22 Aug 2022

According to one Fed governor, ‘purple squirrels’ (false vacancies) are distorting US job postings. But the relationship between unemployment and vacancies will be key to determining whether a soft landing is achievable in the US.

Recruiters use the term ‘purple squirrel’ to describe job candidates with the precise education, experience and qualifications to fit a job’s requirements.

In other words: they are as common as purple squirrels.

However, according to Fed Governor Christopher Waller, fake job vacancies known as ‘purple squirrel’ vacancies are falsely boosting available job numbers. In order to attract these hard-to-find candidates, companies are keeping job postings live for an excessive amount of time.

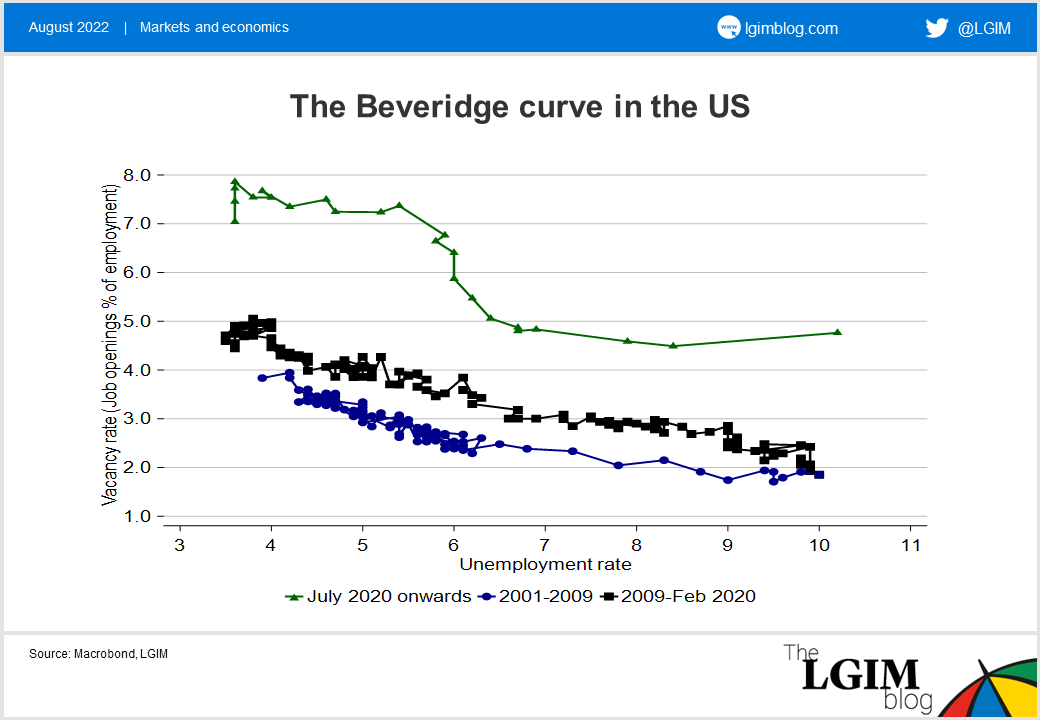

This is one element behind some recent Fed research which argues the Beveridge curve (the relationship between unemployment and vacancies) is currently very steep.

Essentially, the tight labour market has meant employers are finding it hard to find candidates with the right skills, so the opening of additional vacancies has not led to many hires and has instead boosted wage growth.

Removing these excess vacancies with tighter monetary policy could in theory reduce wage pressure and inflation without significantly driving up unemployment.

But not everyone agrees.

Waller is involved in some public jousting with other economists, including former US Treasury Secretary Larry Summers, who co-wrote a policy brief saying it would be unprecedented for vacancies to decline significantly without the economy falling into recession. Waller, for his part, wrote in his own report, “We are saying that something unprecedented can occur because the labour market is in an unprecedented situation”.

Any squirrel sightings?

There are some signs that companies need to tidy up their job ads after trying for months to backfill for employees who quit during the pandemic – so there may indeed be a few purple squirrels out there. Removing these stale vacancies could move the US economy from the green line back towards the black line in the chart above: vacancies falling sharply but without putting many people out of work.

However, around two-thirds of current listings were posted in the past 90 days[1], a higher proportion than before the pandemic. There is also anecdotal evidence of companies reducing experience and education requirements and even tolerating criminal records. This suggests the vacancy numbers are not being dominated by purple squirrels.

Another reason why the job vacancy data largely appear real is that they match well with what small businesses are saying about their ability to fill open positions and the wage pressures they face, which suggest an extremely tight labour market.

How knotty a problem is recession risk?

The three months to June saw job vacancies come down in the US, while unemployment was steady (unemployment even fell another tenth in July[1]). The recent data support the Waller argument.

But even as vacancies decline, we expect wage pressures to remain intense: partly in response to past high inflation, and partly because unemployment still seems below its ‘natural’ rate. Ongoing inflation in services would be inconsistent with the Fed meeting its inflation target. This could lead to the Fed needing to raise rates further than markets expect. The Fed seems to be losing hope that people would fully return to the labour market as Covid concerns eased. There is still a possibly that participation picks up in response to higher inflation and the squeeze on purchasing power, that might help alleviate wage pressures.

However, in our base case, building stress on corporate balance sheets means layoffs could increase alongside further declines in vacancies, with the US ending up in a mild recession in the second half of 2023.

We see about a one in three chance that recession is avoided. However, this would still likely involve some rise in unemployment to bring inflation back to target.

[1] Source: https://www.bls.gov/news.release/empsit.nr0.htm

[1] Source: Goldman Sachs

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.