08 Aug 2022

Global economy

July-released economic data provided further evidence of a slowing global economy. Inflation continued to soar to new highs, growth data disappointed and flash Purchasing Managers’ Index (PMI) surveys showed activity losing momentum. Labour markets remained a bright spot, with tight jobs markets driving nominal wage growth. Heightened inflation, however, meant that real wage growth remained negative.

Against this weaker growth backdrop, markets increasingly priced in interest rate cuts from the Federal Reserve (Fed) in 2023. This anticipation of a policy pivot supported risk assets over the month. Global growth stocks benefited most, delivering 11.5% total return in July, recouping some of their heavy year-to-date losses. Its strong growth tilt meant the S&P 500 was the best performing equity index, delivering 9.2% total return. In fixed income, falling sovereign yields coupled with tighter credit spreads meant that high yield was the best performing fixed income sector, with US high yield delivering 6.0% total return in July. Fears that Russia might shut off supplies to Europe spiked European gas prices and commodities in general delivered 4.3% total return over the month. In emerging markets strong performance from Indian and South Korean markets was counteracted by Chinese real estate weakness. China’s heavy weight in the index meant emerging market equities ended the month as the worst performing major asset class delivering -0.2% total return.

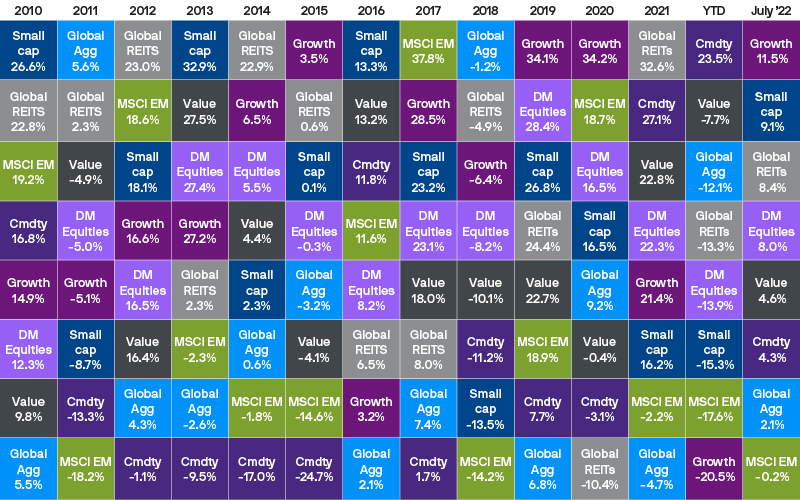

Exhibit 1: Asset class and style returns

Source: Bloomberg Barclays, FTSE, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. DM Equities: MSCI World; REITs: FTSE NAREIT Global Real Estate Investment Trusts; Cmdty: Bloomberg Commodity Index; Global Agg: Barclays Global Aggregate; Growth: MSCI World Growth; Value: MSCI World Value; Small cap: MSCI World Small Cap. All indices are total return in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 July 2022.

Europe

High inflation pushed the European Central Bank (ECB) to deliver its first interest rate hike in over a decade, taking the eurozone out of negative rates. To help ensure smooth transmission of monetary policy it also announced a new tool: the Transmission Protection Instrument (TPI). The TPI enables the ECB to purchase specific securities to counter “unwarranted market dynamics”. The tool is flexible by design, but the ECB is still yet to agree the criteria for activation. In the short term, the ECB will continue to depend on the flexibility of the Pandemic Emergency Purchase Programme to target its bond purchases.

The collapse of former ECB president Mario Draghi’s Italian government could be the first test of the new framework. Italian 10-year government bond spreads widened by 30 basis points over the month relative to German 10-year Bunds.

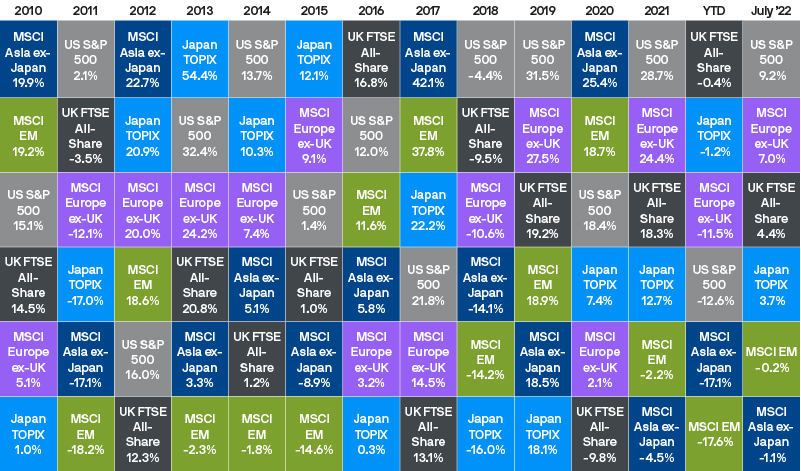

Exhibit 2: World stock market returns

Source: FTSE, MSCI, Refinitiv Datastream, Standard & Poor’s, TOPIX, J.P. Morgan Asset Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 July 2022.

