10 Feb 2022

In the first two parts of this series we outlined how continued supply problems and tight labour markets point to lingering inflation in the developed world. To be clear, we do not expect inflation to continue heading north. Headline inflation may have peaked – or will do so over the spring – and from there, base effects from higher energy prices will allow inflation to moderate. But we do believe the pandemic has dislodged us from the stubbornly low inflation that characterised the last cycle.

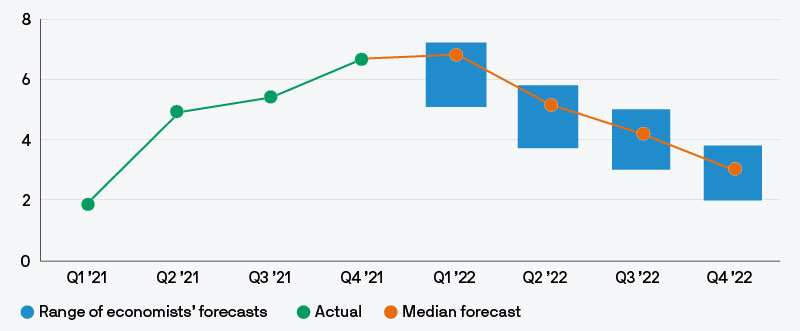

Exhibits 1 and 2 show that the forecasting community is split – the range of projections for inflation is unusually large. Our estimates fall in the upper part of this range. In this final part of this series we look at how to protect your capital in an inflationary environment.

Exhibit 1: US headline CPI forecasts

% change year on year, quarterly average

Exhibit 2: UK headline CPI forecasts

% change year on year, quarterly average

Beware cash and government bonds. Inflation rapidly erodes the purchasing power of cash, particularly in an environment like today where the interest you get on basic savings accounts sits well below the rate of inflation (Exhibit 3). An individual who has had £100 in a deposit account for the last two years earning the Bank of England’s policy rate has already seen the purchasing power of that money fall to £96.50. If this individual leaves that cash in a deposit account in the hope that interest rates will start rising, then on current projections for inflation and interest rates, they will have lost more than a tenth of their purchasing power, in just five years.

Exhibit 3: Return on cash invested at the beginning of 2020

% return

The prospects for those holding government bonds aren’t much better. If the market comes round to the idea that inflation is persistent and central banks will have to tighten policy in the coming years by more than currently expected, then long-duration government bonds could be in for a rough year. For example, a 10 year US Treasury bond would be expected to have a negative total return of 7% were the 10 year yield to rise to 2.5% by the end of this year and negative return of more than 10% if it hits 3%.

Index-linked bonds are not ‘inflation-protected’ bonds, as they are often perceived to be. Inflation-linked bonds are preferable to normal/nominal bonds if you expect inflation to be higher than is already priced in. But inflation-linked bonds are currently already pricing in inflation of 2.8% (CPI) on average in the US over the next five years and 4.1% (RPI) in the UK. If you expect inflation to be higher than that over the next five years you would be better off in inflation-linked bonds than normal government bonds.

However, they are all still bonds. And just as normal government bonds are vulnerable if yields rise, inflation linked bonds are vulnerable if real yields rise. Owning an inflation-linked bond could still lose you money in an environment of above target inflation if central banks tightening policy leads to a rise in real yields, as has often been the case. For this reason, we don’t think inflation-linked bonds are the best way to hedge against inflation at the moment.

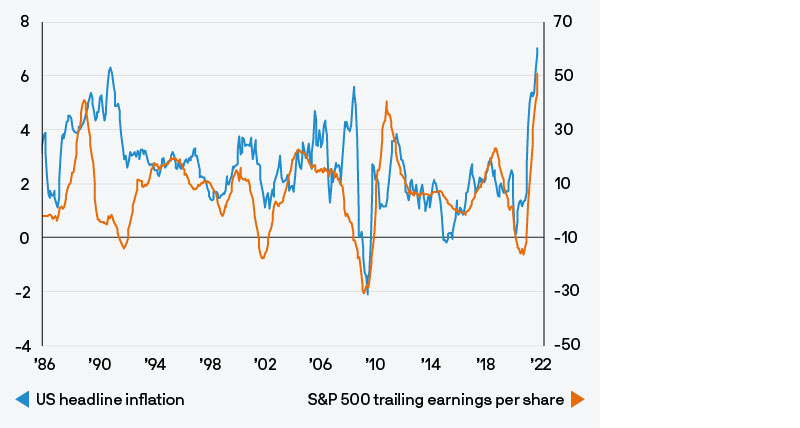

What about equities? Equities often protect capital in modest inflation environments. Broad-based inflation is, after all, corporates demonstrating their pricing power and there is a strong relationship between inflation and corporate earnings (Exhibit 4).

Exhibit 4: US inflation and S&P 500 trailing earnings

% change year on year, earnings are last twelve months’ earnings per share

However, there are two caveats to the ‘inflation is good for stocks’ narrative.

