FOR PROFESSIONAL INVESTORS AND/OR QUALIFIED INVESTORS AND/OR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested. Please remember that past performance is not a guide to the future.

When Brian Jones was found dead in his swimming pool in 1969, he unwittingly became the founder of the 27 Club – an exclusive but undesirable membership tag applied to rock stars and musicians who died three years short of their 30th birthday. By 1971 it included Jimi Hendrix, Janis Joplin and Jim Morrison, who were later joined by Kurt Cobain and Amy Winehouse1.

As a fund manager, there is little overlap between my day-to-day working life and that of a rock star. But one way in which the small-cap market does remind me of Jones and the other members of the 27 Club is in the treatment of growth stocks.

Hear me out.

Unrealistic expectations

While we class ourselves as value investors, we’re not averse to holding growth stocks. In fact, I would go as far as to say I’ve been looking for growth stocks for the past 30 years. The problem is that every other small-cap investor is doing exactly the same thing.

This means that whenever we come across an exceptional growth company, everybody else sees it too. They end up piling in with us, pushing the share price up to such a point that the poor old company finds itself fighting to live up to expectations.

The following chart, which breaks down the small-cap market into growth and value stocks, shows the consequences of this behaviour. As you can see, value stocks trounce growth ones by an absolute country mile over the long term, partly because of that expectation management.

Long term value has beaten growth

Cumulative performance of value relative to growth within DNSCI XIC

.png)

Source: Deutsche Numus as at 31 December 2023.

Note: DNSCI XIC is the Deutsche Numis Smaller Companies (-InvTrust).

There is a period where the reverse was true: between the end of the Global Financial Crisis in 2009 through to the turn in the interest rate cycle in December 2021, growth stocks outperformed value ones, and outperformed by a lot.

Yet growth companies’ earnings didn’t keep beating expectations during this period. Instead, the valuation attributed to earnings became ever higher. In other words, the returns from growth stocks in that period were illusory – and it shouldn’t have come as a surprise when it ended so badly.

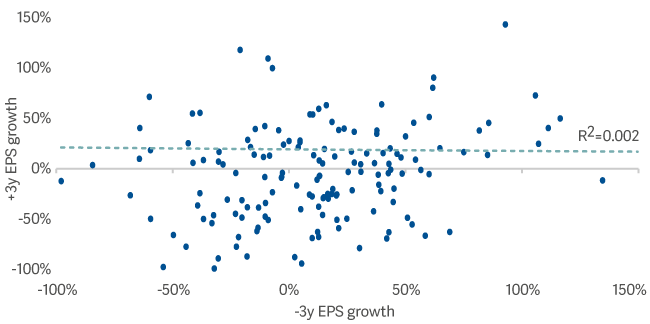

If you don’t believe me, look at the graph below, which shows the earnings growth of every holding in the small-cap index from 2016 to 2019 on the X axis and 2019 to 2022 on the Y axis.

Rock stars are not known for long life spans

No correlation between trailing and future earnings growth 2019 constituents for DNSCI XIC

Source: Bloomberg as at 31 December 2023.

Note: DNSCI XIC is the Deutsche Numis Smaller Companies (-InvTrust).

Quite frankly, the graph looks as if I have been playing darts with it – there is no correlation whatsoever. In other words, it’s very difficult to find a smaller company capable of growing year after year after year without something going wrong.

And this is why fast-growth companies remind me of rock stars such as Jones. Everyone thinks they're sexy, everyone wants to be their friend and bask in their reflected glory. But the trouble is that while they party hard, they end up dying young.

As a result, while most of our peers tend to invest in growth stocks and the areas of the market with momentum working in their favour, we maintain a strict valuation discipline around cashflows, preferring companies with strong balance sheets and market-leading positions.

Companies that live up to the hype

Of course, our strict focus on valuation does mean we occasionally miss out on the odd rock star company that ends up living up to all the hype. Although we made 20x our money on Games Workshop, we could have made 40x if we held on. And, after buying Fever-Tree at 134p, we sold out between 250p and 979p, then watched in horror as shares climbed to 3956p2.

But it also meant we missed the drop when Fever-Tree fell back to 1033p. We avoided the wipeouts in online retailers Cazoo (cars) and Made.com (furniture), where shareholders lost 100% (or almost 100%) of their capital3. Our holdings in Lookers and ScS – more traditional businesses that Cazoo and Made.com tried to disrupt – were a lot less exciting, but they were taken over at premiums of 47%4 and 66%5 respectively.

This may dash the hopes of small-cap investors with dreams of landing a hundred-bagger. As Jones’ bandmates once sang, “you can’t always get what you want”.

But if you maintain a disciplined approach to valuation, well, you just might find, you get what you need.

1https://www.nationalreview.com/2021/07/the-myth-of-the-27-club/

2 & 3Bloomberg

4https://www.reuters.com/markets/deals/global-auto-hikes-buyout-offer-lookers-shares-soar-2023-07-27/

5https://www.standard.co.uk/business/business-news/scs-agrees-takeover-by-italian-rival-in-near-ps100m-deal-b1115535.html