12 Aug 2022

Matt Peron, Director of Research | Portfolio Manager

While Director of Equity Research Matt Peron believes the global economy is likely to slow in the face of higher interest rates, investors’ ability to prudently stay invested has improved due to solid corporate performance and lower valuations.

Key takeaways

Global equities have absorbed fierce body blows from accelerating inflation and rising interest rates this year and now face a third opponent as a higher cost of capital dampens economic growth. But as evidenced by July’s modest equities rebound and earnings results that have been not as bad as feared, all is not lost. In fact, we believe that this year’s volatility has created attractive entry points in select securities whose prices likely have already adjusted to a regime of higher interest rates and slower economic growth.

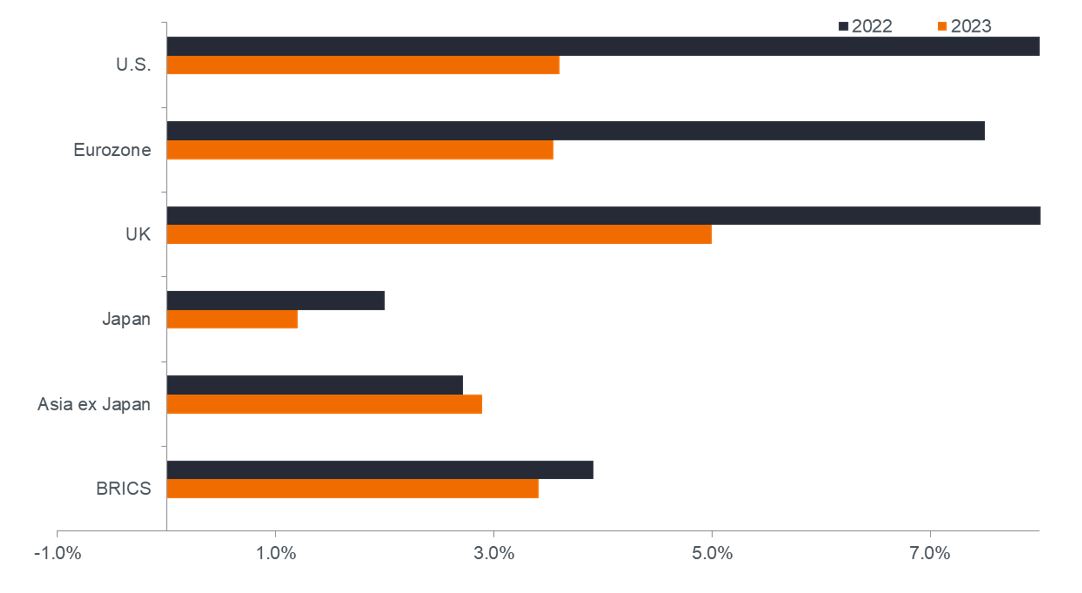

Much hinges on inflation’s trajectory. The US Federal Reserve (Fed) and most other major central banks botched their transitory call in 2021, which resulted in monetary policy – once again – being egregiously behind the curve with respect to accelerating prices. As seen in the chart below, consumer inflation in the US and UK is forecast to average 8.0% and 8.6%, respectively, in 2022 – levels unimaginable only a few years ago.

Consumer inflation forecasts by region

Source: Bloomberg, as of 29 July 2022. 2023 numbers are estimates. Numbers based on full-year consensus forecasts for each year.

Although it is expected to subside in 2023, inflation of this magnitude is unpredictable, especially as rising prices can beget rising prices. In periods of accelerating inflation, consumers and businesses often seek to limit the degree to which their buying power is diminished by pulling purchases forward. Yet, this behaviour can give way to another ill effect of inflation: demand destruction. Once prices hit a certain level, consumption slows, especially in more discretionary areas as households prioritise basic necessities. In recent comments, some retailers are already reporting softening foot traffic and increasing preferences for cheaper, private-label brands by customers.

What policy lag?

Last week’s report that US gross domestic product (GDP) had contracted for the second consecutive quarter ignited a debate on what actually defines a recession. We found the dispute futile as – regardless of which yardstick is used – the economy is slowing; this, after all, is the objective of monetary tightening. Even after having raised the overnight federal funds rate by 250 basis points this year, in historical terms, financial conditions remain relatively easy. Despite the increases, the real yield on 2-year and 5-year US notes implied in Treasury Inflation-Protected Securities (TIPS) revisited negative territory this month after breaching 0.0% in July. With the Fed’s favoured core inflation gauge at 4.8% (and the headline rate excluding food and energy at 8.4%) in June, we recognise the risk that tightening may have to exceed what’s already reflected in market prices.

