13 Aug 2021

Maria Elena Drew, Director of Research, Responsible Investing

Momentum on emissions targets builds ahead of COP26 conference

The impact of climate change presents a systemic investment risk, making the importance of an investment’s environmental footprint more critical than ever before. The world has already experienced a rise of around 1°C in global temperatures over the preindustrial period and has started seeing the impacts of climate change in the form of extraordinary weather events, shrinking glaciers, and changing rainfall patterns.

To be successful in limiting the adverse impacts of climate change, a fundamental shift is needed in the relationship between the economy and the environment. While financial markets are well positioned to play a leading role, ultimately they will only be effective if climate change regulation is in place. However, when it comes to climate change, a mismatch exists between policy and science. Over the past year, we have seen strong momentum to close that gap—a trend we expect to continue as we lead up to the 26th United Nations Climate Change Conference (COP26) in Glasgow in November.

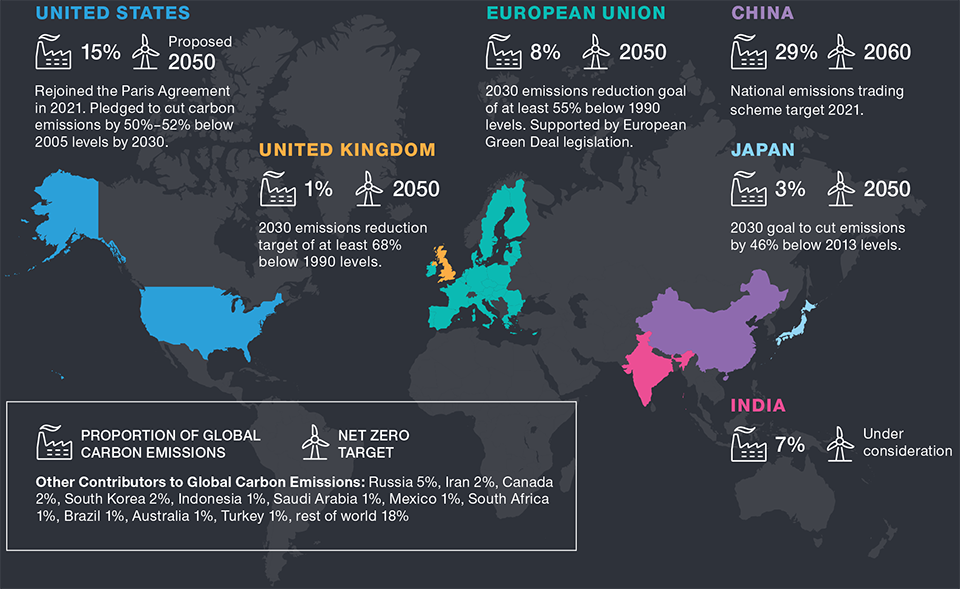

Net zero carbon emissions targets (net zero targets) have been established by 61% of countries, 9% of states and regions in the largest emitting countries, and 13% of cities with a population of over half a million. In aggregate, they account for just over 60% of the world’s carbon emissions.1 A focus of COP26 will be securing greater adoption of net zero targets—more countries have signaled that they will make announcements in the lead‑up to the conference.

A focus of COP26 will be securing greater adoption of net zero targets...

Except for a handful of countries that were already advanced in implementing their climate agenda, direct legislation to underpin net zero targets is largely absent. While we remain in the early stages in terms of implementation, it appears that the urgency of the situation is increasingly understood. Simply put, the odds of meaningful climate regulation coming into force is very high.

Key National Commitments to Reduce Carbon in the Atmosphere

(Fig. 1) Global carbon emissions and key carbon reduction targets

Carbon dioxide (CO2) makes up about three‑quarters of greenhouse gas emissions and is one of the more readily available environmental statistics. As such, it receives the most attention when it comes to climate change analysis. However, staying within a global temperature rise of 1.5°C will require mitigating more than just CO2. In addition to regulation focused on power generation, energy efficiency, and transportation, the task will require comprehensive regulation to mitigate methane (CH4), nitrous oxide (N2O), and fluorinated gases, as well as more sustainable land use and enhancement of carbon sinks.

