Contributors | Peter Fitzgerald & Ian Pizer

Aviva Investors’ Multi-Strategy Target Return managers talk about why their strategy has survived where others have failed, the lessons they have learned and why a radical overhaul of their investment process in 2018 has been paying dividends.

Read this article to understand:

- Lessons learned in managing the AIMS Target Return strategy

- The steps that were taken in 2018 onwards to boost resilience

- Why the managers believe their experience and adaptability should give investors confidence the turnaround will persist

In the animal kingdom, the capacity to adapt under challenging conditions is crucial to survival. Think of the octopus that sprouts a new tentacle if it is damaged. Or consider the axolotl, a translucent, cave-dwelling amphibian that can regrow entire limbs, regenerating bone and muscle.

These are examples not just of resilience, but what the author and risk analyst Nassim Nicholas Taleb calls antifragility – this concept refers to systems or organisations that are able to weather adverse conditions, but also grow stronger and more robust by virtue of being stress-tested.

The same principles hold true in the financial world, where difficult market environments can put portfolios under pressure and test their managers’ skill. Following testing times since 2018, the Aviva Investors Multi Strategy Target Return (AIMS TR) investment approach has come through a number of tough market scenarios – not least the dramatic fallout from the COVID-19 pandemic and the unprecedented rate-hiking cycle that followed from 2022-2024 – and while it hasn’t always been an easy ride, it has emerged stronger.

“Investors should be drawn to strategies that have stood the test of time through multiple different periods,” says Peter Fitzgerald, chief investment officer, multi-asset and macro at Aviva Investors, and manager of AIMS TR. “There is a lot to be said for experience, and the ability to admit mistakes and adapt your process accordingly.”

This experience should come in particularly useful in the current macro environment, in which uncertainty abounds. While central banks are expected to loosen monetary policy over the coming months, divergence between major economies is likely, and while rates are likely to remain higher than they did in the wake of the Global Financial Crisis, escalating geopolitical risk and continuing deglobalisation may complicate central banks’ efforts to bring inflation down.

In this unpredictable environment, building portfolios that are risk diversified, flexible and able to preserve capital through varying market conditions is more crucial than ever. Increasingly, we believe the answer lies not in the traditional split of equity and bonds, but a combination of different strategies, such as those the managers of AIMS TR have honed and tested over the last ten years.

Seeking resilient returns: lessons learned

Fitzgerald and co-manager Ian Pizer are the first to admit the journey has not all been plain sailing, however. Having got off to a flying start following its launch in 2014, the portfolio endured a more challenging period, resulting in two especially disappointing years in 2017 and 2018, partly due to the wrong calls on equity market sectors and interest-rate markets.

AIMS TR was far from alone within its peer group in struggling during that period. By 2020, several rival strategies were closing amid growing scepticism among market commentators as to the merits of global macro and multi-strategy investing.

That prompted a period of reflection by Fitzgerald and his colleagues, which culminated in some significant changes both in terms of personnel and the way investment decisions were taken. Those clients who stayed invested have been rewarded, with Fitzgerald and his team having successfully navigated challenging market conditions over the past five years.

