28 Jan 2026

Short dated high quality corporate bonds are once again emerging as an attractive opportunity for cautious income focused investors. The 1-to-5-year investment grade segment delivers a clear yield premium over cash and government bonds, offers low duration risk and retains a much stronger credit profile than high yield. Here, we highlight how this profile has driven one of the strongest long-term risk adjusted returns across major fixed income markets and why it remains a compelling choice for investors seeking income without taking on unnecessary risk.

By Ben Deane, an Investment Director within Fidelity’s fixed income team

High-quality, short-dated corporate bonds offer an attractive blend of characteristics: an income premium over government bonds, lower duration risk than all-maturity corporates, and less credit risk than high yield. It’s little surprise, then, that the asset class ranks strongly on a long-term, risk-adjusted basis - particularly appealing for investors seeking income while remaining cautious about the macro environment.

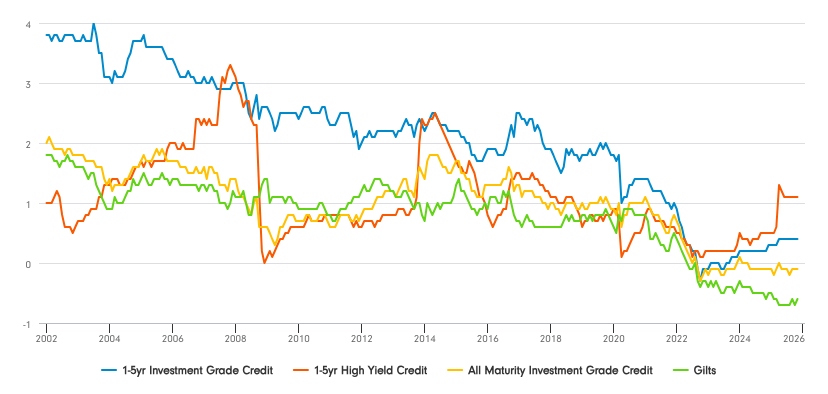

Using data since 1997 (the earliest available for these indices), Figure 1 shows the rolling five-year risk-adjusted returns across four markets: 1-5yr investment grade credit (blue), 1-5yr high yield credit (orange), all-maturity investment grade credit (yellow), and gilts (green). For illustration, in January 2002 the blue line starts at 3.8, reflecting 5yr annualised returns of 6.4% versus volatility of 1.9% (6.4 ÷ 1.9 = 3.8).

What stands out is how consistently 1-5yr investment grade credit has led on a risk-adjusted basis. Since 1997, it has delivered the best risk-adjusted returns 81% of the time - supported by a combination of attractive yields, low duration, and high credit quality.

Next is 1-5yr high yield credit (orange), which has topped the group 19% of the time and has looked particularly strong in recent years. Investor interest here has risen notably since 2022, mostly likely due to its attractive risk-adjusted profile since then. 1-5yr high yield looks attractive over this period because it has the lowest duration profile and highest credit risk profile. In fact, 1-5yr high yield credit is less sensitive to rate moves than its investment-grade equivalent, despite a higher average maturity, because of its higher yield. Duration stands at 2.1 years (implying a ~2.1% capital loss for a 1% rise in yields) versus an average maturity of 3.3 years; while for 1-5yr investment grade, duration is 2.5 years with a 2.8-year maturity.

Duration has been the enemy since 2022 as core yields have risen, while tightening credit spreads have been the friend. Consequently, 1-5yr high yield credit - the most credit-risky but least rate-sensitive - has performed extremely well on a risk-adjusted basis.

However, we would caution more risk-averse investors against allocating to this area of the market at the current stage of the cycle. Credit spreads remain historically tight, and history suggests they are more likely to widen than tighten from here. Reflecting this view, we are gradually reducing credit risk within our portfolios. The most significant credit event since 1997 - the Global Financial Crisis - saw 1-5yr high yield credit experience a 29% drawdown. By comparison, the largest drawdown in 1-5yr investment grade credit was 12% (in 2022), versus 25% for all-maturity credit and 33% for gilts (in 2023). It is also worth noting that 1-5yr high yield credit typically experienced the deepest drawdowns in the years prior to 2022, underscoring that 2022 was an outlier rather than the norm.

Source: Fidelity International, Bloomberg, 31 October 2025. 1-5yr Investment Grade = ICE BofA 1-5 Year Eurosterling Index, 1-5yr High Yield = ICE BofA 1-5 Year US High Yield Constrained Index GBP Hedged, All Maturity Investment Grade Credit = ICE BofA Euro-Sterling Index and Gilts = ICE BofA UK Gilt Index. US High Yield index used for 1-5yr High Yield Credit because there is no comparable 1-5yr sterling high yield index available.

