31 Jan 2024

Author: Toby Gibb - Head of Investment Solutions

With interest on cash so high and markets looking volatile, some investors may be tempted to put their spare money in a standard savings account. However, doing so could come with a severe long-term opportunity cost.

When NS&I offered a one-year savings bond paying 6.2% back in August, take-up was swift. By the time it was withdrawn from sale just over a month later, 225,000 customers had committed their savings to it1.

This was unsurprising: 6.2% was the highest rate ever offered on an NS&I bond2 and it came with “HM Treasury’s 100% guarantee on all money invested”3.

Who wouldn’t want to hold one of these products?

As an asset manager that offers equity and bond funds, NS&I and other savings accounts certainly provide healthy competition for our clients’ capital. However, we would still argue that investors who shelter in cash risk missing out on both income and long-term growth.

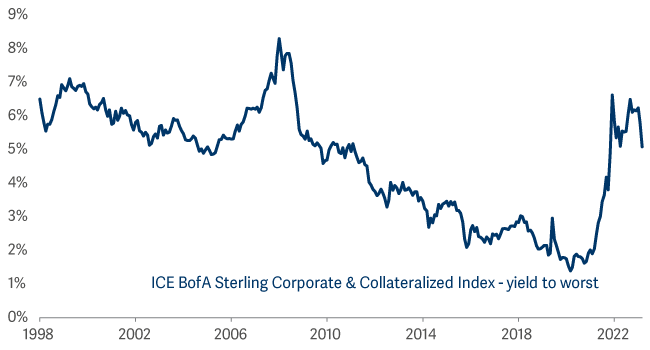

Let’s start with bonds. It is currently possible to find high-quality, investment-grade corporate bonds with yields comparable to those offered by NS&I4.

Attractive all-in yield

Source: Investment-grade corporate bonds offer yields comparable with NS&I (Source: Bloomberg as at 31 October 2023)

Admittedly, these bonds carry a higher risk of default than the UK government, which acts as the guarantor of NS&I. And their prices are volatile. This means investors could lose money if conditions move against them (should inflation begin to rise again, for example) and they sell the bonds before they reach maturity.

But these bonds also have a number of clear advantages over the NS&I products. With the latter, you have to commit your money for a full year. That is great… providing that interest rates continue to rise. If they do, at the end of the year, you can simply take your money and put it in another NS&I product or cash account paying an even higher rate of interest.

But here’s the catch. And it’s a big one. Central banks only push interest rates up when they need to bring inflation under control. And, today, inflation is falling rather than rising: CPI in the UK dropped from 6.7% in September to 4.6% in October5 and from 3.7% to 3.2%6 in the US.

If inflation continues to fall, central banks could even cut interest rates. In recent weeks, investors have started to predict the Bank of England will do exactly this in the first half of 20247. This would give investors in corporate bonds three clear advantages over anyone whose cash is tied up in an NS&I savings bond.

Today, the FTSE-All Share index pays out a dividend yield of almost 4%8; the distribution yield on the Artemis Income Fund is slightly higher9. Both figures may be lower than the NS&I savings bond, but remember that dividend payments can continue to grow indefinitely along with corporate profits (particularly if share buybacks continue at their rapid pace).

Moreover, equities have historically delivered the highest returns for investors over the long term: the FTSE All-Share index has delivered average annualised returns of 7.8% over the past 20 years and the S&P 500 in the US 11.2%10. Given that UK companies are trading on relatively low multiples of their profits11, there appears to be the potential for significant capital gains if sentiment towards the domestic market improves.

So why can’t investors just take the 6.2% return from an NS&I bond over the next year, then invest the proceeds in an equity fund and enjoy annualised returns of between 7.8% and 11.2% from that point forward?

Performance of FTSE All-Share vs CPI and Bank of England base rate: £ total return

Source: Refinitiv

The problem is, of course, volatility. Unlike the slow-but-steady returns from cash, returns from equities are extremely uneven. Data from Bloomberg shows that if you missed the best 15 days of returns from the FTSE All-Share over the past 20 years, you would have made a return of 73.8%. Not bad – but it’s less than a quarter the 312.7% return someone would have made had they remained invested throughout.

Will the turning point for the FTSE All-Share materialise before NS&I’s 6.2% bond matures? Sadly, it is impossible to precisely forecast the stockmarket’s best days. But historically, they have coincided with periods when sentiment and valuations start off unusually depressed (as they are today), then start to look a little brighter. When sentiment changes, markets can move quickly.

Chasing whatever happens to offer the best return today without thinking about what could happen in the future could prove costly. It is undeniable that a guaranteed 6.2% return sounds attractive, but remember that it comes with an opportunity cost.

Whatever asset you choose, it should be one that is suitable for your time horizon, not the one that looks most attractive in the short term – even if it is yielding 6.2%.

1https://nsandi-corporate.com/news-research/news/nsis-one-year-guaranteed-growth-bonds-and-guaranteed-income-bonds-withdrawn

2https://nsandi-corporate.com/news-research/news/nsis-one-year-guaranteed-growth-bonds-and-guaranteed-income-bonds-withdrawn

3https://nsandi-corporate.com/news-research/news/nsis-one-year-guaranteed-growth-bonds-and-guaranteed-income-bonds-withdrawn

4Bloomberg as at 31 October 2023

5https://www.bbc.co.uk/news/business-12196322

6https://www.theguardian.com/business/2023/nov/14/us-inflation-fuel-housing-cpi-fed

7https://www.theguardian.com/business/live/2023/dec/13/uk-gdp-economy-growth-stagnation-falls-october-inflation-interest-rates-boe-fed-business-live

8FTSE Russell

9https://expressapi.fundassist.com/v1/api/Files/981b1c03-b8ce-e811-a82d-005056a3b112

10Bloomberg

11Goldman Sachs as at 25 September 2023

Investment in a fund concerns the acquisition of units/shares in the fund and not in the underlying assets of the fund.

Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them.

For information on sustainability-related aspects of a fund, visit the relevant fund page on this website.

For information about Artemis’ fund structures and registration status, visit artemisfunds.com/fund-structures

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

Third parties (including FTSE and Morningstar) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit artemisfunds.com/third-party-data.

Important information

The intention of Artemis’ ‘investment insights’ articles is to present objective news, information, data and guidance on finance topics drawn from a diverse collection of sources. Content is not intended to provide tax, legal, insurance or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or investment by Artemis or any third-party. Potential investors should consider the need for independent financial advice. Any research or analysis has been procured by Artemis for its own use and may be acted on in that connection. The contents of articles are based on sources of information believed to be reliable; however, save to the extent required by applicable law or regulations, no guarantee, warranty or representation is given as to its accuracy or completeness. Any forward-looking statements are based on Artemis’ current opinions, expectations and projections. Articles are provided to you only incidentally, and any opinions expressed are subject to change without notice. The source for all data is Artemis, unless stated otherwise. The value of an investment, and any income from it, can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.