30 Jan 2024

Raheel Altaf, Fund Manager

The promise of emerging markets disappointed in 2023 and, despite a rebound in sentiment in the final quarter, the sector ended the year well behind its developed market counterparts. Yet the Artemis SmartGARP Global Emerging Markets Equity Fund still managed to deliver double-digit returns1, highlighting the benefits of taking an active approach.

While the asset class remains cheap and fundamentals continue to improve, we believe taking a differentiated approach will be vital to making the most of its potential in the year ahead – especially in the following areas.

One of the reasons emerging markets delivered such lacklustre returns last year was the disappointing news from China.

While its economy grew at a healthy pace in Q1 (up 2.2% on the previous quarter), growth slowed to just 0.8% in Q22. That growth fell so far short of expectations was attributed to weak demand at home and the struggles of the real estate sector3.

This weakness appeared to be confirmed in July, when China reported worse-than-expected data for both imports and exports4.

Yet policymakers in Beijing aren’t standing idly by while their economy stalls. News that consumer prices had tipped into deflation was enough to convince them to take more direct action to shore up demand, with an unexpected cut to one-year lending rates in mid-August5.

Other more recent stimulus actions are encouraging, but will take some time to feed through to the economy.

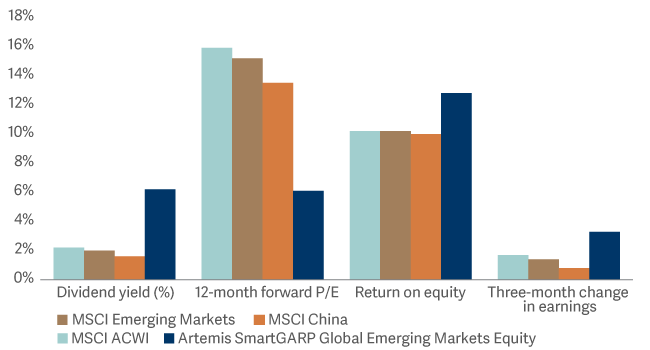

Yes, there are risks, but these are more than reflected in share prices. On average, our Chinese holdings trade at a 62% discount to the MSCI AC World index, even though they are growing much faster and offer higher yields6. These depressed valuations offer a margin of safety; we remain overweight the region.

Financial characteristics of Fund’s China holdings vs market

Source: Artemis, Bloomberg and MSCI as at 31 December 2023.

While our largest absolute position is in China, our largest relative overweight is to Brazil.

As an agricultural heavyweight, supplying soya beans, corn, beef, coffee and sugar to many parts of the world, Brazil’s economy is thriving. Following better-than-expected Q3 figures, the Brazilian Finance Ministry raised its 2023 GDP forecast for the year from 2.5% to 3.2%7, while its trade surplus reached a record level on the back of increasing self-sufficiency in energy8.

More broadly, Brazil is one of several emerging markets whose monetary policy is diverging from developed markets as inflationary pressures fade. Its central bank has cut interest rates by 200bps since August and has indicated this pace of easing is likely to continue9.

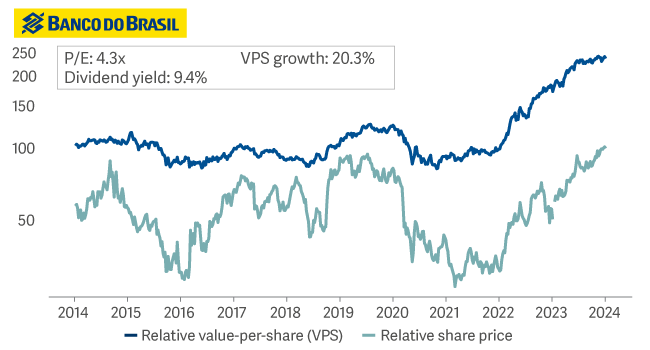

Yet while these tailwinds have led to vastly improved cashflows, valuations remain low, making it one of the best markets in the world for income investors. As recently as 2022, oil company Petrobras paid out almost $40bn in dividends on a market cap of just over $80bn10. Banco do Brasil, the leading lender to the booming agribusiness sector, is trading on a P/E of 4.3 with a dividend yield of 9.4%11.

