12 Dec 2023

The Aegon Diversified Monthly Income Fund targets an income of 5% per annum^, distributed monthly. Our multi-asset approach blends bonds, equities property and specialist income assets to meet this objective, while offering the potential to preserve and grow capital.

The Fund has been successfully delivering an average yield of over 5%* for almost a decade, irrespective of the macro and market environment. Investment grade bonds may now be yielding around that figure and high yield bonds more, but it would be easy to dismiss the attractions of a multi-asset approach to income investing.

A key benefit of a multi-asset income approach is diversification. Diversification of both risk and return. This can extend beyond bonds and equities to include alternatives which represent a genuinely differentiated investment opportunity. To maximise this, however, requires true flexibility. With wide investment parameters, no benchmark and no fixed allocation framework, the managers have freedom to adjust the portfolio in real time to find the best blend of income ideas for the prevailing investment environment.

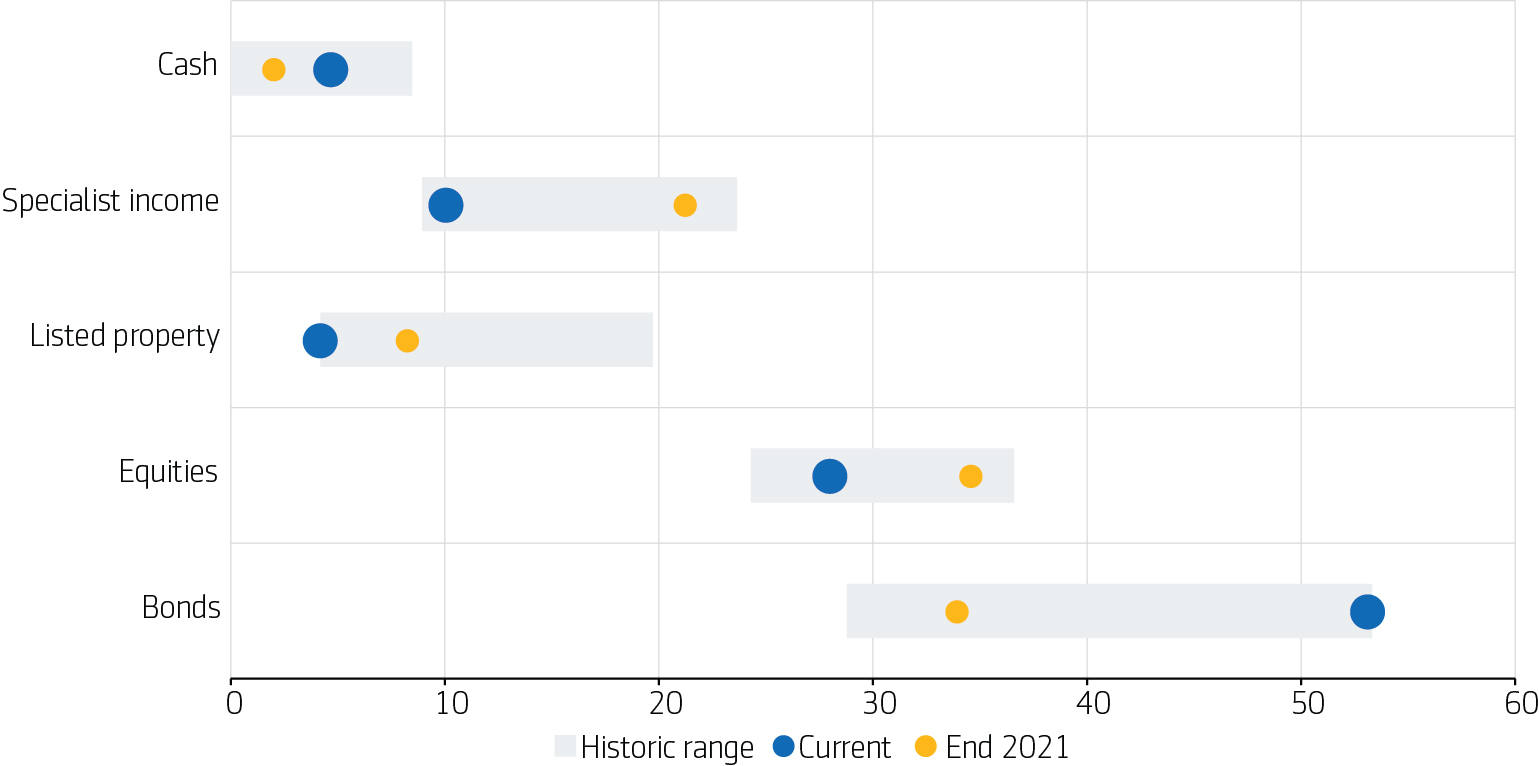

As Chart 1 shows, we have used that flexibility to the full, with significant variances in our allocations to different assets. The most material change in the last 18 months has been to increase our allocation to bonds, where our weighting is close to its highest level since the Fund’s launch almost 10 years ago. The re-pricing of bond markets in 2022 offered us a compelling opportunity to rebalance the portfolio and reduce the risk needed to meet the Fund’s 5% income objective^.

Chart 1: Asset allocation ranges since inception (%)

Source: Aegon Asset Management. Allocation as at 30 June 2023. Asset allocation ranges shown for Aegon Diversified Monthly Income Fund since inception on 25 February 2014.

This flexibility is important in delivering consistent income through the economic cycle, not only when interest rates are high. Income alone is not the whole story though.

The Fund’s broad investible universe and flexible approach to portfolio construction make it an ‘all-weather’ solution for income-seeking investors and we believe that the current environment presents a particularly compelling entry point.

1. An uncertain macro environment

There is particular uncertainty around the macroeconomic environment and the likely direction of markets. The Fund’s flexibility to act quickly and without constraint will be valuable when markets turn, for example prompted by an easing of inflation.

2. Diverse opportunity set

The opportunity-set for income investors looks attractive across multiple asset classes. Yields on bonds are at levels not seen for many years and the Fund is taking advantage of these with a historically high allocation, while remaining aware of default and duration risk.

We also see opportunities in equities, particularly in stocks paying healthy and growing dividends. Equity distributions are growing strongly and we see income-focused names becoming more important to equity investors in an era of higher rates, higher inflation and perhaps lower growth than we have been used to.

