Generative artificial intelligence is the hot technology of the moment. It has the potential to be transformative, but as with other recent technologies - electric vehicles, renewable energy, blockchain - valuations can become detached from fundamentals. Equity research analyst Jonathan Tseng provides an overview of the technology, its risks and where we see investment potential.

Key points

In recent months, artificial intelligence (AI) has gripped peoples’ attention. We’ve been tracking the technology for some time and recently conducted a deep dive research project into the subject, including sessions with key global thinkers in the field.

Generative AI creates new and original content using machine learning algorithms and configurations from existing information. It recognises patterns and rules from data and uses this knowledge to create new data that resembles the original data. It can create new images, video, music, code, and text based on patterns in data. This content is so advanced it is almost life-like.

Generative AI can produce this content without human intervention while traditional rules-based AI requires human input to decide the parameters for decision-making. Generative AI’s two key breakthroughs are the use of latent diffusion models, which automatically iterates an algorithm to end up with a realistic final image, and large language model transformers, which conduct calculations in parallel rather than in a series to enable faster and more voluminous data processing.

While generative AI is a leap forward, it does not think in a way that replicates independent human thought. It is still a variant of traditional deep learning (a branch of machine learning), as opposed to a more profound shift towards Artificial General Intelligence that we see in movies such as The Terminator, The Matrix or C-3PO from Star Wars.

What’s great and not-so-great about generative AI

Generative AI is brilliant at quickly completing certain tasks to a high standard; but it may not get jobs done exactly right. Its core weakness is that it can be poor at ensuring the quality, accuracy, and originality of the content it produces. It can design realistic images but may occasionally include basic errors like giving a car two steering wheels or a man three legs.

This means generative AI should not necessarily be seen as something that will replace humans in the workplace. There will inevitably be jobs that become scaled down or even obsolete such as customer service representatives who mostly deal with repetitive queries that could largely be AI-automated. But other jobs could be enhanced by generative AI including creative tasks such as video games design, movie background development, music production, computer programming and copywriting. Just as Microsoft’s Excel became a widespread tool for quantitative tasks, generative AI could become an exciting new resource for artistic projects.

