10 Oct 2022

Karen Ward, Chief Market Strategist for EMEA

What’s happened?

A number of events have coincided with the volatility seen in sterling markets:

Ambitions for a ‘new economic model’

A new government took office led by Prime Minister Liz Truss. The new PM and leaders of her cabinet voiced an ambition for a new economic model and as part of that revamp made a number of changes to senior civil service posts, including the dismissal of the Permanent Secretary to the Treasury.

Energy package

Given movements in wholesale gas prices, UK households were set to see gas bills rise by another 80% in October, on top of the 54% increase seen in the spring. The prime minister announced a substantial package of measures, capping the energy price and providing a short-term subsidy so that in effect households will now see a much more modest rise in utility bills this winter. The exact cost is unknown because of uncertainty about the eventual cost of buying gas, but is expected to amount to around £100bn-150bn over the two-year duration of the freeze.

Bank of England delivers a more tepid increase in interest rates

At its September meeting, the Bank of England delivered only a 50 basis point increase in interest rates. This was behind the Federal Reserve and European Central Bank, despite evidence of stickier inflation and limited spare capacity in the economy.

New Chancellor Kwasi Kwarteng’s mini-budget

This contained a reversal of the previous increase in national insurance contributions, reduction in the basic rate of income tax, abolition of the top rate of tax, and stamp duty cuts. No revenue raising measures or spending cuts were announced so the energy package, coupled with additional measures will be funded by an additional £90bn in borrowing this fiscal year. Chancellor Kwarteng has stated that there will be more tax cuts to come.

The Office for Budget Responsibility (OBR) did not provide an independent costing

The OBR also did not provide analysis of the impact of these measures on the outlook for UK government debt sustainability. The government has since pledged that the OBR will provide analysis on 23 November and at this time the chancellor will also set out fiscal rules.

In our view, the combination of all these individual events created uncertainty in markets about the UK’s institutional architecture, and the central bank and government’s commitment to sustainable monetary and fiscal policy.

What have markets done?

Sterling has seen the largest of the moves. The pound has fallen 8% against the dollar since the start of September, however this has been in an environment of broad dollar strength. Perhaps a more accurate characterisation of individual sterling risk premia is to consider the fall against the euro, amounting to around 3.5%.

Gilt prices fell substantially as markets digested the impact of the fiscal package on UK monetary policy and the changing outlook for demand and supply of UK Gilts. The new packages suggest that net borrowing this fiscal year will amount to around £190bn. Although this is less than the £300bn in fiscal year 2020/21 at the peak of the Covid pandemic, the backdrop for Gilt demand has now changed. In 2020 the Bank of England was a net buyer of Gilts amounting to around £270bn. The Bank had previously announced that over the next 12 months it would be a net seller of Gilts to the tune of £80bn. However, as conditions became disorderly the Bank announced that it was postponing its plans to sell and instead embarked on a new temporary Gilt purchase programme. This served to effectively backstop the market, although the 10-year Gilt yield still stands at over 4%, up from around 1% at the start of the year. This apparent easing of policy at a time of monetary tightening was explained by the need to meet the financial stability component of the Bank’s mandate.

In contrast, the FTSE 100 has been relatively resilient. Roughly 80% of the earnings generated by FTSE 100 companies are made overseas and therefore become more valuable when sterling declines. However, the FTSE 250 generates 40% of its earnings domestically and has seen a decline of 9% month-to-date.

UK market moves

Source: Refinitiv Datastream, Refinitiv Eikon, J.P. Morgan Asset Management. Data as of 28 September 2022.

What’s next?

The focus remains on the Bank of England, which next meets on 3 November. Against a backdrop of declining sterling, the Bank released a statement on 26 September stating that “it will make a full assessment at its next scheduled meeting of the impact on demand and inflation from the Government’s announcements, and the fall in sterling, and act accordingly”. This dampened expectations that were building in the market of an interim policy announcement.

The Bank finds itself in a difficult position. Although the government has made clear that many of its initiatives aim to boost the supply of the economy, in the near-term at least they will merely add to demand at a time when the UK appears to be running at full capacity and inflation is already uncomfortably elevated and persistent. The decline in sterling will also feed imported and domestic inflation. The Bank of England has little choice but to meet fiscal loosening with monetary tightening.

Without the ability to tighten policy with asset sales, efforts will now focus on increasing short-term interest rates. At the time of writing, the market expects the Bank will need to raise interest rates by 1.25 percentage points (pp) in November. The following meeting in December is expected to see another 1.00pp increase, taking rates to 4.5% by the end of the year.

