03 Dec 2025

Investment view from Jack Holmes, Fund manager

Related funds | Artemis Monthly Distribution Fund

Many great thinkers through the ages have prized the concept of simplicity. Leonardo da Vinci believed it to be “the ultimate sophistication”; Albert Einstein quipped that “everything should be made as simple as possible, but not simpler”; while author William Golding concluded that “the greatest ideas are the simplest”. Then why, I wonder, do so many investment professionals try to make things so complicated?

Multi-asset strategies are a case in point. Many of them contain a wide variety of asset classes and different sleeves run by people who may have never even met. Advisers and investors, in my view, would be much better served with a simple, transparent portfolio they can understand and analyse.

I would say this. Cards on the table: I co-manage the Artemis Monthly Distribution Fund, which is a combination of just two assets – global equities and bonds. We do not use derivatives (beyond some simple currency hedges) and we do not use complex strategies.

In my experience, you can find nearly everything you are looking for as an investor in equities and bonds. Some analysts say this is a time for gold but I co-manage an income fund and gold does not pay dividends. Gold producers do, and our second-biggest equity holding is Canada’s Kinross Gold1. This is far from an imperfect solution either. Over the past two years, gold has increased in price by just over 100%, whereas Kinross Gold has risen by more than 350%2.

Keeping things simple also helps manage correlation risk. It starts with the managers talking to each other. I am not a fan of strategies where each asset stream is managed independently. As a bond specialist, I might be given one benchmark and the equity manager another. This just increases the risk of everyone pointing in the same direction or of different exposures cancelling each other out.

We saw this in many funds in 2022. The equity portions were loading up on longer-duration, high-growth assets. On the fixed income side, if you were using a global aggregate index as your benchmark, that also tilted you towards long-duration assets, in order to lift returns in a low-yield world.

In theory, you had a diversified portfolio – perhaps 50% equities, 50% fixed income. But when interest rates began to rise sharply in 2022, so did correlations, and most (if not all) assets in this supposedly diversified portfolio sold off in unison.

Because we have a small team of equity and bond managers who work closely together, we were able to act quickly at the start of 2022 and coordinate both sides of the portfolio. In equities, we reduced leverage and added to commodity producers and tangible assets. At the same time, we took down duration within fixed income. The fund did lose money during the perfect storm of rapid rate hikes, inflation spikes and volatility but we sheltered our investors from the worst of the damage.

Within our strategy, if we were just running a fixed income portfolio with no kind of consciousness of what the equity side was doing, we would probably own a lot more banks. We do not, because banks represent a significant overweight in that side of the portfolio, as we believe bank equities to be a more attractive proposition at this moment in time thanks to strong profitability and cash returns.

It is the same with energy: I particularly like the offshore energy sector within the high-yield space. But if I find my co-manager Jacob de Tusch-Lec planning to run with four or five energy positions on the equity side – and we believe equities to be the better way to express that view – then we do not want to double up.

To the virtue of simplicity, we could add nimbleness. I understand from a marketing perspective why providers may have a rigid asset-allocation division between bonds and equities if they have several strategies and want to distinguish between them. But what drives our asset allocation is not a top-down view on markets, it is the relative attractiveness of individual opportunities and sectors within each one, which means the balance between equities and bonds fluctuates.

Many of the multi-asset solutions that have sprung up over recent years were designed for the QE environment of low bond yields, which meant alternatives had to be found. However, we believe we are now back to an environment where bonds serve a very real and useful purpose in simple multi-asset portfolios. Once again, we can buy bonds for income and equities for growth.

What’s more, the elevated bond yields on offer since the interest rate hiking cycle began give us more freedom on the equity side of the portfolio to buy companies that might offer a lower yield but can grow their dividends more quickly.

