19 Oct 2021

An area of significant market focus, which has been reflected in increased volatility in US treasury yields, has been the inflation outlook. In the first quarter of 2021, markets questioned the long term disinflationary narrative with inflation breakevens continuing to rise. However, the momentum behind this began to falter somewhat in the second quarter of 2021 as US CPI peaked in June at 5.4%, and the Federal Reserve (Fed) began to make increasingly hawkish noises around future policy. This has kept medium-to-long-dated US breakevens range-bound in recent months as the market awaits further evidence of any structural shifts in inflation.

Our view is that US headline inflation is likely to return towards to the Fed’s 2% target in the medium term, but that the risks remain to the upside. This is given our expectation that the Fed will not tighten in an aggressive, pre-emptive manner, and that the outlook for economic growth remains reasonably positive. For this reason, we hold an overweight in long-dated US inflation.

The UK has been subject to supply-side shortages centred around energy, food and fuel for a broad array of reasons. However, we think these bottle-necks will prove to be largely transitory. As such, the surge higher in UK inflation anticipated for late 2021 and early 2022 should dissipate as the economy more fully re-opens. We do not anticipate a prolonged period of sustained excess demand, or an un-anchoring of inflation expectations, nor a central bank prepared to accommodate persistently elevated inflation. Given this, we have a short position in medium-term UK inflation.

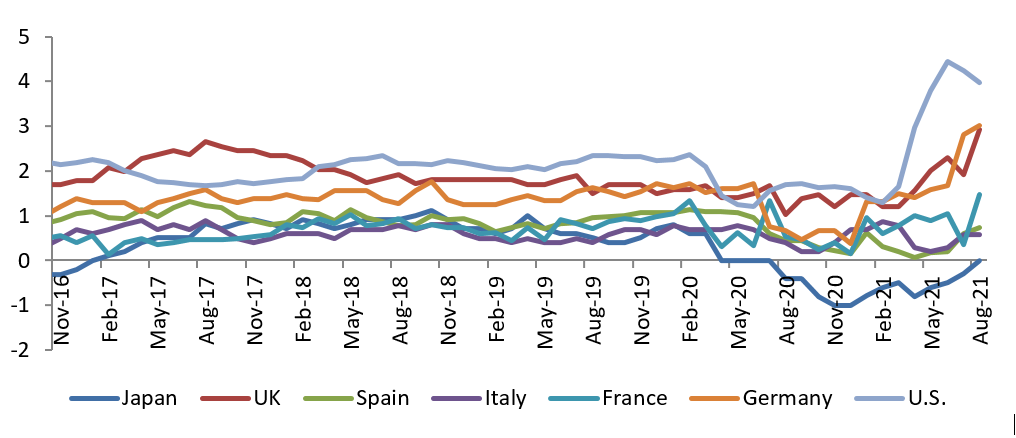

Elevated developed country core inflation rates

US Treasury yields have moved higher on the back of higher inflation expectations and the Fed’s discussion of a movement away from ultra-accommodative policy. However, to see a significant move higher in yields, we believe we would need to see either interest rate hikes come into sharper focus rather than a tapering of asset purchases alone, or a sustained period of above-target inflation. That said, we put a relatively low probability on either of these two scenarios. As such, although we think Treasury yields are likely to move higher, it is unlikely to be a dramatic move.

Similarly, we believe that the Bank of England would look to tighten policy if higher inflation was judged to be more structural. At the same time, it would want to avoid derailing the economic recovery by acting prematurely. Central banks more broadly are looking to strike a delicate balance between supporting the economic recovery, while being alive to the threat of higher inflation. Our view is that they will maintain a reasonably cautious stance during such uncertain times, but will be looking very carefully for any signs of more structural demand-led inflation.

US: although the growth rate peaked in Q2, we think the US economic recovery has further to go. The large reduction in fiscal support might see weaker-than-expected conditions in the short term. However, the US growth outlook is still supported by increasing immunisation, continuing accommodative fiscal and monetary conditions, and large consumer and corporate cash balances.

