01 Feb 2024

Global equities managers Alex Stanić, Natasha Ebtehadj and Swetha Ramachandran reveal where they expect to find the biggest investment opportunities in 2024 and how they plan to make the most of them.

This year will be a big one for elections. Politics can create volatility, but also opportunities for long-term investors. Could Donald Trump return to the White House? Will removal staff be packing boxes at 10 Downing Street? India will go to the polls, too. And Russians will be electing their next president – although wary of forecasts, I am willing to predict the winner there will be Vladimir Putin. It’s good to understand the dynamics driving different economies around the world, but we resist the urge to overlay a geographic asset allocation on our portfolio. Instead, we focus only on what we can do something about.

Ultimately, we believe universal secular growth themes – such as the growing appetite for semiconductors or the need for cost-saving advanced healthcare – matter more to long-term returns. Find the best companies to exploit these rich seams of opportunity in 2024 – and if geopolitics and economics support them, then all the better.

One issue that emerged in 2023 that I expect to see much more of in 2024 is ‘asynchronicity’. This means that economies in different parts of the world, though interlinked, are moving at different paces and sometimes in different directions.

For example, we are particularly interested in three emerging markets this year, each for different reasons: China, Mexico and India. In 2024, as most of the world hopes for a gentle slowdown, China will attempt to emerge from its recent difficulties and grow. Chinese stocks are now even less popular than the UK’s, which is really saying something. What could change?

The government is deploying stimulus. Is it measured? Yes. Is it gradual? Yes. Will it have an impact? Eventually, probably. Do you need direct exposure? Perhaps, but you can access the market through stocks elsewhere. At present, we are doing this through Nikkei, Estée Lauder and Rio Tinto (iron ore prices have been strong recently).

While China was once the factory of the world, growing political distrust of its leaders and Covid’s impact on stretched supply lines have made governments in the developed world look into bringing jobs back home, or at least closer. This year could see onshoring and reshoring have a profound impact on emerging markets.

For this reason, Mexico should benefit from its proximity to the US. Many American companies are opening plants there to take advantage of cheap, abundant labour and shorter shipping times. Toymaker Mattel, famous for the Barbie doll, has expanded its factory in Monterrey and closed two plants in Asia1. Tesla has plans to become a neighbour, with a proposed huge flagship investment in a $10bn ‘gigafactory’2. As of July 2023, Mexico replaced China as the US’s biggest trading partner3.

Finally, I have just returned from a trip to India where the groundwork looks to have been set for a potential decade-long investment boom. Government spending on physical (roads, railways and the electricity grid) and digital infrastructure (digital ID and payments) has been substantial and will continue4. In addition, the ‘reshoring strategy’ is generating a manufacturing boom and consumer recovery after inflation dampened real wage growth.

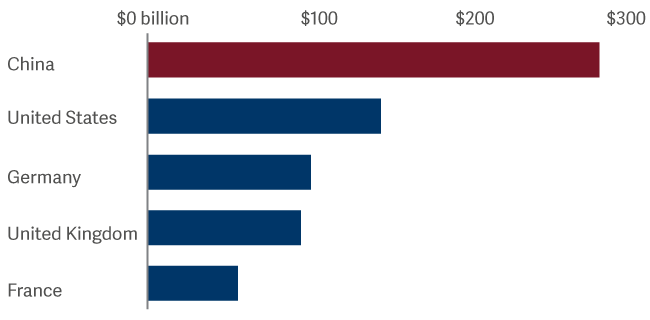

‘Experiential consumption’, or spending on experiences, is a trend we remain positive about following the post-Covid reopening. We own hotel stocks that have characteristics similar to luxury brands (such as high margins and asset-light business models) and believe they can continue to benefit from positive pricing trends. Meanwhile, analysis by McKinsey suggests that 2024 will be the biggest ever year of global travel, spearheaded by the return of Chinese tourists. China was the world’s largest outbound tourism market in 2019, spending $255 billion5 on international travel, accounting for about 20% of the total market6.

As China re-opened, Chinese nationals prioritised travel to Asian destinations, with trips to Europe significantly below pre-Covid levels7. Numbers only began to meaningfully recover in Q3 20238, but we expect this trend to gather momentum this year.

Travel and tourism expenditure, 2019. Source: International Monetary Fund

It is not just hotels and airlines that will benefit from the return of Chinese tourists to Europe: they are eagerly awaited in fashion capitals such as Paris and Milan due to their higher-than-average propensity for buying luxury brands when travelling. In luxury, while we have seen some normalisation in spending as growth returns to the long-term trend, the best brands are reinforcing their economic moats, strengthening their appeal to a relatively resilient and price-inelastic consumer. For these best-in-class luxury brands, the outlook remains positive.

Investment in a fund concerns the acquisition of units/shares in the fund and not in the underlying assets of the fund.

Reference to specific shares or companies should not be taken as advice or a recommendation to invest in them.

For information on sustainability-related aspects of a fund, visit the relevant fund page on this website.

For information about Artemis’ fund structures and registration status, visit artemisfunds.com/fund-structures

Any research and analysis in this communication has been obtained by Artemis for its own use. Although this communication is based on sources of information that Artemis believes to be reliable, no guarantee is given as to its accuracy or completeness.

Any forward-looking statements are based on Artemis’ current expectations and projections and are subject to change without notice.

Third parties (including FTSE and Morningstar) whose data may be included in this document do not accept any liability for errors or omissions. For information, visit artemisfunds.com/third-party-data.

Important information

The intention of Artemis’ ‘investment insights’ articles is to present objective news, information, data and guidance on finance topics drawn from a diverse collection of sources. Content is not intended to provide tax, legal, insurance or investment advice and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security or investment by Artemis or any third-party. Potential investors should consider the need for independent financial advice. Any research or analysis has been procured by Artemis for its own use and may be acted on in that connection. The contents of articles are based on sources of information believed to be reliable; however, save to the extent required by applicable law or regulations, no guarantee, warranty or representation is given as to its accuracy or completeness. Any forward-looking statements are based on Artemis’ current opinions, expectations and projections. Articles are provided to you only incidentally, and any opinions expressed are subject to change without notice. The source for all data is Artemis, unless stated otherwise. The value of an investment, and any income from it, can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested.