European equities managers Ollie Beckett and Rory Stokes present the case for European smaller companies and explain why the asset class offers bountiful opportunity for active stock pickers.

Key takeaways:

- European small caps have historically outperformed their large cap counterparts most of the time, generally benefiting from stronger balance sheets and higher earnings.

- The sector experiences a large amount of M&A and IPO activity and is relatively under-researched by analysts, providing fertile ground for active stock pickers.

- We believe the next decade will be shaped by sustainability and Europe is a global leader in the sustainability space.

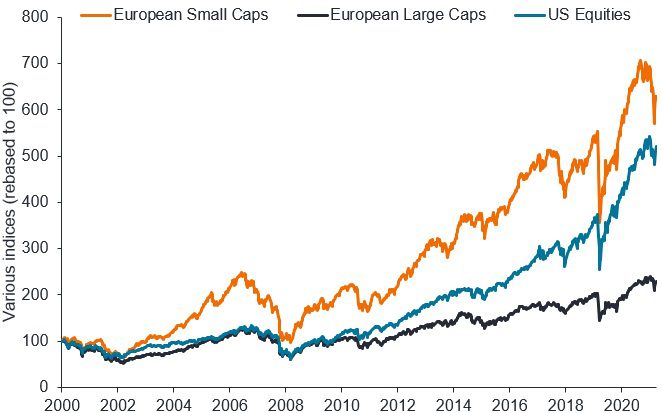

Smaller companies have outpaced large companies

Smaller companies have the potential for higher growth, and with more opportunity for future growth than their larger counterparts. By their very nature, small caps are commonly younger companies, generally early in their development, with room to expand geographically or into adjacent markets, and often operating in faster-growing nascent industries.

In comparison, large cap peers often operate in mature industries and have already expanded their operations globally. These large cap stocks can become reliant on charging higher prices, reducing their costs or taking market share. Some may point to US equities, particularly mega-cap US technology stocks, as an outlier to this trend with their historic ‘winner takes all’ business models. But even here we are seeing saturation difficulties and greater regulatory scrutiny, in addition to a recent anti-growth market stance. In our view, it is less likely for an average large-cap stock to double its revenues from its position when compared to a smaller company.

Figure 1: small caps outperform most of the time

Source: Refinitiv DataStream, Janus Henderson Investors Analysis, in Local currency, as at 31 March 2022. Indices used: European Small Caps = MSCI Europe Small Cap Index, European Large Caps = MSCI Europe Large Cap Index, US Equities = S&P 500 Index. Rebased to 100. Past performance does not predict future returns.

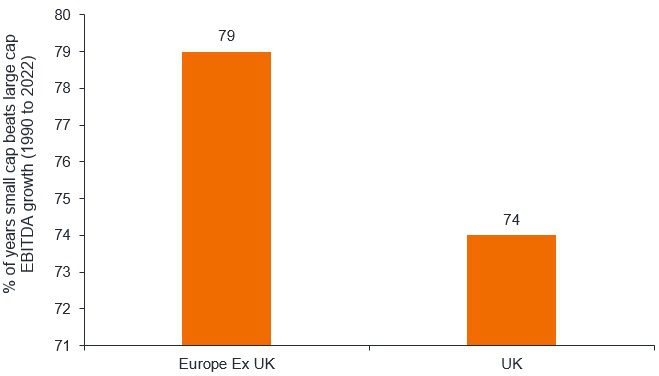

Strong balance sheets and higher earnings provide a solid foundation

Smaller companies are often more reliant on economic growth than large cap stocks. However, strong balance sheets can help these types of companies to survive and even emerge stronger from economic downturns, such as that caused by the COVID-19 pandemic. Data shows that a larger proportion of European smaller companies have more cash and are relatively more attractive valuation-wise when compared to their large cap counterparts. Smaller companies have also historically generated greater growth in earnings than large caps, which has been a driver behind higher performance – figure 2. While this does not suggest that small caps will continue in the same trajectory, this point reinforces the strength of small cap balance sheets.

Figure 2: performance driven by higher earnings growth

Source: JPMorgan research, Janus Henderson Investors Analysis, as at 31 March 2022.EBITDA = Earnings before Interest Tax Depreciation and Amortisation. Past performance does not predict future returns.

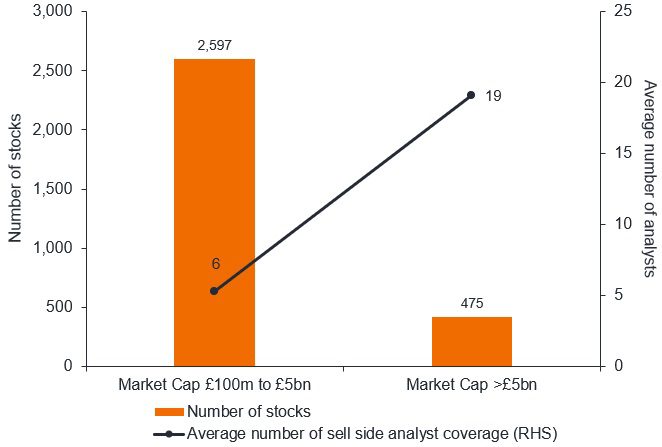

Huge universe of companies largely ignored by sell side research

The European small cap universe offers a much larger pool of less well covered stocks compared to its large cap counterpart. A large majority of these companies are ignored or uncovered by sell side research, leaving the door open for discerning investors to unearth the next gem.

