09 Jun 2022

A year ago, the dominant narrative in markets was that we were heading into a rerun of the “Roaring Twenties,” with the global economy set to enjoy years of above-trend growth as it emerged from the Covid-19 pandemic. Fast forward a few months and the word on everyone’s lips is “stagflation,” the combination of below-trend growth, above-target inflation, and high unemployment last seen in the 1970s.

For policy makers and investors alike, those are difficult macroeconomic conditions to navigate. Of course, this doesn’t mean stagflation is inevitable, nor does it mean there aren’t ways to potentially help investment portfolios against it if it does indeed occur. But to understand them, it may help to take a look at how markets and the global economy got to this point.

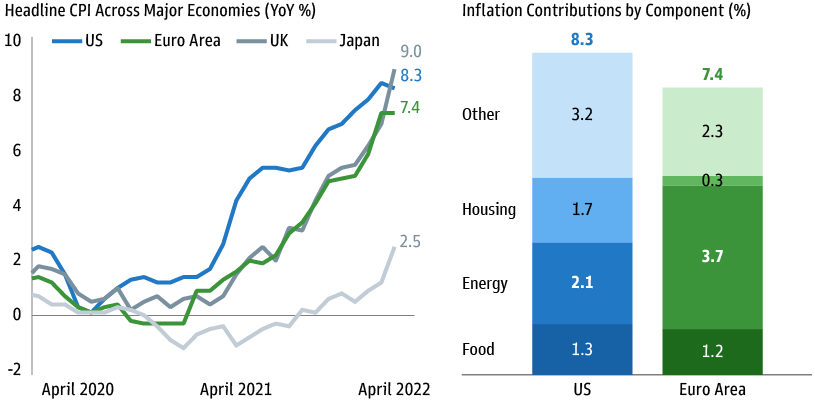

Unease about inflation has been building for some time—the result of persistent supply shortages tied to the pandemic and the war in Ukraine. Inflation signals are now flashing red across all major economies (Exhibit 1), though for different reasons: commodity prices in Europe, more broad-based inflation in the US and the UK including wage and shelter pressures. More recently, signs of slowing growth in major economies have revived the specter of stagflation. Chinese cities are still subject to lockdowns that have weighed on economic activity there, surging energy prices have slowed growth in Europe, and the US economy contracted in the first quarter.

EXHIBIT 1: INFLATION IS AT A MULTI-DECADE HIGH IN MOST CASES – EVEN THOUGH THE DRIVERS VARY

Source: Bloomberg, Haver Analytics, Eurostat, and Goldman Sachs Asset Management. LHS Notes: “YoY” refers to year-over-year. Data are as of April 2022. RHS Notes: Based on final prints as of April 2022. “Housing” corresponds to “Shelter” for the US and to “Actual rentals for housing, Maintenance and repair of the dwelling, and Water supply and miscellaneous services relating to the dwelling” for the Euro area. Past performance does not guarantee future results, which may vary.

The combination of rising prices and slowing growth increases pressure on central banks and the perception that they are falling behind the curve. Monetary policy has become more aggressive—the Federal Reserve, for instance, raised rates by 50 basis points in May—but there’s a limit to what policy can do. This is because inflation today is mostly the result of supply shocks over which policymakers have little-to-no control. As Fed Chairman Jerome Powell put it recently, “Our tools don’t really work on supply shocks. Our tools work on demand.”

Some market participants worry that they will work too well. Indeed, stagflation is often the result of a central bank attempting to reassert control of spiraling inflation expectations—rates chase inflation higher but not high enough to destroy demand and bring supply back into balance. Because policymakers can’t control supply-related price pressures, they may feel compelled to hike rates more rapidly and substantially than they would have otherwise to keep inflation expectations in check. Indeed, markets have priced in another 150 basis points of Fed rate hikes by year end, with the next two likely to come in doses of 50 basis points each. That may ultimately be sufficient to weaken demand without having much impact on supply-driven inflation, potentially pushing the economy into recession (the US economy already contracted 1.4% in the first quarter) and increasing unemployment. The Bank of England raised similar concerns among investors when it hiked interest rates this month and warned that a recession may be imminent.

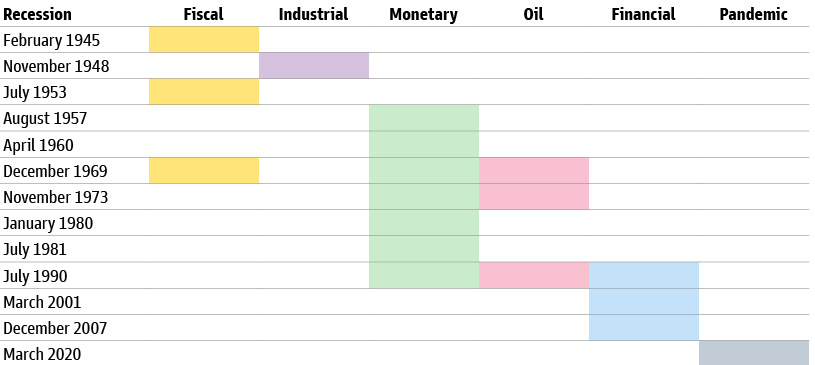

When it comes to engineering a soft landing—slowing an overheating economy without inducing a recession—central banks have a somewhat mixed track record. In the US, 11 of the 14 Fed tightening cycles since World War II have led to a recession within two years of the first rate hike. Hard landings were particularly common in the 1970s and 1980s when the Fed was pushing against long-run inflation expectations that had risen to uncomfortably high levels. The silver lining is that only eight of these recessions can be even partially attributed to Fed tightening (Exhibit 2), and soft or “softish” landings have been more common recently.

EXHIBIT 2: KEY CONTRIBUTORS TO US RECESSIONS

Source: Goldman Sachs Asset Management. The NBER's traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. https://www.nber.org/research/business-cycle-dating

None of this means a return to 1970s style stagflation is inevitable. We expect growth to moderate, but it’s important to point out that it would be moderating from a very high level, and it remains strong by historical standards. The Euro Area economy grew a robust 5.0% y/y in the first quarter, suggesting there’s ample room for a regional slowdown that doesn’t necessarily turn into a recession. Even the US contraction in the first quarter may have been tied to inventory buildups and other temporary factors that are unlikely to be repeated. Some industries, such as Travel and Leisure, have yet to reopen fully and still have room to drive above-trend growth as they ramp back up to pre-pandemic activity and spending levels.

We are also starting to see some potential signs that supply disruptions may be easing. We believe, for instance, used car prices have eased, and overall inflation in the US may be close to peaking (Europe’s reliance on Russian gas and oil will likely keep inflation there elevated for longer). Indeed, the US consumer price index rose at an annual pace of 8.3 per cent in April, a step down from the 8.5 per cent increase recorded in March, even though core pressures accelerated. If this trend holds up, the Fed may not have to raise rates so aggressively, as higher interest rates, bond yields and a stronger dollar have already done some of the heavy lifting when it comes to tightening financial conditions.

Even so, these are uncertain times. Inflation is expected to remain higher for longer and growth appears likely to moderate, albeit from a high level. And for the Fed, containing inflation without unduly hurting growth will be a delicate balancing act; overtightening coupled with balance sheet reduction, would likely tighten financial conditions, reduce liquidity and present challenges for risk assets.

This is why we believe today’s environment warrants a more careful approach to asset allocation, steered by active managers who can pivot quickly in response to changing conditions.

First, investors may want to consider increasing exposure to real assets such as commodities, real estate and infrastructure, which may have the best chance of outperforming in an inflationary or stagflationary environment. For example, energy sector Master Limited Partnerships that operate the pipelines, refineries and other infrastructure required to move and refine oil in the US boast high earnings and may offer investors strong distribution yields. Many are also trading at a discount to their long-term average.

Second, it may be premature to underweight equity and credit exposure, as earnings and corporate balance sheets have remained robust and global earnings growth looks set to stay strong in 2022. But in today’s environment, we think value equities look more attractive than long duration growth stocks with strong prospective cash flows that must now be discounted back to the present at higher rates. Investors may also want to consider a tilt toward higher-quality credit (developed market over emerging, investment-grade over high-yield, floating rate over fixed).