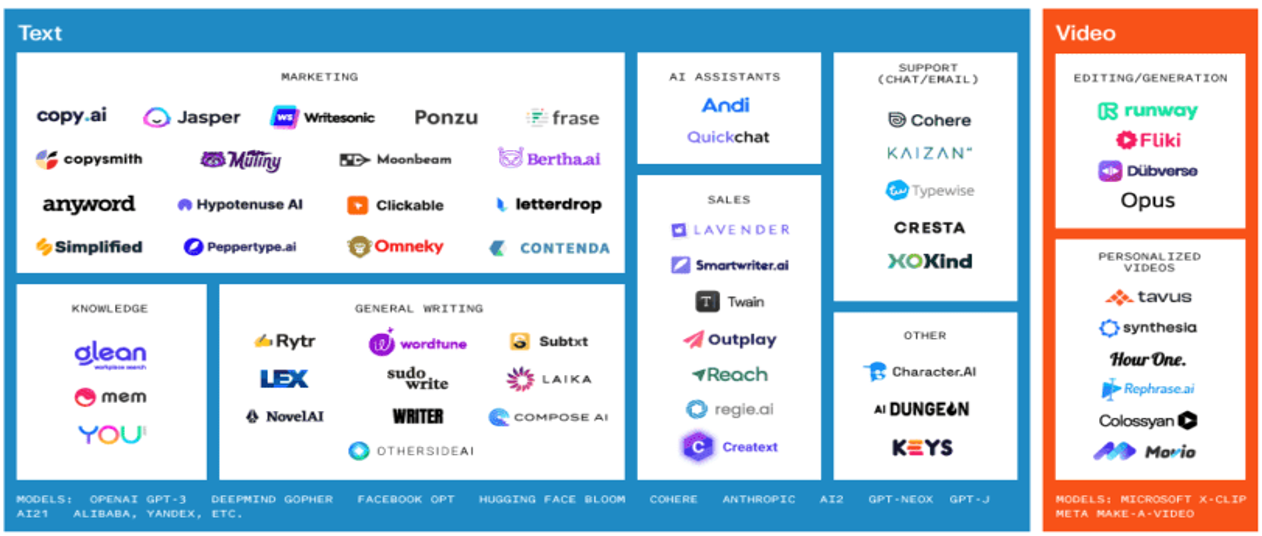

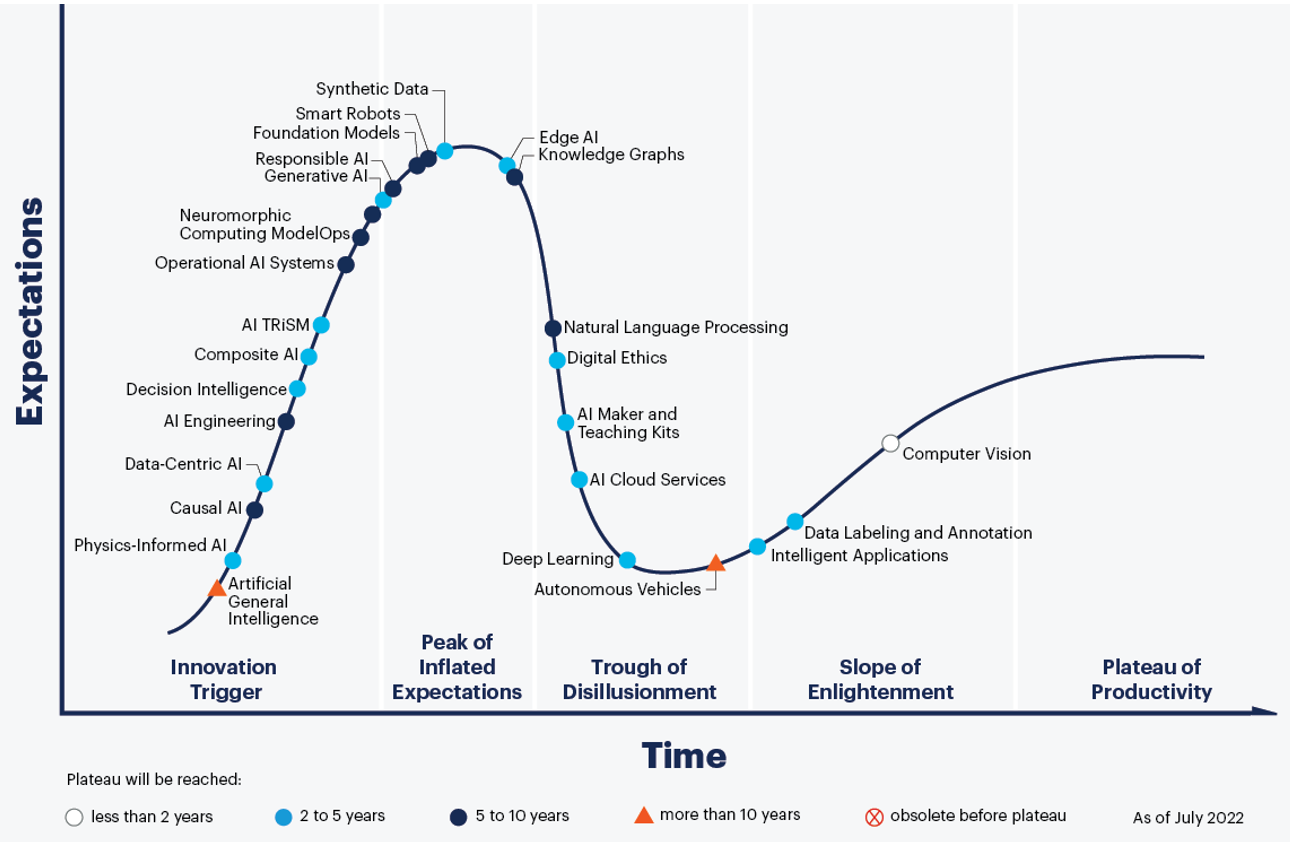

The generative AI landscape

Source: Sequoia Capital, April 2023.

Deploying generative AI in repetitive roles and augmenting other jobs should drive productivity gains. It could free up workers to focus on higher value-add tasks and create new avenues of growth, just as 4G enabled start-ups such as Uber, Airbnb and Instagram, which all require consistent mobile connectivity. However, there will be upheaval for workers. Many employees will have to adapt, particularly in creative industries such as editors, translators, marketers, graphic designers, and music producers. The online educational sector has sharply fallen as companies admit that AI has already affected their sales, and other industries will also feel the pressure. The best placed workers will be those that learn to exploit the technology to better perform in their roles.