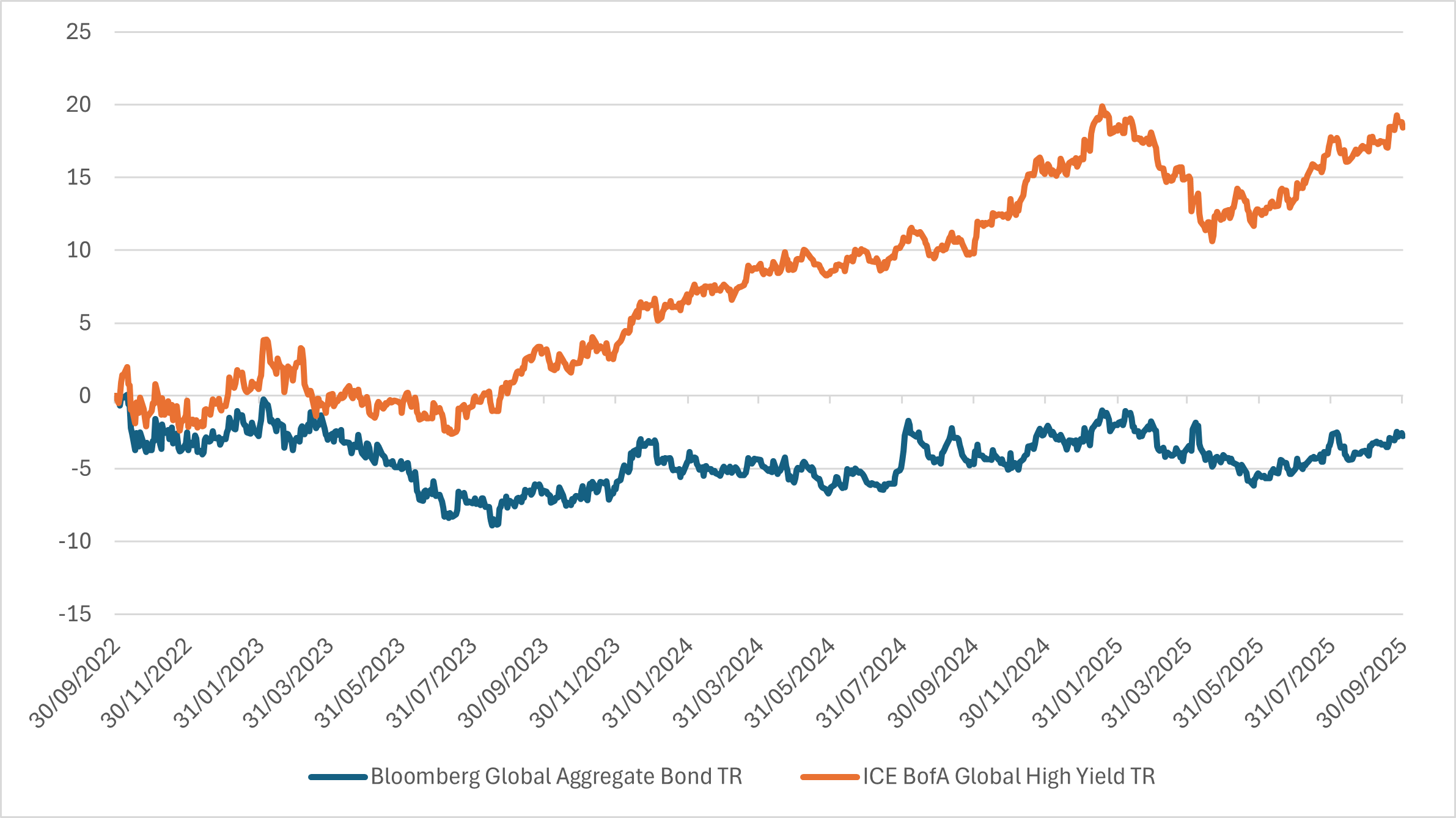

More than half of our fixed income allocation consists of high-yield bonds, with a focus on higher quality, shorter duration securities. This part of the portfolio generates yields in the high single digits and that drumbeat of consistent income is an attractive proposition for a portfolio that pays investors on a monthly basis. High yield bonds also provide diversification away from government bonds, superior returns compared to investment grade credit and lower volatility than equities.

Performance of high yield vs global investment-grade bonds over 3yrs

Finally, what about the case for active management in multi-asset income investing? If you were to take a passive approach to this kind of portfolio, you would probably have a lot of exposure to US tech stocks. The fixed income side would be dominated by government and investment-grade bonds and, ipso facto, much more reliant on duration – making it vulnerable to interest rate movements.

In a higher-inflation, less globalised world – with massive government deficits and stretched balance sheets – this does not make sense, in my view. We saw days in April when both the S&P 500 and price of US Treasuries fell significantly – meaning these government bonds provided no protection.

Meanwhile, high-yield benchmarks are stuffed full of over-indebted companies that we do not wish to lend to, including telecoms, which we believe have very little pricing power and endless capex needs.

On both sides of the Artemis Monthly Distribution Fund – equities and bonds – we endeavour to find under-owned, undervalued securities and to offer investors something that behaves differently to passive exposures and other actively managed funds.

For equities, this means thinking differently about what might constitute an income stock and widening our horizons to consider banks, Japanese insurers, defence companies, gold miners and other industries that are not typically represented in other managers’ equity income funds. Our philosophy of thinking outside the box also applies to what we don’t own. Avoiding core income stocks with too much leverage has given our relative performance a significant boost in recent years and has meant that our fund acts as a good diversifier for other assets in broader client portfolios.

Ultimately, we believe our approach – of a small, nimble team building a focused, simple portfolio of bonds and equities in areas that offer good value and income – to be well suited to a more volatile and uncertain world.

Notes and references

1Artemis as at 30 Sep 2025

2Bloomberg for the two years to 31 Oct 2025 in US dollar terms

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS.

CAPITAL AT RISK. All financial investments involve taking risk and the value of your investment may go down as well as up. This means your investment is not guaranteed and you may not get back as much as you put in. Any income from the investment is also likely to vary and cannot be guaranteed.

This is a marketing communication. Before making any final investment decisions, and to understand the investment risks involved, refer to the fund prospectus (or in the case of investment trusts, Investor Disclosure Document and Articles of Association), available in English, and KIID/KID, available in English and in your local language depending on local country registration, available in the literature library.

Risks specific to Artemis Monthly Distribution Fund

Investment in a fund/trust concerns the acquisition of shares in the trust and not in the underlying assets of the fund/trust.

Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them.

For information about Artemis’ fund structures and registration status, visit our fund structures page

For changes made to the Artemis Funds (Lux) range of Luxembourg-registered funds since launch, visit our fund changes page

Third parties (including FTSE, Russell, MSCI and Refinitiv) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit our third party data page

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

We recommend that you get independent financial advice before making any investment decisions.

Important information

The intention of Artemis’ ‘investment insights’ articles is to present objective news, information, data and guidance on finance topics drawn from a diverse collection of sources. Content is not intended to provide tax, legal, insurance or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or investment by Artemis or any third-party. Potential investors should consider the need for independent financial advice. Any research or analysis has been procured by Artemis for its own use and may be acted on in that connection. The contents of articles are based on sources of information believed to be reliable; however, save to the extent required by applicable law or regulations, no guarantee, warranty or representation is given as to its accuracy or completeness. Any forward-looking statements are based on Artemis’ current opinions, expectations and projections. Articles are provided to you only incidentally, and any opinions expressed are subject to change without notice. The source for all data is Artemis, unless stated otherwise. The value of an investment, and any income from it, can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.