17 Feb 2023

Want to find out more? View the RSMR Factsheet here:

Invesco Asia Trust plc

Jakarta’s infamous traffic is back, buzzing at pre-pandemic congestion levels. This, as well as the 2024 election and a national drive to grow the Electric Vehicle (EV) ecosystem, were the most discussed topics on our recent trip to Indonesia with members of the Invesco Asia Trust plc board.

After a series of Covid-19 lockdowns, business in Jakarta is back to normal, with local shopping malls busy on weekdays. Over three days in the capital, we met with banks, real estate developers and conglomerates, as well as some entrepreneurial founders of companies in the fintech and EV industries. The vibrancy of the economy and the reforms of Joko Widodo’s administration left us confident on Indonesia’s long-term prospects.

Indonesia’s general election will take place on Valentine’s Day 2024. President Joko Widodo, the well-respected incumbent, is unable to run for a third term, with three candidates clearly ahead in the latest polls. The current front-runners are: Ganjar Pranowo, current Governor of Central Java; Prabowo Subianto, Minister of Defense (contesting his third presidential election); and Anies Baswedan, ex-Governor of DKI Jakarta.

Ganjar Pranowo is a member of the PDI-P, the party that President Widodo serves, and therefore the continuity candidate that the market would welcome most. Ahead of the election, many companies expect economic activity to slow in the second half of 2023, with certain business decisions potentially postponed until results are announced in early 2024.

Indonesia has one of the world’s largest nickel reserves and in 2022 cemented its position as the world’s largest producer of refined nickel. The country has big ambitions to develop an end-to-end EV ecosystem, targeting fleets of 2 million EV cars and 13 million EV motorbikes by 2030, with the introduction of an EV incentive scheme to attract consumers as well as foreign direct investment (FDI). The government is already exploring opportunities with international companies interested in building battery facilities and EV manufacturing sites in Indonesia.

