19 Feb 2026

Is there a difference between an ethical bond fund and a sustainable one? The terms ethical and sustainable are sometimes used interchangeably, and although there are some notable similarities between the two, these are distinct strategies at Royal London Asset Management.

While the Royal London Ethical Bond Fund shares the importance of Environmental, Social and Governance (ESG) risk consideration as part of its investment process, it does not have a sustainable objective aside from its exclusionary investment approach. In comparison, the Royal London Sustainable Corporate Bond Trust has the additional overall universe-defining constraint of sustainability with its Sustainability Focus Label.

In this article we highlight our approach for these two funds and discuss how our underlying investment philosophy is used, the similarities between our ethical and sustainable bond funds, and some key differences.

Royal London Asset Management believes that ESG issues are vital in all credit research. As such, we combine rigorous financial analysis with assessments of how ESG factors could influence the risk profile of the issuers. We have to judge whether the overall risk profile, based on financial and ESG factors, is appropriately reflected in the valuation of bond. We combine this analysis with a number of other features, notably a bias towards secured debt or bonds with strong covenant protections and an emphasis on portfolio diversification. Overall, we believe that our active approach allows us to take advantage of credit market inefficiencies arising from over reliance on credit ratings and benchmark composition.

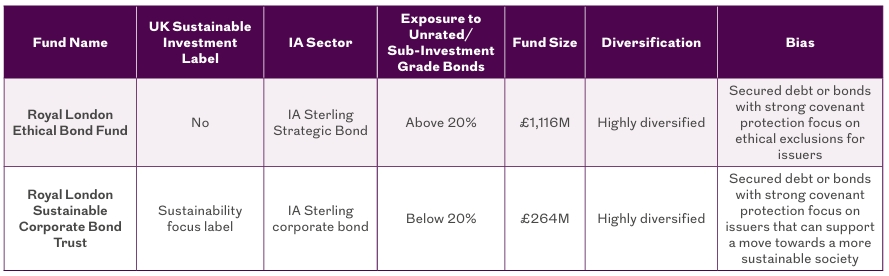

Both funds have similar investment philosophies, the Royal London Sustainable Corporate Bond Trust is prohibited from holding debt issues by certain entities. However, there are some key differences shown on the table below.

Source: Royal London Asset Management, data as at 30 November 2025.

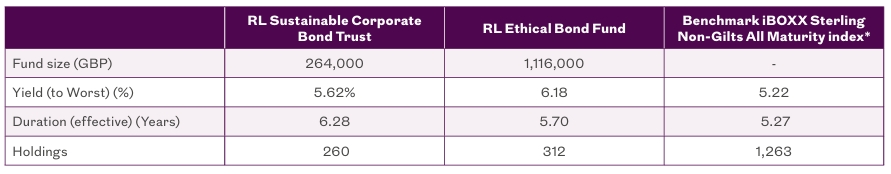

Source: Royal London Asset Management, data as at 30 November 2025.

The Royal London Ethical Bond Fund is a non-labelled fund that considers sustainability characteristics, this means that the investment manager identifies bonds to invest in through the following sustainability approach:

The ethical screen criteria applied to all companies under consideration entail nine exclusions to determine the eligibility of the company issuing the bond. These include sector-based exclusions (alcohol, armaments, fossil fuels, gambling, pornography, tobacco) and behaviour or practice-based exclusions (animal testing, environment, human rights). For more information on the Royal London Ethical Bond Fund, see our consumer-facing documents which can be accessed here.

Our Royal London Sustainable Corporate Bond Trust, is a fund that has a Sustainability Focus Label which means that it invests mainly in assets that focus on sustainability for people or the planet. The fund’s sustainability objective is to invest in companies that make a positive contribution to one or more of four sustainability themes, through their products or services as determined by the investment manager using its sustainability standard.

At least 70% of the fund’s assets meet its sustainability standard which requires 50% of a company’s revenues to be derived from product or services aligned to one or more of the four sustainability themes. These themes are as follows:

In practice, this means the fund favours areas such as social & affordable housing, hospitals, transport, roads, schools & universities, water infrastructure, electricity distribution and telecommunication. In relation to financial bonds (e.g. banks, insurance and financial services), we have a preference for issuers that promote financial inclusion, again subject to sufficient sector diversification being achieved.

Our approach means that Royal London Sustainable Corporate Bond Trust will invest in bonds based upon both our credit research and ESG analysis. This allows us to combine our long-held investment philosophy with a rigorous emphasis on sustainability. Although the primary element of our approach is based on positive selection, the fund applies an absolute prohibition on investing in any company with certain features such as the manufacture of tobacco-based products, armament production or product testing on animals other than for human health. There is also a prohibition on debt issued by entities with unacceptable corporate governance structures. The result of this process, in our opinion, is a corporate bond fund with a lower environmental and higher positive social impact than recognised indices, benchmarks and peer groups.

This fund uses the Sustainability Focus label, which is for funds that invest mainly in assets that focus on sustainability for people or planet.

