10 Jan 2023

Amid a volatile macroeconomic backdrop, investment vehicles incorporating environmental, social, and governance (ESG) considerations typically underperformed non-ESG peers in 2022. This has galvanised sceptics and led to questions around the validity of ESG. Paul LaCoursiere and Bhaskar Sastry outline three reasons why ESG will remain a crucial consideration for investors.

Sailing is among my favourite leisure activities. On clear days it’s a relaxing affair, but when winds pick up and the waters are choppy, it can be a bumpy ride. Championing sustainable investing can often feel like a similarly unpredictable journey, and 2023 is likely to be no exception.

- Paul LaCoursiere

The Russia-Ukraine-led energy crisis reveals both the interlinked nature of the global economy and its dependence on fossil fuels. Along with the COVID-19 pandemic, the conflict has resulted in an economic slowdown, decades-high inflation, and a growing food crisis in the developing world. Governments have reacted by implementing costly energy rescue packages and price caps, which have hit countries’ already faltering fiscal budgets.

The crisis is bringing the energy trilemma into sharp focus - how can countries ensure energy security, energy affordability, and energy sustainability? Currently, energy security and affordability are being prioritised at the expense of sustainability. Many countries are naturally focused on building fossil fuel energy reserves, and it’s clear that they cannot and should not abandon fossil fuels at this stage.

However, the continuation of a fossil fuel-based economy solves neither energy security nor the climate crisis. As Albert Einstein said, “We can’t solve problems by using the same kind of thinking we used when we created them”. Consequently, starting in 2023, we expect governments to begin to adopt a longer-term strategy focused on boosting investment in and deployment of renewable energy, thus making progress towards ‘solving’ the energy trilemma and achieving a Just Transition, in which benefits of the transition to a green economy are shared widely and those who stand to lose economically are supported.

In 2022, we saw how susceptible oil and gas importers were to volatile prices influenced by global geopolitics and macroeconomics, and sometimes artificial price setting. Many European Union (EU) countries were left vulnerable by the Russia-Ukraine conflict through an over-reliance on Russian gas and oil and a history of underinvestment in alternative energy sources. Until recently, Europe imported 45% of its gas, 44% of its coal, and 25% of its oil from Russia1. In response to the invasion, the EU has outlined plans under the REPowerEU proposal to source 45% of its energy mix from renewables and save 13% of energy consumption through increased efficiency. This has democratic support, with 85% of Europeans believing that the EU should reduce its dependency on Russian gas and oil2. In the US, the Biden administration has passed the landmark Inflation Reduction Act, which allocates US$369 billion to clean energy and decarbonisation projects, as well as clean energy tax credits, with the aim of reducing US carbon emissions by around 40% by 2030.

As policymakers wake up to the prospect of prolonged high energy prices and potential blackouts, the arguments for on- and off-grid renewables - which offer clean, decentralised energy - will become ever more attractive.

Capital investments in renewables are expected to reach US$500 billion in 2022 and could overtake upstream oil and gas for the first time. Carbon Tracker, a think tank that researches the impact of climate change on financial markets, predicts that solar and wind could generate all of the world’s electricity by the mid-2030s and displace fossil fuels to provide all energy worldwide by 2050.

However, the transition will take time; renewables, whether from solar, wind farms or hydroelectricity, take several years to build and involve significant capital outlay, although subsequent running costs are very low. Meeting baseload demand for longer periods also requires improvements in grid reliability and battery storage, but these are happening at pace.

Success stories like Greece, which ran entirely on solar, wind, and hydroelectric power for five hours in October 2022, show what’s possible. Greece now hopes renewables will account for at least 70% of its energy mix by 2030. We expect to see more of these success stories starting in 2023.

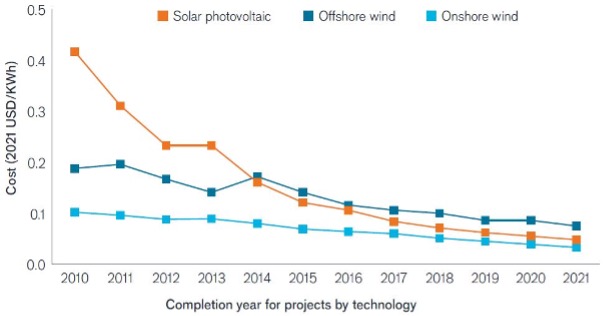

Thanks to technological developments, design improvements, and economies of scale, renewables are becoming cheaper every year (see Figure 1). In 2021, according to the International Renewable Energy Agency (IRENA), the global weighted average levelised cost of electricity (the average cost of the lifetime of the plant per megawatt hour of electricity generated) of new utility-scale solar photovoltaic and hydropower was 11% lower than the cheapest new fossil fuel-fired power generation option, whilst that of onshore wind was 39% lower.

Furthermore, Oxford University researchers have stated that, compared to the fossil fuel-based system, ‘a rapid green energy transition will likely result in overall net savings of many trillions of dollars’. Research from the Royal Society of Chemistry shows that wind, water, and solar requires less energy, costs less, and could create more jobs than fossil fuels. These are encouraging developments, not least for the poor and vulnerable in developing countries who lack access to electricity.

Source: International Renewable Energy Agency, 2022.

Renewable energy assets such as wind farms and solar parks have the potential to generate long-term, stable, inflation-linked revenues on relatively low operating costs. This leaves them well-placed to perform strongly in a ‘stagflationary’ environment. Once capacity is installed, renewables prices can drop further. Investors are starting to appreciate that this cost advantage is shifting the dynamics in favour of renewables.

However, the energy transition will be challenging for governments. It means removing substantial subsidies which support the fossil fuel industry and accepting the upfront cost of building new renewable generators instead of continuing to use gas. The intermittency of renewables requires flexible plants that can switch to costly and polluting gas when renewable supply is insufficient. Building out renewables transmission infrastructure is also expensive and takes time. Finally, there are structural impediments in the electricity markets, such as marginal cost pricing in Europe and the UK, which some have called to be reformed.

Strong leadership will be required to overcome these challenges. We believe certain governments globally will start to acknowledge the challenges and implement necessary measures in 2023.

The International Institute for Sustainable Development has said that developing any new oil and gas fields is incompatible with limiting warming to 1.5°C, and that global oil and gas production and consumption must decrease by at least 65% by 2050. The implication is that renewables in all forms (wind, solar, hydro, biofuels, nuclear, green hydrogen, and geothermal) should make up a larger share of the energy mix.

In 2021, global energy transition investment aimed at decarbonising economies was over US$750 billion, representing 10% of energy investment, according to the International Energy Agency (IEA). This was already a 27% jump from 2020, driven by growth in renewables and electrified transport. Growth in renewable energy installations and electric vehicles is expected to limit the increase in global emissions from 2021 to 2022 to less than 1%. That is much smaller than the increase in the previous year and remarkable given the rise in fossil fuel use driven by the Russia-Ukraine crisis.

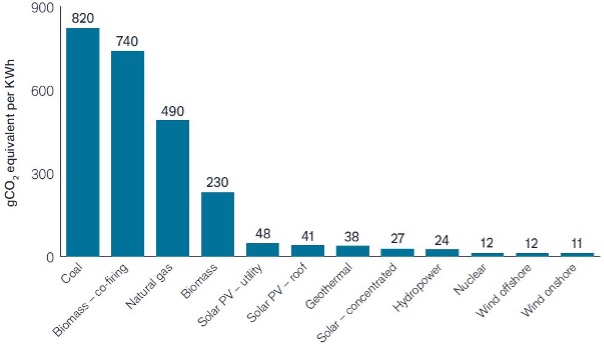

This is because, while the initial construction and installation of renewable infrastructure creates a carbon footprint (including through mining for metals), overall, renewables emit much lower average carbon emissions over their lifetime, as Figure 2 shows.

Source: United Nations Intergovernmental Panel on Climate Change, 2014.

Bloomberg NEF estimates that, to get on track for net zero, annual energy transition investment (the term used for money spent on deploying clean technologies, including renewables, electric vehicles, and carbon capture) needs to average US$2.1 trillion from 2022 to 2025, doubling to US$4.2 trillion from 2026 to 2030.

The transition will require both governments and the private sector to propel the effort forward. Governments have the potential to commit to a clean energy future, redirect subsidies from fossil fuels to renewables, and limit use of gas as a bridging fuel. In turn, companies and investors may have opportunities to benefit from directing long-term capital into supporting the energy transition and the green industries of the future.

When I’m sailing, I often have the choice of following a direct route or taking a longer, more circuitous journey. On climate action, Europe appears to be taking the former route and the US the latter.

- Paul LaCoursiere

In our previous outlook, we discussed divergent boardroom attitudes towards ESG and whether ESG would be considered synergistic with financial performance. Prior to 2022, there were nuanced disagreements around ESG; however, the fundamental proposition of ESG integration - that it is worthwhile to incorporate ESG and climate considerations in the investment process - was largely unquestioned.

This year, the mood has shifted. ESG funds and strategies that allocated to technology growth stocks and underweighted energy stocks have typically underperformed their non-ESG counterparts. Questions over the role of ESG in fiduciary duty are being retraced. Meanwhile, companies and investors have been expected to uphold ever stronger ESG standards, notably in the US. Disquiet has turned into fundamental disagreement.

Criticisms have largely come from the Republican Party and the US political right, which have denounced ESG variously for being a left-wing ideology, an instrument of global elites, a threat to the domestic fossil fuel industry, and, ultimately, a detractor from financial returns. As the energy crisis rages on, ESG has been termed a ‘woke ideology’ and ‘perverse’, among other things.

This year, the Texas Comptroller divested from almost 350 funds and 10 asset management companies that promote ESG. Florida’s Governor approved a resolution that bars the state’s pension fund from considering ESG factors in making investment decisions, and several other states have followed suit.

The backlash has spread to the private sector. One of the notable achievements of COP26 last November was the creation of the Glasgow Financial Alliance for Net Zero (GFANZ), a coalition of financial institutions with over US$150 trillion of assets under management committed to reaching net zero by 2050. Under pressure from clients of participant banks who argued that divesting from fossil fuel assets was a breach of fiduciary duty, the requirement to abide by the UN-backed ‘Race to Net Zero’ campaign was dropped.

Meanwhile, President Biden’s administration pushed through the Inflation Reduction Act, an ambitious program which aims to kickstart investment and deployment of clean energy.

We don’t expect the divisions between the sustainability champions and the ESG doubters to resolve anytime soon. Indeed, it’s likely the polarisation will become starker in 2023.

In our previous outlook, we called for realism and honest debate about what ESG can and cannot achieve. This is more important than ever. We believe we need to remove the hyperbole and define what ESG really is.

First, ESG is not a single approach but an umbrella term for a variety of strategies, some of which are based on financially relevant metrics, and others which are based on the values of the investor. ESG approaches can be used in isolation or together (for example, exclusionary screening and ESG integration). It’s important that investors understand the characteristics of the product they are buying. Second, research shows that ESG risks are financial risks, so incorporating ESG considerations should provide a more holistic assessment of the risks and opportunities of an investment. Finally, the rise of ESG investing in recent years partly reflects the need to tackle existential systematic sustainability challenges including climate change and environmental damage. These challenges are not going away.

Nevertheless, the reprioritisation of ESG is understandable against a backdrop of high energy prices and potential blackouts. The underperformance of ESG funds and strategies raises larger questions of the role of the investment management industry in facilitating both energy security and a successful energy transition to tackle climate change. These are sensitive issues, and it’s unsurprising that there is heated debate amid all the uncertainty. As we stated in our previous outlook, open and honest debate around the role of ESG - its strengths, limitations, and any trade-offs - is critical, especially in this time of division.

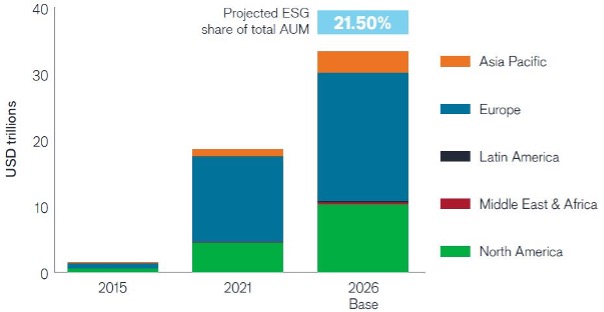

An obvious conclusion from recent events is that ESG adoption will slow amongst US investors; however, a recent survey by PwC of 250 institutional investors and asset managers worldwide with combined global assets of $60 trillion - or nearly half of global assets under management (AUM) - reveals intentions for more, not less, ESG investment. The study3 shows that, in its base case growth projection scenario, North America ESG AUM would more than double from 2021 levels to over US$10.5 trillion in 2026 (see Figure 3), with 81% of institutional investors planning to increase allocations to ESG products over the next two years.

Source: ‘Asset and wealth management revolution 2022: Exponential expectations for ESG’, PwC, October 2022.