Typically, there is a lag of several months before higher rates begin to bite. Yet indications point to the global economy already slowing. Part of this is likely due to lingering supply chain dislocations, with rolling port closures in China and a shortage of semiconductors being prime examples. In the US, the contribution of personal consumption to GDP has slid over the past two quarters and business investment became a detractor. Forward-looking purchasing manager indices – not just in the US, but in other regions – have all slid toward contraction territory.

Purchasing Manager Indices by region

Source: Bloomberg, as of 29 July 2022.

Should inflation stay uncomfortably elevated – forcing a commensurate policy response – we would expect the economy’s current trajectory to continue or even accelerate. Further putting central banks into a corner is the nature of this bout of inflation. Monetary tightening has the objective of suppressing demand. However, both supply and demand factors are contributing to higher prices, with the former typically less responsive to policy initiatives. While many supply-chain issues may eventually be resolved, if the Fed truly intends to rein in inflation, it may have to double down on the demand-side tools at its disposal. Should this path prove inevitable, we could see a downside surprise in economic growth.

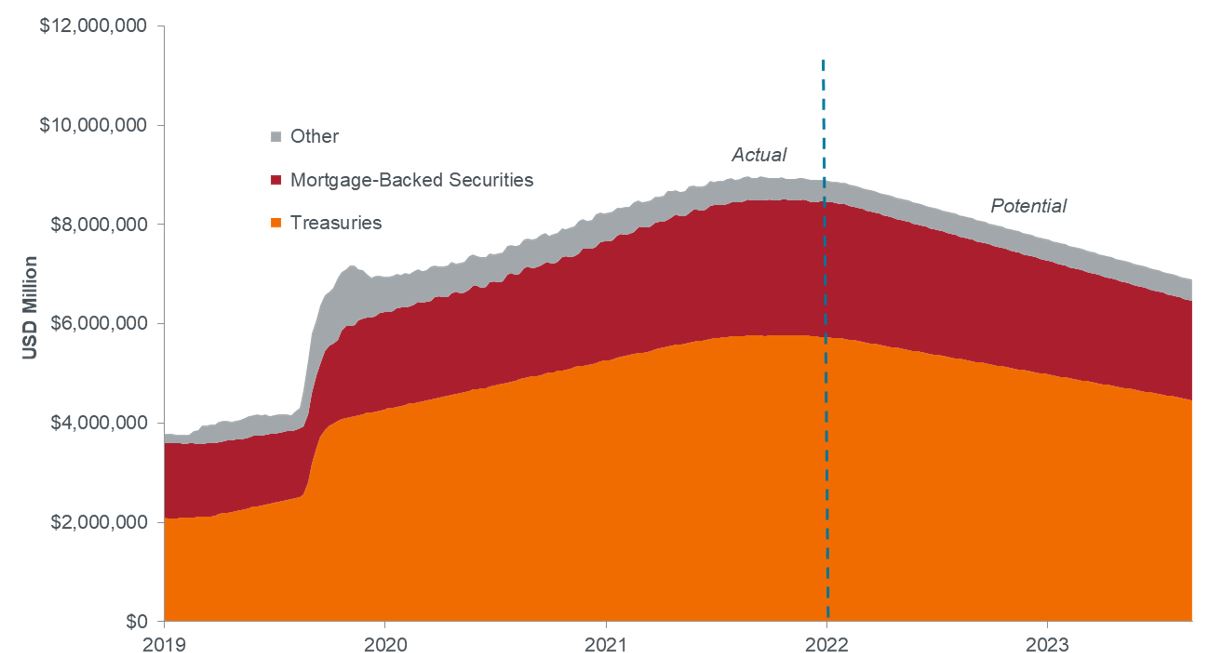

Recent and potential Federal Reserve total asset levels

Source: Bloomberg, as of 29 July 2022.

Working in the Fed’s favour is the extra punch provided by its balance sheet reduction programme. Massive bond purchases throughout the pandemic have been an important tool in keeping the cost of capital low, so the Fed ceasing to reinvest up to $95 billion of maturing assets every month should result in higher yields. That this is not occurring – and with yields in this segment of the curve are well off their June highs – may be an additional signal that investors see a cooling economy ahead.