Generative AI could create risks around intellectual property and plagiarism, spreading fake news or abusive content, false impersonation, and misuse by criminals for deception, fraud and manipulation. There’s even a doomsday-type scenario talked about in some quarters where AI becomes an enemy to humanity, with robot soldiers and AI systems becoming uncontrollable. While this may seem far-fetched, it is a risk that experts such as Elon Musk, co-founder of OpenAI, the company behind Chat-GPT, and Geoffrey Hinton, a global pioneer of AI, have warned about. Indeed, CEOs from leading AI companies including Google, Microsoft and OpenAI recently met with the US vice-president to discuss the safety of their products.

Whether or not this existential AI risk is realistic, we believe in the responsible and ethical development, deployment and use of AI. It’s important to raise the level of understanding and discussion about issues of digital ethics broadly, and promote commitments from companies to best practices and disclosures of AI specifically. As a result, we have been engaging with over 100 digital technology companies for the past year on the subject.

Another risk is around competition. AI development requires significant resources that only well-funded organisations can afford, and as such, could mean the industry becomes oligopolistic. This could invite some sort of competitive regulation; indeed, the UK Competition and Markets Authority is launching a review of the AI market and the US Federal Trade Commission recently stated that it is “focussing intensely” on the industry.

There are also wider considerations and risks to the sector. The semiconductor industry is influential to and influenced by geopolitical trends, and as a result, governments are increasingly adopting protectionist measures. Decoupling global supply chains and near-shoring or friend-shoring, could restrict the flow of data and talent in AI. Authorities are starting to restrict exports of AI technologies and could require companies to disclose more information about the algorithms they are developing. Geopolitical tensions could affect the ability of companies and researchers to protect their intellectual property, potentially limiting the pace of innovation.

All these factors add an extra dimension of political risk to investing in AI. However, while these pressures may slow development, they are unlikely to halt it given how global AI innovation is, with many regions and countries at its forefront.

Investing in generative AI

Investing in AI is not as straight forward as picking the best technology. There is a long value chain from basic hardware components to specialised software chatbots to pick from. Another key consideration is a company’s level of exposure. For example, Microsoft is well positioned to capture opportunities in the technology - it holds a large stake in OpenAI and has already incorporated ChatGPT into its search engine and plans to integrate it into its Office suite.

However, Microsoft’s incremental revenue base from generative AI may not be as large as the market expects. At this stage, generative AI won’t move the dial much for such a behemoth, and Google and Amazon will continue to be formidable competitors. Despite this, Microsoft’s share price has risen by a third over the past six months in what appears to be overexcitement about AI.

