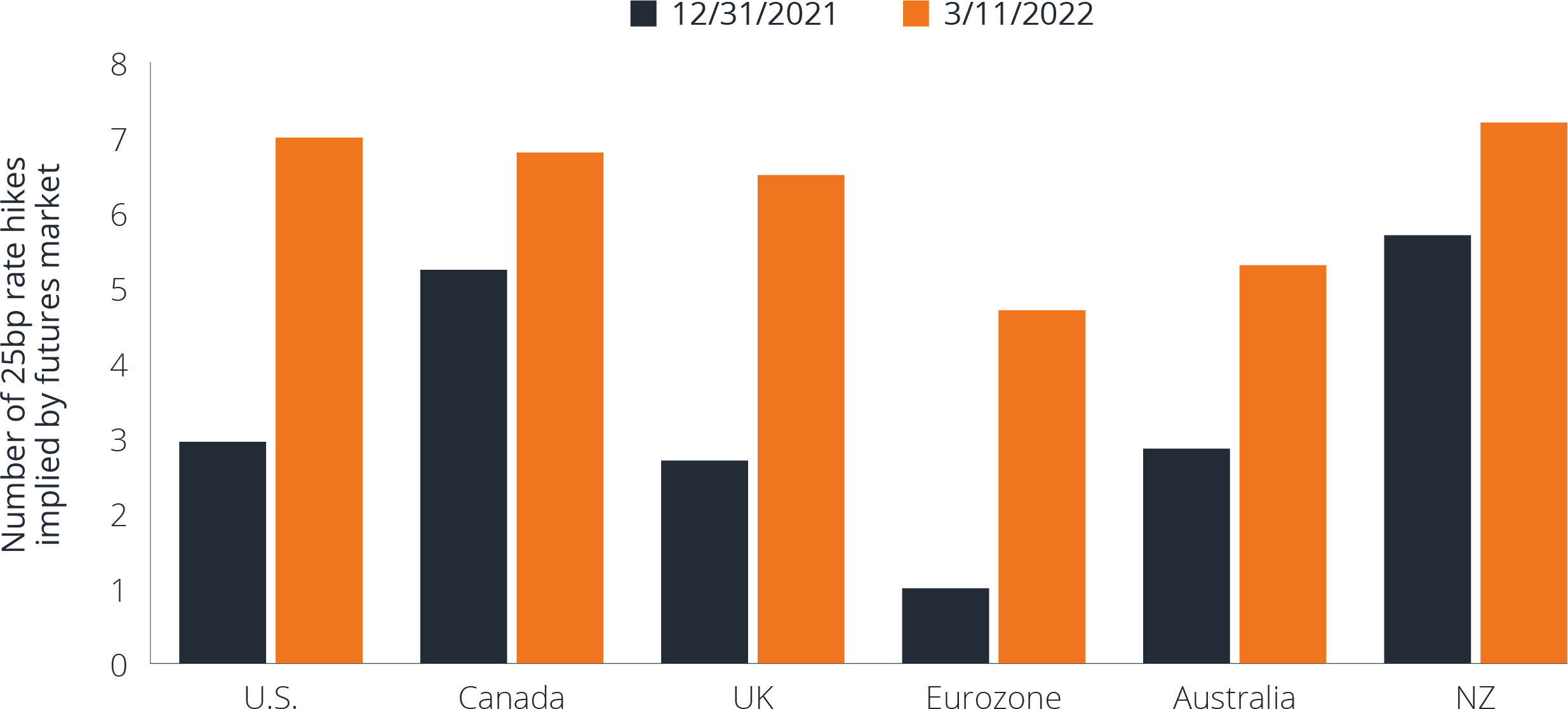

Figure 1: Change in Market Expectations for Policy Rate Hikes in Major Regions during 2022

Accelerating inflation has resulted in futures and swaps markets pricing in a considerably higher number of rate hikes in 2022.

Source: Bloomberg, data as of 11 March 2022. Past performance is no guarantee of future results.

Countries have responded with an acceleration of their normalization programs, a development evidenced in the dramatic increase in the market’s expectations for the number of rate hikes to occur across major economies over the remainder of the year. A synchronous upward move in rates would reduce bond investors’ ability to seek out jurisdictions less susceptible to imminent interest rate risk.

Despite the acknowledgement by central bankers that rates must move higher, the risk exists that the medicine might not fit the ailment. The blunt instrument of higher rates tends to be less effective at combating inflation fueled by supply dislocations than it is for demand-driven price acceleration. But with inflation at a multi-decade high, central banks will have to react. Fed Chairman Jerome Powell recently stated he’s committed to meeting the challenge of a “Volker Moment” with respect to taming the pace of inflation. It is this incongruency between the source of inflation and potential prescription that we believe has heightened the risk of policy error.

With increased geopolitical uncertainty and the rising risk of policy error, any prediction of the shape of the yield curve in coming months has a strong chance of missing the mark. With respect to the two outcomes that concern us, we don’t believe the global economy will tip into recession – despite the recent inversion between yields on 2-year and 10-year Treasuries. The most likely spark for recession would be policy rates increasing too rapidly – again, a scenario we view as unlikely. Such tightening would lead to price gains on longer-dated Treasury securities as flatter – and possibly a more sustained inversion on – yield curves reflect a weakening economy. While incremental tightening could tap brakes on economic growth and support prices for longer-dated bonds, we do not believe the math justifies increasing allocations to this part of the curve. In our view, after years of accommodative policy, the mismatch between duration and yield has resulted in the incremental reward of reaching for yield in longer-dated maturities not being worth the considerably higher interest rate – or duration – risk embedded in these securities.