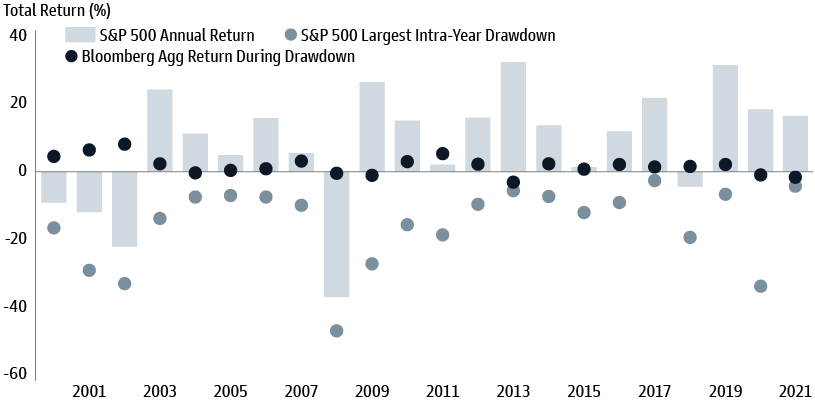

For global bonds, 2022 has until now been among the worst years in decades, with soaring inflation leading to double-digit losses across most fixed income categories. But with recession risk on the rise and real US yields edging into positive territory, the time for being significantly underweight bonds—particularly the high-quality investment-grade bonds that anchor a core fixed income (CFI) allocation—may be nearing an end. Each investor’s risk profile and tolerance for short-term losses will determine how much to allocate to CFI. But historical data (Exhibit 3) suggests that progressively increasing its weight in portfolios may help avoid unintended consequences.

EXHIBIT 3: VOLATILITY IN CONTEXT: UPS AND DOWNS

Source: Bloomberg and Goldman Sachs Asset Management. As of December 31, 2021. ‘Volatility’ refers to a financial instrument’s price variation. Past performance does not guarantee future results, which may vary.

These are challenging times, both for central banks that must navigate slowing growth and rising prices without pushing the economy into stagflation and recession, and for investors to protect their portfolios. Volatile conditions are likely to rock many a boat, but we believe that those who stay active and refuse to panic when the market does give themselves the best chance of staying afloat.

Risks

All investing involves risk. Equity securities are more volatile than bonds and subject to greater risks. Bonds are subject to interest rate, price and credit risks. Prices tend to be inversely affected by changes in interest rates.

Investments in foreign securities entail special risks such as currency, political, economic, and market risks. These risks are heightened in emerging markets.

Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Private equity investments are speculative, highly illiquid, involve a high degree of risk, have high fees and expenses that could reduce returns, and subject to the possibility of partial or total loss of fund capital; they are, therefore, intended for experienced and sophisticated long-term investors who can accept such risks.

Master Limited Partnerships ("MLPs") may be generally less liquid than other publicly traded securities and as such can be more volatile and involve higher risk. Investments in securities of an MLP involve risks that differ from investments in common stocks, including risks related limited control and limited rights to vote on matters affecting the MLP, risks related to potential conflicts of interest between the MLP and the MLP’s general partner, cash flow risks, dilution risks and risks related to the general partner’s right to require unit holders to sell their common units at an undesirable time or price. MLPs are also generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns.

MLPs may also involve substantially different tax treatment than other equity-type investments, and such tax treatment could be disadvantageous to certain types of investors, such as retirement plans, mutual funds, charitable accounts, foreign investors, retirement accounts or charitable entities. In addition, investments in MLPs may trigger state tax reporting requirements. Generally, a master limited partnership (“MLP”) is treated as a partnership for Federal income tax purposes. Therefore, investors in an MLP may be subject to certain taxes in addition to Federal income taxes, including state and local income taxes imposed by the various jurisdictions in which the MLP conducts business or owns property. In addition, certain tax-exempt investors in an MLP, such as tax-exempt foundations and charitable lead trusts, may incur unrelated business taxable income (“UBTI”) with respect to their investment. UBTI may result in increased Federal, and possibly state and local, tax costs, and may also result in additional filing requirements for tax exempt investors. Non-U.S. investors may be subject to U.S. taxation on a net income basis and have U.S. filing obligations as a result of investing in MLPs. The tax reporting information for MLPs generally is provided to investors on an annual IRS Schedule K-1, rather than an IRS Form 1099. To the extent the Schedule K-1 is delivered after April 15, you may be required to request an extension to file your tax returns.

General Disclosures

The views expressed herein are as May 13, 2022 and subject to change in the future. Individual portfolio management teams for Goldman Sachs Asset Management may have views and opinions and/or make investment decisions that, in certain instances, may not always be consistent with the views and opinions expressed herein.

Views and opinions expressed are for informational purposes only and do not constitute a recommendation by Goldman Sachs Asset Management to buy, sell, or hold any security, they should not be construed as investment advice.

Past performance does not guarantee future results, which may vary. The value of investments and the income derived from investments will fluctuate and can go down as well as up. A loss of principal may occur.

There is no guarantee that objectives will be met.

THIS MATERIAL DOES NOT CONSTITUTE AN OFFER OR SOLICITATION IN ANY JURISDICTION WHERE OR TO ANY PERSON TO WHOM IT WOULD BE UNAUTHORIZED OR UNLAWFUL TO DO SO.

This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. This material is not intended to be used as a general guide to investing, or as a source of any specific investment recommendations, and makes no implied or express recommendations concerning the manner in which any client’s account should or would be handled, as appropriate investment strategies depend upon the client’s investment objectives.

This information discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. This material has been prepared by Goldman Sachs Asset Management and is not financial research nor a product of Goldman Sachs Global Investment Research (GIR). It was not prepared in compliance with applicable provisions of law designed to promote the independence of financial analysis and is not subject to a prohibition on trading following the distribution of financial research. The views and opinions expressed may differ from those of Goldman Sachs Global Investment Research or other departments or divisions of Goldman Sachs and its affiliates. Investors are urged to consult with their financial advisors before buying or selling any securities. This information may not be current and Goldman Sachs Asset Management has no obligation to provide any updates or changes.

Economic and market forecasts presented herein reflect a series of assumptions and judgments as of the date of this presentation and are subject to change without notice. These forecasts do not take into account the specific investment objectives, restrictions, tax and financial situation or other needs of any specific client. Actual data will vary and may not be reflected here. These forecasts are subject to high levels of uncertainty that may affect actual performance. Accordingly, these forecasts should be viewed as merely representative of a broad range of possible outcomes. These forecasts are estimated, based on assumptions, and are subject to significant revision and may change materially as economic and market conditions change. Goldman Sachs has no obligation to provide updates or changes to these forecasts. Case studies and examples are for illustrative purposes only.

Goldman Sachs does not provide legal, tax or accounting advice, unless explicitly agreed between you and Goldman Sachs (generally through certain services offered only to clients of Private Wealth Management). Any statement contained in this presentation concerning U.S. tax matters is not intended or written to be used and cannot be used for the purpose of avoiding penalties imposed on the relevant taxpayer. Notwithstanding anything in this document to the contrary, and except as required to enable compliance with applicable securities law, you may disclose to any person the US federal and state income tax treatment and tax structure of the transaction and all materials of any kind (including tax opinions and other tax analyses) that are provided to you relating to such tax treatment and tax structure, without Goldman Sachs imposing any limitation of any kind. Investors should be aware that a determination of the tax consequences to them should take into account their specific circumstances and that the tax law is subject to change in the future or retroactively and investors are strongly urged to consult with their own tax advisor regarding any potential strategy, investment or transaction.

Although certain information has been obtained from sources believed to be reliable, we do not guarantee its accuracy, completeness or fairness. We have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public sources.

United Kingdom: In the United Kingdom, this material is a financial promotion and has been approved by Goldman Sachs Asset Management International, which is authorized and regulated in the United Kingdom by the Financial Conduct Authority.

European Economic Area (EEA): This financial promotion is provided by Goldman Sachs Bank Europe SE.

This material is a financial promotion disseminated by Goldman Sachs Bank Europe SE, including through its authorised branches ("GSBE"). GSBE is a credit institution incorporated in Germany and, within the Single Supervisory Mechanism established between those Member States of the European Union whose official currency is the Euro, subject to direct prudential supervision by the European Central Bank and in other respects supervised by German Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufischt, BaFin) and Deutsche Bundesbank.

Switzerland: For Qualified Investor use only – Not for distribution to general public. This is marketing material. This document is provided to you by Goldman Sachs Bank AG, Zürich. Any future contractual relationships will be entered into with affiliates of Goldman Sachs Bank AG, which are domiciled outside of Switzerland. We would like to remind you that foreign (Non-Swiss) legal and regulatory systems may not provide the same level of protection in relation to client confidentiality and data protection as offered to you by Swiss law.

Asia excluding Japan: Please note that neither Goldman Sachs Asset Management (Hong Kong) Limited (“GSAMHK”) or Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H ) (“GSAMS”) nor any other entities involved in the Goldman Sachs Asset Management business that provide this material and information maintain any licenses, authorizations or registrations in Asia (other than Japan), except that it conducts businesses (subject to applicable local regulations) in and from the following jurisdictions: Hong Kong, Singapore, Malaysia, India and China. This material has been issued for use in or from Hong Kong by Goldman Sachs Asset Management (Hong Kong) Limited, in or from Singapore by Goldman Sachs Asset Management (Singapore) Pte. Ltd. (Company Number: 201329851H) and in or from Malaysia by Goldman Sachs (Malaysia) Sdn Berhad (880767W).

Australia: This material is distributed by Goldman Sachs Asset Management Australia Pty Ltd ABN 41 006 099 681, AFSL 228948 (‘GSAMA’) and is intended for viewing only by wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth). This document may not be distributed to retail clients in Australia (as that term is defined in the Corporations Act 2001 (Cth)) or to the general public. This document may not be reproduced or distributed to any person without the prior consent of GSAMA. To the extent that this document contains any statement which may be considered to be financial product advice in Australia under the Corporations Act 2001 (Cth), that advice is intended to be given to the intended recipient of this document only, being a wholesale client for the purposes of the Corporations Act 2001 (Cth). Any advice provided in this document is provided by either Goldman Sachs Asset Management International (GSAMI), Goldman Sachs International (GSI), Goldman Sachs Asset Management, LP (GSAMLP) or Goldman Sachs & Co. LLC (GSCo). Both GSCo and GSAMLP are regulated by the US Securities and Exchange Commission under US laws, which differ from Australian laws. Both GSI and GSAMI are regulated by the Financial Conduct Authority and GSI is authorized by the Prudential Regulation Authority under UK laws, which differ from Australian laws. GSI, GSAMI, GSCo, and GSAMLP are all exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia and therefore do not hold any Australian Financial Services Licences. Any financial services given to any person by GSI, GSAMI, GSCo or GSAMLP by distributing this document in Australia are provided to such persons pursuant to ASIC Class Orders 03/1099 and 03/1100. No offer to acquire any interest in a fund or a financial product is being made to you in this document. If the interests or financial products do become available in the future, the offer may be arranged by GSAMA in accordance with section 911A(2)(b) of the Corporations Act. GSAMA holds Australian Financial Services Licence No. 228948. Any offer will only be made in circumstances where disclosure is not required under Part 6D.2 of the Corporations Act or a product disclosure statement is not required to be given under Part 7.9 of the Corporations Act (as relevant).

Canada: This presentation has been communicated in Canada by GSAM LP, which is registered as a portfolio manager under securities legislation in all provinces of Canada and as a commodity trading manager under the commodity futures legislation of Ontario and as a derivatives adviser under the derivatives legislation of Quebec. GSAM LP is not registered to provide investment advisory or portfolio management services in respect of exchange-traded futures or options contracts in Manitoba and is not offering to provide such investment advisory or portfolio management services in Manitoba by delivery of this material.

Japan: This material has been issued or approved in Japan for the use of professional investors defined in Article 2 paragraph (31) of the Financial Instruments and Exchange Law by Goldman Sachs Asset Management Co., Ltd.

Date of First Use: May 26, 2022, 279306-OTU-1613309