17 Nov 2023

Alex Stanić, Fund Manager

Alex Stanić, lead manager of the Artemis Global Select Fund, says that to call all banks cyclical is a generalisation: in selective emerging markets with low penetration of financial products, there is a clear long-term opportunity.

Our strategy begins by identifying long-term trends, many of which may seem obvious: automation, the growing demand for healthcare and the move to a lower-carbon world.

What tends to be more difficult is finding companies of sufficient quality to play these trends. This has proved to be the case with financial inclusion, for which we have just bought our first stock.

The United Nations has identified financial inclusion as an enabler for seven of its 17 Sustainable Development Goals1. Last year, the World Economic Forum estimated that 1.4 billion adults had no access to banking2, which underlines the scale of the problem – and for investors, the size of the opportunity.

The chosen one

The first stock based on this trend we have added to our portfolio is HDFC Bank, India’s leading private sector bank.

India may seem like an odd place to play the theme of financial inclusion, due to the enormous strides it has already made in this area: about 78%3 of its population had a bank account by 2021, compared with 20%4 less than a decade earlier.

However, we believe that this has simply laid the groundwork for the likes of HDFC Bank to build on.

Financial inclusion means more than just opening a bank account – it also refers to access to credit, loans, equity and insurance. There is a strong correlation between wealth creation and the use of these services and Goldman Sachs projects India will have the world’s second-largest economy by 20755. This represents a potentially enormous tailwind to performance over the coming decades.

Safety in numbers

Yet banks are famously cyclical, so as long-term investors who aim to benefit from the power of compound earnings growth, why are we investing in businesses that are dependent on the performance of the economy?

The above statement is something of a generalisation. While it may be true for developed market banks with highly penetrated and mature markets, in selective emerging markets, at a far lower level of penetration, it can be a different story.

HDFC Bank’s return on equity (ROE) has averaged 18% a year over the past 18 years, through a variety of economic environments6. This level of ROE was last attained by UK-based banks in the run-up to the Global Financial Crisis and proved unsustainable. HDFC Bank, however, has not had to resort to excessive leverage to get to this level, making use instead of inherently higher profitability – its return on assets (RoA) stands at 1.9%, compared with 1%7 or considerably less for many major banks across the developed world.

Such metrics, combined with the tailwinds mentioned above, could result in HDFC Bank delivering compound earnings growth in the mid- to high-teens every year for the foreseeable future.

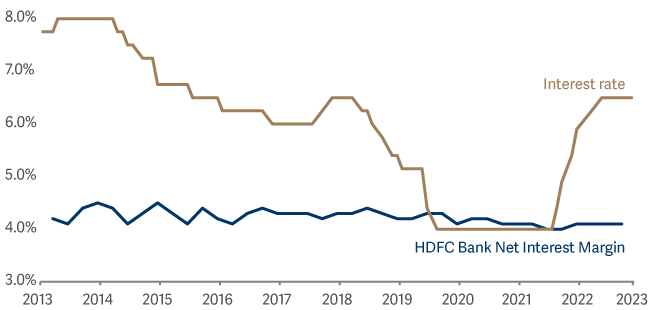

It will still have to cope with cyclical shocks of the type faced by banks in the developed world – as an emerging market, India’s GDP has fluctuated more violently than that of the UK over the past decade, for example. Yet while interest rates have halved from 8% to 4% during this time, before bouncing back to 6.5%8 today, HDFC Bank’s net interest margin – the difference between what it charges borrowers for loans and what it pays depositors – has proved resilient9.

India’s interest rate vs HDFC Bank’s net interest margin

Source: Bloomberg, HDFC Bank

This stability in margins is a feature across Indian banks – in general, duration risk is less of an issue, they offer floating-rate loans and lend to consumers who are used to paying higher rates, meaning rate cycles have less of an impact on credit quality.

Such a generalisation ignores the fact that some Indian banks do experience credit problems at certain points in the cycle. However, over the past 10 years, HDFC Bank’s ratio of provision expenses to average assets has been about half that of three of its four largest peers10.

The price is right

After identifying companies of sufficient quality to play long-term themes, the final step in our process involves ensuring we don’t overpay for them.

There are other quality banks in emerging markets – for example, Bank of Central Asia in Indonesia is a strong franchise in a high-growth market with a low level of financial penetration and has an ROE comparable to that of HDFC Bank. With financial inclusion among Indonesia’s population of 272 million standing at just 51%, there is a clear path towards further growth11.

But at a price-to-book (P/B) ratio of 4.25x, it is too expensive for us. HDFC Bank on the other hand trades at a P/B of just 2x – a 10-year low12.

The train is coming

There are other reasons why we would prefer to back a bank based in India. Aside from the long-term tailwinds mentioned above, catalysts for economic performance could be set to deliver results in the short term, too.

The country has made enormous investment in infrastructure over the past decade, and continues to make significant progress in this critical area. For example, the average rail speed 10 years ago was around 20km/h, which is slower than a reasonable cyclist. That’s now reached 40km/h and is expected to get to 80km/h in the next five years13.

That sort of advancement provokes change in an economy that countries don’t tend to go back from. But this change has so far been driven by the government – private sector investment in India as a percentage of GDP has been falling since 201314. The economy could get another leg-up when this trend reverses, which we think is inevitable – the major players will want to be on this train as it gathers momentum. And so do we.

1 https://sdgs.un.org/sites/default/files/publications/2649unsgsa.pdf

2 https://www.weforum.org/agenda/2022/09/financial-inclusion-findex-radio-davos-world-bank-economist/

3 https://www.statista.com/statistics/942795/india-financial-institution-account-ownership-rate/

4 https://www.statista.com/statistics/942795/india-financial-institution-account-ownership-rate/

5 https://www.goldmansachs.com/intelligence/pages/how-india-could-rise-to-the-worlds-second-biggest-economy.html

6 Bloomberg

7 Bloomberg

8 Bloomberg

9 HDFC Bank

10 Bernstein

11 https://www.statista.com/statistics/941457/indonesia-financial-institution-account-ownership-rate/

12 Bloomberg

13 https://www.statista.com/statistics/1029292/india-average-freight-train-speed/

14 https://theprint.in/economy/private-investment-a-shrinking-slice-of-indias-gdp-pie-since-2012-its-a-vote-of-no-confidence/1535969//

Important information

FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. This is a marketing communication. Refer to the fund prospectus, available in English, and KIID/KID, available in English and in your local language depending on local country registration, from www.artemisfunds.com or www.fundinfo.com, before making any final investment decisions. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Investment in a fund concerns the acquisition of units/shares in the fund and not in the underlying assets of the fund.

Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them.

For information on sustainability-related aspects of a fund, visit www.artemisfunds.com.

The fund is an authorised unit trust scheme. For further information, visit www.artemisfunds.com/unittrusts.

Third parties (including FTSE and Morningstar) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit www.artemisfunds.com/third-party-data.

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

Issued by Artemis Fund Managers Ltd which is authorised and regulated by the Financial Conduct Authority.