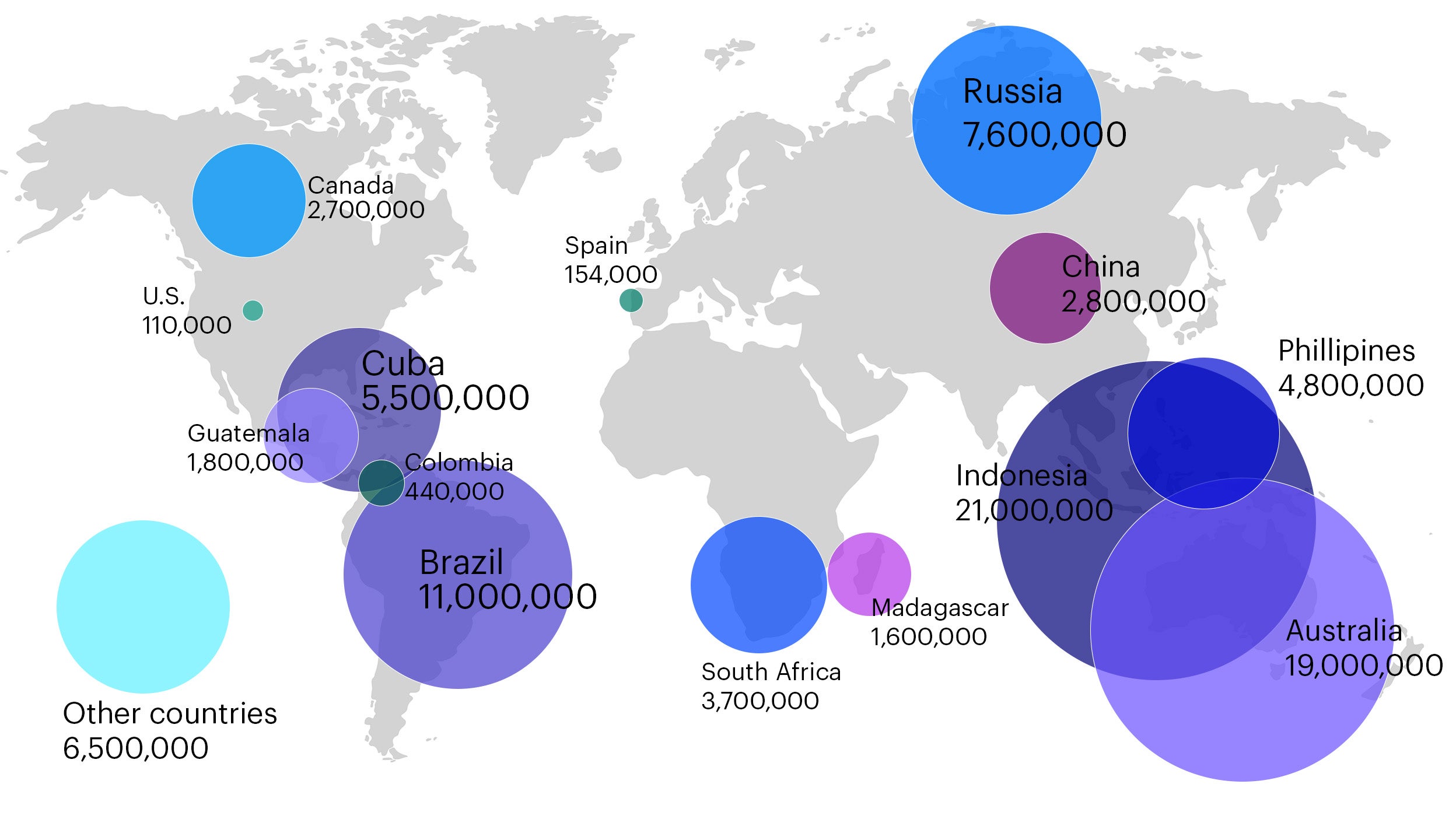

Figure 1. Nickel reserves (Metric tons)

Nickel downstreaming has been a notable success in recent years. The government’s decision to ban nickel ore exports in 2019 encouraged local smelting and resulted in the nickel-related exports value ballooning 10 times to over $20bn in 2022.

We met with a local nickel mine operator, who has ambitious plans to build high-pressure acid leaching plants to enable the conversion of nickel ore into an intermediary product that is suitable for EV batteries. The process itself is very carbon-intensive, and although investment is being made in solar and hydro plants, there are also issues with the waste material left after the extraction of the metal from the ore. It’s a common issue for all mining assets, not just nickel – so plenty to consider from an environmental, social and governance (ESG) perspective.

Indonesia has one of the most vibrant digital ecosystems in Southeast Asia, with its largest internet companies having enjoyed meaningful growth in recent years. Management teams have shifted focus from growth towards profitability, with higher monetization rates, reduced subsidies and downscaling unprofitable businesses some of the ways for them to achieve this target. Although this change of attitude is very welcome, we see some near-term challenges. Firstly, e-commerce companies are likely to see a decline in gross merchandise value (GMV) as free shipping and discount coupons are withdrawn. There is also a risk that some internet companies may look to raise capital given the low levels of cash on their balance sheet.

Some of our strategies continue to have exposure to Bank Negara Indonesia, which has been a beneficiary of improved governance and risk management. The senior management team joined in 2020 from Bank Mandiri, the largest bank in Indonesia, kickstarting a transformational program whose top priority was lowering the risk of the corporate loan book by underwriting more loans to top corporate clients. Currently, a quarter of the corporate loan book is top tier clients, reducing the bank’s credit costs from over 3% in 2021 to 2% in the first nine months of 2022.

Management’s long-term credit cost target is 1%, shifting 100% of the corporate loan book towards the best quality, top tier clients. Lower credit costs would help the bank hit its medium-term return on equity1 target of 18%, and in our view, this potential isn’t reflected in the current valuation of their shares, which are trading on an estimated 2023 price/book multiple of just 1.15x.

Originally published by: Jakarta’s jumping: Exciting outlook for Indonesia (investmentweek.co.uk)

Footnote

1 ‘Return on equity’ is a measure of the profitability of a business in relation to the equity.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

All information as at 27 January 2023 unless otherwise stated.

This is marketing material and not intended as a recommendation to buy or sell any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.