12 Feb 2026

European equities are trading at a historically wide discount to US equities across almost all valuation metrics and sectors. While part of this gap reflects weaker growth, lower returns on equity, and Europe’s sector mix, the scale of the discount is increasingly difficult to justify on fundamentals alone. With pessimism deeply embedded in prices and expectations low, our investment team highlight why the selective upside is now increasingly compelling.

PRO Multiple authors Europe ex UK 06/02/2026

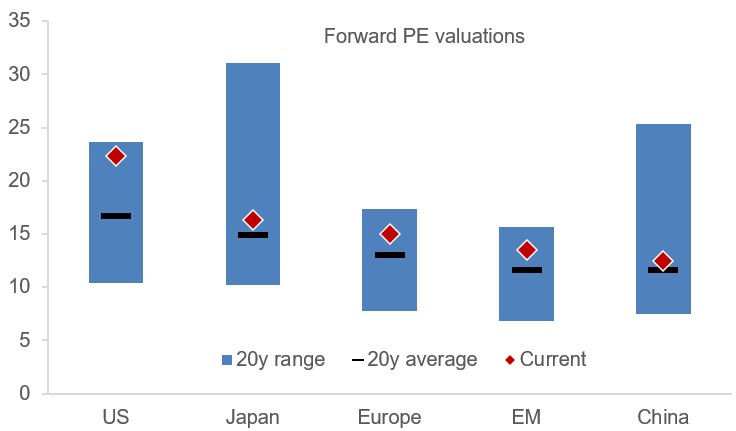

On a forward price-to-earnings basis, Europe trades at roughly a 30–35% discount to the US - far wider than its long-term average. Historically, European equities traded only modestly cheaper than US equities. Since 2015, however, this relationship has broken down, driven primarily by sustained US multiple expansion rather than a material drop in European profitability.

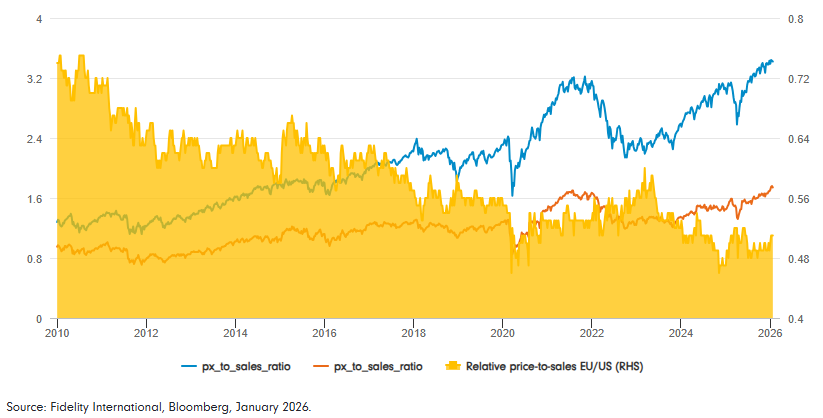

The divergence is even more pronounced on price-to-sales and price-to-book metrics. While structurally lower margins and returns on equity account for part of the gap, European margins have not deteriorated over time and, in some cases, have improved. This suggests valuation compression has outpaced changes in fundamentals.

Stronger US growth has been a key justification for higher valuations. Since 2015, US sales per share have grown at approximately 5% per annum, compared with roughly 0.5% in Europe. This is a meaningful difference, but two important caveats apply. First, the growth gap is partly cyclical, reflecting Europe’s greater exposure to repeated macroeconomic shocks. Second, valuation differentials have widened by significantly more than growth differentials.

In a global context, the US increasingly appears to be the valuation outlier, while Europe trades closer to Japan and emerging markets. This comparison reinforces the view that the US premium reflects elevated optimism as much as superior fundamentals.

The US appears to be the valuation anomaly

Source: Fidelity International, LSEG DataStream, MSCI indices, January 2026.

Europe’s heavier exposure to banks, energy, and industrials helps explain lower headline multiples, but it does not explain why European equities trade at a discount across every sector. Relative to history, European valuations are depressed across the sector spectrum, indicating a broad-based risk premium rather than sector-specific weakness.

Financials: European banks are better capitalised, less complex, and more profitable than at any point since the Global Financial Crisis. Once returns are considered, price-to-tangible-book multiples are broadly comparable with US peers, yet lingering investor scepticism continues to weigh on valuations.

Energy and utilities: European energy companies trade at around a 30% discount to US peers despite broadly similar earnings and return profiles. Utilities display a similar pattern, with 20–25% valuation discounts for largely comparable regulated businesses.

Healthcare: Historically trading at parity, European healthcare now trades at roughly a 15% discount despite similar post-pandemic earnings growth - an unusual gap that appears largely sentiment-driven.

Industrials: US industrials generally enjoy higher margins and capital efficiency than in Europe, but comparable headline valuations mask selective opportunities among European industrial champions, which offer strong incumbency advantages and durable market positions.

Europe’s valuation appears low in absolute terms, but even more so when set against a US market that has benefited from a decade of multiple expansion, earnings concentration in mega-cap technology, and supportive policy tailwinds. From a global perspective, the risk of mean reversion arguably sits more with US valuations than with Europe’s.

No sector better illustrates the gap between perception and reality in Europe than financials. For more than a decade following the Global Financial Crisis, European banks were structurally weak: over-levered balance sheets, poor asset quality, repeated regulatory interventions, dividend restrictions, and chronically low returns on equity. For many investors, this experience continues to define the sector.

Yet the fundamentals have changed materially. Capital ratios are now roughly double pre-GFC levels, balance sheets have been de-risked, loan-to-deposit ratios have normalised, and cost structures have been rationalised through branch reductions and digitalisation. Crucially, profitability is no longer driven primarily by leverage or one-off trading gains, but by structurally higher net interest income and improved operating efficiency.

Returns on tangible equity for large European banks are now broadly in line with the wider European market and, in several cases, comparable with US peers. This has enabled the resumption of meaningful capital returns, with many banks offering double-digit cash yields through dividends and buybacks while retaining excess capital buffers.

Despite this progress, European banks continue to trade at discounts to both the broader equity market and their own long-term average valuation multiples. This suggests investors remain anchored to historical experience rather than current fundamentals. While structural challenges persist - slower GDP growth, regulatory complexity, and political fragmentation - the sector today is more resilient, better capitalised, and more disciplined than at any point in the past fifteen years.

For client portfolios, the implication is not that European banks are risk-free, but that markets continue to price them as if previous problems are permanent. As confidence in the sustainability of returns builds, financials represent one of the clearest areas where Europe’s valuation discount could narrow without requiring heroic macroeconomic assumptions.

Europe deserves to trade at a discount given slower growth and structural challenges. However, current valuations imply structural decline rather than structural slowdown. Balance sheets are stronger, expectations are subdued, and investors are increasingly paid to wait. Europe may not be the fastest-growing equity market, but it is one where disciplined, selective stock-picking can exploit valuation gaps shaped more by memory than by reality.

Important Information

This material is for Institutional Investors and Investment Professionals only, and should not be distributed to the general public or be relied upon by private investors.

This material is provided for information purposes only and is intended only for the person or entity to which it is sent. It must not be reproduced or circulated to any other party without prior permission of Fidelity.

This material does not constitute a distribution, an offer or solicitation to engage the investment management services of Fidelity, or an offer to buy or sell or the solicitation of any offer to buy or sell any securities in any jurisdiction or country where such distribution or offer is not authorised or would be contrary to local laws or regulations. Fidelity makes no representations that the contents are appropriate for use in all locations or that the transactions or services discussed are available or appropriate for sale or use in all jurisdictions or countries or by all investors or counterparties.

This communication is not directed at, and must not be acted on by persons inside the United States. All persons and entities accessing the information do so on their own initiative and are responsible for compliance with applicable local laws and regulations and should consult their professional advisers. This material may contain materials from third-parties which are supplied by companies that are not affiliated with any Fidelity entity (Third-Party Content). Fidelity has not been involved in the preparation, adoption or editing of such third-party materials and does not explicitly or implicitly endorse or approve such content. Fidelity International is not responsible for any errors or omissions relating to specific information provided by third parties.

Fidelity International refers to the group of companies which form the global investment management organization that provides products and services in designated jurisdictions outside of North America. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. Fidelity only offers information on products and services and does not provide investment advice based on individual circumstances, other than when specifically stipulated by an appropriately authorised firm, in a formal communication with the client.