04 May 2022

Investors in China have contended with internal and external challenges over recent months, which have put pressure on Chinese equities. Yet some areas of the market have performed well. Raheel Altaf and Peter Saacke explain where they have found attractive opportunities and why they expect to find more in overlooked areas.

FOR PROFESSIONAL AND/OR QUALIFIED INVESTORS ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested.

Reference to specific stocks should not be taken as advice or a recommendation to invest in them.

For much of this year, Chinese equity markets have suffered from weaker sentiment stemming from geopolitical tensions and the latest Covid wave, which has led to shutdowns in a number of provinces. This has compounded Chinese equities’ weakness from 2021, when tightening monetary policy, regulations against mega-cap technology companies and curbs against the property sector caused investors to be cautious

While risks remain, it is worth noting that investors’ positioning and the market’s valuation suggest pessimism is already reflected. Chinese equities have been a long-term laggard against other equity markets.

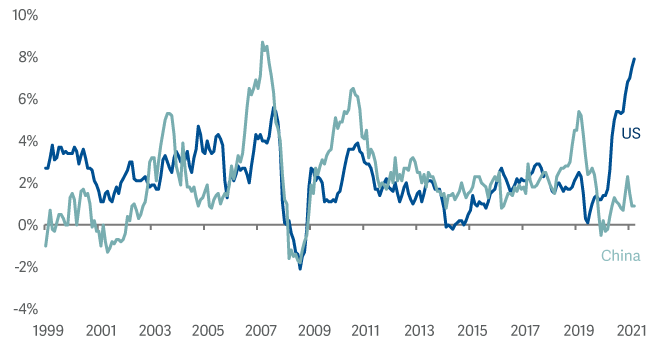

Inflation - US versus China

Source: Bloomberg as at 28 February 2022

One example of a stock that has performed well for us over the last year is China Suntien Green Energy. This company has 6000 km of legacy gas pipeline assets, but has in recent years shifted its focus towards renewable power generation.

While natural gas sales made up two thirds of revenues in 2020, the remaining third of revenues generated from wind and solar power generation are forecast to grow rapidly as construction of more than double the existing renewable power generation capacity is underway.

With China committing to decarbonise its economy the company is well placed to benefit from this trend for many years to come. With continued prospects for innovation and growth, we believe China still offers exceptional opportunities for investors.

Our proprietary quantitative framework takes a dispassionate view, looking through the volatility. To select the best potential holdings, we have a disciplined framework that tracks company specific information as well as macroeconomic and market trends across thousands of companies.

The process allows us to identify companies with improving fundamental trends. Superior growth in earnings, cash flows, dividends, operating profits and assets should lead to strong performance over the long run. Yet there are times where investor attention is elsewhere and divergences between share prices and fundamental improvements create opportunities.

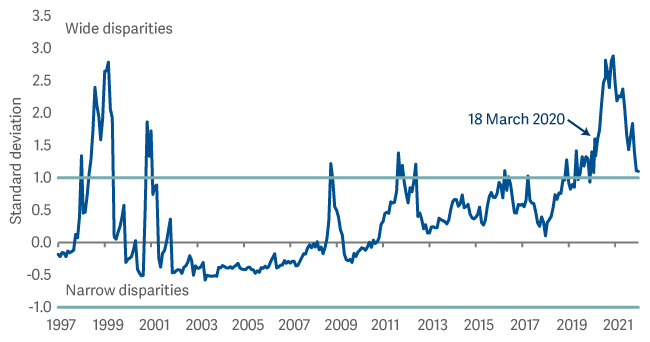

China valuation spreads

Source: Empirical Research Partners Analysis as at 30 September 2021. Note: Top quintile compared to the region average.

Source: Empirical Research Partners Analysis as at 30 September 2021. Note: Top quintile compared to the region average.

Currently this divergence between valuations between some sectors and the rest of the market as shown in chart above, suggests there are many untapped opportunities in China. We find them in unloved parts of the market such as financials, energy and infrastructure companies.

Two examples of overlooked stocks that we expect to benefit from long-term growth trends:

PICC is the leading property/casualty insurer in the country. Motor vehicle and health insurance are growth drivers, with insurance demands from an ageing population increasing. Yet the stock trades on a p/e of 5, with a dividend yield in excess of 8%.

Zhejiang Expressway has similar financial characteristics. It builds and manages toll roads in China’s Zhejiang province and has repeatable, dependable earnings. This is another example of a company that has delivered consistent growth in excess of the market in the last decade, but its share price has not kept pace with these fundamental improvements.

Looking beyond the short-term challenges, China still offers exceptional opportunities for investors who focus on fundamentals and are willing to look to the longer term. Recent positive developments in money supply and monetary policy suggest that sentiment could soon turn, leading to a rerating of Chinese stocks.

To find out more about the Artemis SmartGARP Global Emerging Markets Equity Fund visit the fund page at www.artemisfunds.com.

FOR PROFESSIONAL AND/OR QUALIFIED INVESTORS ONLY. NOT FOR USE WITH OR BY PRIVATE INVESTORS. This is a marketing communication. Refer to the fund prospectus and KIID/KID before making any final investment decisions. CAPITAL AT RISK. All financial investments involve taking risk which means investors may not get back the amount initially invested. Investment in a fund concerns the acquisition of units/shares in the fund and not in the underlying assets of the fund. Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them. For information on sustainability-related aspects of a fund, visit www.artemisfunds.com. The fund is a sub-fund of Artemis Investment Funds ICVC. For further information, visit www.artemisfunds.com/oeic. Third parties (including FTSE and Morningstar) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit www.artemisfunds.com/third-party-data. Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness. Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice. Issued by Artemis Fund Managers Ltd which is authorised and regulated by the Financial Conduct Authority.