For more information on the Royal London Sustainable Corporate Bond Trust, see our consumer-facing documents which can be accessed here.

*Common to both funds.

Within both funds, the use of unrated and off-benchmark bonds is a key feature, which we believe differentiates them from their peer group. By following a less constrained investment policy, we aim to build a robust portfolio comprising bonds often overlooked by investors. We believe both Royal London Ethical Bond Fund and Royal London Sustainable Corporate Bond Trust offer investors a clear investment choice relative to more benchmark-orientated credit funds. Both follow similar investment approach and are supported by our Sterling Credit research team. The Royal London Sustainable Corporate Bond Trust has a Sustainability Focus Label and invests mainly in assets that focus on sustainability for people or the planet, while we believe the Royal London Ethical Bond Fund offers an exclusionary investment approach.

*Common to both funds.

*Common to both funds.

Source: Royal London Asset Management, data as at 31 December 2025.

Source: Royal London Asset Management, data as at 31 December 2025. May not sum to 100 due to rounding.

Source: Royal London Asset Management, data as at 31 December 2025. May not sum to 100 due to rounding.

Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested.

Investment risk: The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested.

Concentration risk: The price of Funds that invest in a reduced number of holdings, sectors, or geographical areas may be more heavily affected by events that influence the stock market and therefore more volatile.

Exchange rate risk: Changes in currency exchange rates may affect the value of your investment.

Liquidity risk: In difficult market conditions the value of certain fund investments may be difficult to value and harder to sell, or sell at a fair price, resulting in unpredictable falls in the value of your holding.

Emerging markets risk: Investing in emerging markets may provide the potential for greater rewards but carries greater risk due to the possibility of high volatility, low liquidity, currency fluctuations, the adverse effect of social, political and economic instability, weak supervisory structures and accounting standards.

Derivative risk: Derivatives are highly sensitive to changes in the value of the underlying asset which can increase both fund losses and gains. The impact to the fund can be greater where they are used in an extensive or complex manner, where the Fund could lose significantly more than the amount invested in derivatives.

Credit risk: Should the issuer of a fixed income security become unable to make income or capital payments, or their rating is downgraded, the value of that investment will fall. Fixed income securities that have a lower credit rating can pay a higher level of income and have an increased risk of default.

Interest rate risk: Fixed interest securities are particularly affected by trends in interest rates and inflation. If interest rates go up, the value of capital may fall, and vice versa. Inflation will also decrease the real value of capital.

Efficient Portfolio Management (EPM) techniques: The fund may engage in EPM techniques including holdings of derivative instruments. Whilst intended to reduce risk, the use of these instruments may expose the Fund to increased price volatility.

Counterparty risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss.

Inflation risk: Where the income yield is lower than the rate of inflation, the real value of your investment will reduce over time.

Responsible investment style risk: The Fund can only invest in holdings that demonstrate compliance with certain sustainable indicators or ESG characteristics. This reduces the number securities in which the Fund can invest and there may as a result be occasions where it forgoes more strongly performing investment opportunities, potentially underperforming non-sustainable funds.

Charges from capital risk: Charges are taken from the capital of the Fund. Whilst this increases the yield, it also has the effect of reducing the potential for capital growth.

For more information about our range of products and services, please contact us.

Royal London, Asset Management, 80 Fenchurch Street, London, EC3M 4BY

For advisers and wealth managers bdsupport@rlam.com +44 (0)20 3272 5950

For institutional client queries institutional@rlam.com +44 (0)20 7506 6500

For further information, please visit www.rlam.com

We are happy to provide this document in braille, large print and audio.

This is a financial promotion and is not investment advice. For professional investors only. Not suitable for a retail audience.

The value of investments and the income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. This is a financial promotion and is not investment advice. Telephone calls may be recorded. For further information please see the Privacy policy at www.rlam.com.

The RL Sustainable Managed Income Trust is an authorised unit trust scheme. The Manager is RLUM Limited, authorised and regulated by the Financial Conduct Authority, with firm reference number 144032. For more information on the Trust or the risks of investing, please refer to the Prospectus or Key Investor Information Document (KIID), available via the relevant Fund Information page on www.rlam.com.

The RL Ethical Bond Fund is a sub-fund of Royal London Bond Funds II ICVC, an open-ended investment company with variable capital with segregated liability between sub-funds, incorporated in England and Wales under registered number IC001128. The Authorised Corporate Director (ACD) is Royal London Unit Trust Managers Limited, authorised and regulated by the Financial Conduct Authority, with firm reference number 144037. For more information on the fund or the risks of investing, please refer to the Prospectus or Key Investor Information Document (KIID), available via the relevant Fund Information page on www.rlam.com.

Issued in February 2026 by Royal London Asset Management Limited, 80 Fenchurch Street, London EC3M 4BY. Authorised and regulated by the Financial Conduct Authority, firm reference number 141665. A subsidiary of The Royal London Mutual Insurance Society Limited. Ref: AL RLAM PD 0209

For professional investors only, not suitable for retail clients. This is a marketing communication.