In terms of monetary policy, it’s true that the Fed, like other major central banks, is now beginning to think in terms of tightening. Furthermore, the 22 September Fed meeting was seen by many as little more hawkish than expected. However, in terms of interest rates, realistically we still do not foresee the Fed hiking rates until the second half of 2022. As such, we think the big picture is largely unchanged, with central banks beginning to move from a snail to tortoise speed, rather than a hare’s speed.

Europe: a notable feature of the Eurozone has been its lagging of the US economy, in terms of both the timing and pace of recovery. Indeed, indicative of this, while the US Q2 growth rate may transpire as a cyclical peak, growth is widely expected to accelerate further in the Eurozone. Key Eurozone growth drivers are similar to the US, namely government spending, increasing immunisation and continuing highly accommodative monetary conditions. With respect to the last of these, an important difference is a likely significantly more extended period of monetary accommodation. Indeed, although the European Central Bank (ECB) recently announced ‘a recalibration’ of its pandemic purchase programme, it has signalled that that policy rates could stay on hold until the mid-2020s.

China: developments in China’s property sector, centred around the highly indebted Evergrande (which we consider in more detail below), have dominated the financial news, and market participants expect it to have some negative growth impact. At the same time, containment measures aimed at controlling the recent Covid-19 wave, and the ramifications of the recent cross-sectoral regulatory crackdown, have also weighed on sentiment and economic growth. However, our base case remains that, with so much potentially at stake, the authorities should ultimately be successful in preventing a more disorderly and wide-ranging property sector downturn. Still, in our view, while China will continue to grow, the rate of expansion could be slower than many have been expecting. This could impact certain commodities, as well as some individual countries.

Overall: on balance, we think the global economic recovery has considerably further to go, with several years of above-trend growth likely. Key near-term risks to the global outlook include: a worsening downturn in the Chinese property sector, and a greater-than-expected impact from the large fiscal support reduction in the US. Other risks include further unexpected coronavirus upsurges, and elevated inflation that proves less transitory than expected. Closely connected to the inflation issue are the risks of monetary policy error, and US Treasury yields rising by more than expected.

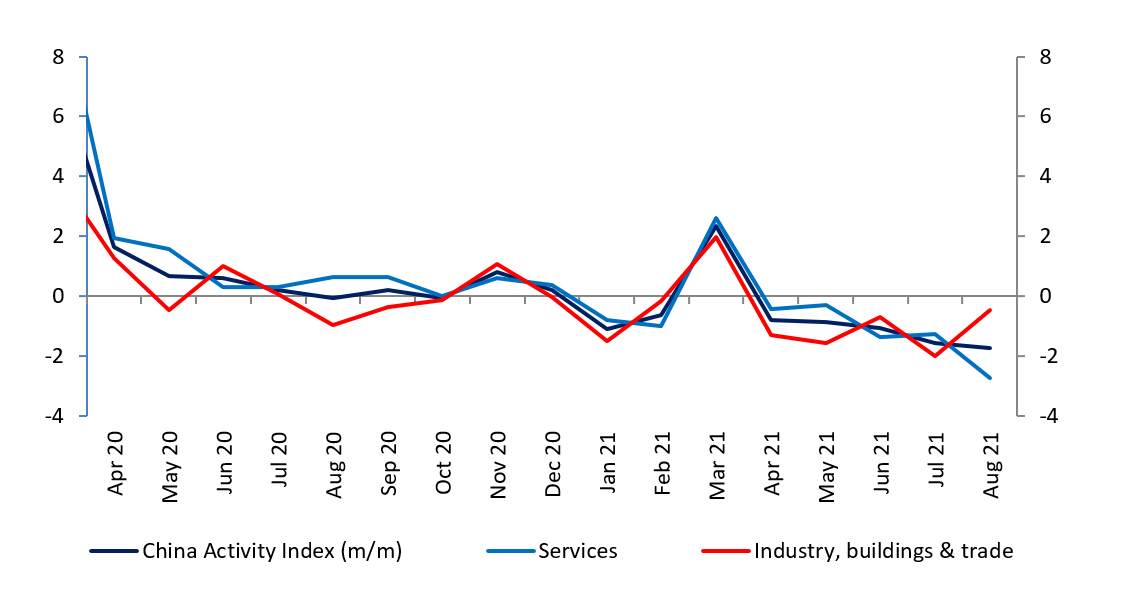

As reflected in our China Activity Index (see below), economic growth in China has slowed. This is the result of Covid-19 mobility restrictions, some tightening of monetary and fiscal conditions after the strong bounce back of last year, and the weakening property sector.