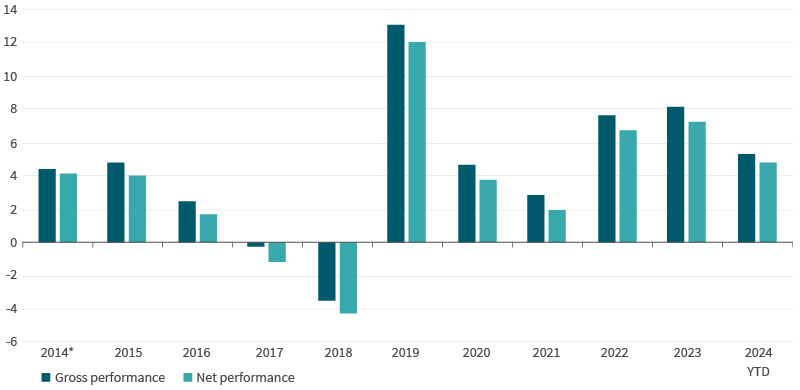

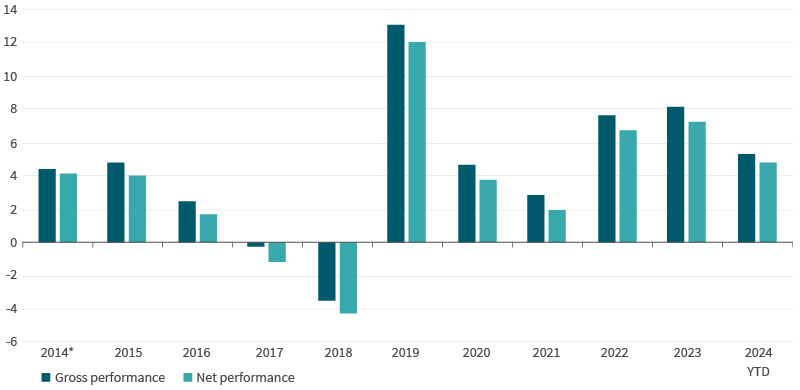

Figure 1: AIMS calendar year composite performance (per cent)

Past performance is not a guide to future returns.

For the Aviva Investors Multi Strategy Target Return Composite. Inception date of the Strategy is July 31, 2014. Performance shown gross and net of fees, USD. Source: Aviva Investors, B-One. Data as of June 30, 2024.

Fitzgerald says the first step in the turnaround was to develop a clearer objective as to what the strategy was trying to achieve for clients and the role it could play in their portfolio – simply put, it should form part of an alternatives allocation, similar to a liquid hedge fund, as opposed to a replacement for an equities allocation.

AIMS Target Return can be thought of as a strategy that can offer investors resilient returns in a variety of market environments, with low sensitivity to equity markets and with a focus on capital preservation through periods of equity market stress. To maximise the probability of achieving excess returns through good times and bad, the managers seek to construct a diversified portfolio containing a mix of strategies, both “long” and “short”, across multiple asset classes. (You can find out more about how the strategy invests and the role of AIMS TR in a liquid alternatives portfolio in “Managing uncertainty with liquid alternatives: The case for AIMS Target Return”.1)

Greater clarity as to the strategy’s objective was accompanied by steps to improve various aspects of the investment process: placing more emphasis on the output of several quantitative investment models; bringing in new investment expertise, especially within the options arena; and making the team managed by Fitzgerald and Pizer more directly accountable for idea generation and performance and less reliant on other investment teams.

Fitzgerald says for him this latter decision was key. Previously, he says, there was too much emphasis on the need for continuous collaboration across the investment floor. The result was too many ideas and an overly complicated strategy to manage.

Pizer agrees. Previously, he says, too many trade ideas ended up being debated. Although many were never included, inevitably too many others were. Similarly, a decision to close two other strategies in the AIMS range at the end of 2022 enabled a more focused approach.

“As a result of the changes, ideas are being filtered more rigorously and only the stronger ones survive. We have reduced the number of trades to around 15 from 30 or so. This has the added benefit of making it easier to manage risk. We’ve also sped up decision making,” he says.

Quantitative techniques

Both managers say a decision to make greater use of various quantitative tools, some of them third-party systems and others proprietary, and to hire experts from outside the organisation, also help explain the strategy’s consistent investment record over the past five years.

“Over this period, AIMS has employed more quantitative and systematic strategies than it did during its first five years. That's been an area of significant investment, both in terms of the systems we developed and brought into the business, and the people we hired,” Fitzgerald says.

For instance, the team has developed what it calls a regime model. This looks for signs of unusual behaviour and correlations between different asset classes to determine if markets overall are in one of three states, categorized as: “normal”, “transition” or “turmoil”.

The model is not looking to make precise predictions as to where markets are heading; rather, it is trying to assess the risk environment by finding signs markets are starting to behave differently.