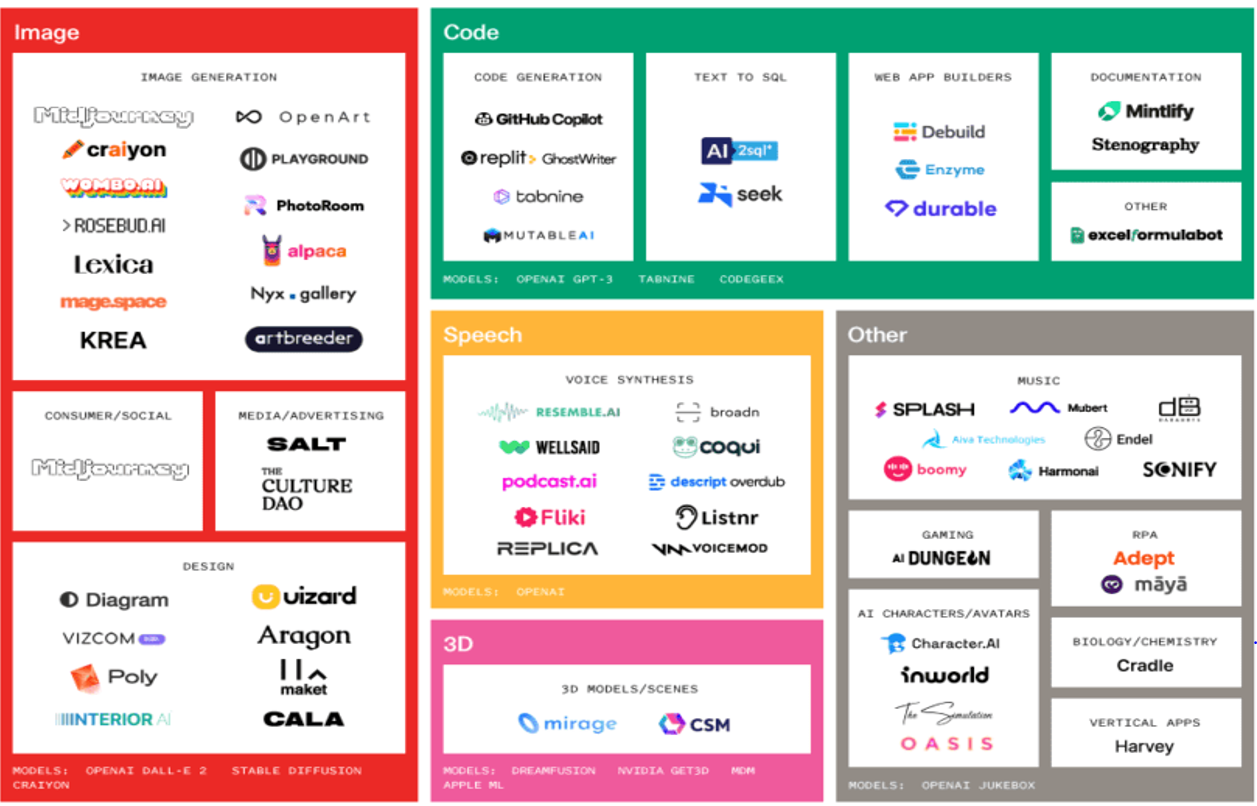

It’s important to not only look at the beneficiaries of generative AI but also expectations and valuations. Gartner, a technological consultancy, cautions about the oft-repeated hype cycle in technology, where an innovation progresses from innovation to overenthusiasm, through disillusionment, and eventually to an understanding of its relevance and role in a market. Generative AI as a technology has some way to go before reaching overenthusiasm, but at some point, it is likely to and there can be bouts of overenthusiasm in individual companies involved in the industry along the way.

In the shorter-term, a lot of hot money has chased AI names over the past year, and much of that is driven by investors seeking exposure to the theme rather than applying a more disciplined investment framework to generate long-term returns. This means that while AI may have a long period of growth ahead, specific securities and areas can become overvalued and risky. In my opinion, investors are best served by adopting a price-informed approach that emphasises the underappreciated parts of the tech value chain. Semiconductors is a part of the AI value chain that I believe offers an attractive risk-reward profile.

The AI hype cycle

Source: Gartner, July 2022.

Semiconductors: A vital component in AI

A key bottleneck for generative AI is the capacity of hardware. ChatGPT is already overloaded with demand and its service is slower or rationed at peak times. Moreover, generative AI models find output gains from greater size - so ChatGPT-3, which used 175 billion parameters, is dwarfed by the size of ChatGPT-4, but the latter is far more capable that its additional size suggests. Generative AI models are not yet approaching diminishing marginal gains and are hungry for more power. Companies that can improve computer infrastructure will find a willing audience both from users and providers of generative AI.

Specifically, semiconductor companies are key beneficiaries of AI’s demand for power. AI chips are highly specialised, optimised to cope with processing large amounts of data and running complex algorithms. Generative AI chips are not fundamentally different from traditional AI, but the computational requirements for running generative AI models can be much greater and therefore these chips are more powerful or specialised.

This has led to the introduction of sophisticated semiconductor hardware accelerators with an assortment of acronyms, such as advanced central processing units (CPU), graphics processing units (GPUs), field-programmable gate arrays (FPGAs), tensor processing units (TPUs), and application-specific integrated circuits (ASICs), to support the computational demands of generative AI. There are also innovations in development such as neuromorphic chips that are inspired by human brains and use artificial silicon neurons designed to compute.

The question of who makes the best semiconductors is not clear cut as it depends on the specific application - different chips have different strengths. The field is also continually evolving so smart investing requires a strong sense of where the industry is heading. What is clear is that AI will drive significant growth in the semiconductor industry.

NVIDIA's GPUs are perhaps the best known as they have been widely adopted for AI applications given their reputation for high performance and efficiency, particularly in deep learning applications; as a result, the company has rapidly re-rated on market optimism. Semiconductor companies such as Intel, Samsung Electronics, Applied Materials, and ASMPT can benefit from generative AI and have competitive valuations.

An attractive industry but discretion is advised

AI and generative AI are exciting new areas of technological development that promise years of growth ahead. For investors, there are potentially very attractive returns on offer. But investors should be careful around valuations - some names are being over-hyped, which could lead to relative underperformance over time.

Investors must also mindful that the industry is not without regulatory and political risk. There is a chance of a backlash from the public given the propensity of AI to cause upheaval in the jobs market and sensationalist fears of a sci-fi-type dystopian AI world. Investors should be able to minimise risks by being well-versed in the technology and selecting stocks in underappreciated parts of the supply chain such as semiconductors, while maintaining valuation discipline.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of investments in overseas markets. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes.