30 Jan 2026

A year on from the Sustainability Disclosure Requirements (SDR) marketing rules being applied to UK funds, new definitions of what constitutes a sustainable product have reshaped the market. Fidelity’s Chief Sustainability Officer Jenn-Hui Tan outlines why progress from here will depend on the extent to which providers navigate regulatory complexity, distributors gain comfort with the new labels and market dynamics affect sentiment towards sustainable funds.

By Jenn-Hui Tan, Fidelity International

The purpose of the Financial Conduct Authority’s SDR differed from that of fund regimes such as the EU’s Sustainable Fund Disclosure Requirements (SFDR). Instead of requiring the whole market to disclose based on their level of sustainability integration, SDR focused on protecting consumers through its Anti-Greenwashing and Naming and Marketing rules, creating a high bar for a fund to be considered sustainable and to apply a voluntary Sustainability label.

Asset managers wishing to apply one of four labels (Sustainability Focus, Improvers, Impact and Mixed Goals) were required to disclose funds’ sustainable investing approaches to a more granular level than before, including providing details of the methodologies used to meet a “robust standard” of sustainability.

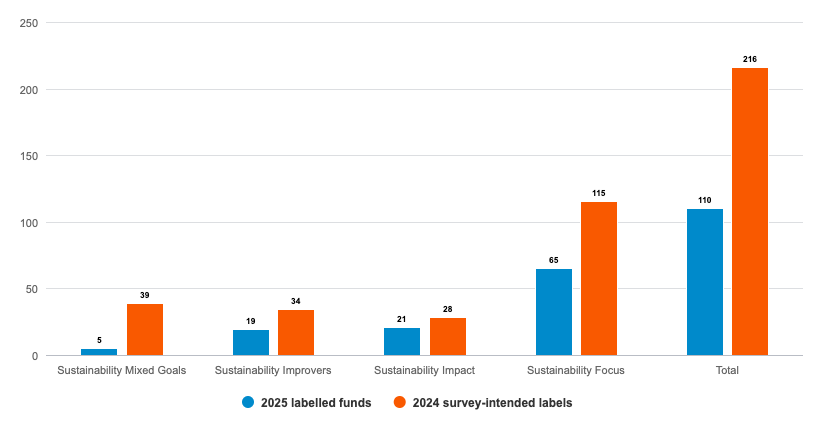

While this rigour enhanced internal standards and increased transparency for clients, getting disclosures right took time and resource, and created backlogs for the regulator’s authorisation process. This resulted in a temporary forbearance for those funds seeking a label to comply with the Naming and Marketing rules from December 2024 to April 2025. In the end, fewer funds that had been anticipated applied and qualified for a sustainable label, according to a survey in June 2025 by the Investment Association (see chart).

Source: Investment Association, June 2025

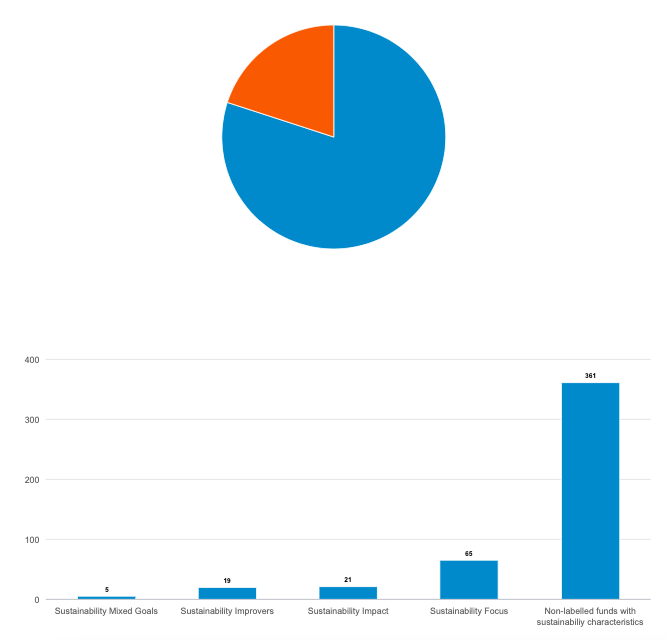

Instead, the largest category became unlabelled funds with ESG characteristics. These could not apply a sustainability label or use sustainability words in their names but had to provide similar consumer-facing disclosures as those required for labelled funds.

