What has changed?

- US likely to run hot in 2026: Any weakening could be met with fiscal measures as administration has little tolerance for a recession. We expect three Fed cuts in 2026 from May onwards.

- Earnings momentum has broadened beyond US mega-caps, supporting risk appetite.

- Early signs of fiscal traction in Germany and improving sentiment across several EM markets.

What has stayed the same?

- US exceptionalism remains in question as valuations stay full and policy uncertainty persists.

- The medium-term outlook for a weaker dollar remains intact.

- Inflation trends are uneven: US services inflation is sticky, while Europe benefits from disinflation and a stronger euro.

What are we watching?

- Developments in JGB markets have the potential to spillover into global bond and FX markets.

- The evolution of US fiscal policy s key, while the Fed’s reaction function is under increasing political scrutiny.

- The durability of broadening earnings growth and the resilience of AI-linked investment will drive risk-on sentiment.

Cycle gauges

Source: Fidelity International, January 2026.

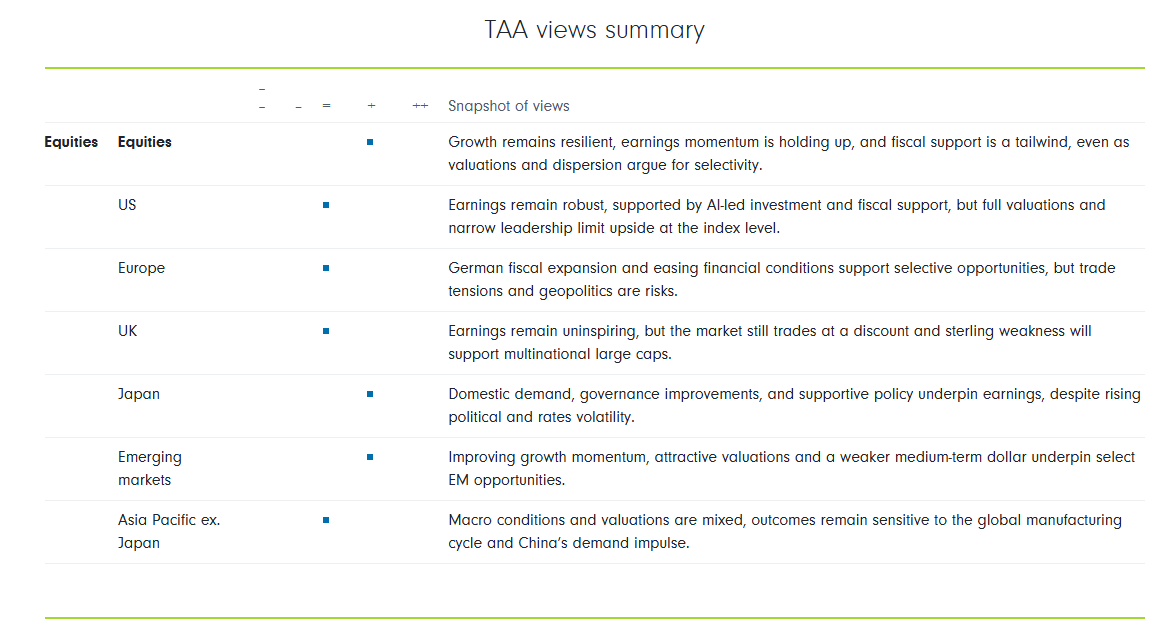

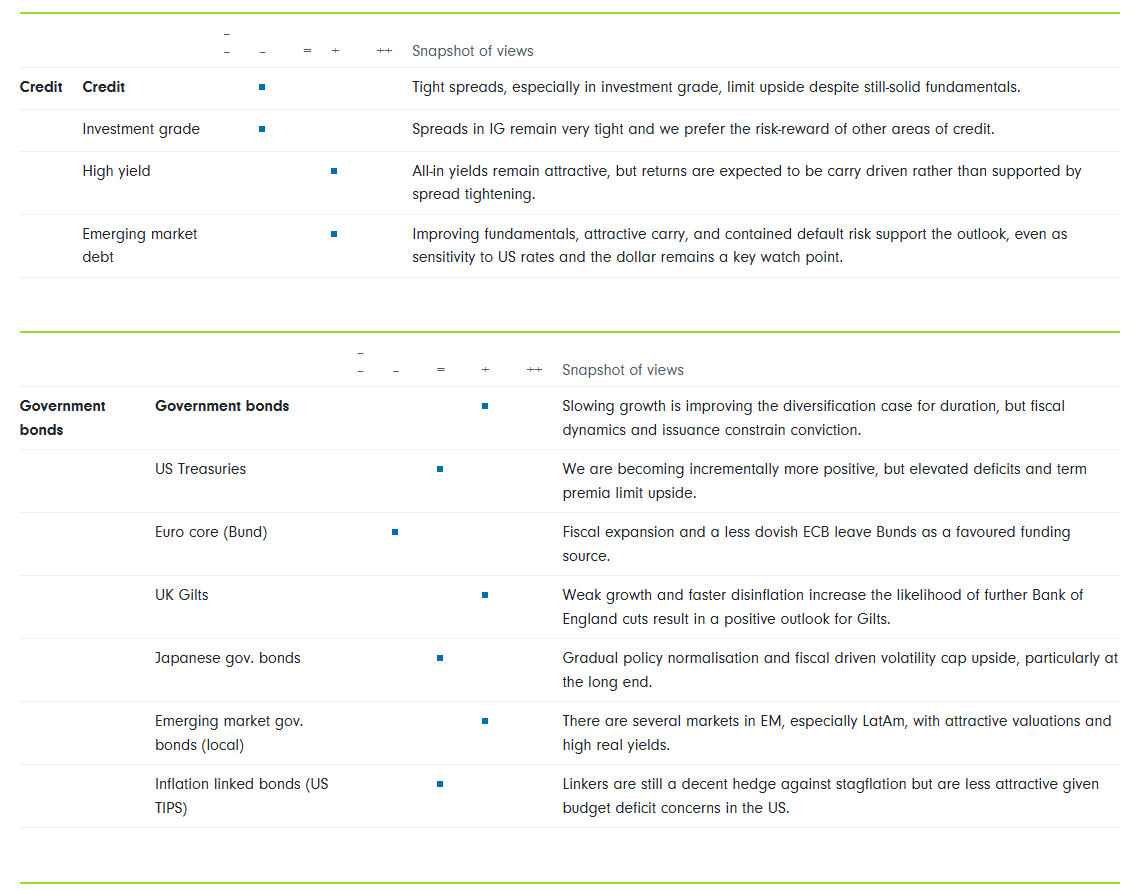

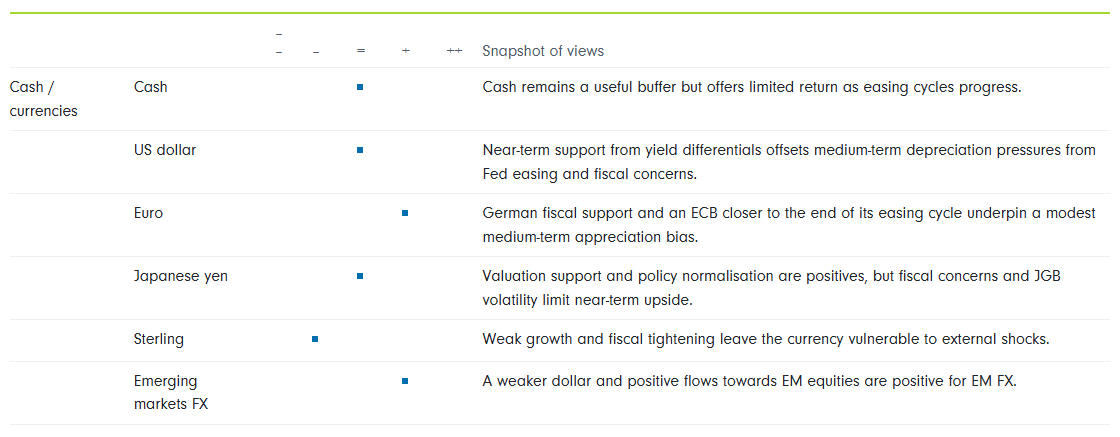

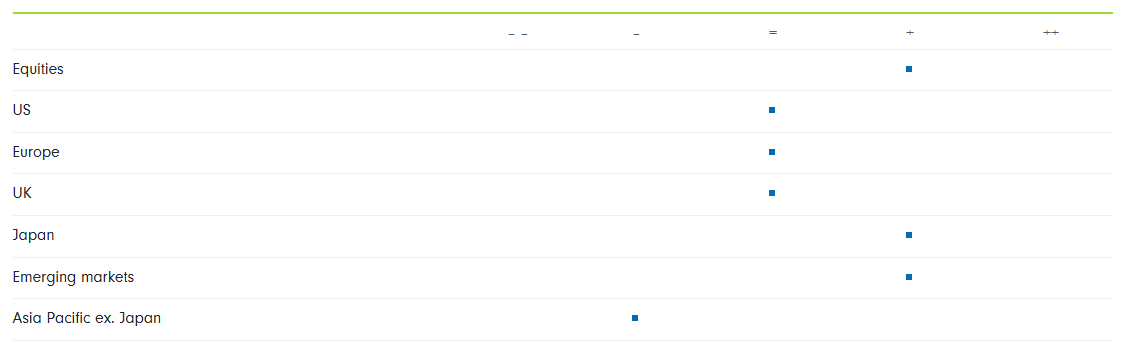

