12 Dec 2022

The pain for the UK economy from rising mortgage rates and utility costs has only just begun. Brace for a longer and deeper recession than consensus expects, write Tim Drayson and Hetal Mehta.

The latest data suggest the UK economy has slipped into recession, but so far has avoided an abrupt adjustment. The dislocation in the gilt market following the mini-budget in late September proved short-lived. The consensus is that as inflation falls, the economy can stabilise in the spring and summer and then resume growth towards the end of next year.

This strikes us as too optimistic. The cost of living crisis is likely to be a significant drag for several quarters to come, but two additional shocks are about to hit that could tip the UK into a more protracted downturn.

After a mild autumn, temperatures have now plummeted in the UK. Many households have delayed switching on their heating, but will now be cranking up their thermostats.

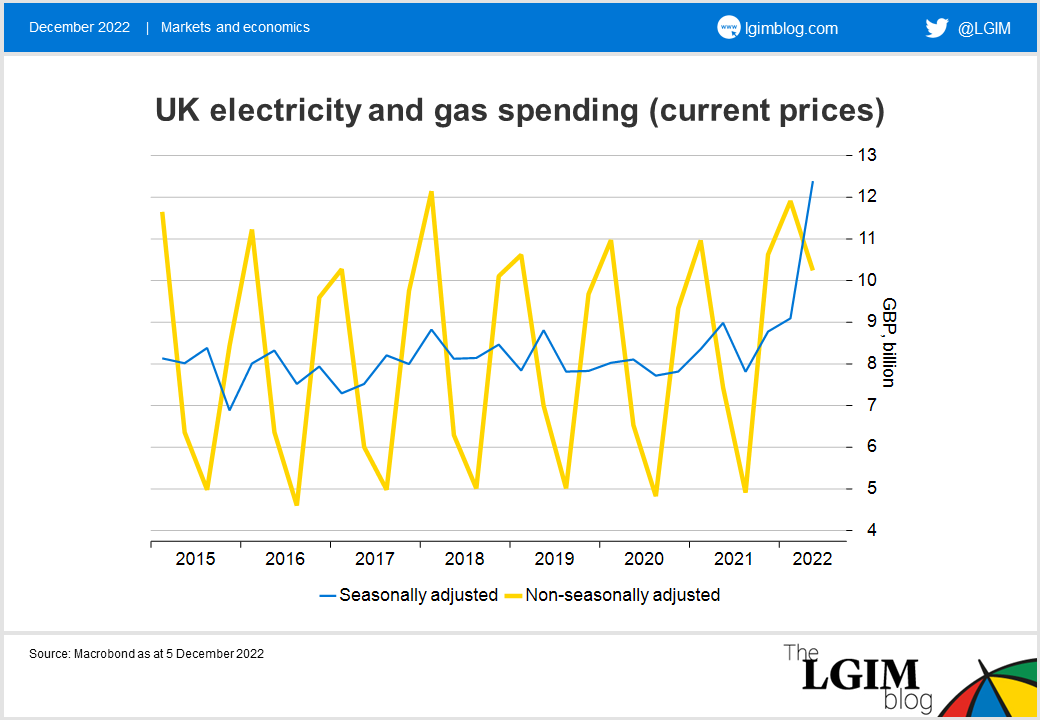

When measuring GDP, the Office for National Statistics adjusts energy consumption seasonally through the course of the year. This means the volume consumed is scored as similar in the summer and in winter, even though actual (non-seasonally adjusted) consumption is heavily skewed to the winter. The April price rise meant seasonally adjusted consumption at current prices rose in the second quarter.

The hit to real incomes appeared in the inflation data when utility prices reset higher in April and again in October. But the damage to cash flow only occurs when energy is consumed (i.e. when people switch on their heating). While some households are on a direct debit and probably built up a credit by overpaying on their utility bill through the summer, we calculate that around a third of British households are either on a pre-payment meter or pay for their utilities shortly after units of energy are consumed.

This could equate to a hit to their cash flow of 0.5-1% over the next few months and lower consumption of other goods and services, on top of the officially recorded squeeze on real incomes (even taking into consideration the energy price guarantee). There is some additional protection for the most vulnerable households, but they could still face a cash flow problem during the coldest months. This winter cash squeeze is much more acute in the UK than US, because utility prices have risen by four times as much here.

Following the mini-budget, quoted mortgage rates spiked above 6%. These have slowly begun to ease back, but very few households have so far paid these higher rates. Data from the Bank of England show that the effective rate of new two-year fixed rate mortgages in October only rose 30 basis points (bps) from September to 3.2%.

This is because most of the mortgage offers were made before the gilt market meltdown. Going forward, if the Bank of England continues to hike rates, we will be surprised if we see fixed-rate mortgage offers much below 5% anytime soon.