The other key issue facing Europe remained gas supply. Despite fears to the contrary, the Nordstream 1 pipeline reopened after its scheduled maintenance period. After initially restarting flows at 35% of 2020/2021 levels, Russia announced a reduction to 20% to enable repairs to a turbine. Germany rejected this explanation and gas prices rose sharply towards month-end in response to renewed fears of gas supply scarcity. To shore up domestic supplies, the European Commission requested that countries look to reduce their consumption by 15%, although this was met with disagreement from several members of the bloc, raising the risk of European disunity in the months ahead.

European recessionary risk was most apparent in currency markets where the euro briefly slipped below parity with the dollar before rallying slightly in response to the ECB’s move. Normally euro depreciation is positive for export driven European earnings, but given the recessionary risk is largely focused on gas disruption and the subsequent impact on production, the feedthrough in this scenario is less clear. This means 2022 European earnings growth estimates – currently 13.9% year-on-year – look vulnerable to downwards revisions. Eurozone Q2 GDP did however surprise to the upside, with the economy proving relatively resilient to the geopolitical headwinds so far.

In the UK, Prime Minister Boris Johnson resigned after he lost the support of his parliamentary party. The Conservative leadership race quickly narrowed the field down to two candidates: Rishi Sunak, the former chancellor, and Liz Truss, the current foreign secretary. Ahead of the final vote by the roughly 200,000 Conservative party members, Truss is leading in the polls. The winner, and next prime minister, will be announced on 5 September. While there are key differences on fiscal spending between the candidates, thus far investors appear to be paying little attention to the race. Ultimately the UK economy and markets will be more sensitive to global forces than the actions of the next occupant of No. 10.

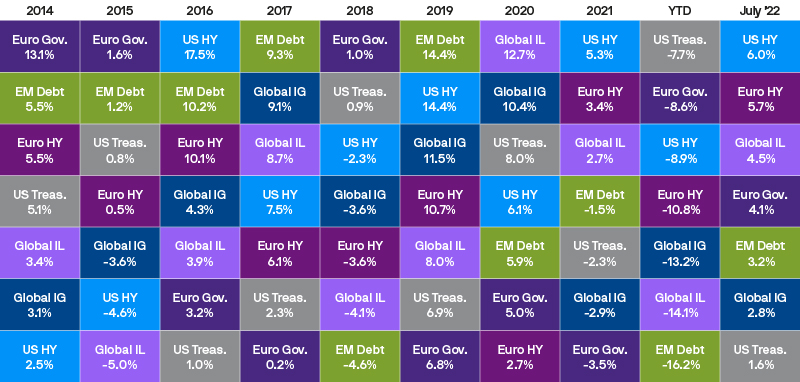

Exhibit 3: Fixed income sector returns

Source: Bloomberg Barclays, BofA/Merrill Lynch, J.P. Morgan Economic Research, Refinitiv Datastream, J.P. Morgan Asset Management. Global IL: Barclays Global Inflation-Linked; Euro Gov.: Barclays Euro Aggregate Government; US Treas: Barclays US Aggregate Government - Treasury; Global IG: Barclays Global Aggregate - Corporates; US HY: BofA/Merrill Lynch US HY Constrained; Euro HY: BofA/Merrill Lynch Euro Non-Financial HY Constrained; EM Debt: J.P. Morgan EMBIG. All indices are total return in local currency, except for EM and global indices, which are in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 July 2022.

US

The Fed increased rates by 75 basis points for the second consecutive meeting after headline inflation in July once again beat expectations, printing 9.1% year-on-year. Inflationary pressure in the stickier shelter and services elements continued to build. With its laser focus on inflation the Fed is unlikely to be willing to acknowledge the trade-off between growth and inflation that it faces until there are clear signs that headline inflation has turned lower.

In reaction to rising fears about a Fed-induced recession, the US yield curve inverted in July between 2- and 10-year yields, as yields on US 10-year Treasuries fell over the month. Compounding growth worries, July’s flash PMIs showed the US slipping into contraction with the composite index printing 47.5. This was due to a fall in the services sector which dropped to 47.0, while manufacturing remained in expansionary territory at 52.3. Q2 GDP added to growth concerns with real GDP growth printing -0.9% quarter on quarter. The weakness in the report was widespread with falls in construction, investment and government spending only partly offset by modest increases in trade and consumption. While two quarters of negative growth means the US is technically in recession, the strength of the labour market means that the National Bureau of Economic Research is unlikely to formally declare one at this stage.