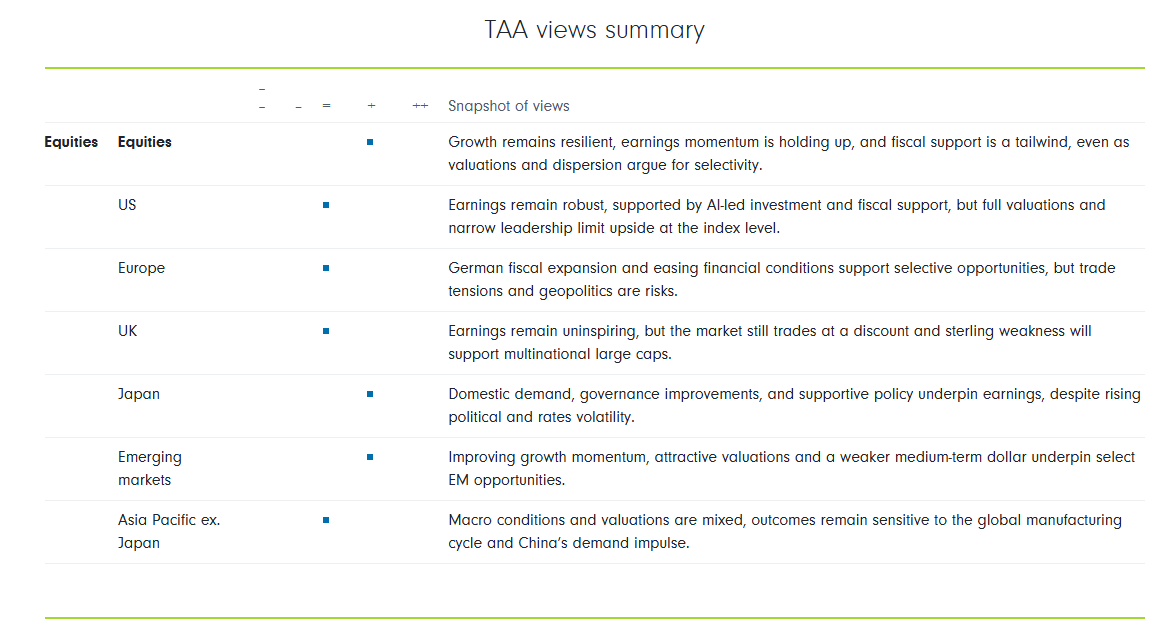

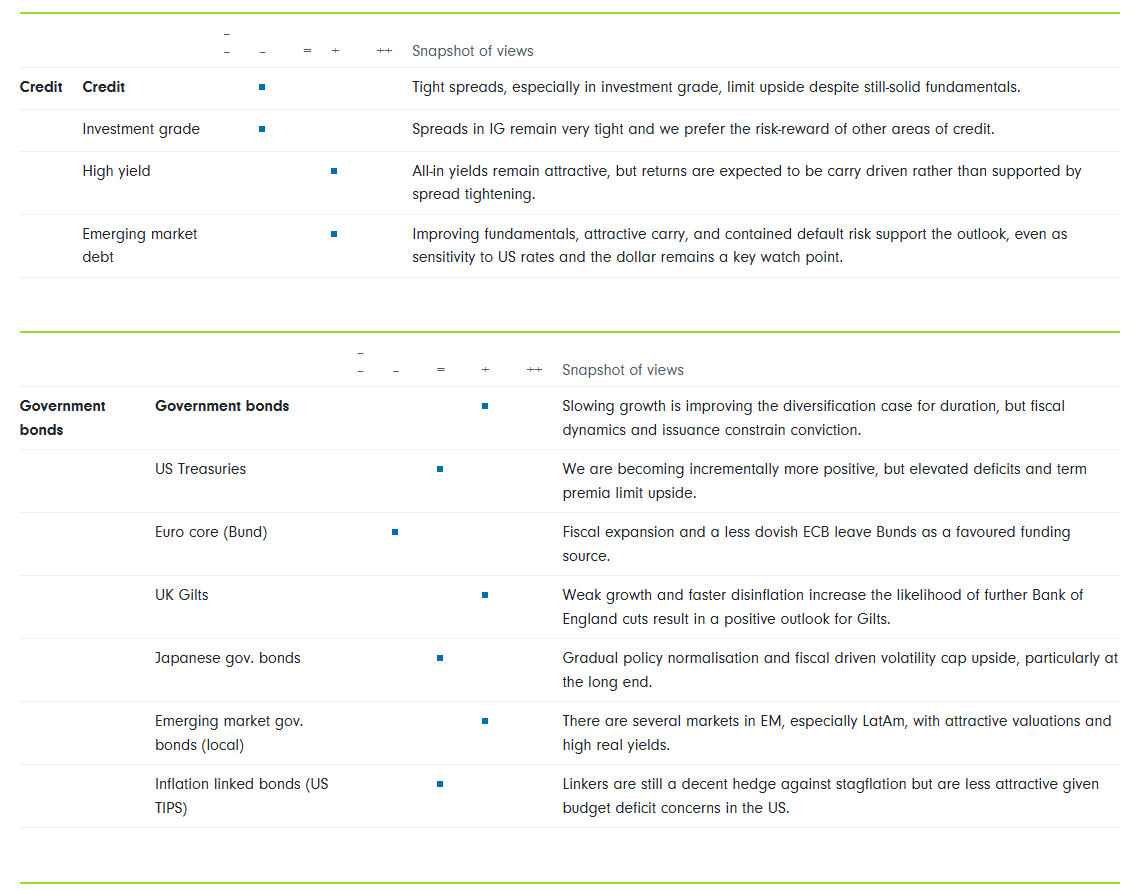

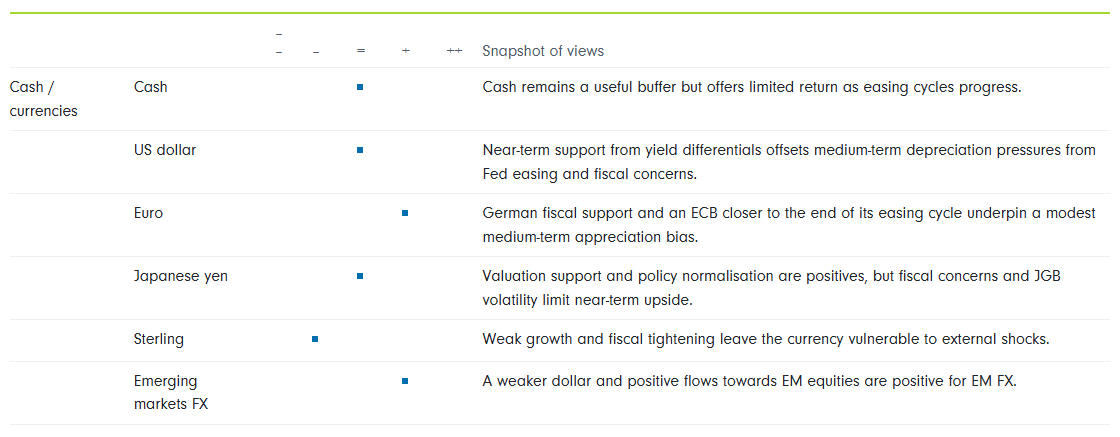

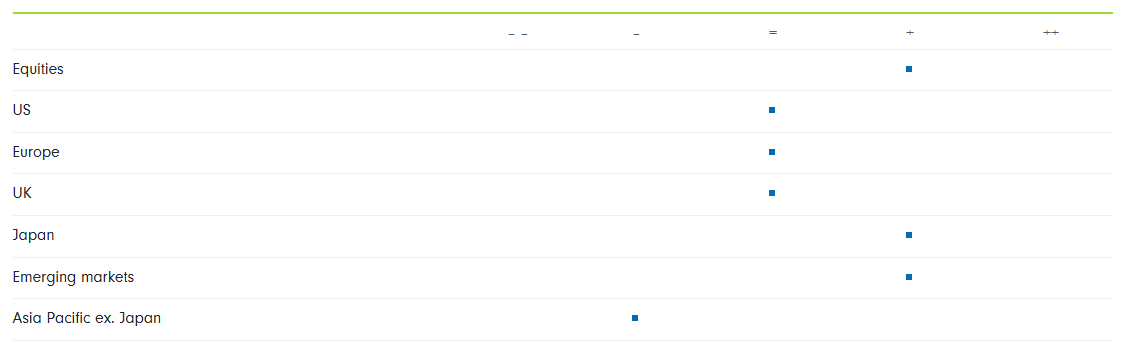

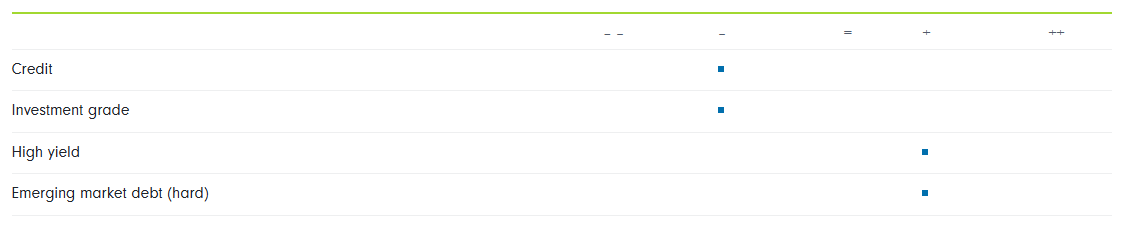

TAA views summary

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Regional equity views use universes defined by MSCI indices.

Best ideas for investment outcomes

Growth

- EM equities, particularly Korea, South Africa, and Greece with re-rating potential; Japanese equities more broadly, but also mid-caps in Japan and Germany.

- Thematic equities related to the grid upgrade benefit from idiosyncratic return drivers as the US and EU look to accommodate greater demand and more renewable energy.

- Global multi asset strategies taking a flexible approach, accessing growth opportunities across the capital structure.