The report also estimates that Europe ESG AUM will increase 53% to US$19.6 trillion, while the fastest percentage growth is expected among Asia-Pacific (APAC) investors, with more than a tripling in ESG AUM to US$3.3 trillion in 2026.

The outcome of the US mid-term elections will be important in determining how events play out. At the time of writing, the Democrats have retained control of the Senate and the Republicans look favourites to win a slim majority in the House of Representatives. The results could well influence future ESG legislation and ESG adoption in the US.

I’ve been lucky enough to sail in the Caribbean. On first visiting over 30 years ago, I recall snorkelling around vivid, multi-coloured coral reefs. Sadly, some of these areas now look like graveyards. Corals occupy less than 0.1% of the ocean floor but house over 25% of all marine life. Thanks to pollution and climate change, these once vibrant coral reefs are turning into bleached wildernesses.

- Paul LaCoursiere

Biodiversity is the rich tapestry of life on Earth and the complex ways living things and non-living entities like rocks and soil interact to create the natural world. Nature is now in crisis as a direct consequence of the ever-expanding sphere of human activity. We expect biodiversity loss to emerge as the second most important sustainability issue after climate change.

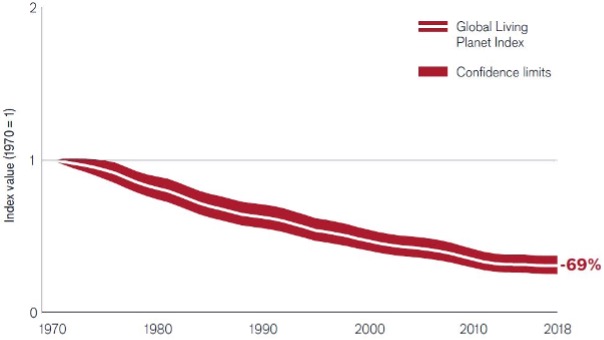

We have written previously about the scale of human-induced biodiversity loss and ecosystem damage. Almost 70% of animal species have disappeared in the last 50 years (see Figure 4) and one million species are currently at risk of extinction in the coming decades. Given these stark warnings, scientists are talking of ‘biological annihilation’ and a ‘sixth mass extinction’.

Source: WWF/ZSL - ‘WWF Living Planet Report 2022’. The global Living Planet Index shows that a subset of 31,821 populations of 5,230 vertebrate species has declined by an average 69% in abundance between 1970 and 2018. The white line shows the index values and the shaded areas represent the statistical certainty surrounding the trend (95% statistical certainty, range 63% to 75%).

This is important for investors because nature provides a multitude of services to humanity, the monetary benefits of which are worth US$44 trillion - more than half of global GDP - each year (not to mention innumerable benefits to our wellbeing). The functioning of whole sectors of our economies, not least food and agriculture, depends on nature’s services to function.

Thus far, there has been limited nature-related action by governments, corporate leaders, and investors. However, we expect that to change in 2023 for three key reasons:

Global challenges, including climate change and biodiversity loss, are not going away; indeed, they are worsening. The COVID-19 pandemic and Russia-Ukraine crisis have driven a rise in income inequality between developed and developing countries, as well as within countries. By taking a holistic investment approach that considers these challenges, ESG provides investors with a way to potentially improve the resilience of their portfolios while aiming to address such challenges.

Yet, the concept of ESG has faced something of a perfect storm in 2022. ESG has historically represented an accessible and comprehensive package of considerations that investors can use to better understand the characteristics of an investment. However, recent events have highlighted some of the drawbacks, including the assimilation of disparate issues such as carbon intensity and diversity metrics, and how (or whether at all) these metrics should be combined into a single score. In the worst instance, the complexity of these issues has engendered a sense that ESG lacks transparency.

It’s clear that ESG must adapt and evolve in order to thrive. We look forward to open and honest debate from all sides on what ESG is, what it can meaningfully achieve, and why it is important - something that should lead to constructive outcomes in 2023 and beyond.

1 London School of Economics and Political Science, April 2022.

2 European Commission, May 2022.

3 ‘Asset and wealth management revolution 2022: Exponential expectations for ESG’, PwC, October 2022

Important Information:

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in Europe by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Outside of the U.S.: For use only by institutional, professional, qualified and sophisticated investors, qualified distributors, wholesale investors and wholesale clients as defined by the applicable jurisdiction. Not for public viewing or distribution. Marketing Communication.

Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.