18 Feb 2022

Taking a step back from day-to-day market movements, we have reflected on our team's overall investment strategy outlook and economic thinking. An update of our established framework of recession indicators suggests that the economy has moved into late cycle much faster than we expected. This makes our bullish view on equities more tactical than it was before.

Although we have only just published our first-quarter outlook, we have seen some big moves already this year, like US yields gaining more than 40 basis points so far in 2022 or equity markets dropping almost 10% before rallying back 5% in the space of three days and then weakening again.

Inflation has continued to surprise even beyond our above-consensus forecasts. An easing of supply disruptions is expected to unfold through the year, but there is considerable uncertainty around how quickly this will occur. At the margin, this appears to be happening more slowly than previously hoped. The market has quickly moved this year to price in nearly seven US rate hikes by year end, having expected just two for 2022 at the end of last year.

Central banks face a dilemma. The future growth and inflation mix appears worse than they had forecast. This has led to a decisively hawkish shift without any corresponding upgrade to the growth outlook. However, the rise in inflation could still reflect a one-off adjustment to reopening from the pandemic and the previous disinflationary forces could reassert themselves.

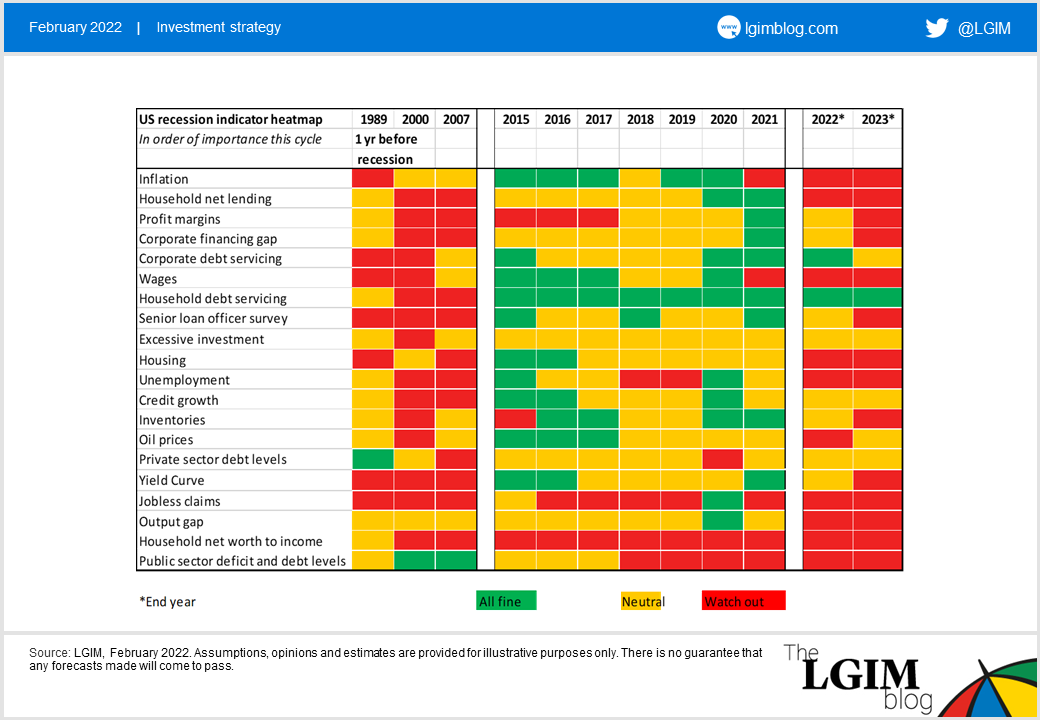

Amid all these macroeconomic fireworks, an update of our recession indicators is long overdue. The table below suggests that the economy has moved into late cycle much faster than we expected.

These late-cycle dynamics are reinforced if we map asset-class performance against the cycle as well. The strong performance of commodities, the curve flattening, and the weak performance of credit are typical signs of late-cycle behaviour.

Despite the move in the recession indicators, we remain of the view that a recession in the next 12 months is unlikely. Consumers have built up savings, economic growth rates are above trend, and longer-term inflation expectations are well behaved so central banks can remain gradual in their rate hikes, although a policy mistake and a Federal Reserve panic cannot be excluded.

Our framework warns us that the risks for corrections in equity markets are increasing. However, we believe that rising recession risk is still needed to validate a correction closer to the 20% bear market threshold. Aside from the brief but violent 1987 stock-market crash, during the past 50 years the S&P 500 has never fallen by more than 20% outside a recessionary environment (although it came close a few times).

Though the current correction is in our view mainly due to the re-pricing of rate hikes, we believe that equities usually digest higher bond yields well – eventually. Temporary indigestion can nevertheless happen if the increase is fast and inflation or hawkish monetary policy are the main drivers. This, together with the pricing of geopolitical risk, is what has happened in the past few weeks.

However, we now see central-bank actions as priced fairly, especially as an easing of supply disruptions might temporarily mask the overheating in the months to come.

We stick with our medium-term +1 position (on a scale of -3 to +3) in our multi-asset portfolios, but the call is getting more tactical than it was last year. For instance, we want to be more patient to buy a market dip: in 2021 we would start to get interested in marginally increasing our exposure around a 5% equity drawdown, but now we will wait for lower levels before we contemplate increasing risk in our portfolios. On the other hand, we will also be more inclined to sell strength in equity markets.

Credit spreads have broadly tracked equity markets in the selloff. They have moved from uber-expensive to expensive, and we’re looking for another bout of widening from here before shifting from our medium-term credit underweight.

Unless otherwise stated, information is sourced from LGIM internal analysis as at 14 February 2022.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.