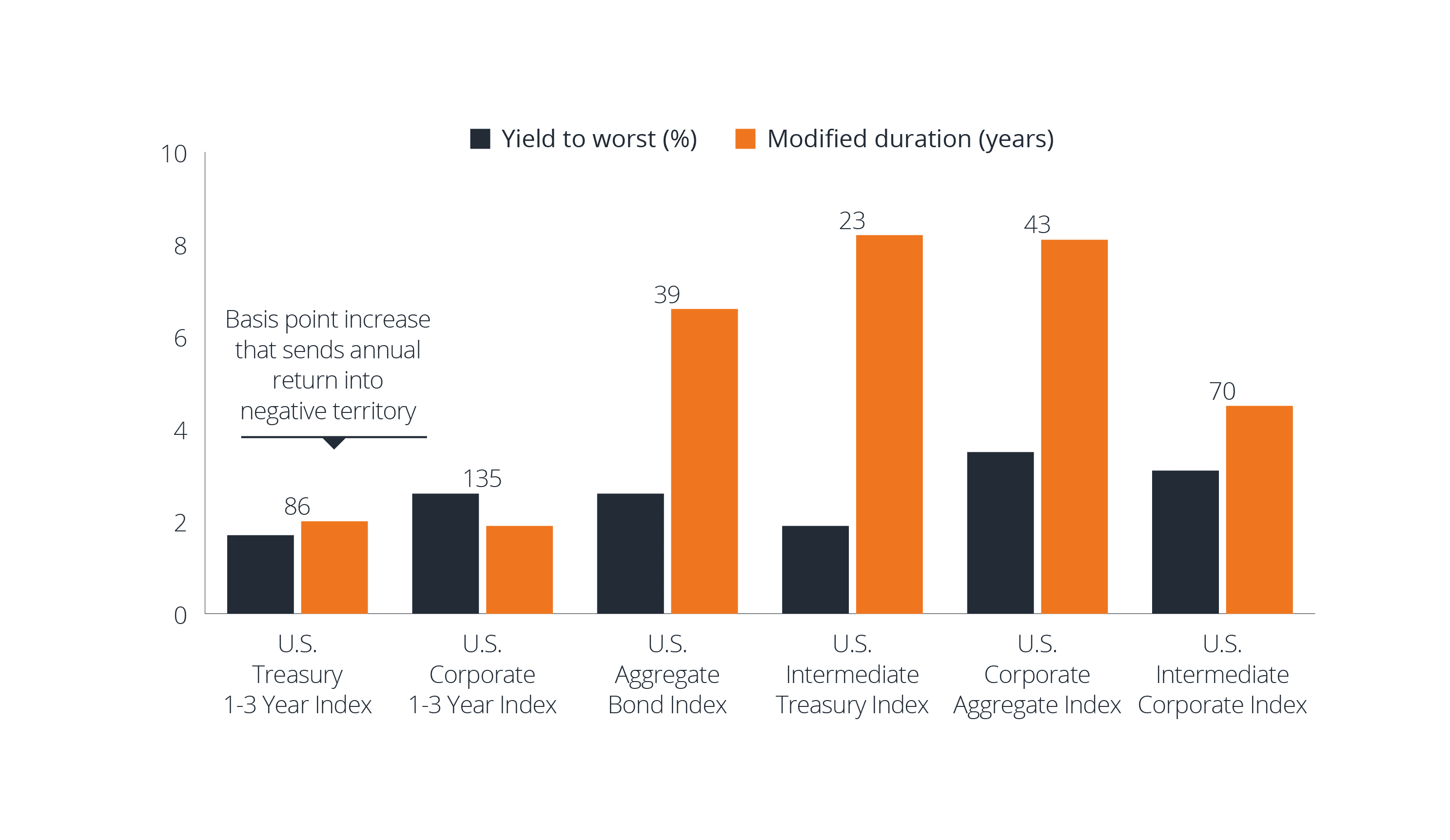

Figure 2: Shorter-Dated Securities Less Vulnerable to Yield/Duration Mismatch

The recent increase in shorter-dated yields has resulted in the associated securities being better positioned to withstand any additional rise in interest rates.

Source: Bloomberg, data as of 11 March 2022. Past performance is no guarantee of future results.

Source: Bloomberg, data as of 11 March 2022. Past performance is no guarantee of future results.

As illustrated in Figure 2, this mismatch between duration and yield exposes longer-dated bonds to having a year’s worth of returns overwhelmed by even a slight rise in interest rates. With central banks’ history of falling behind the curve and the risk of higher inflation expectations becoming embedded, the allure of harvesting only modestly higher yields on longer-dated bonds, in our view, is not worth the accompanying – and material – duration risk.

For much of the past two years, the risk profile of shorter-dated bonds wasn’t much better. That, however, has changed as this segment of the yield curve has responded to central bank guidance about the imminence of a rate “liftoff.” Yields on bonds in the one- to three-year range have risen to such a degree that they can better withstand an additional uptick in rates. Importantly, we believe that front-end rates are unlikely to climb higher as the number of hikes already priced into the market is, in our view, the maximum that we will see. In fact, we believe that compositional changes within the Fed’s voting members will result in the U.S. central bank taking a more dovish path than many anticipate.

As a consequence, we think the pressures that have acutely buffeted the front end of yield curves over much of the past year don’t have much more room to run and these maturities are likely to exhibit lower levels of volatility than longer-dated bonds in the months to come. We believe this lower volatility combined with yield levels that were unavailable only months ago makes the front end of the curve an attractive destination for allocating capital during this period of uncertainty.

An allocation toward shorter-dated bonds does not have to consign investors to paltry returns. While shorter-dated Treasuries (out to 10-year maturities) presently yield less than 2.20%, this is considerably higher than only a few months ago. And even when concentrating on this “safer” segment of the curve, investors can take steps to optimize returns. One tactic is to increase an allocation to corporate credit, including securities of lower-rated – but still investment-grade – issuers that offer more attractive yields than those of higher-rated peers.

For example, two-year corporate bonds with BBB ratings yield 2.7% (as of 14 March 2022). In order to achieve the same yield in the AA segment, investors must extend out to five-year maturities. For three-year BBB securities, their 3.05% yield is roughly equivalent to nine-year AA issuance. Hand in hand with longer maturities is higher duration exposure. Despite their lower rating, the shorter tenor on BBB securities allows for greater visibility into their payment streams as they near maturity, which should translate to lower volatility. This is especially relevant as higher-rated corporates tend to have greater sensitivity to the type of interest rate swings that we think are possible farther out along the curve.