The macro meets the (equities) market

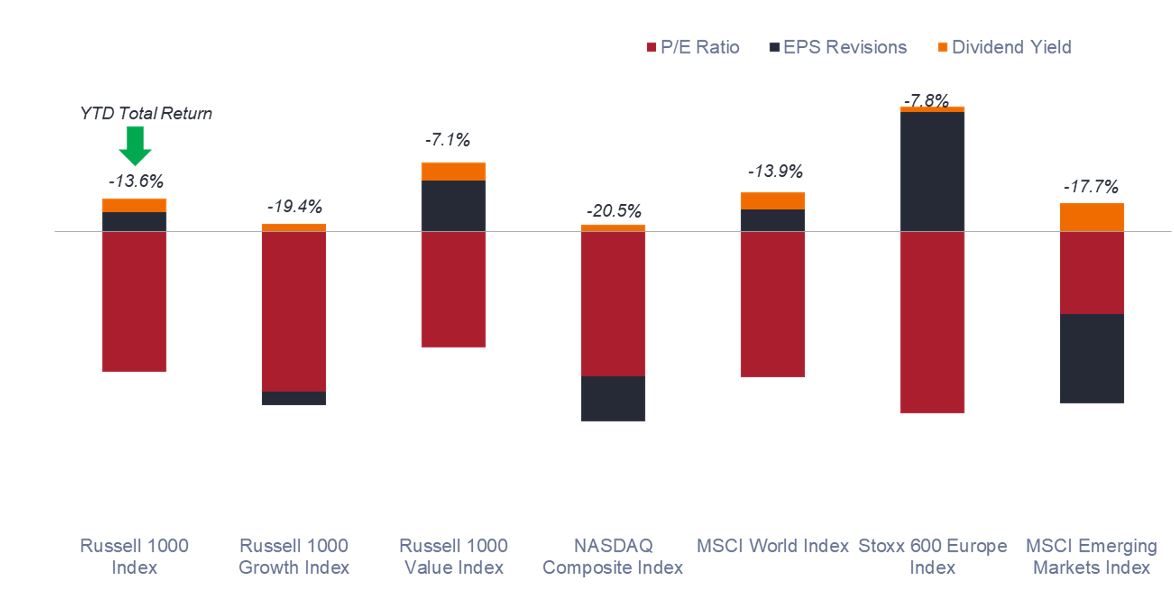

The warning signs we see in the global economy are not an argument against exposure to riskier assets. We believe much of the damage has already been done as a considerable amount of this year’s sell-off is attributable to the valuations of secular growth stocks adjusting to discount rates well above the “zero bound.” As seen below, the largest contributor to 2022’s negative returns has been multiple compression. And with the exception of emerging markets and Internet and e-commerce names that have become more exposed to economic cyclicality as they’ve increased their market share in consumption and digital advertising, earnings revisions have been net contributors, especially in value segments and Europe.

Contribution to year-to-date equity total returns

Source: Bloomberg, as of 29 July 2022. Note: Contribution categories provide approximation of total returns for given period; not drawn to scale. Russell Indices for US growth and value, MSCI for international and emerging markets, NASDAQ for higher growth US and Stoxx for Pan-Europe.