The risk-reward is adjudged greater when the model thinks markets are in a normal state. Conversely, investors are no longer rewarded for taking risk when markets are in transition and in danger of moving from a normal state to turmoil.

“If the model shows we’re in transition, it’s a cautionary signal. It’s not saying the market is definitely going down, rather that the risk of it doing so is elevated, and you are no longer rewarded for taking that risk,” Pizer says.

By rapidly detecting the changed environment, the model can come into its own if markets do end up going into turmoil. Conversely, when the regime goes back into transition, that generally indicates the market is starting to heal and provides a buy signal.

Pizer says the model was developed as part of a quest to employ more quantitative techniques to spread risk. He explains the tendency for leading central banks’ policy to be increasingly correlated had reduced the diversification on offer from more qualitative trades based on the macroeconomic backdrop.

Fitzgerald says that depending on which of the environments the model assesses markets to be in, the strategy will systematically allocate from zero to 15 per cent into equities.

“It is a quantitative input into our decision making which we will follow almost all the time. It is the main reason we got back into equities towards the end of 2022,” he says.

Systematic strategies

There has been an increased use of quantitative signals and systematic strategies to help achieve the consistency of investment objectives through time.

Another model enables the team to gain exposure to currencies in a much more systematic way by considering both carry and momentum as factors likely to drive movements in prices. Since it was introduced two years ago, the strategy has made money from taking foreign exchange positions after several years of negative returns from currencies.

With the hiring of Patrick Bartholet and Ralph Maison, the team has significantly increased its level of expertise within options and volatility strategies. Between them, the two have more than 50 years’ experience at investment banks, trading and analysing options.

Pizer says there was a recognition they had not been taking enough risk in the early years. By enabling them to take more risk, but in a more targeted and disciplined fashion, the new additions to the team have been another important factor behind the improvement in performance.

For example, a short position in volatility, designed to profit from a more stable market environment, was one of the top performing strategies in 2022, and was a direct result of the new hires.

Pizer says while it is possible to make significant sums over the long term by selling volatility, there is a danger it is all given back in a very short space of time without the requisite expertise.

“We found through experience it can be costly if your timing is just a little bit off. By hiring Pat and Ralph, we’ve been able to trade in options and volatility strategies in a much more precise and targeted way,” he says.

The same goes for the decision to appoint Vincenzo di Gennaro. Not only did he lead the development of the regime model, but he has also helped develop in-house models that look at various factors likely to drive share prices, such as the strength of companies’ balance sheets. This more quantitative approach has allowed the team to diversify the range of strategies they employ, for instance by trading baskets of individual company stocks and by being less reliant on qualitative positions.

Looking ahead

In the near term, the two managers say the current market environment, with greater divergence between central bank policymaking, and interest rates likely to remain quite volatile for some time, should provide a rich opportunity set.

“You want things to be changing. If policy rates go from zero to more than five per cent in a short space, you don't have to capture the whole of that move to make a material return from playing bond markets in a way that wasn't really on the table prior to 2022,” Pizer says.

Fitzgerald adds that were inflation to remain more elevated than over the previous 20 years, as he anticipates, that should also boost the allure of global macro strategies such as AIMS. (See “Inflation and the correlation conundrum: Why it’s time to look at liquid alternatives in a new light”.2)

“In a higher inflation, higher rates world, bonds and equities tend to be more positively correlated as central banks have less scope to bail out equity markets. In such an environment, alternatives are arguably better placed than bonds to provide balanced portfolios with downside protection,” he says.

More importantly however, they agree there is something to be said for the fact the strategy is still thriving, unlike many of its competitors. Investors have reason to believe the improved resilience of AIMS TR is here to stay, given the lessons that have been learnt, the changes implemented and the way the strategy performed in 2022 in the face of a torrid time for both bonds and equities. As in the animal kingdom, as in fund management: experience and adaptability are key factors in success. It’s a case of survival of the fittest.