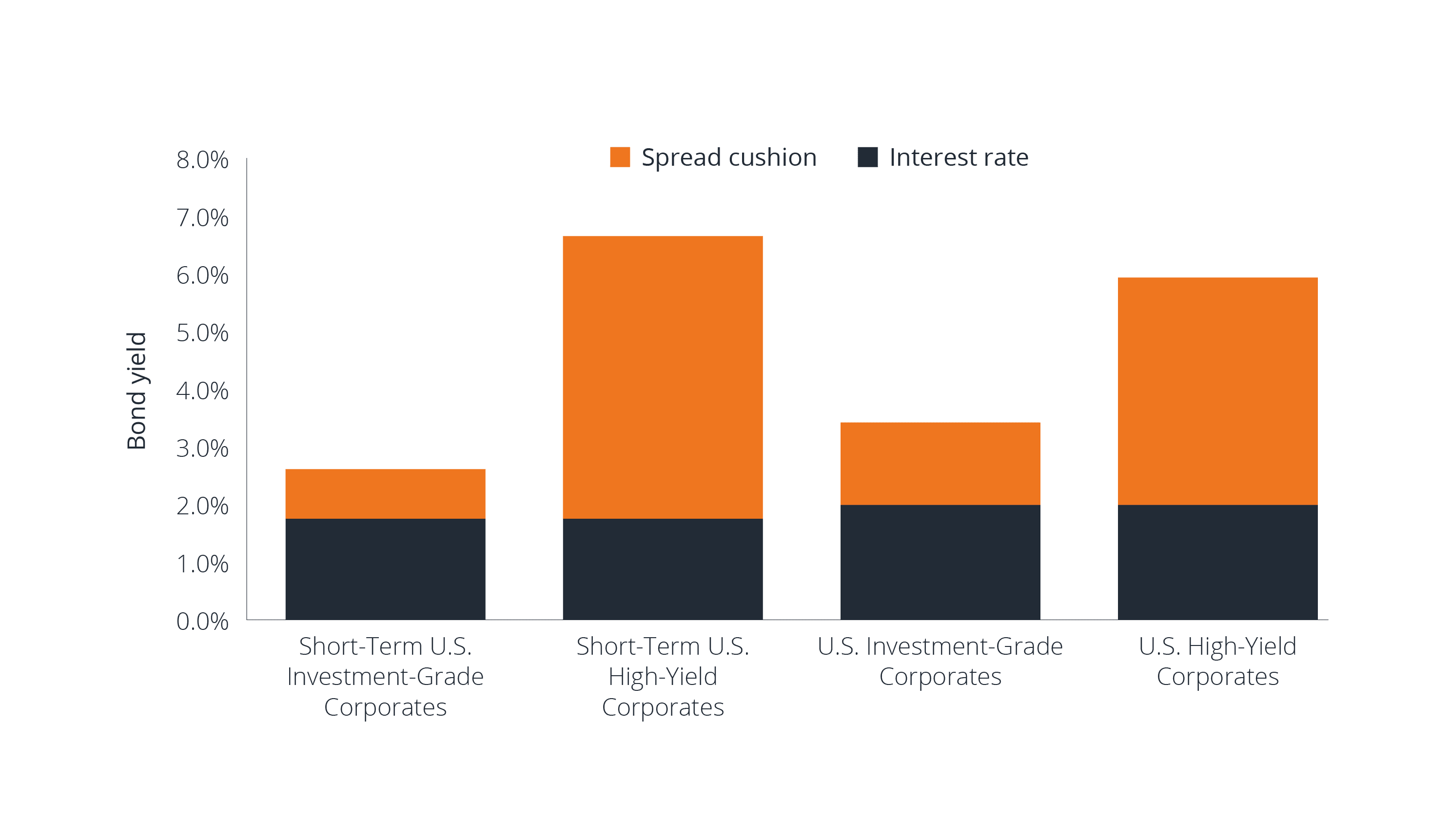

Put another way, lower-rated credits possess a larger “cushion” to absorb changes in interest rates. As illustrated in Figure 3, both AAA and AA rated corporate credits have very little spread cushion – the difference between their yield and that of their risk-free benchmark – to absorb changes in interest rates. Lower-rated corporates, including high-yield issuance, have a greater ability to withstand an additional bump in interest rates. And given our concerns of elevated inflation expectations becoming embedded in consumers’ minds, this is a consideration that we believe cannot be ignored.

Figure 3: Yield Composition for Different Rating Segments on U.S. Corporates

Investment-grade corporate credits with lower ratings and high-yield issuance possess larger “spread cushion” for absorbing an upward move in interest rates.

Source: Bloomberg, data as of 11 March 2022. Past performance is no guarantee of future results.

In summary, higher-than-expected inflation, the rising risk of policy error and geopolitical concerns have clouded the mid-term outlook for the bond market. With the future path of interest rates uncertain, we believe taking on additional duration risk should be avoided. That said, with the market likely more hawkish than what the Fed will ultimately do, yields on shorter-dated bonds have likely hit a plateau, and thus should be considered attractive candidates for increased allocations. And although yields are still low in historical terms, the potential for lower volatility and moderately higher income generation in these securities – especially for corporate credits – compared to a few months ago means this segment of the bond market can again act as a capital preservation ballast for a broader fixed income allocation.

Important Information

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in the following jurisdictions: (a) Europe by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier)

Outside of the U.S.: For use only by institutional, professional, qualified and sophisticated investors, qualified distributors, wholesale investors and wholesale clients as defined by the applicable jurisdiction. Not for public viewing or distribution. Marketing Communication.

Janus Henderson, Janus, Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.