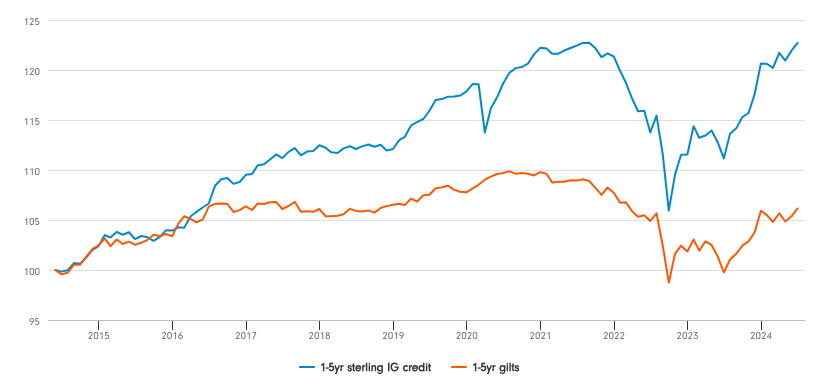

With credit spreads remaining tight, many investors are rotating out of credit and into government bonds. The logic appears sound; it seems safer to hold gilts. So, why not simply move into short-dated government bonds instead of staying in credit? Even at tight levels, credit spreads still offer an incremental yield over government bonds - and when that modest advantage is compounded over time, it can generate meaningful excess returns. In May 2014, spreads, much like today, were tight at 107 basis points (bps). Over the following decade, they fluctuated between wider and tighter levels, yet by May 2024, spreads had returned to exactly 107bps. At first glance, it might have seemed sensible in 2014 to switch into gilts. However, as Figure 2 shows, over that same ten-year period, 1-5yr sterling corporate bonds outperformed 1-5yr gilts. Despite periods of spread widening, corporate bonds delivered solid excess returns. In short, the compounding effect of even a small spread advantage is a powerful driver of superior long-term returns.

Source: Fidelity International, Bloomberg, 31 October 2025. 1-5yr sterling IG credit = UR0V Index, 1-5yr gilts = GVL0 Index.

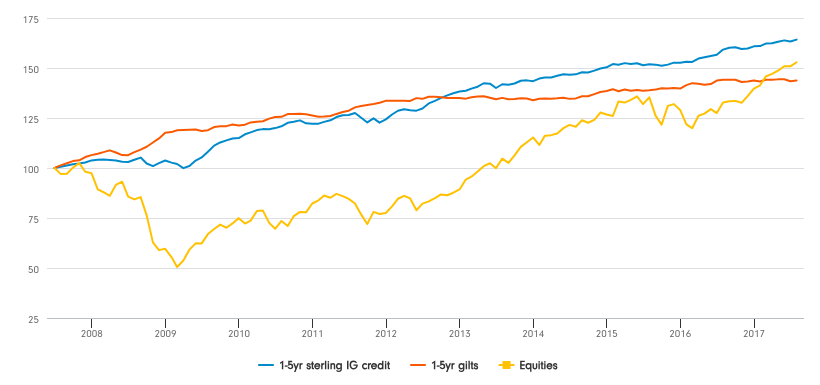

But what about the worst-case scenario? What if we are on the verge of another Global Financial Crisis-style period of sharp spread widening? Even in that extreme case, history offers some reassurance. As Figure 3 shows, an investor who bought credit in June 2007 - just before the crash - would have experienced a period of underperformance versus gilts. However, within around five years, 1-5yr credit had begun to outperform again. Just being invested over time can deliver superior outcomes. Crucially, equity markets still hadn’t recovered at least a decade later. Timing the markets with such precision is extremely difficult, but if you can do this, your efforts may be better focused on your equity exposure rather than on trying to time movements in credit or gilts.

Source: Fidelity International, Bloomberg, 31 October 2025. 1-5yr sterling IG credit = UR0V Index, 1-5yr gilts = GVL0 Index, Equities = MSCI World GBP Hedged.

When selecting short-dated corporate bond funds, many investors default to passive vehicles, assuming the lower-return profile of the asset class makes active management unnecessary. The logic seems intuitive: in a market perceived to offer limited absolute or excess return potential, why pay for active oversight? We believe this view is misplaced. In our experience, going passive in the short-dated space is suboptimal - and for reasons that extend well beyond the standard case for active management, such as identifying winners and avoiding losers.