Finally, valuations on many alternative assets are discounting earnings pressure, which may not transpire if we are close to the top of the rates cycle.

3. Income as a driver of total returns

The Fund has demonstrated its ability to provide a reliable monthly income, payable through income units, but income has merit reinvested as a component of total return in its own right. The changing income environment allows for greater exposure to lower-yielding assets within the portfolio. Cash also provides a yield once again, so its tactical use is no longer as detrimental to income investors as it once was, allowing for greater flexibility in asset allocation as the cycle unfolds.

Since we launched the Aegon Diversified Monthly Income Fund almost a decade ago it has delivered on its income objective. We believe that the current macro uncertainty demands a truly flexible multi asset solution. As such, we believe the Fund is well-placed to continue to deliver an attractive risk-adjusted return for investors.

*Source: Aegon Asset Management, based on mid-price, on 1 August 2023. Since inception on 25 February 2014.

^Income is not guaranteed and 5% is a target yield, being the fund's target total distribution over the next 12 months as a percentage of the current mid-market share price. The target yield may be revised in future.

Important Information

For Professional Clients only and not to be distributed to or relied upon by retail clients.

The principal risk of this product is the loss of capital. Please refer to the KIID and/or prospectus or offering documents for details of all relevant risks. For all documents please see www.aegonam.com/documents.

Past performance does not predict future returns. Outcomes, including the payment of income, are not guaranteed.

Opinions and/or example trades/securities represent our understanding of markets both current and historical and are used to promote Aegon Asset Management's investment management capabilities: they are not investment recommendations, research or advice. Sources used are deemed reliable by Aegon Asset Management at the time of writing. Please note that this marketing is not prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing by Aegon Asset Management or its employees ahead of its publication.

Fund Charges are taken from capital, increasing distributions but constraining capital growth.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice.

Data attributed to a third party (“3rd Party Data”) is proprietary to that third party and/or other suppliers (the “Data Owner”) and is used by Aegon Asset Management UK plc under licence. 3rd Party Data: (i) may not be copied or distributed; and (ii) is not warranted to be accurate, complete or timely. None of the Data Owner, Aegon Asset Management UK plc or any other person connected to, or from whom Aegon Asset Management UK plc sources, 3rd Party Data is liable for any losses or liabilities arising from use of 3rd Party Data.

Aegon Asset Management UK plc is authorised and regulated by the Financial Conduct Authority.

AdTrax: 5929743.1. | Exp. Date: 30 September 2024