Source: Investment Association, June 2025

Despite a challenging beginning, SDR has brought discipline and clarity to a market which was previously clouded by confusion as to what constitutes best practice. It has made good progress in addressing greenwashing risks, according to the IA survey, and narrowed a broad range of fund types into specific buckets which capture conceptually similar products.

This should make sustainability more accessible for end investors. For clients who prefer to buy sustainable funds, the sustainability labels provide a useful shorthand; though investors and advisers still need to look under the hood to understand differences between labelled and non-labelled ESG promoted funds.

Providers have more mixed views as to whether the rules offer sufficient flexibility to allow the market to grow and support future UK sustainable fund flows, given the additional cost required to obtain a label and provide disclosures, and how comparable funds are under the new regime.

According to an October 2025 PWC/UKSIF investor survey on SDR, there is still uncertainty among some distributors as to what the labels represent and if they can be relied upon to inform adviser sustainability research.

Even as familiarity with SDR increases, flows will continue to depend on factors such as client understanding of the market, changing investment dynamics (sustainable fund flows have been mixed in 2025) and the level of concern about managing sustainability risks or being exposed to long-term trends.

Client interest in sustainable investing remains high: a significant majority (74%) of respondents to PwC’s 2024 UK Investor Survey said they would increase investment in firms taking climate-related actions. Many investors are aware of the tangible (if hard to measure) benefits that sustainable investments can provide, alongside financial returns.

Nonetheless, we believe more can be done in the industry to strengthen the demand case for sustainable funds, particularly through explaining their role in addressing systemic risks (e.g. mitigating the financial impacts of climate change and supporting the energy transition) at economy and issuer level. Extending the SDR regime to portfolio management services could also help increase awareness of sustainable products and their characteristics.

From a supply-side perspective, asset managers are eager to bring more sustainable products to market, but in an efficient manner, so speed of approvals and ease of interaction with regulators is critical. Harmonisation across jurisdictions and streamlining reporting at product and entity level could also support future launches, but this will take time and must avoid disrupting the marketplace as far as possible.

New regulations from the European Securities and Markets Authority (ESMA) and upcoming changes to the Sustainable Finance Disclosure Regulation (SFDR) mean overseas funds have their own standards which differ from those in the UK. While there may be differences, what matters most is transparency. Clear labelling that communicates which standards a fund adheres to is essential for clients to understand what they are buying and how this may affect their overall allocations.

For Fidelity, the effort invested in SDR labelling represents a long-term commitment to the sustainable investing space. We continue to explore opportunities to expand our labelled product range, including in less served areas such as fixed income and systematic investing.

The success of SDR and other labelled products, however, will hinge not only on delivering the sustainable aspect of their proposition, but also on meeting financial expectations for risk-adjusted returns. Products that deliver both outcomes will continue to attract interest and investment even as the regulatory environment evolves.

1According to an October 2025 PWC/UKSIF report, the number of funds with an SDR label has since reached 150 – still short of the previously expected 200+ indicated a year ago. New report from UKSIF and PwC UK on the FCA’s SDR and investment labelling regime – UKSIF

Jenn joined Fidelity International in 2007 and provides external and internal leadership for Fidelity’s sustainable investing activities, including the strategy and policies on engagement, voting and ESG integration. Prior to Fidelity, he was a corporate finance lawyer advising on capital market and M&A transactions at Norton Rose Fulbright.

This information is for investment professionals only and should not be relied upon by private investors. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in emerging markets can be more volatile than other more developed markets. A focus on securities of companies which maintain strong environmental, social and governance (“ESG”) credentials may result in a return that at times compares unfavourably to investments without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security’s ESG credentials can change over time.

GCT251130EUR