Composite disclosure

Aviva Investors Global Services claims compliance with the Global investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Aviva Investors Global Services has been independently verified for the periods 1 January 1998 through 31 December 2022. The verification reports are available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm's policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. Verification does not provide assurance on the accuracy of any specific performance report. The firm is defined as Aviva Investors Global Services, which includes all managed assets, excluding direct real estate investments. The firm was redefined as of 31 December 2013, when open ended direct real estate assets were removed from the firm. Closed end direct real estate assets had been excluded from the firm as at 31 December 2010. Therefore, direct real estate assets managed by Aviva are not included within the assets under management value. Following the acquisition of Friends Life group by the Aviva Group, the assets managed by Friends Life group, and it's investment operations, were integrated into Aviva Investors in 2015. Aviva Investors Global Services AUM increased from £131bn at the end of 2014 to £172bn at the end of 2015. Further to an agreement dated 26 May 2018 between Aviva Investors Global Services Limited and LaSalle Investment Management, Aviva Investor's global indirect real estate investment division was transferred to LaSalle Investment Management with effect from 6 November 2018. Additional details are available upon request.

The composite aims to provide a positive total return under all market conditions over the medium to long term by investing globally, and uses a range of strategies to achieve its objective. The Fund targets a gross return of 5% above the European Central Bank base rate over rolling three year periods with less than half of global equity volatility. This composite is hedged into US dollars. This composite was created on 28/10/2014. With an inception date of 31/07/2014. The returns are calculated net of non-reclaimable withholding taxes on dividends, interest and capital gains. Reclaimable withholding taxes are recognised on a cash-basis. Net returns are calculated net of actual fees. The fee scale for pooled clients ranges from 0.1% p.a. to 1.8% p.a. and for segregated mandates the fee scale starts at 0.5% p.a. All income is taken gross of tax, but net of irrecoverable taxes. Further information is available upon request. The Firm uses derivative instruments for investment purposes as per the prospectus. These derivatives include futures, forward, options and swaps. A more complete description of the derivatives used can be found in the investment guidelines of each fund within the composite, along with the maximum exposure level allowed for each fund. For composite benchmarks the weights are rebalanced monthly. Dispersion measure, based on an equal weighted calculation (equal weighted ex-post standard deviation), is done when there are more than 5 accounts in the Composite. The vast majority of the composites will not show a dispersion measure. The three year annualized volatility measures displayed, if applicable, are calculated using the three year annualized ex-post standard deviations. This information is not presented when there are less than 36 monthly observations available. Net-of-fees returns are applied in the calculation of this GIPS Report's Risk Measures.

Policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request A list of composite and limited distribution pooled fund descriptions and a list of broad distribution pooled funds are available upon request. Fees are specific for each portfolios. All asset weighted management fees currently being charged in a composite are calculated for each composite. Fees for non retail portfolios are negotiable. There may be inconsistencies between the source and timings of the exchange rates used to calculate the returns among the portfolios within this composite and between the composite and the benchmark. The sources of exchanges rates for the funds is as per our Valuation / Pricing principles. The source of the exchange rates of system reporting the composites and benchmarks returns are quoted WM / Reuters Closing Spot Rates (1600hr London). Further information is available on request. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

References

- “Managing uncertainty with liquid alternatives: The case for AIMS Target Return”, Aviva Investors, November 16, 2023.

- “Inflation and the correlation conundrum: Why it’s time to look at liquid alternatives in a new light”, October 5, 2022.

Key risks

Investment/objective

Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. There is no guarantee the fund will achieve its objective.

Derivatives risk

Investments can be made in derivatives, which can be complex and highly volatile. Derivatives may not perform as expected, meaning significant losses may be incurred. Derivatives are instruments that can be complex and highly volatile, have some degree of unpredictability (especially in unusual market conditions), and can create losses significantly greater than the cost of the derivative itself.

Illiquid securities risk

Some investments could be hard to value or to sell at a desired time, or at a price considered to be fair (especially in large quantities), and as a result their prices can be volatile