Figure 3: larger universe, less well covered, more mispriced securities

Source: Bloomberg, Janus Henderson Investors Analysis, as at 31 March 2022.

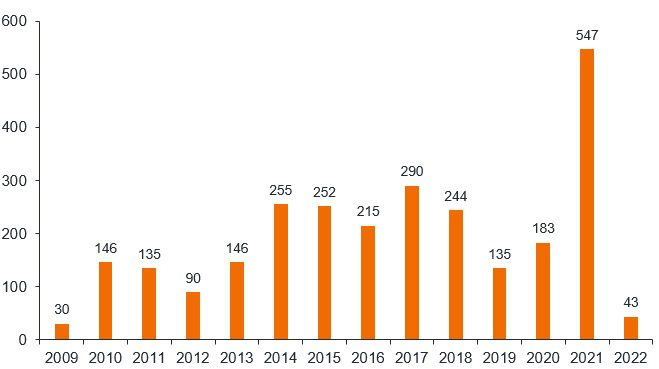

IPO and M&A activity serve as a structural tailwind

In addition to its large universe, western Europe sees a large number of initial public offerings (IPOs) each year, providing a constant stream of new investment opportunities for small cap managers – figure 4. Alongside this is a greater focus on merger and acquisition (M&A) activity, where smaller companies are consistently targeted. This is an important consideration since M&A transactions generally involve a valuation premium being attached to a stock’s undisturbed share price in order to entice existing shareholders. Data shows that around 91% of all M&A transactions from 2008 to 2021 have involved a small cap stock being acquired in Europe.

Figure 4: new companies coming to market

Source: Bloomberg, Janus Henderson Investors Analysis, as at 31 March 2022. Average market cap €780m. Past performance does not predict future returns.

Are smaller companies meaningfully riskier?

The small cap universe bears several compositional differences compared to large caps. Technology, for one, is significantly less represented within smaller companies. Following a fantastic decade of highly valued tech, we consider this as simply a lower concentration of risk within small caps. Smaller companies are also more likely to be insider owned, i.e. family/cornerstone investor-owned and run. This generally means there is more care taken in how capital is deployed and there is less likelihood of, for example, reckless acquisitions focused on short-term earnings revisions.

European smaller companies – why now?

- Inflation

When compared with large-cap companies, financials, materials and real estate are better represented. This could prove advantageous as these sectors traditionally benefit from rising interest rate environments. Take real estate for example, where an inflationary environment has tended to translate into greater demand and higher occupancy rates. Real estate owners can hike rents in inflationary periods, and many lease contracts featuring rents indexed to grow annually with inflation.

- Valuations

European small caps are at their lowest valuations in the past decade, which makes them attractively valued relative to history. However, we must be aware that further downgrades may come.

Source: Bloomberg, Janus Henderson Investors Analysis, as of 14 June 2022. Forward price-to-earnings (P/E) is a ratio used to value a company’s shares, compared to other stocks or a benchmark index. It is calculated by diving the current share price by its forecasted earnings per share. The MSCI Europe Small Cap Index captures small cap representation across the 15 Developed Markets (DM) countries in Europe*. With 1,050 constituents, the index covers approximately 14% of the free float-adjusted market capitalization in the European equity universe. Past performance is not a guide to future returns.

- Europe’s green agenda

While the past 10 years have been defined by the pace of mega cap technology, we believe the next decade will be shaped by investment into sustainability. Europe is already a global leader in this space and continues to assert its dominance through the European Union’s many initiatives, totalling more than €1.8 trillion.1 The most recent is the European Recovery Fund, which has put sustainability at the core of efforts to repair the economic and social damage caused by the COVID-19 pandemic. We believe that European companies, many of which already consider sustainability matters, may potentially benefit from the global push towards sustainable practices.

The universe of smaller companies within Europe offers a highly diverse and vibrant mix of growing businesses. With strong balance sheets, solid earnings and less well-covered companies prone to being mispriced, we believe that European smaller companies can provide a significant opportunity for active stock pickers. In addition, the macro backdrop of inflationary pressures and the rising importance of environmental and social factors could stand to benefit the asset class.

1 European Commission, The EU’s NextGenerationEU (NGEU) stimulus package as at November 2020.

Equity securities are subject to risks including market risk. Returns will fluctuate in response to issue, political and economic developments.

Smaller capitalisation securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalization securities.

Initial Public Offerings (IPOs) are highly speculative investments and may be subject to lower liquidity and greater volatility. Special risks associated with IPOs include limited operating history, unseasoned trading, high turnover and non-repeatable performance.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants, and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Real estate securities, including Real Estate Investment Trusts (REITs), are sensitive to changes in real estate values and rental income, property taxes, interest rates, tax and regulatory requirements, supply and demand, and the management skill and creditworthiness of the company. Additionally REITs could fail to qualify for certain tax-benefits or registration exemptions which could produce adverse economic consequences.