...most estimates indicate that the world’s current climate change commitments put us on a path to 2.7°–3.0°C of global warming.

To date, most of the world’s climate regulation has focused on carbon—mostly within the power sector—but that is changing. To put the potential impact of forthcoming regulation into perspective, most estimates indicate that the world’s current climate change commitments put us on a path to 2.7°–3.0°C of global warming. This is based on climate commitments made through the nationally determined contributions (NDCs) submitted by signatories of the Paris Agreement in 2015. Using a statistically based probabilistic framework, the probability of staying below 2°C warming is only 5% assuming a continuation of current trends.2 If all countries were to meet their NDCs, it rises to 26%.2 These low probabilities underpin the importance for net zero commitments.

While markets have anticipated some climate legislation coming into force, namely in select sectors directly impacted by energy transition, we do not see widespread evidence of dislocation in valuations across the broader economy. As new rules come into effect around the world, we expect that performance around climate issues will become increasingly more important to investment performance. Interestingly, we see a bifurcation in corporate approaches to climate change across all sectors of the economy.

As legislative initiatives start to directly impact financial performance, we believe the differentiation between winners and losers will become evident (and potentially quite quickly). Of course, regulation is not the only factor moving the needle on how issuers are responding to climate change. Other important factors are innovation and consumer preferences.

On the innovation front, new advances have driven down costs in renewable power, which has sped up deployment of renewable capacity. The International Renewable Energy Agency estimates that the 3.2 terawatts implied in current NDC power targets for 2030 should be met as soon as 2022. On the consumer preferences front, we see companies adding environmental labeling to products as well as increasing demand for more sustainable products such as meat alternatives.

At T. Rowe Price, we systematically evaluate climate change factors for individual securities and portfolios with our proprietary Responsible Investing Indicator Model (RIIM). RIIM analysis provides two key benefits for our analysts and portfolio managers. First, RIIM proactively searches for environmental indicators and controversies on companies and sovereign issuers—this is an important feature as environmental data are not required disclosure nor are they standardized like financial data. Second, RIIM provides a framework for evaluating environmental factors—in essence it creates a common language for our analysts and portfolio managers to discuss how an investment is performing on environmental factors as well as compare securities within the investment universe.

Our evaluation of climate change factors focuses on energy transition and physical risk, but we also believe that an issuer’s environmental footprint and track record are important indicators of how they may perform in a tightening regulatory environment.

With our RIIM assessment, we consider our investments’ environmental characteristics holistically—key areas of focus include:

Another critical element of our climate change‑related analysis occurs through engagements. The most common topics of our environmentally focused engagements in 2020 were disclosure, greenhouse gas emissions, product sustainability, and general environmental management. In relation to disclosure, we continue to advocate for investee companies to report using Sustainability Accounting Standards Board and Task Force on Climate‑Related Financial Disclosures frameworks. In 2020, we also put more emphasis on the importance of reporting scope 1–3 greenhouse gas emissions.3