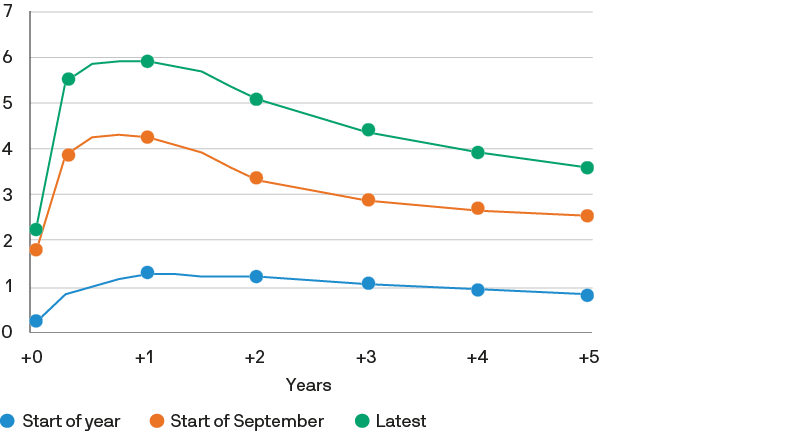

Market expectations for Bank of England base rate%

Source: Bloomberg. J.P. Morgan Asset Management. Expectations are calculated using 6-month OIS forwards. Past performance is not a reliable indicator of current and future results. Data as of 26 September 2022.

This will clearly have a dampening effect on economic activity. UK mortgage rates on a typical 2-year fix had already more than doubled in the first eight months of the year, hitting 3.6% in August. UK interest rate swaps – a key determinant of mortgage rates – have surged further in September. For many UK homeowners, the feedthrough from higher interest rates will not be instant given that only 20% of households are currently on floating rate mortgages. That said, for the 35% of mortgage holders with a fixed rate mortgage for only 2 years, refinancing will be a painful process. If mortgage rates hit 6% next year as markets are currently pricing, the average household would be paying over £1,400 a month for a 75% loan to value, 2-year fixed mortgage. This compares to an average payment of less than £900 on equivalent terms in the first half of 2021.

The problem for the Bank is that failure to act with sufficient force risks undermining its commitment to inflation, a further decline in the currency, further imported inflationary pressures and a need to act with even greater hikes further down the line.

S&P (AA stable) and Moody’s (Aa3 stable) rating reviews are due on 21 October and rating downgrades are possible. Although markets often move well ahead of official ratings announcements, sometimes changes can push a bond beyond a threshold forcing investors to sell for regulatory purposes. For example, downgrades to A+ would remove Gilts from the investible universe for some central bank type mandates, and foreign investors hold 30% of the Gilt market.

Several data releases may also be important. UK inflation data for September is released on 19 October; another upside surprise would only strengthen calls for the Bank of England to tighten even more aggressively. Monthly GDP for August is also due in mid-October. If this suggests UK activity is slowing sharply, it will add to concerns about the government’s cash flows.

These are not easy times for policymakers in any region. They face an uncomfortable balancing act of trying to support demand and maintain popularity amongst their electorate, yet without stoking further inflation and losing credibility over the long-term sustainability of their plans.

Words and actions will be heavily scrutinised over the coming days and weeks as markets assess whether policymakers in the UK are getting that balance right.

Our core judgment is that the market volatility witnessed will ensure that policymakers provide sufficient assurance about medium-term plans to anchor credibility, and as such we have seen the worst of the market moves.

But a ‘misstep’ on monetary policy, or further concerns about the UK’s institutional architecture, risks feeding a vicious cycle of tightening monetary conditions, deteriorating economic activity and further doubts about fiscal sustainability.

The Market Insights programme provides comprehensive data and commentary on global markets without reference to products. Designed as a tool to help clients understand the markets and support investment decision-making, the programme explores the implications of current economic data and changing market conditions. For the purposes of MiFID II, the JPM Market Insights and Portfolio Insights programmes are marketing communications and are not in scope for any MiFID II / MiFIR requirements specifically related to investment research. Furthermore, the J.P. Morgan Asset Management Market Insights and Portfolio Insights programmes, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not a reliable indicator of current and future results. J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://am.jpmorgan.com/global/privacy. This communication is issued by the following entities: In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador. In the United Kingdom, by JPMorgan Asset Management (UK) Limited, which is authorized and regulated by the Financial Conduct Authority; in other European jurisdictions, by JPMorgan Asset Management (Europe) S.à r.l. In Asia Pacific (“APAC”), by the following issuing entities and in the respective jurisdictions in which they are primarily regulated: JPMorgan Asset Management (Asia Pacific) Limited, or JPMorgan Funds (Asia) Limited, or JPMorgan Asset Management Real Assets (Asia) Limited, each of which is regulated by the Securities and Futures Commission of Hong Kong; JPMorgan Asset Management (Singapore) Limited (Co. Reg. No. 197601586K), this advertisement or publication has not been reviewed by the Monetary Authority of Singapore; JPMorgan Asset Management (Taiwan) Limited; JPMorgan Asset Management (Japan) Limited, which is a member of the Investment Trusts Association, Japan, the Japan Investment Advisers Association, Type II Financial Instruments Firms Association and the Japan Securities Dealers Association and is regulated by the Financial Services Agency (registration number “Kanto Local Finance Bureau (Financial Instruments Firm) No. 330”); in Australia, to wholesale clients only as defined in section 761A and 761G of the Corporations Act 2001 (Commonwealth), by JPMorgan Asset Management (Australia) Limited (ABN 55143832080) (AFSL 376919). For all other markets in APAC, to intended recipients only. For U.S. only: If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2022 JPMorgan Chase & Co. All rights reserved.