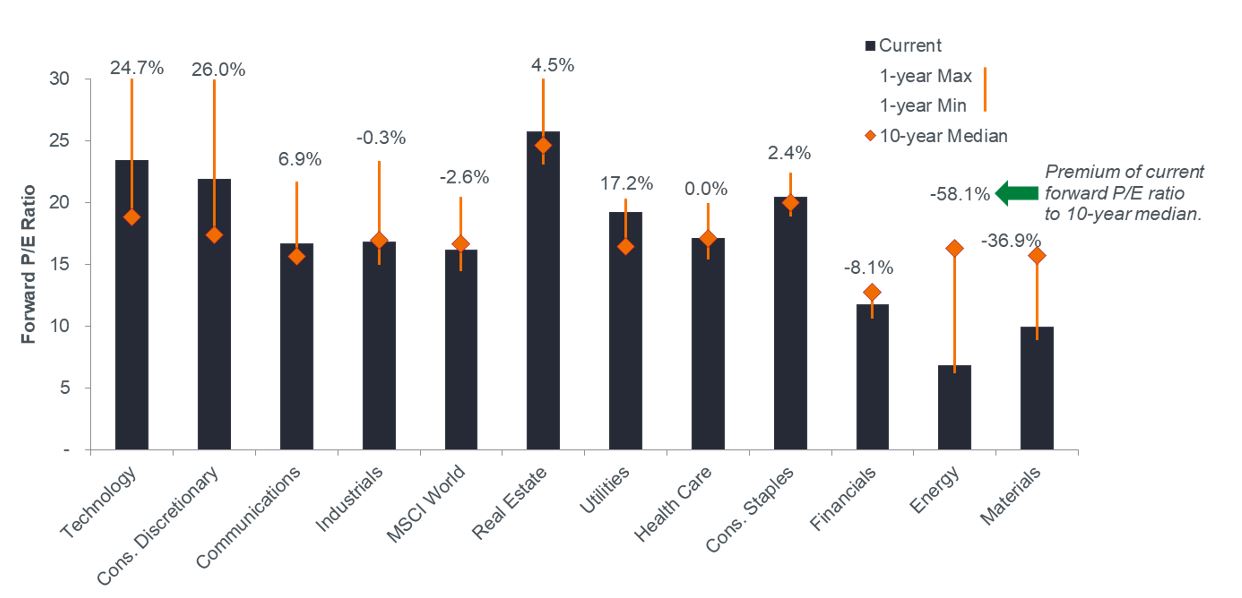

Valuation compression has also resulted in many sectors being priced closer to historical norms. This is especially true for the more defensive segments of the market that would be logical destinations should the economy continue to lose steam. Both consumer staples and health care price/earnings (P/E) ratios are on par or just above their 10-year averages.

MSCI World Index Price/Earnings ratios by GICS sector

Source: Bloomberg, as of 29 July 2022.

Tech and internet valuations, meanwhile, may still appear frothy, but they are, in fact, well below their 2022 peaks. Furthermore – and as we have argued in the past – many of these stocks are highly leveraged to the secular growth themes that we believe will continue to command a greater share of overall corporate earnings growth. Consequently, we believe that – in many cases – higher valuations are merited.

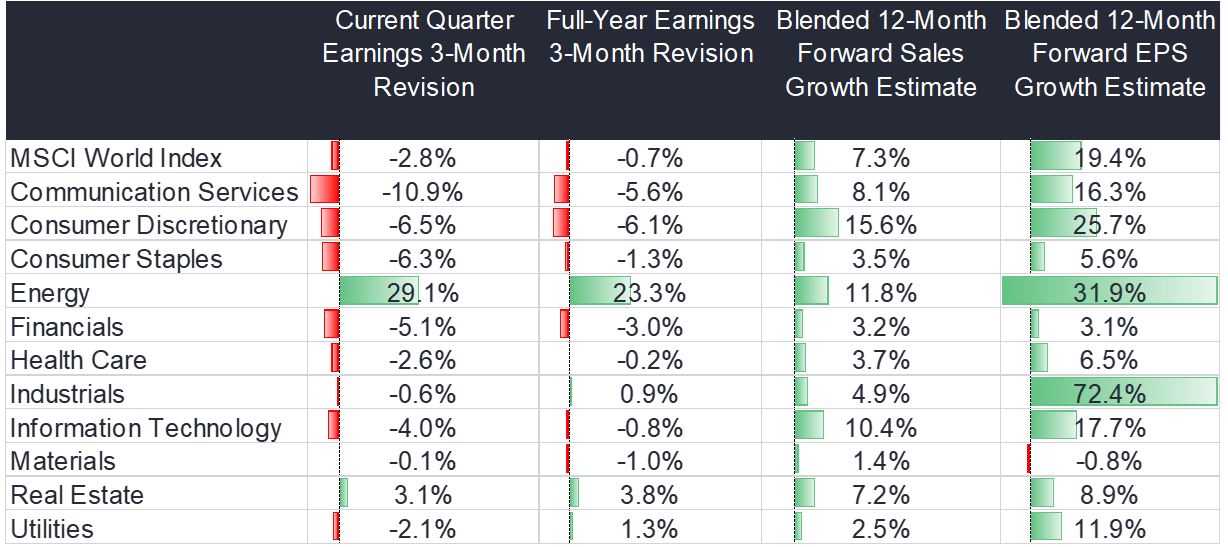

Reinforcing this argument is the resilience displayed by these companies’ financial results. With roughly 60% of the MSCI World Index’s component companies having already reported second-quarter results, every category has thus far exceeded both sales and earnings estimates. Importantly, earnings growth remains positive across most sectors. Consensus forecasts expect the trend to continue