Income

- Emerging market bonds in certain markets continue to look attractive given elevated yields and should also benefit from a weaker dollar over the medium term.

- Quality income equities provide relative defensiveness and stability.

Capital preservation

- Gold is effective diversifier in an environment of unstable bond-equity correlations and the role of the dollar is challenged, although we are cautious of how far it has run this year. We are positive on real assets more generally, particularly commodities such as copper, as a hedge against inflation re-accelerating.

- Selectively allocating to structural growth themes can increase portfolio resilience alongside traditional defensives.

Uncorrelated returns

- Absolute return strategies, driven by active investment decisions and incorporating idiosyncratic sources of risk – particularly those with a focus on tail risk mitigation

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters.

Equities

Key views

- Maintain positive view of Japanese equities, especially mid-caps due to strong corporate earnings growth, higher domestic exposure, and ongoing corporate reforms. There could be some political volatility, though.

- US earnings continue to surprise positively, with some signs of broadening out. The AI-led capex cycle continues to support earnings, but elevated valuations and narrow market leadership limit the scope for further multiple expansion. We prefer to express exposure through structural themes such as grid upgrades and electrification rather than broad US equity exposure.

- Continue to be overweight select EM markets. Our top picks include Korea, South Africa, and Greece, with attractive re-rating stories due to stimulus, governance reforms, and sector-specific tailwinds.

South African equities benefitting from falling bond yields and rising gold price

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Regional equity views use universes defined by MSCI indices. Chart source: Fidelity International, LSEG Workspace, January 2026.

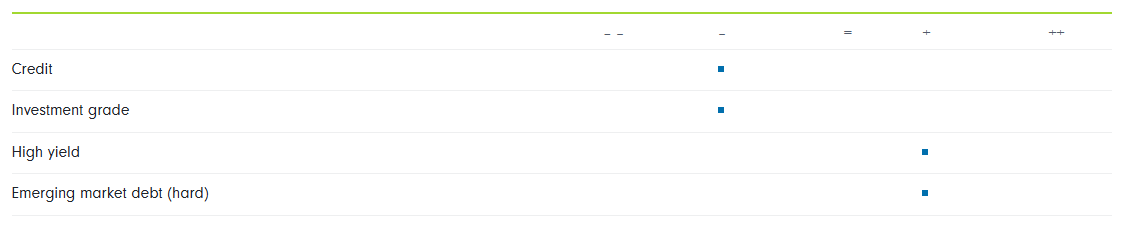

Credit

Key views

- Prefer HY to IG: Spreads this tight often lead to poor forward returns from credit risk. High yield benefits from shorter spread duration, resilient balance sheets and still-attractive all-in yields, with default expectations remaining benign. Our preference is to treat high yield as a carry opportunity rather than a source of spread tightening.

- Retain positive view of emerging market credit: Spreads have remained resilient though the recent risk wobble, giving us further confidence in our positive view. This remains a supportive environment to extract carry, albeit with greater selectivity.

IG spreads this tight often lead to poor forward returns from credit risk; we prefer the carry of HY

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Chart source: Fidelity International, LSEG Workspace, November 2025.