This is going to be a significant shock to homeowners as almost half the stock of mortgages is either variable or up for renewal within the next two years. Some might decide to sell to avoid higher payments, but the group most exposed are buy-to-let investors. Their business model is based on rental income exceeding their mortgage payments and long-term capital growth.

The market is highly fragmented, with 43% of landlords only owning one property, representing almost a million tenancies (out of the 4.4 million in the private rental sector). In recent years, tax reform has already made owning multiple properties less attractive, but as mortgages now reset, some will become cash flow negative. Thirty-five percent of landlords are retired and the median non-rental income among landlords is a surprisingly low £24,000, so they might not be able to withstand negative cash flow for very long.

November house price data from Nationwide and Halifax showed prices falling on average by almost 2% on the month, their steepest declines since the financial crisis. The UK has now joined several other housing market downturns. Many landlords may decide to cash out before prices fall further, but this wave of selling into a market with first-time buyers finding property unaffordable is likely to intensify the price falls.

The one piece of goods news is that this should not become a banking crisis since most landlords are sitting on a healthy chunk of equity due to lower loan to value lending criteria since the financial crisis and years of housing price appreciation, fuelled by low interest rates.

We see prices falling 10-20% in nominal terms. UK housing market busts have historically played out over several years, so we expect price falls lasting well into 2024. As prices fall, housing transactions and associated GDP will be weak. There is also the negative wealth effect on consumption, which will increase over time. In contrast to the last two downturns, it seems unlikely the Bank of England will come to the rescue with aggressive rate cuts, as we expect inflation to still be above target at the end of next year.

In the meantime, rising unemployment will likely add to distress in housing, which in turn will feed back into even weaker consumer spending. While some of the fiscal tightening has been delayed till after the next election, there is no room for the government to cushion the downturn.

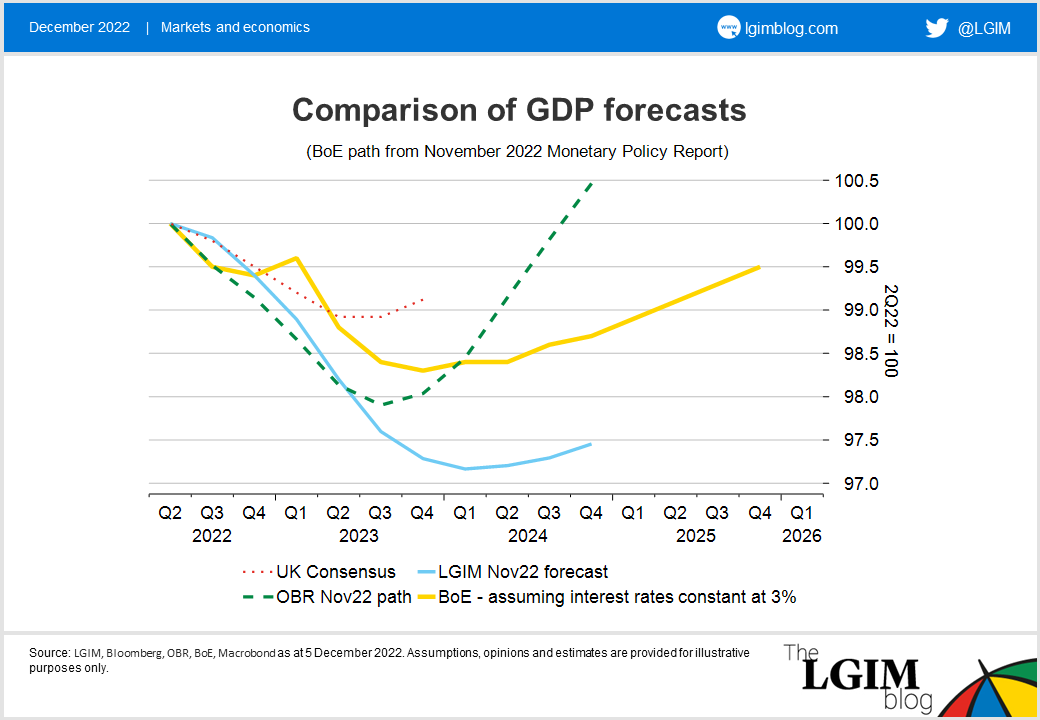

Overall, we see a peak to trough decline in output of almost 3% with the recession persisting into 2024 and only a tepid recovery thereafter.

This forecast is not as severe as the financial crisis or the recessions of the seventies, but that is partly because the UK has not fully recovered from COVID-19 and business investment is already fairly depressed. However, this is a considerably bleaker outlook than envisaged by either consensus or the Office for Budget Responsibility.

Disclaimer: Views in this blog do not promote, and are not directly connected to any Legal & General Investment Management (LGIM) product or service. Views are from a range of LGIM investment professionals and do not necessarily reflect the views of LGIM. For investment professionals only.