Source: FactSet, Artemis as at 4 January 2024. Image source: brandsoftheworld.com.

Note: value-per-share and share price relative to MSCI Emerging Markets Index. Value-per-share (VPS) is a combined measure of earnings, cash flow, operating profits, dividends and asset value per share. Reference to specific stocks should not be taken as advice or a recommendation to invest in them.

There are reasons to be cautious in emerging markets, however. Last year, many active managers warned about the return of speculative behaviour, which reduced the focus on fundamentals. While they were predominantly referring to the US, this behaviour wasn’t confined to developed markets.

Uncertainty in the developing world has led emerging market investors to load up on tech and more defensive areas, leading to inflated share prices.

This is one of the reasons why we are underweight Taiwan. As the leader in semiconductor manufacturing, the country may be at the centre of global trade, but high valuations12 and inflationary pressures in the West make it vulnerable to a slowdown in demand.

Meanwhile, India’s annual GDP growth is close to 7%13, underpinned by a robust consumer and significant investment in infrastructure. Yet its average P/E of 22 is even higher than the US’s figure of 19.614. Although we have 10% of our fund in what is now the world’s most populous country15, this represents an underweight position compared with our benchmark.

Emerging market stocks are trading on multi-decade valuation lows across a range of metrics compared with their peers in the developed world, while their economies have in general already started easing.

Flexibility around monetary and fiscal policies is causing diverging policy paths with the West and supporting prospects for growth. More accommodative measures from China in particular could prove decisive in changing sentiment.

Yet despite the improving outlook, the divergence in economies – and valuations – means blindly buying into emerging markets probably isn’t the best way to play the sector. Just look at last year.

Find out more about the Artemis Global Emerging Market Fund

1Artemis/Lipper

2https://kpmg.com/cn/en/home/insights/2023/08/china-economic-monitor-q3-2023.html

3https://assets.kpmg.com/content/dam/kpmg/cn/pdf/en/2023/08/china-economic-monitor-q3-2023.pdf

4https://www.export.org.uk/news/648071/Chinas-July-trade-numbers-worse-than-expected-as-both-imports-and-exports-fall.htm

5https://www.reuters.com/markets/asia/china-leaves-benchmark-lending-rate-unchanged-amid-better-economic-data-2023-10-20/

6Artemis, Bloomberg and MSCI as at 31 December 2023

7https://www.reuters.com/world/americas/brazil-raises-2023-gdp-growth-outlook-activity-strengthens-2023-09-18/

8https://www.reuters.com/markets/brazil-posts-record-trade-surplus-988-billion-2023-2024-01-05/

9Zurich Weekly Macro and Markets View, 18 December 2023

10https://www.reuters.com/business/energy/brazils-petrobras-pay-69-billion-dividends-2023-03-02/

11Source: FactSet, Artemis as at 4 January 2024.

12https://www.ceicdata.com/en/indicator/taiwan/pe-ratio

13https://www.reuters.com/world/india/india-likely-report-higher-gdp-growth-estimates-202324-2024-01-05/

14Bloomberg and MSCI

15https://www.statista.com/statistics/262879/countries-with-the-largest-population/

The intention of Artemis’ ‘investment insights’ articles is to present objective news, information, data and guidance on finance topics drawn from a diverse collection of sources. Content is not intended to provide tax, legal, insurance or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or investment by Artemis or any third-party. Potential investors should consider the need for independent financial advice. Any research or analysis has been procured by Artemis for its own use and may be acted on in that connection. The contents of articles are based on sources of information believed to be reliable; however, save to the extent required by applicable law or regulations, no guarantee, warranty or representation is given as to its accuracy or completeness. Any forward-looking statements are based on Artemis’ current opinions, expectations and projections. Articles are provided to you only incidentally, and any opinions expressed are subject to change without notice. The source for all data is Artemis, unless stated otherwise. The value of an investment, and any income from it, can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.