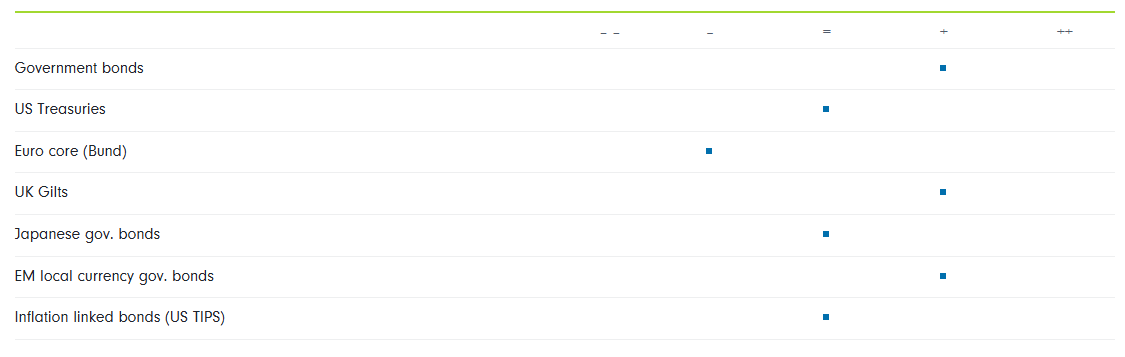

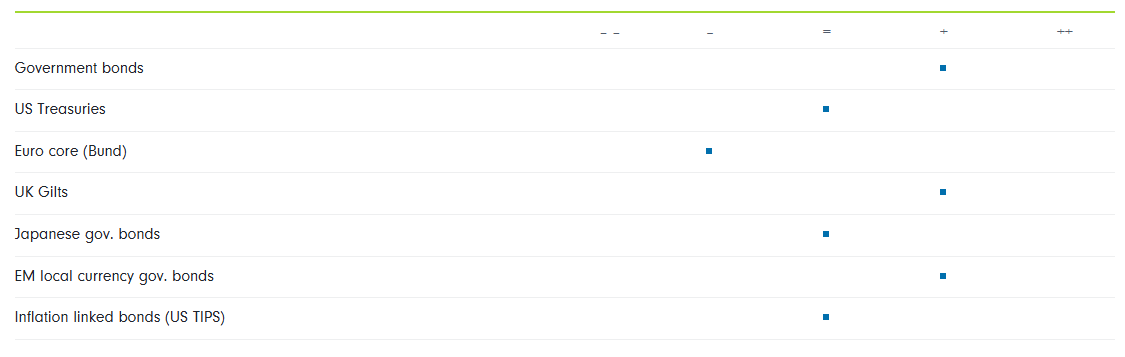

Government Bonds

Key views

- We have become more constructive on duration as growth concerns increasingly outweigh inflation risks, and government bonds are regaining some diversification value in portfolios. While valuations are not uniformly compelling, selective opportunities exist across regions and tenors.

- Maintain preference for EMD local currency given several bottom-up ideas with attractive real yields and/or steep curves (South Africa, Brazil, Mexico). We are watching EMFX closely for a tactical rebound in USD which could weigh on broad EMD though. Tactically profit-taking or hedging some FX may be timely.

- We are neutral JGBs with an underweight bias given the ongoing normalisation path and the risk of fiscal driven volatility. The recent spike in long JGB yields highlighted investor concerns about Japan’s fiscal position.

Fiscal concerns are putting upward pressure on JGB yields

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Chart source: Fidelity International, LSEG Workspace, January 2026.