We also recognise the degree to which companies have streamlined operations to support earnings growth but at the same time believe that more caution is merited than what has been priced into the market. A higher cost of capital will almost inevitably cool aggregate demand, and we don’t think that – at present levels – earnings forecasts have adequately factored this in. With this in mind, we think next year’s earnings estimates continue to be too high. The bond market appears to align with our view as yields on mid- to longer-dated Treasuries are well off their June peaks.

Equity earnings estimates and 3-month revisions by sector

Source: Bloomberg, as of 29 July 2022.

The steadiness of fundamentals in both defensive sectors and in those exposed to secular-growth themes means that investors might have the opportunity to maintain an equities allocation that, in our view, should have the ability to weather additional near- to mid-term economic softness.

A place for bonds

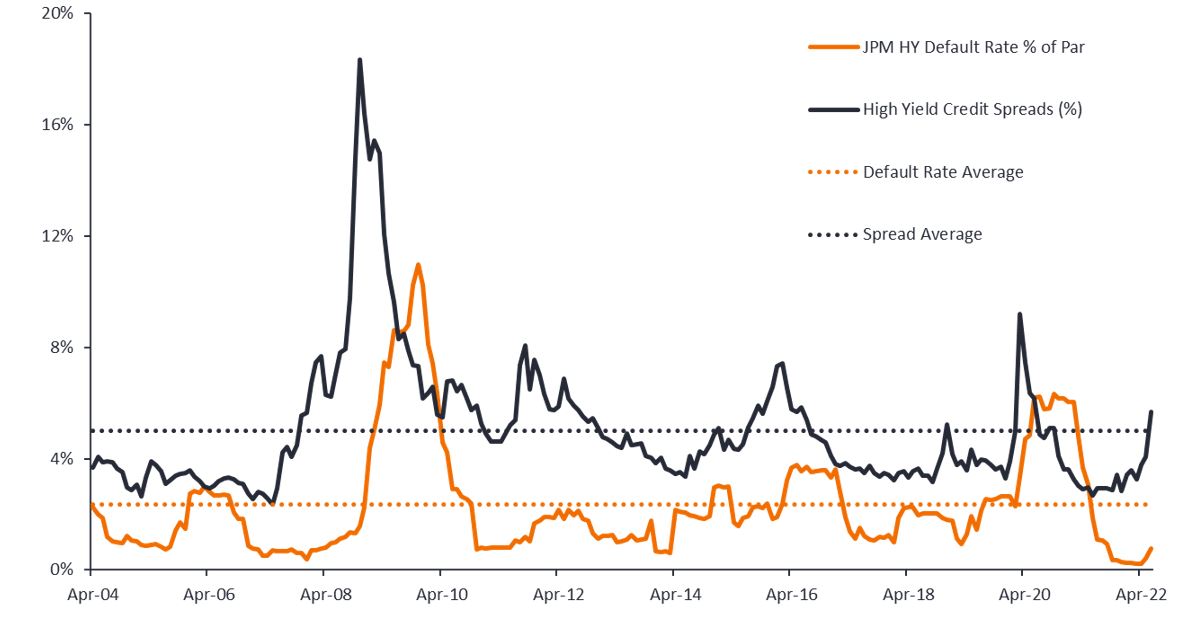

Further evidence of sound corporate fundamentals can be seen in high-yield corporate defaults remaining well below historical norms. Defaults in these riskier issuers can be a bellwether for wider pain in the corporate sector. But many management teams took advantage of exceptionally low rates to repair balance sheets and buttress themselves against the potential for weaker revenue growth.

High-yield corporate default levels and yield spread to benchmark

Source: JPMorgan, as of 29 July 2022.

Even in a year that has largely been risk off, spreads between the yields of lower-quality corporate bonds and those of their risk-free benchmarks only climbed above – and just barely above – their long-term average in June.