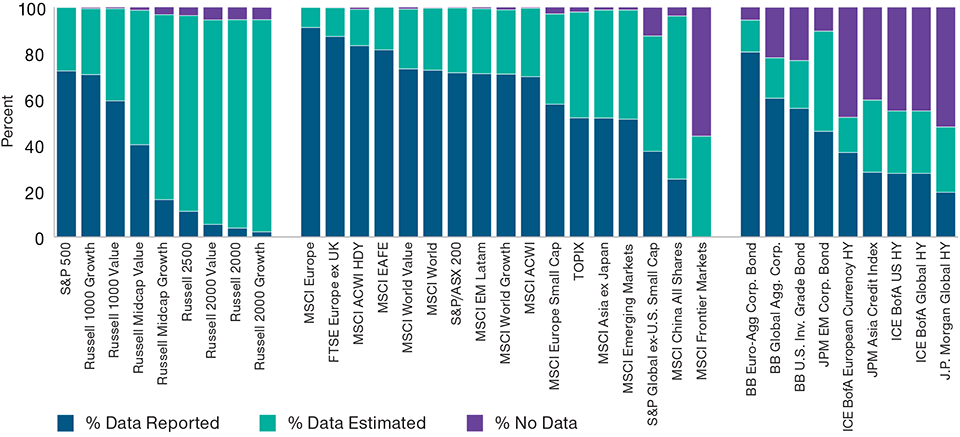

We work with an imperfect data set when it comes to environmental analysis. This is partly a problem of limited disclosure and lack of universal reporting standards, but it is partly because some environmentally oriented factors are qualitative in nature (i.e., controversies, targets). Issues of disclosure and standardization are gradually being resolved and new sustainable finance regulations will accelerate what had been a largely voluntary trend from corporates, but we still have a long way to go. For example, carbon emissions is one of the most widely available statistics, but disclosure levels for scope 1–2 emissions cover less than half our investible universe and disclosure for scope 3 emissions is even lower.

We purchase a data set from Sustainalytics that provides carbon emissions and intensity for a universe of more than 11,000 companies, of which nearly 75% of the companies have estimated data. As illustrated in Figure 2, for some indexes, upward of three‑quarters are covered with reported data; however, other indexes are almost entirely reliant on estimated data. While a reliance on estimated data can sound disconcerting to some investors, it has utility because it helps us understand the order of magnitude of carbon emissions for our portfolios versus their benchmarks. However, we do have to be cognizant of the data quality when considering it in our investment decisions.

Disclosure on Carbon Emissions Data Is Often Limited

(Fig. 2) Carbon emissions data availability by index

Climate change is increasingly a major concern for global communities, companies, our clients, and our investment teams. The focus on how companies are working to mitigate the risks to their activities is only set to intensify, and COP26 and regulatory efforts will bring the issue further into the spotlight.

1 Taking Stock: A Global Assessment of Net Zero Targets, Energy and Climate Intelligence Unit (March 2021). Net zero means achieving a balance between the greenhouse gases put into the atmosphere and those taken out. This state is also referred to as carbon neutral.

2 Liu & Raftery, Country‑based rate of emissions reduction should increase by 80% beyond nationally determined contributions to meet the 2°C target (Nature 2021).

3 Scope 1 (direct emissions from owned or controlled sources), scope 2 (indirect emissions from the generation of purchased electricity, steam, or cooling), scope 3 (all other indirect emissions).

Additional Disclosures

MSCI and its affiliates and third party sources and providers (collectively, “MSCI”) makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. Historical MSCI data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The S&P 500 Index, the S&P/ASX 200 Index, and S&P Global ex US Small Cap Index are products of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (“SPDJI”), and has been licensed for use by T. Rowe Price. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); T. Rowe Price product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index, the S&P/ ASX 200 Index, and S&P Global ex US Small Cap Index.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2021. FTSE Russell is a trading name of certain of the LSE Group companies. FTSE Europe ex UK is a trademark of the relevant LSE Group companies and is/are used by any other LSE Group company under license. All rights In the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The LSE Group is not responsible for the formatting or configuration of this material or for any inaccuracy in T. Rowe Price Associates’ presentation thereof.

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright © 2021, J.P. Morgan Chase & Co. All rights reserved.

ICE Data Indices, LLC (“ICE DATA”), is used with permission. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITY WITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD‑PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND T. ROWE PRICE OR ANY OF ITS PRODUCTS OR SERVICES.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

TOPIX—Tokyo Stock Exchange, Inc.

Copyright ©2021 Sustainalytics. All rights reserved. Sustainalytics is a leading independent ESG and corporate governance research, ratings and analytics firm operating for over 25 years and supporting investors around the world with the development and implementation of responsible investment strategies.

IMPORTANT INFORMATION

This material is being furnished for general informational and/or marketing purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, nor is it intended to serve as the primary basis for an investment decision. Prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.