The weight of US equities in global markets, a turbulent period for bonds and the impact of environmental, social and governance (ESG) factors on performance are three key issues on investors’ minds. In this article, Aviva Investors’ Shane O’Brien discusses what they mean for multi-asset investors.

Three key questions are currently on investors’ minds and dominate discussions:

- Do US equities now take too large a share of equity or multi-asset portfolios?

- Are bonds still a good investment and what is their place in multi-asset portfolios?

- How are multi-asset funds being affected by ESG factors?

In this article, we explore the answers to these questions and what all this means for multi-asset investors.

1. Do US equities take too great a share of portfolios?

Accounting for 62.6 per cent of the MSCI All Country World Index as at end-February 2024, US equities take a significant share of many equity portfolios.1 So should we be worried about the dominance of the US market?

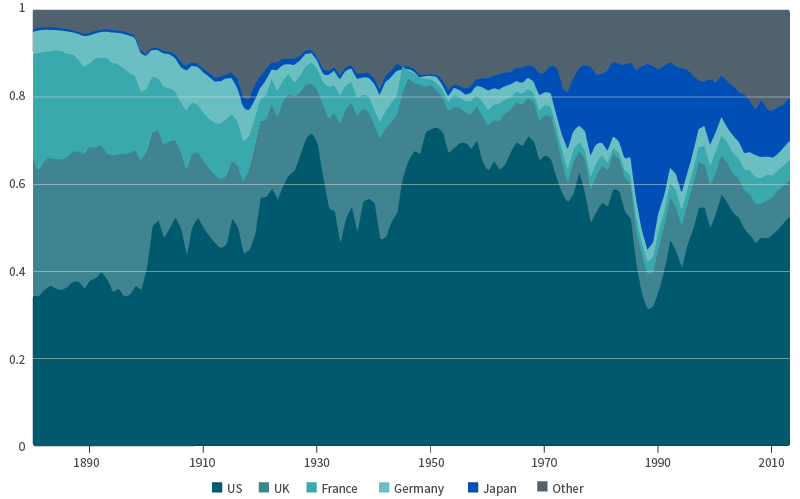

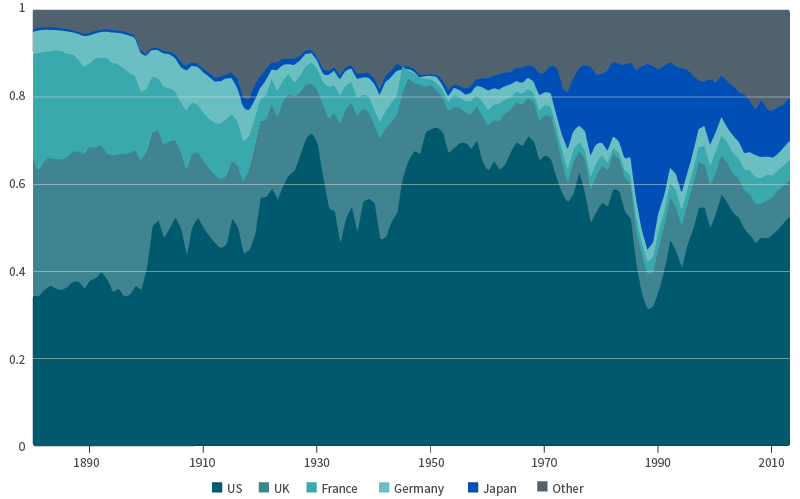

To answer that question, the first thing is to look at what regional weights have looked like over time. Figure 1 shows the US has always made up a high share of global market capitalisation, ever since the 1800s. The current level is at the higher end of the historical range, but still well within it.

Figure 1: US equities have always been a big part of global market capitalisation

Source: Journal of Financial Economics, August 2022.2

Concerns have also been raised over the dominance of the “Magnificent Seven” US tech companies: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.3 Their scale is indeed mind-boggling: the Magnificent Seven take a bigger share of global equity market capitalisation than Japan, the UK, China and France combined.4

Does this make the US market too concentrated? These companies do account for a sizeable proportion of the US index – but then again, concentration is a feature of many other markets. The top ten US stocks comprise about 25 per cent of the total US equity market; by comparison, the top ten UK stocks comprise 36 per cent of that market, and the equivalent figures are even higher in France (56 per cent) and Germany (57 per cent).