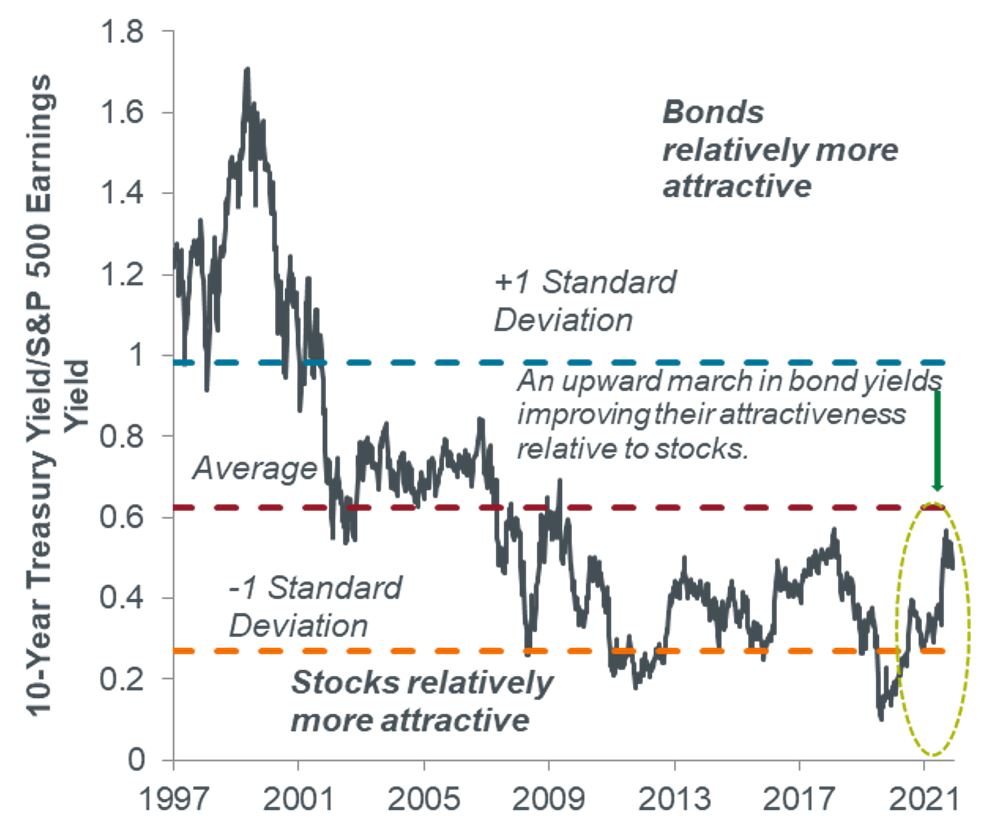

All allocator’s perspective

Higher bond yields are the intention of tighter policy. Widening spreads on corporate issuance bears monitoring for signs of stress. But taken together, these have resulted in fixed income yields resetting at levels that offer investors the potential for attractive income streams and a degree of diversification to equities that had been absent for much of the pandemic era.

Equities earnings yield relative to 10-year US Treasury

Source: Bloomberg, as of 29 July 2022.

Staying invested may seem like a dangerous proposition in volatile markets. Generational inflation makes maintaining the resolve needed even harder. But markets have already experienced a material correction this year, leaving stock valuations at more palpable levels. We cannot rule out additional economic slowing; in fact, we believe investors are best served by preparing for such an eventuality. Equity market conditions have evolved in a way, however, that should, in our view, enable investors across an array of risk appetites to stay invested.

The re-emergence of more fairly valued secular-growth stocks, well-positioned defensive segments and higher levels of diversification via bonds present investors with options for taking advantage of this year’s sell-off and construct an allocation has the potential to weather near-term headwinds while also allowing for exposure to the powerful themes that, in our view, should account for a greater share of corporate earnings over a long-term horizon.

Important information

This document is intended solely for the use of professionals, defined as Eligible Counterparties or Professional Clients, and is not for general public distribution.

Past performance does not predict future returns. Marketing communication. The value of an investment and the income from it can fall as well as rise and investors may not get back the amount originally invested. There is no assurance the stated objective(s) will be met. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell, purchase or hold any investment.

There is no assurance that the investment process will consistently lead to successful investing. Any risk management process discussed includes an effort to monitor and manage risk which should not be confused with and does not imply low risk or the ability to control certain risk factors.

Various account minimums or other eligibility qualifications apply depending on the investment strategy, vehicle or investor jurisdiction. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes.

Issued in Europe by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Investment management services may be provided together with participating affiliates in other regions.

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.