26 Jan 2021

We've added the new Responsible Growth Portfolio to our Responsible Managed Portfolio Service (MPS) range. There are now four risk profiled portfolios in the RSMR Responsible MPS, alongside the RSMR Rfolios MPS range of eight risk profiled portfolios.

The RSMR MPS offers advisers a range of attractive, cost-effective risk-profiled options. The RSMR Responsible portfolios range, now including the new Responsible Growth Portfolio, provides a pragmatic solution for advisers seeking greater exposure to responsible investment supported by a rigorous fund research process.

ESG factors represent potential risks to any fund’s holdings, irrespective of the fund’s badge, therefore, we consider ESG to be an integral part of the research process for all funds we assess, monitor and ultimately rate.

We introduced Responsible fund ratings back in 2012 (called SRI ratings at the time) in response to demand from our advisory clients. For us, funds with a Responsible rating go beyond ESG investing with each of the 44 RSMR Responsible rated funds needing to satisfy our additional criteria.

As part of our Responsible fund rating process, we determine which of the four RSMR Responsible categories the fund belongs in:

The funds can then be further subdivided using the SRI Services categories which categorise funds at a more granular level whilst providing advisers with synergy between both RSMR and SRI Services.

As the RSMR Responsible fund universe continued to grow, we launched the RSMR Responsible Balanced Portfolio in June 2016, initially as an advisory portfolio but then converted to a discretionary portfolio in March 2018, at which point we also added the Responsible Cautious and Responsible Dynamic portfolios. We've been running standard and Responsible (or SRI) client portfolios comprising RSMR rated funds for advice businesses for much longer than that.

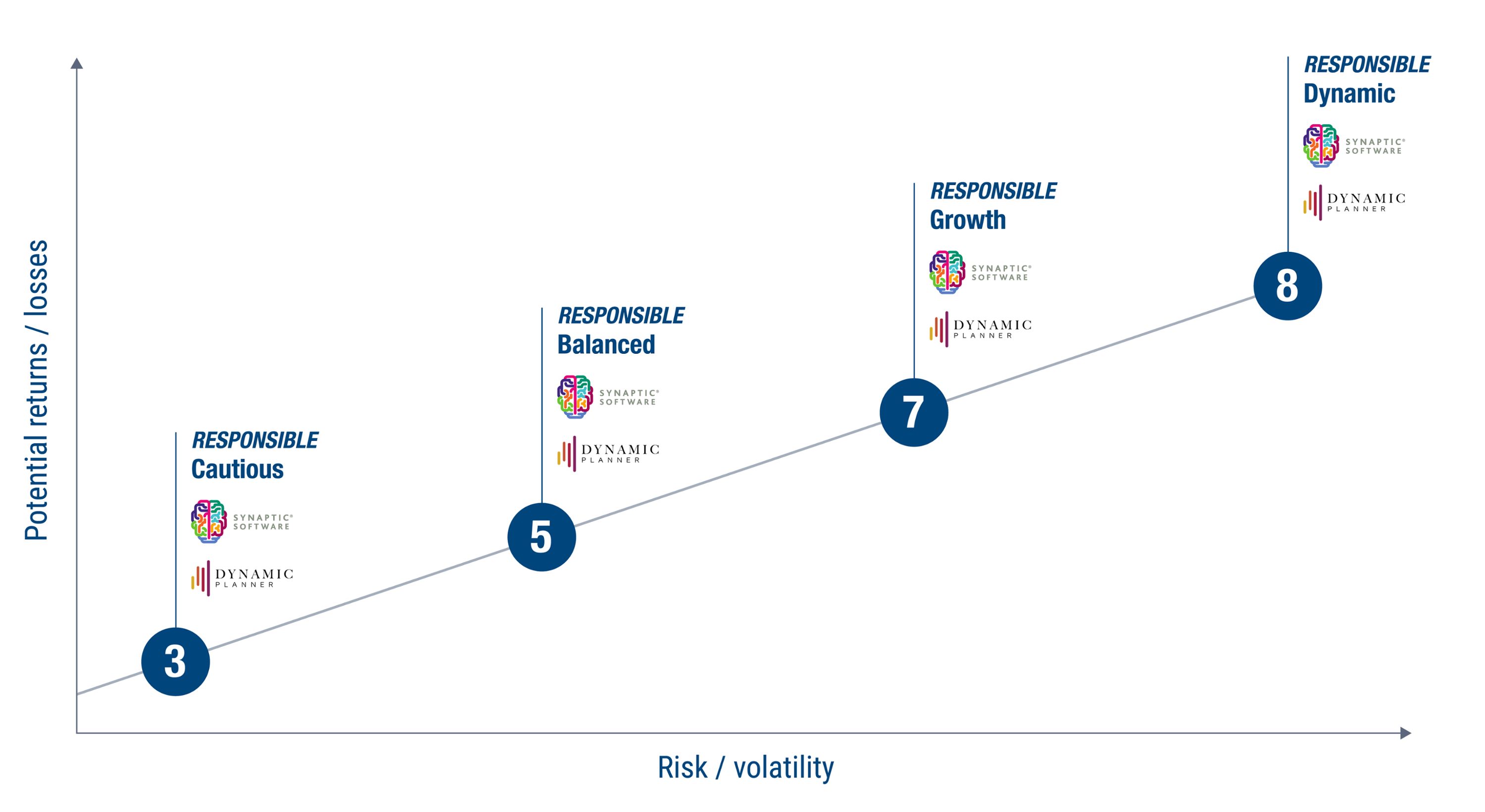

We've taken the opportunity to broaden our offering in the Responsible investing area through the launch of the Responsible Growth Portfolio, which means we can offer advisers four RSMR Responsible portfolios, risk profiled by Synaptic and Dynamic Planner.

RSMR’s MPS investment approach is designed to be easily explained by the adviser and easily understood by the client and has achieved strong and consistent past performance.

It begins with putting together a strategic asset allocation for each portfolio. The intention is for this to be relatively stable over time and not be influenced by any market timing decisions. Ours is a forward-looking approach, considering the various longer-term risk and return expectations for the relevant asset classes relative to their history. Our information and data are drawn from a wide range of industry sources to form a consensus of the investment factors which may drive returns in the future, for example valuation levels, interest rate and inflation expectations, economic growth rates and so on.

Whilst we hold formal discussions on asset allocation quarterly, any new information relevant to asset class views, and any potential portfolio fund changes, are frequently discussed within the RSMR team.

While our allocations and fund choices will vary over time, the initial asset allocations are 37.5% International Equities, 27.5% UK Equities, 26.0% Fixed Income, 5.0% Multi-Asset and 4% Cash. The Portfolio’s IA benchmark will be Mixed Investment 40-85% Shares.

Our fund selections include some of the larger fund management groups who have been active in responsible investing for a number of years, such as Aegon Ethical Equity, BMO Responsible UK Equity, Janus Henderson Global Sustainable Equity and Royal London Sustainable Managed Income. There are also funds from some lesser known groups who have equally strong pedigrees in responsible investing and often provide more specialist exposure to the portfolio, such as FP WHEB Sustainability, Quilter Cheviot Climate Assets, Troy Trojan Ethical and VT Gravis Clean Energy Income.

The RSMR Responsible and Rfolios MPS ranges are risk profiled by Dynamic Planner and Synaptic and are available on the abrdn Wrap, abrdn Elevate, Aviva, FundsNetwork, Nucleus, Quilter and Transact platforms.

The annual DFM management charge for the RSMR MPS is 0.15% with no VAT.

RSMR provides impartial, qualitative, forward-looking research for advice businesses.

Click here to head to the RSMR blog for market updates and a whole host of informative, up-to-the-minute content.

Click here to sign up to RSMR research where you can access RSMR fund ratings, fund profiles, factsheets, insights, market updates and event information.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested.

Rayner Spencer Mills Research Limited is a limited company registered in England and Wales under Company Registration Number 5227656. Registered office: Number 20, Ryefield Business Park, Belton Road, Silsden, BD20 0EE. RSMR is a registered trademark.