In addition, while the Magnificent Seven might be based in the US, they are really global businesses. The US is a place where investors can get exposure to large, global firms, and investing in a company listed in the US does not equate to investing only in the US economy.

One further question relates to US equities’ performance. The profitability of the Magnificent Seven is at an all-time high (which is not necessarily to say their current share prices are justified).5 And although past performance is not an indicator of future returns, Figure 2 shows that, over five, ten and 20 years, US equities’ performance has been substantially higher than in other regions. This helps explain their growing share of the global pie.

Figure 2: US equity performance has dominated (per cent)

.png)

Past performance is not a reliable indicator of future performance.

Note: Indices used are available on request. The performance for all the equity indices are in GBP terms.

Source: Aviva Investors, Refinitiv, Morningstar Direct. Data as of January 31, 2024.

Our view: US equities should not be seen so much as a region, but more as a global marketplace. Having a globally diversified portfolio should enable investors to capture gains among the top companies over time.

2. Are bonds still a good investment?

In nearly 50 years, bond markets have only had five years of negative performance.6 That said, the last few years have been turbulent. While bonds were good diversifiers for equities in previous periods when equities sold off, like the global financial crisis (GFC) or the COVID-19 pandemic, 2022 was painful.

As inflation and interest rates went up, bond prices fell even more than equities and, as a result, some lower-risk multi-asset funds performed worse than higher-risk ones.7 So, do bonds still have a place in diversified multi-asset portfolios?

The short answer is “yes”. Although future returns are never guaranteed, bonds are in a better position than they have been in a long time, for two reasons.

The first is current bond yields are higher than they have been in previous years. Figure 3 shows that, across a selection of bond markets, current yields are near their highest in ten years. All things being equal, that means holding those bonds to maturity will deliver that attractive income yield.

Figure 3: Current bond yields compared to the highest, lowest and average of the last ten years (per cent)

.png)

Past performance is not a reliable indicator of future performance.

Note: Monthly data starting from December 31, 2013.

Source: Aviva Investors, Bloomberg. Data as of January 31, 2024.

The second reason bonds still have a place in multi-asset portfolios is diversification. When bond yields are at or near zero, as they were in the years following the GFC, it is very hard for them to offer protection from fluctuations in equity prices, but when yields are high, as they are today, bonds do a far better job of diversifying allocations.

That is because in a recession, when equity prices typically fall, interest rates are often cut to stimulate the economy, mechanically driving yields down and bond prices up. Again, past performance is not a guarantee of future returns, but it is worth noting that since 1950, bonds have outperformed equities in every recession cycle (see Figure 4).

While we are not predicting a recession, economic downturns can never be anticipated with certainty. In a multi-asset portfolio, it therefore makes sense to hold assets that can offer protection if a recession does happen, and few asset classes have historically offered the same level of protection as bonds.

Figure 4: In every recession since 1950, bonds have delivered higher returns than equities and cash (average annual absolute return, per cent)

.png)

Past performance is not a reliable indicator of future performance.

Note: Asset class total returns since 1950 represented by S&P 500, Bloomberg Barclays Global Aggregate Bond Index and three-month US Treasury bills.

Source: Aviva Investors, S&P, Bloomberg. Data as of December 31, 2022.

Our view: Bonds still play an important role in a diversified portfolio. Not only are long-term expected returns more attractive than they have been in a long time, but bonds can also be a good diversifier in turbulent economic times.

3. How is ESG impacting returns?

ESG has become a commonly used term in investment over the last few years, and it makes sense to ask how ESG considerations could impact investment returns. To answer this question, it is important to distinguish between what is meant by ESG integration versus sustainable investing.