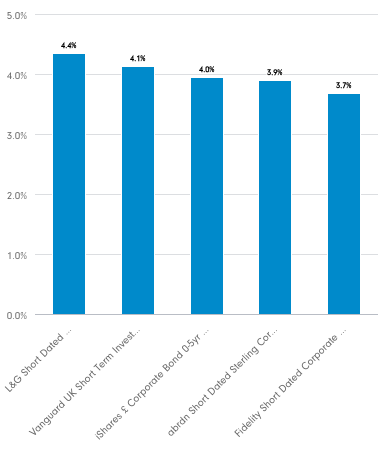

Active management allows us to take advantage of inefficiencies created by the mechanical nature of index tracking. For instance, we can invest in bonds with five to six years to maturity that are about to enter the 1-5yr index, positioning ahead of forced passive buying. Conversely, we can buy sub-one-year bonds that passive funds must sell as they roll out of the index, often at attractive valuations. These short-maturity securities can offer appealing yield opportunities despite their limited time to maturity. As of October 2025, 9% of Fidelity Short Dated Corporate Bond was invested in sub-one-year bonds (all off-benchmark). Remarkably, this portion of the portfolio offered an average yield to maturity of 4.8%, higher than the index yield of 4.4%, despite its lower interest rate risk. This yield advantage stems partly from forced passive selling, a by-product of rules-based rather than value-based investing. Sub-one-year holdings also enhance portfolio liquidity as they naturally convert to cash upon maturity.

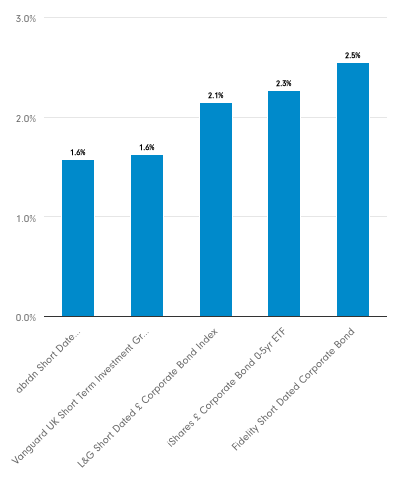

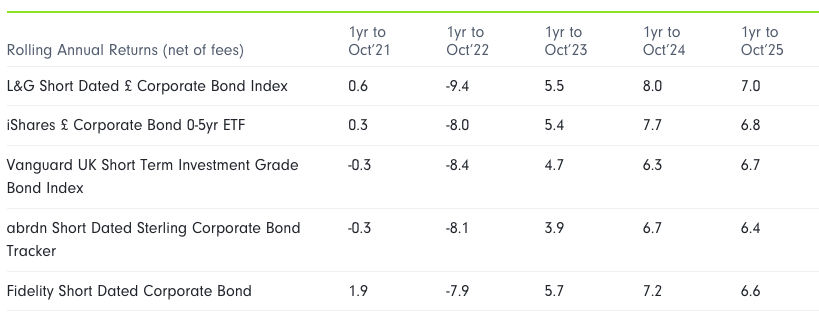

Over the past five years, the Fidelity Short Dated Corporate Bond Fund has compared favourably with passive peers - delivering higher returns after fees, lower volatility, smaller drawdowns, and stronger risk-adjusted performance.

Source: Fidelity International, Morningstar, 31 October 2025. Selected funds are all the passive short dated corporate bond funds in the IA Sterling Corporate Bond sector.

Ben Deane is an Investment Director within Fidelity’s fixed income team with 8 years of experience having joined Fidelity in 2016 as a graduate. Ben sits within the Fixed Income Investment Directing team and is focused on Sterling, Global and Sustainable Thematic Investment Grade (IG) strategies, including Fidelity Sustainable MoneyBuilder Income, Fidelity Short Dated Corporate Bond, Fidelity Sterling Corporate Bond, Fidelity Long Dated Sterling Corporate Bond, FF Global Corporate Bond, FF Sustainable Climate Bond and FF2 Sustainable Social Bond. Ben has primary responsibility for leading the day-to-day product responsibilities for the Sterling, Global and Sustainable Thematic IG strategies, including investor and press communications, client service and portfolio manager support. Ben holds a bachelors in Economics from the University of Bath, holds the Investment Management Certificate (IMC) and has obtained the Principles of Sustainable Finance from University Rotterdam. He has passed the CFA level 1 exam.

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of investments in overseas markets. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuers ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between government issuers as well as between different corporate issuers. Due to the greater possibility of default, an investment in a corporate bond is generally less secure than an investment in government bonds. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the Fund investing in them. Fidelity’s fixed income range of funds can use financial derivative instruments for investment purposes, which may expose them to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities and is only included for illustration purposes.