China Activity Index

Market worries regarding the highly indebted property developer Evergrande have been growing. This is certainly justified given the size of Evergrande (with over USD300 billion of debt), the dominance of bond issuance from this space, strong linkages with the domestic banking system and the general importance of property as a store of wealth in China.

It is hard to ignore something as large as Evergrande getting into trouble, and we have seen increased volatility in the bonds of other Chinese property companies. However, our base case for now remains that the Chinese authorities, well-cognisant of the risks, should ultimately be able to manage the fallout in the property sector. This would include ensuring an orderly restructuring of Evergrande if necessary, and avoiding other broader sector spillovers that might more seriously endanger economic growth.

In general, while a likely greater-than-expected slowdown in China could meaningfully impact a number of countries and sectors, it shouldn’t derail the global economy.

The recent underperformance of Asian bond markets has improved valuations, but we think this is largely justified on balance. A key driver of this has been concerns about the Chinese property market, which as noted, has been a very big bond issuer in recent years, and is important for Chinese economic growth. Certainly Asian High Yield now appears extremely cheap relative to US High Yield, and is pricing in a number of defaults, so we feel selectively adding some exposure may be warranted.

Resurging Covid-19 deaths in some Asian markets such as Thailand and Indonesia have been another negative factor. These issues notwithstanding, in our view a broader issue for the Asian region, in keeping with many emerging markets more broadly, is their positioning in the economic cycle – unlike in the US and Europe, liquidity tightening, including through higher policy interest rates, is a less distant prospect, which is an unfavourable factor for regional bond markets.

The global economy is likely to look through the current slowdown in China and tightening of fiscal conditions in the West and deliver above above-trend growth next year. Although headline inflation rates will likely remain elevated for a time, ultimately we think they will gradually move closer to central bank targets. However, a key risk factor for global bond markets will be concerns regarding excessive complacency on the inflation front (particularly on the part of the Fed), and the associated risk of central bank policy error. When such concerns increase, we could see sharp rises in Treasury yields, as was the case in March.

Given the increasing importance of China for the global economy, recent issues in the country’s property market, and the potential of this to have a wider national growth impact, is also very much a key global risk factor.

Developed government bond markets – while central banks are beginning to think about policy normalisation, whenever this happens it will be very gradual – a case of moving from a snail to tortoise speed, rather than a hare’s speed. The monetary backdrop should therefore stay quite supportive for developed government bond markets. Within these markets, US government bonds offer best relative value, while bunds and peripheral government bonds appear most expensive. However, it is worth remembering that euro bond markets are most supported in terms of the monetary backdrop, given expectations for ECB policy.

Global Investment Grade credit – markets are economically, technically and fundamentally quite well supported at present, with search-for-yield behaviour also helpful, particularly in Europe. However, valuations are no longer cheap and there is more limited cushion for downside risks, especially in the cyclical BBB area. As such, we envisage selective profit-taking opportunities could arise in areas where spreads may have tightened excessively. At the same time, we would consider selectively adding risk exposure if the volatility seen in government bond markets were to spread developed credit markets.

High Yield – the macro and earnings backdrop is generally supportive, with low refinancing risk at present. High Yield is probably better placed than Investment Grade given that defaults (which are very low presently) tend to lag the economic cycle, and bigger cushions in terms of spread levels. However, this is offset to some extent by generally less attractive valuations (particularly in more cyclical areas of the market), as well as more localised issues, calling for a high degree of selectivity.

Emerging market debt – country selection will remain critical, particularly given variable Covid-19 conditions, different stages of the economic cycle, and monetary tightening already taking place in some places. Generally, hard currency sovereigns appear fully valued at present, although there are still a number of idiosyncratic opportunities. However, more attractive entry points could arise in local currency sovereigns, especially in those cases where market participants might price in too much tightening. While recent property sector woes and slowing growth in China have certainly improved valuations in Asian credits, we would be reluctant to see the sell-off as a generalised regional buying opportunity.

RISK WARNING

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.