An investment approach that integrates ESG would consider environmental, social and governance issues as part of the analysis, but the priority for the fund would be financial risk and return. Because in this context ESG is just an input and does not determine the whole profile of the fund, the short to medium-term performance of an ESG integrated fund shouldn't differ much from that of a standard fund. This is illustrated in Figure 5, which shows someone investing in an ESG integrated global equity strategy would have seen very similar overall returns to a standard global equity investment.8

In contrast, a sustainable portfolio prioritises a sustainable goal. It will aim to manage risk and deliver returns, but ESG is fundamental to the investment process. Sustainable funds are generally more concentrated, focusing on the sustainable outcome, such as a lower carbon footprint of the portfolio, for example. This can result in greater variance of returns (see Figure 5). This means it is important for investors to be clear about their objectives and sustainability preferences when choosing between these approaches.

Figure 5: Global equity total annual returns – all versus ESG integrated passive and sustainable active strategies (per cent)

.png)

Past performance is not a reliable indicator of future performance.

Note: Global equities are represented by the MSCI World Index; ESG integrated passive equities are represented by the MSCI World ESG Universal Index; active sustainable equities are represented by a peer group of 11 sustainable global equity strategies. All show total returns in GBP. Not all the peers have five-year track records, therefore the data set becomes smaller for the older time periods.

Source: Aviva Investors, Refinitiv. Data as of January 31, 2024.

Our view: ESG will affect performance differently depending on the approach. ESG integration will deliver performance that is more similar to standard strategies than sustainable strategies. In both cases, the impact on returns can be positive or negative.

Three points to remember

- The US is more than a region; it is a global marketplace.

- Bonds can still play an important role in diversification.

- ESG will affect performance differently depending on the approach, so it is important investors choose the approach that aligns with their own objectives.

References

- MSCI All County World Index. Data as of February 29, 2024.

- Dmitry Kuvshinov and Kaspar Zimmermann, “The big bang: Stock market capitalization in the long run”, Journal of Financial Economics, Volume 145, Issue 2, Part B, August 2022.

- These companies are for illustrative purpose only. This list is not an investment recommendation.

- LSEG DataStream. Data as of November 30, 2023.

- Past performance is not a reliable indicator of future performance. Sources: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, Meta annual reports, 2023.

- Based on the entire data series of the Barclay’s US Aggregate Bond index. Data as of January 31, 2024.

- Refinitiv. Data as of January 31, 2024.

- Past performance is not a reliable indicator of future performance.

Important information

THIS IS A MARKETING COMMUNICATION

Except where stated as otherwise, the source of all information is Aviva Investors Global Services Limited ("Aviva Investors"). Unless stated otherwise any opinions expressed are those of Aviva Investors. They should not be viewed as indicating any guarantee of return from an investment managed by Aviva Investors nor as advice of any nature. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested.

The Aviva Investors Multi‐asset Funds comprise two ranges, each with five funds (together the “Funds”):Aviva Investors Multi-asset Plus Fund range comprises the Aviva Investors Multi‐asset Plus Fund I (“MAF Plus I”), the Aviva Investors Multi‐asset Fund Plus II (“MAF Plus II”), the Aviva Investors Multi‐asset Plus Fund III (“MAF Plus III”), the Aviva Investors Multi‐asset Plus Fund IV (“MAF Plus IV”) and the Aviva Investors Multi‐asset Plus Fund V (“MAF Plus V”) Aviva Investors Multi-asset Core Fund range comprises the Aviva Investors Multi‐asset Core Fund I (“MAF Core I”), the Aviva Investors Multi‐asset Fund Core II (“MAF Core II”), the Aviva Investors Multi‐asset Core Fund III (“MAF Core III”), the Aviva Investors Multi‐asset Core Fund IV (“MAF Core IV”) and the Aviva Investors Multi‐asset Core Fund V (“MAF Core V”).

The Funds are sub-funds of the Aviva Investors Portfolio Funds ICVC. For further information please read the latest Key Investor Information Document and Supplementary Information Document. The Prospectus and the annual and interim reports are also available on request. Copies in English can be obtained free of charge from Aviva Investors UK Fund Services Limited, 80 Fenchurch Street, London, EC3M 4AE. You can also download copies from our website. Issued by Aviva Investors UK Fund Services Limited. Registered in England No 1973412. Authorised and regulated by the Financial Conduct Authority. Firm Reference No. 119310. Registered address: 80 Fenchurch Street, London, EC3M 4AE. An Aviva company.

.png)

.png)

.png)

.png)