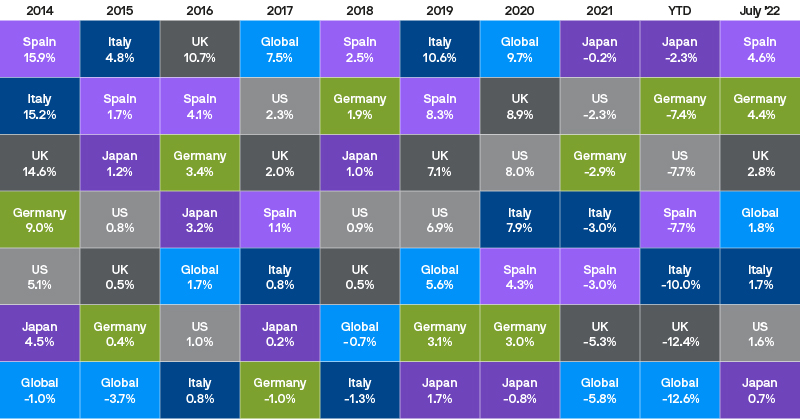

Exhibit 4: Fixed income government bond returns

Source: Bloomberg Barclays, Refinitiv Datatsream, J.P. Morgan Asset Management. All indices are Bloomberg Barclays benchmark government indices. All indices are total return in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 July 2022.

China

China continued to grapple with the Omicron outbreak and a series of rolling lockdown measures were enacted in various cities. There are still few signs of softening the zero-Covid policy, and we do not expect any major announcements until after the Party Congress in the autumn. Economic data, however surprised to the upside with Q2 GDP printing 1.0% year-on-year and, most importantly for the West, exports significantly beating expectations at 17.9% year-on-year. This contributed to an easing of supply chain pressures in the latest global PMI readings.

Chinese credit growth also improved as authorities, as yet free from the inflationary pressures dogging western economies, were able to increase stimulus measures to support the economy. Despite this, the MSCI China index returned -9.3% total return over July as concerns about the property market impacted the real estate sector which returned -19.9% total return over the month.

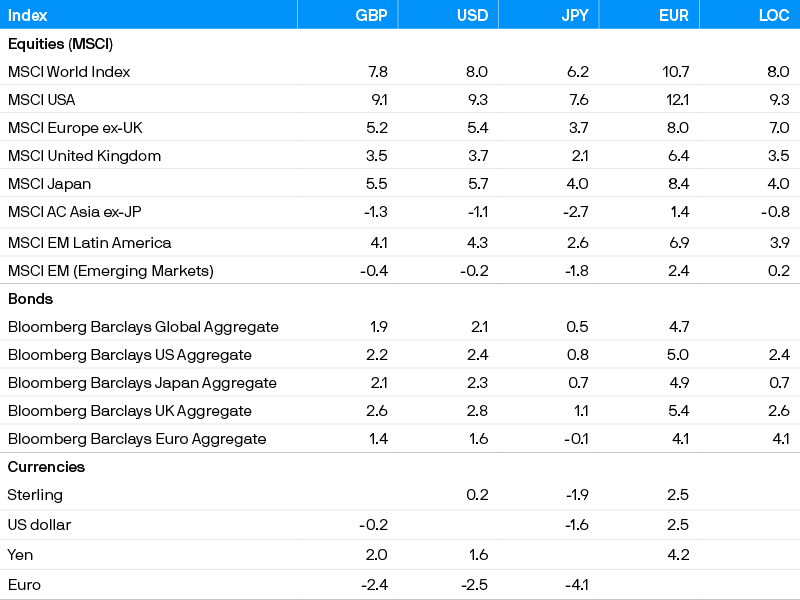

Exhibit 5: Index returns for July 2022

Source: Bloomberg Barclays, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. Past performance is not a reliable indicator of current and future results. Data as of 31 July 2022.

Conclusion

July saw the global economy start to feel both the full impact of high inflation, and central banks’ attempts to curb it. While the drivers are different, recession risk has risen in Europe and the US is technically already in one. Markets had previously moved ahead of the economy to price in a lot of bad news, and expectations of a central bank pivot meant risk assets delivered positive returns over the month. So far this year, much of the equity market decline has been driven by valuation de-rating. Earnings downgrades do pose further risks, but stock price declines now already look consistent with a modest downturn in profits.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be. In Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only.

For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2022 JPMorgan Chase & Co. All rights reserved.