First, much higher inflation tends not to be good for stocks. Inflation is like chocolate. Too little doesn’t satisfy since it often signifies chronically weak demand in the overall economy. But too much inflation is equally troublesome. This is because, beyond a certain point, central banks generally have to step in and slow the economy down, a process that rarely runs smoothly and more often than not eventually leads to a period of recession during which margins get squeezed and corporate earnings and equities tend to fall.

So long as inflation turns quickly this spring and settles at around 3% in the US and UK, and 2% in the eurozone, then we do not expect this to be an inflation backdrop that will trouble stock markets.

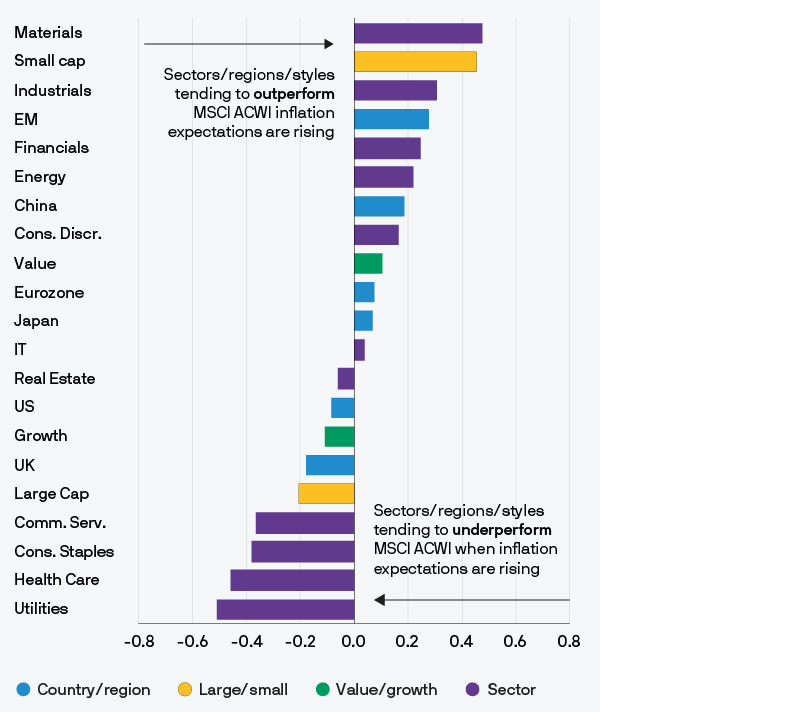

The second caveat to bear in mind is that some sectors and, in turn, equity styles and regions, will benefit from higher inflation more than others. Exhibit 5 shows the historical correlation between inflation expectations and the performance of various equity benchmarks relative to the MSCI ACWI Index of global large and mid- cap stocks.

Exhibit 5: Correlation of equity markets with the change in US inflation expectations

Correlation of the change in US inflation expectations and six-month rel. performance of indices vs MSCI ACWI, since mid-2000

Cyclical sectors such as financials, industrials, materials and energy, tend to outperform the global benchmark in periods of rising inflation expectations. By contrast, defensives and growth stocks tend to struggle. Technology is the sector that looks most vulnerable today, given their valuations have likely benefitted from the low interest rates and flat yield curves over the past couple of years.

Alternatives provide many options for investors to protect their capital from inflation. Inflation is ultimately caused by too much demand relative to available supply. When that imbalance extends to property markets they can provide a good inflation hedge as rents and capital values increase. However, one does need to distinguish between property markets where demand is strong relative to supply and those where demand is structurally challenged.

The long-standing shift to online shopping that has been accelerated by the pandemic, along with the pandemic driven shift to working from home, is putting structural pressure on demand for many retail properties. The other side of this is that demand for industrial/logistics properties that support online retail distribution remains very strong. We still believe there is strong demand for offices, a sector which benefits from having everyone together at the same time.

So a selective exposure to global property can help protect against inflation. Some infrastructure assets also have inflation protection written into their contracted returns and so can provide a good inflation hedge.

Investors typically view gold as a good inflation hedge, but this isn’t always the case. Gold is an asset that provides zero income and so becomes attractive when bonds offer negative yields. This can be the case when inflation is high, particularly if central banks are seen to be losing control. But if inflation is high and central banks are increasing rates against a backdrop of robust growth, then real yields can rise – an environment that is usually more challenging for gold.

Conclusion

In summary, persistent moderate inflation poses a risk to cash and government bonds. Gold and index-linked bonds may not be as good a hedge as is often thought. So long as inflation looks on course to moderate and settle at roughly 3% we expect returns in stocks that will outpace inflation until interest rates eventually rise to a point which causes a recession. However, look to financials, energy and industrials to provide the best inflation hedge, as well as the options available in alternative markets.

The Market Insights program provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions.

For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programs are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research. This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance. Copyright 2022 JPMorgan Chase & Co. All rights reserved.