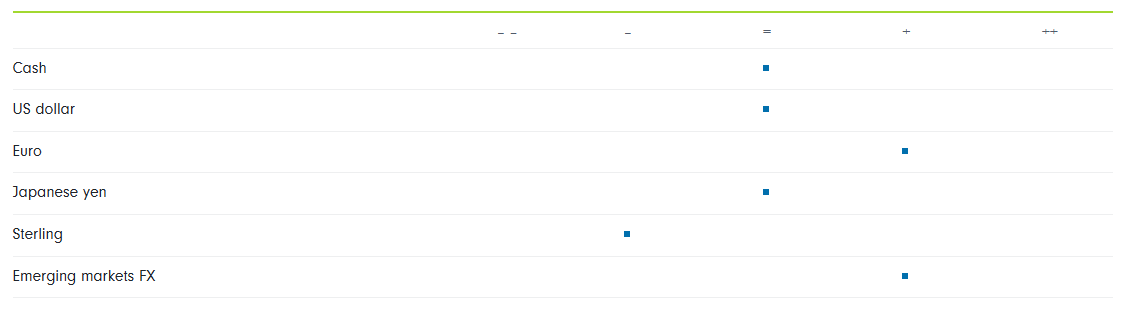

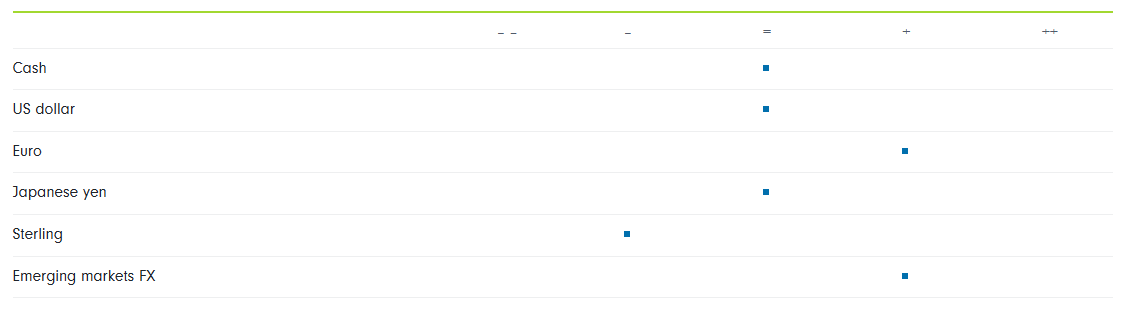

Cash / Curriencies

Key views

- Tactically neutral USD: We remain neutral on USD near-term given a cyclical bounce. However, the medium-term outlook for a weaker dollar still stands as the Fed cuts interest rates alongside institutional pressure.

- Positive EUR, negative GBP: We remain positive on the euro, supported by improving European data, German fiscal expansion and an ECB that is likely close to the end of its cutting cycle. Meanwhile consolidation and the BOE resuming rate cuts should continue to weigh on the pound.

- Maintain long EM FX: The current macro environment is still conducive for carry. We continue to prefer currencies like ZAR and BRL.

- Stay long gold: Gold remains a core diversifier as easing cycles continue, geopolitical risks persist and central-bank demand stays firm. We are looking for re-entry opportunities after some profit taking.

Gold surges to new high fuelled by dollar weakness and flight from sovereign bonds and currencies

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Chart source: Fidelity International, LSEG Workspace, January 2026.

Other TAA Views

- Grid Upgrade: We continue to expect resilience in structural growth stories rather than traditional defensives. As power consumption growth is set to accelerate, companies exposed to the grid upgrade continue to be particularly attractive.

- European defence sector: Europe faces a structural need to re‑arm as geopolitical risks rise, with procurement and R&D spending already climbing and European policymakers increasingly determined to localise defence supply chains. Despite stretched valuations after a strong rally, the medium‑term outlook is positive, due to sustained spending growth toward ~3% of GDP by 2030 and a shift toward equipment‑heavy budgets that favour European contractors.

- US mid-income consumer: Front‑loaded fiscal stimulus from the One Big Beautiful Bill, moderating inflation, and a stabilising labour market should support real income growth for mid‑income households, where targeted retailers and services have lagged the broader discretionary rally and still trade at discounts despite improving earnings revisions.

- Real assets: Selective materials exposure, such as copper miners, are underpinned by long-term structural growth drivers including US reshoring and electrification (including AI power demand) and the China recovery.

Power consumption growth set to accelerate from data-centre buildout, making the Grid Upgrade an attractive opportunity.

Source: Fidelity International, January 2026. Views reflect a typical time horizon of 12–18 months and provide a broad starting point for asset allocation decisions. However, they do not reflect current positions for investment strategies, which will be implemented according to specific objectives and parameters. Chart source: Fidelity International, November 2025.

Important information

This material is for Institutional Investors and Investment Professionals only, and should not be distributed to the general public or be relied upon by private investors.

This material is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior permission of Fidelity.

This material does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at, and must not be acted on by persons inside the United States. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers. This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity (Third-Party Content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content. Fidelity International is not responsible for any errors or omissions relating to specific information provided by third parties.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client.