02 Dec 2021

The global leaders from around 200 countries that convened for the COP26 summit had a stark warning from scientists ringing in their ears. If limiting global warming to less than 1.5 °C versus pre-industrial levels was to remain within reach, swift and decisive action at COP26 was required. While several new announcements were made in areas including coal, deforestation and methane emissions, progress fell short of the scale and specificity required to give us confidence that disruptive climate outcomes can be avoided.

As the practicalities of reaching net zero become clear, governments are finding the short-term economic costs unpalatable. Massive change is required to reach net zero emissions, which in the short term is likely to involve considerable economic cost. Finding new jobs for many of the roughly 30 million people involved globally in the fossil fuel sector is one clear example. The short-term costs are making governments hesitant in committing to ambitious targets. This was evident in statements from leaders in the emerging world, who stressed that climate ambitions must be balanced against economic goals. The summit did see some new commitments: of particular note was India’s pledge to reach net zero by 2070 and to triple the usage of renewable energy by 2030, while the announcement that the US and China will cooperate on emission cuts was also encouraging. Yet the reluctance of both China and India (among others) to join global commitments on coal power and methane emissions sent a clear message: the energy transition will not be prioritised above economic progress, unless wealthier nations are willing to take into account their high cumulative emissions since the beginning of the industrial revolution and ramp up their support to help with the economic costs. In the developed world, several countries have upgraded their climate targets this year but current levels of emissions when judged on a per capita basis often compare much less favourably to emerging markets, especially for the US. In addition, analysis from Climate Action Tracker highlights that the UK is the only major developed nation to have policies and targets deemed “almost sufficient” to limit warming to below 1.5 °C, with no wealthy nation’s plans currently being ranked as sufficient.

Developed markets will provide more financial support to the emerging world, but it’s not coming quickly. In 2009, wealthy countries committed to make USD 100 billion a year available from public and private sector sources to the developing world by 2020. But this target was not met. While accelerating the available levels of financing was a key priority of the conference, it still looks like the USD 100 billion target will only be reached in 2023.

The onus will fall on the private sector to drive change. Our other key takeaway is that governments are reluctant to be the ones inflicting the economic pain. Agreement on the rules for a new global carbon market was encouraging, but the lack of progress on setting a global carbon price was a major disappointment. In the absence of clear government solutions to drive change, the focus – and indeed the key breakthrough – was the agreement to ensure the financial system will deploy capital in a manner consistent with climate objectives. The Glasgow Financial Alliance for Net Zero, an initiative tabled by Mark Carney, saw over 450 financial institutions commit more than USD 130 trillion of private capital to support the net zero transition. Yet governments will still have a key role to play here: a combination of policy incentives and clearer guidance on future regulation will be necessary to enable the financial sector to effectively put its capital to work.

Investors will need to pay more attention to the climate risks in their portfolio. Even when assuming that current pledges are implemented in full and on time, restricting global warming to 1.5 °C still appears unlikely based on analysis from across the scientific community. The potential for macroeconomic disruption, not just in carbon-intensive industries but extending across the economy, will increasingly need to be factored in by long-term investors. Physical climate risks, most acute in the emerging markets, will sadly also warrant careful consideration.

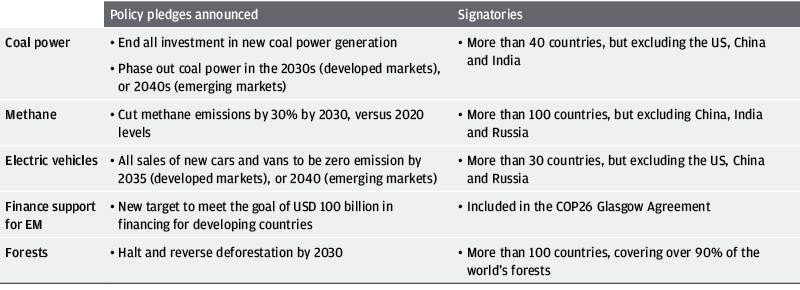

Exhibit 1: Key developments at COP26

Source: UKCOP26.org, J.P. Morgan Asset Management. Data as of 12 November 2021.

Source: UKCOP26.org, J.P. Morgan Asset Management. Data as of 12 November 2021.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2021 JPMorgan Chase & Co. All rights reserved.