18 Jul 2022

By Tim Drayson , Lars Kreckel , Christopher Jeffery

Numerous factors are putting upward pressure on prices in Japan, and the yen is acting as an escape valve for the central bank's yield curve control policy.

Japan stands out as one of the few economies that appears impervious to the wave of inflation washing over the world economy.

Headline inflation has finally breached the 2% target, but core inflation (stripping out fresh food and energy) is still below 1%, even after the depressing effect of mobile phone fee cuts dropped out of the figures.

But this might be about to change for a number of reasons.

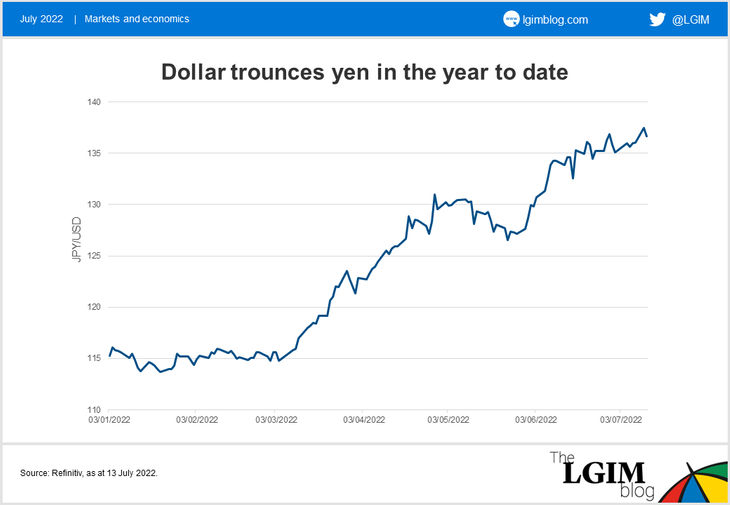

First, Japan is experiencing the same supply shocks as elsewhere. As an importer of natural gas, it can’t escape the impact of the war in Ukraine. Second, the weak exchange rate is adding to imported price pressures. Also, its exports are becoming super competitive. This should add to demand.

Third, Japan has been slow to return to normal from various COVID-19 outbreaks. Mobility appears to have improved in June but remains below pre-pandemic levels. As service sector activity recovers, employment should pick up. With restrictions on international arrivals beginning to ease, there is an additional boost from net tourism of around 0.5% of GDP still to come. The labour market is not yet as tight as in other Western economies, but there is not much slack either.

Improving demand and woeful demographics could generate some wage pressure.

Fourth, fiscal policy is supportive, with the July Upper House election potentially giving Prime Minister Fumio Kishida a mandate for further stimulus. Finally, Japan appears to be seeing a sharp rise in house prices which will help break the deflation psychology.

What does this mean for markets? A clear break from Japan’s deflation psychology could become a positive catalyst for Japanese stocks.

Households hold over half of their assets in cash and are very underweight equities. This makes sense in a deflationary environment, but if mindsets shift towards inflation, there would be a lot of room for household balance sheets to shift towards equities, re-rating the asset class in the process.

We have seen no evidence of this shift happening yet, but are closely watching a number of signposts.

The Japanese government bond market has been anesthetised by the Bank of Japan’s policy of 'yield curve control', which has imposed a cap on 10-year yields at just 0.25%.

We think that framework is set to repeatedly come under market pressure, particularly during episodes of rising global yields. There is an inherent contradiction in trying simultaneously to drive up inflation expectations and keep bond yields contained, which we believe will eventually come back to bite the authorities.

With bond yields suppressed, the currency has become the channel of transmission – with the yen a hostage to fortune on global markets. So far, the government has been supremely relaxed about the yen depreciation.

But there are already signs of public opinion starting to turn against the strategy of implicit currency debasement. Timing the end of the monetary regime is difficult, but we think upward pressure on the yen is a likely endgame.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.